Since a first launch in 1998, ISDA Protocols have become the go-to solution to enable financial institutions and their counterparties to respond to regulatory requirements and market events by amending affected contracts without the need to trawl through and bilaterally renegotiate every single document.

Rocket 4, the article "ISDA Revelation: the ISDA Master Agreement and Related Arrangements" summarised the scope, benefits and protections the wider International Swaps and Derivatives Association framework provides to OTC markets. In deference to our publisher, the metaphor of a rocket was employed, with its sections from nose cone to tail each mapped to one of the key constituents of the ISDA toolset, that unite in providing its projectile power. The growing array of protocols were given the supporting but crucial role of stabilizing 'Left Tail Fin', rightