Attempting to gain perspective the morning after an unprecedented night before sounds like an exercise in futility yet that is precisely what Britons, Europeans, Africans, indeed the world sought to do in the immediate aftermath of Britain's vote to leave the European Union. With almost lightening speed, the translation of rhetoric to concepts and of concepts to the exercise of democratic freedoms through a referendum unravelled the safety blanket of a political, economic, social, diplomatic and security body which was the EU, as seen by most Scottish, Irish and London voters.

But the voice of the slim majority of the British public has spoken and the new world order will force a recalibration of relationships in the shifting sands of global geopolitics. One such set of relationships of extreme importance to Songhai Advisory, is that of Sub Saharan African countries and their engagement with the UK. At this embryonic stage of Britain having filed for divorce, we are in unchartered waters. Precisely how African nations will be affected is not clear but the need to persevere through the haze and focus minds on how the continent should ready itself is an exercise in prudence and one which it can ill afford to ignore.

A Change to Donor Aid?

At the heart of the Brexit campaign was the argument that being part of the EU has led to profligate spending with 'GBP350milion' being sent weekly to the EU. Thus now with the gradual UK retreat, thoughts have turned to what this could mean for development assistance. Loretta Minghella, CEO of Christian Aid told Reuters: "Leaving the EU must not mean turning our backs on the world, especially those in our world struggling to free themselves from poverty. The UK has long been a leader of global progress towards a world free from poverty and there is no reason why that should change now that it has voted to leave the EU 1".

In regional terms, Africa was the largest beneficiary of UK aid in 2015, receiving GBP2.54 billion2. Of this amount, some of the largest recipients of aid on the continent were Ethiopia (GBP331.4 million), Nigeria (GBP 253.5 million), Sierra Leone (GBP 213.8 million), South Sudan (GBP205.2 million) and Tanzania (GBP 199.7 million). Funding was given in support of programmes such as education, water, healthcare and sanitation. Just last month, the UK's Department for International Development (DFID) sent emergency shelter kits to Ethiopia due to the recent flooding that has displaced thousands of Ethiopians3. During the Ebola outbreak in Liberia, DFID donated 16% of its budget to ministry of finance in Liberia through the EU4.

For Lord-Gustav Togobo, Songhai's Director of Healthcare & Social Impact, Brexit means there will likely be change in UK development assistance over medium term yet this could also yield opportunities: "In the short term, commitments will still be met between the UK and the continent. These are social interventions which cannot just be erased. But in the medium-long term, the UK will probably start pulling out gradually because the focus will be more on domestic affairs. Also, for a country like Ghana, we have to look at it from the fact that Ghana has attained middle income status: the more it strengthens economically, the more rapidly aid will decline. Africa has already begun the process of finding its own solutions to African problems, with the likes of Tony Elumelu, but this will heighten. Entrepreneurs will be looking to find even more social impact solutions and private capital from impact investors will still seek out such opportunities". That said, a dramatic contraction in aid, should it occur, could be politically destabilising. In high risk environments, local politicians newly without resources to meet the expectations of their constituents/clients will struggle to maintain existing political arrangements.

Terms of Trade - Any Change?

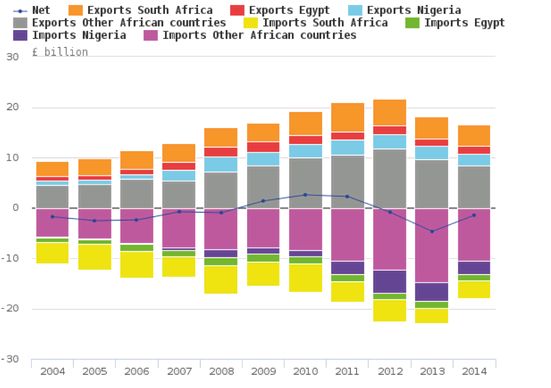

In 2015, Nigeria, South Africa and Egypt accounted for almost half of Africa's GDP in 2015 which contributed to 5.1% of global gross domestic product (GDP)1. Given the intimate relationship between growth and business confidence, it is no surprise therefore that Britain's trade with Africa has mostly been with these three countries, particularly in the areas of goods and services. What is perhaps less of a given is that 2014 figures show that there was a trade deficit between the UK and Africa as a whole: the UK imported more from Nigeria and 'other African countries' - bar South Africa and Egypt- than it exported to them5.

The UK's stated goal of doubling exports by 2020 may well remain a goal for the UK government, in spite of the announcement by David Cameron to step down from the premiership within three months. The argument for this strategic priority is actually accentuated by Brexit. CEO of the newly-created UK-Ghana Chamber of Commerce in Accra, Tony Burkson, told Songhai Advisory that the latest development in the UK could even favour UK-Ghana trade and investment opportunities in the near to medium term:

Despite the unexpectedness of the vote to leave the EU, we believe that in the short term there will be no material change in bilateral trade relations between Ghana and the UK. In the long term, Brexit may prove to be a positive contribution to trade between the UK and Ghana as British companies look to diversify their export markets if as expected a trade deal with the EU takes a while to complete.

British businesses in Ghana will continue to benefit from the stable political and economical environment in Ghana and we do not foresee any change in British FDI into Ghana in the short to medium term.

Ghana is poised to negotiate all trade agreements that involved the UK. The trade deals between UK and Ghana are estimated to amount to GBP1.3 billion and the Minister of Foreign Affairs and Regional Integration Hannah Tetteh has assured the public that while Britain is working out the small-print of its retreat from the EU, it would still be bound by its previous agreements so trade deals would remain unaffected until 20186.

Investment

With the pound plummeting to its lowest levels since 1985, capital flight seems an inevitability as an uncertain climate in Britain is one thing investors will seek to flee from. The comparatively low levels of investment in the UK from African countries – just GBP3billion in 2014 versus the UK's GBP 42.5 billion worth of FDI into the African continent – may well get even smaller as African investors choose caution alongside the rest of the investor crowd. Indeed, the Sterling is losing confidence against many of the world's major trading currencies: falling by 10% against the dollar, 11.4% against the Yen on fateful Friday (24 June).

Ghana Must Go... And Renegotiate

Speaking on Ghana's CitiFM radio, Ghana's Minister of Finance, Seth Terkper considers that Brexit could be both positive and negative for Ghana. The positive effect is that the prices of crude oil will be falling due to the depreciation of sterling and since Ghana is a net importer, Christmas may have come early (though Ghanaians will likely apply pressure on government for cheaper fuel imports to translate into lower prices at the petrol pump). For Terkper, a negative effect is the rise in Ghana's trading currencies (mostly the dollar). He considers that the predicted recession of the UK economy will prevent adequate gold exports from Ghana to the UK which would negatively impact Ghana's export earnings. The rising dollar would cause businesses to invest more in American assets as the returns from such assets would be higher compared to European countries and Britain.

For Renaud Dossavi, a Togolese writer, the viewpoint he shared with Songhai was that, for Africa in the long run, life will be made easier, more interesting in fact because "Brexit will make it easier for Africa to negotiate with several groups with divergent interests rather than with one juggernaut (EU/Brussels)". The Economic Partnership Agreements (EPAs) between the European Union and African regional economic communities in the last few years has been an especially pained diplomatic process.

You Don't Bring Me Flowers

Barbara Streisand's song, 'You Don't Bring Me Flowers' has a café named after it in London's leafy Hither Green but it also resonates with Kenya's trading position with Britain right now. The UK is Kenya's third largest export market78< sup> stated that going forwards, Brexit would lower flower sales and decrease revenue.

Echoing this sentiment is Dr Nic Cheeseman of Oxford University who explained flower sales would decrease because Kenya and Britain would be required to develop new foreign policies governing exports between the two countries. Kenyan exports were predicted to increase by 12% from 2013 to 2016. However, this will likely be affected by Britain's decision to leave the EU.

Planning for the worst is a position which was commendably taken by the Governor of the Central Bank of Kenya9 (CBK), who has stated that Kenya has enough foreign reserves to protect its economy from the predicted economic recession of Britain. He backed this statement by assuring citizens of a standby loan of US$1.5 billion which had been secured from the IMF. According to the Governor, the CBK is ready to intervene anytime its money and foreign exchange markets face Brexit-related challenges and the loan from the IMF will be used only once reserves are depleted. The CBK has stated that it would respond to challenges by tightening monetary policy and increasing interest rates. This is after interest rates were increased by 3% over a two-month period in 2015.

Echoing the CBK governor's tone, Songhai East Africa Director notes that in the last decade trade within the East African Community (EAC) has come to exceed that between EAC countries and the UK. "A stunning reversal" with the opposite having been the case for decades prior.

Remittances & Return(ees)

Research has shown that the UK is one of the leading senders of remittances, globally10. India and Nigeria rank as the two top destinations for the hard-earned money from friends and relatives residing in the UK. Will this change in the wake of Brexit? Songhai Advisory's Lagos-based Analyst Adedayo Ademuwagun thinks so because the drop in the pound: "could mean a bit less money for Nigerians back home receiving money from relatives or employers in the UK".

For one Nigerian Diasporan professional whose quintessentially British accent belies the fact that he was raised in the UK, Brexit now also means a rethink of identity: "firstly, I'm Nigerian, secondly, I'm African and then way, way down, I'm British. In fact, I wouldn't even call myself that anymore". Whether this white-collar worker in London is reflective of a wider Nigerian Diasporan sentiment is unclear but if there are others who think in this way it may well feed into not only how Diasporans move their money, but how they view where they live. Indeed, one Ghanaian first generation migrant- usually conservative in her viewpoint- told her second generation grown-up children that they should 'start to think seriously' about where they want to live, because 'back home' presents less risk than staying in the UK. Simply put by a Ghanaian Diasporan who works in the City of London: "Time to go back home."

But Brexit may mean something else to the wealthy, thirty/forty-something Africans who are mainly based on the continent: a weaker pound could mean more shopping trips to the UK. The UK's Channel 4 has been airing a documentary entitled 'Lagos to London' which is a fly on the wall expose of how Nigeria's super-rich are spending it big in the UK on aspirational (some might argue excessively so) lifestyles, education and real estate11, so perhaps it wouldn't be wrong to think that this could intensify.

For those Africans who don't have as much spending power, however, getting to Britain might be slightly less expensive (indeed, cost is relative) but a more hostile process. That one of the hallmarks of the leave campaign was the need to reduce immigration, it seems illogical to believe that Africans clamouring to try to move or even just holiday in the UK would be any easier, though some Africans in the UK Diaspora have vocalised that view. Acheampong Tutu, Executive Director at Innovation for Empowerment and Development (IFED), a not for profit based in Accra was unequivocal: "some Africans who do not yet have working permits will now be completely barred from entering the UK for jobs. They will now tighten up their borders".

Unintended Consequences: Cementing Self-Determination

While social media is awash with speculation about what the future holds, not every part of the continent is chattering away or sparing much of a thought regarding what Brexit means. Landing Goudiaby, Songhai's Dakar-based Associate says that: "people here do not much understand the consequences because they haven't really mastered the EU operation. That said, for some football fans they are concerned that French players can no longer evolve in the UK as is currently the case!" Similarly, Songhai's Burkina-based Associate, Nadoun Coulibaly, rationalises thus: "Seen from Burkina, Brexit is happening almost unseen. There's no official reaction given at this moment- the media haven't really made any noise about it at all. It's not really a worry for people here. This is explained by the historical fact that Burkina is not a traditional partner of the UK".

But even if Brexit is having little effect on some, others are drawing linkages with arguably a very unintended consequence: that "it sets as a bad precedence for Africa as we envision African unity" says Tutu. An even more immediate threat which is trending on social media is the impact that the referendum is having on secessionist movements, namely that of Biafra in Nigeria's southeastern region who are once again calling for the creation of an independent state called the Biafra (at the crux of Nigeria's 1967 civil conflict). The 'prime minister' of the self-proclaimed Biafran government in exile, Emmanuel Enekwechi speaking to IBTimes UK,12 said that pro-Biafrans wanted "the same right" as British people who got the opportunity to determine their future through a referendum on the region's status within Nigeria. Ademuwagun elaborates further: "These referendums are relevant to Nigeria because of the UK's role when eastern Nigeria tried to break away in 1967. The UK backed the Nigerian government against the breakaway Biafra in the resulting civil war. So this Brexit referendum will probably weaken UK's moral position to oppose a Nigerian separatist referendum—if it ever comes up in future".

Outlook

To conclude, there is not one homogenous viewpoint on how Brexit will impact on the African continent. The dust has in no way settled, and one clear reminder from the Brexit vote is the well-worn Ghanaian (or dare I say, African) adage, that 'no condition is permanent': positions – though today might seem fixed, tomorrow may become fluid. The certainty we can be assured of however, is that preparedness for uncertainty, of any hue, is the best position to adopt, so that if such a time presents itself for an opportunity to rise, African nations should be ready.

Footnotes

1. http://news.trust.org/item/20160624123159-7l0p6/?source=hpOtherNews1

2. https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/482322/SID2015c.pdf

3. The British Government. New UK support to Ethiopia for flooding crisis. The British Government. 2016 https://www.gov.uk/government/world-location-news/new-uk-support-to-ethiopia-for-flooding-crisis

4. Kieran Guilbert. UK must restore aid to Sierra Leone and Liberia: Report. 2014 http://www.reuters.com/article/us-foundation-aid-uk-ebola-idUSKCN0HQ5BF20141001

5. https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/articles/theukstradeandinvestmentrelationshipwithafrica/2016

6. http://citifmonline.com/2016/06/24/brexit-will-affect-ghana-uk-trade-relations-hanna-tetteh/

7. http://www.businessdailyafrica.com/Sterling-stocks-in-free-fall-as-UK-nears-EU-exit/-/539552/3264630/-/8phkxlz/-/index.html

8. Jane Ngige - http://www.standardmedia.co.ke/business/article/2000206127/brexit-to-impact-negatively-on-kenya-s-exports-warns-kenya-flower-association

9. Dr Patrick Njoroge

10. http://www.migrationobservatory.ox.ac.uk/briefings/migrant-remittances-and-uk

11. http://www.channel4.com/programmes/lagos-to-london-britains-new-super-rich/on-demand/63212-001

Written by Kissy Agyeman-Togobo, Songhai Managing Partner with contributions from the Songhai Team: Managing Partner Nana Adu Ampofo (UK), Lord-Gustav Togobo, Director of Healthcare and Social Impact (Ghana), Landing Goudiaby, Associate (Senegal), Nadoun Coulibaly, Associate (Burkina Faso), Adedayo Ademuwagun, Analyst (Nigeria) as well as Emmanuel Danquah (Accra), Elsie Taylor-Sampson (Accra), Razaq Balogun (Accra), Fatima Tambajang (Accra) and Metolo Foyet (Niger).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.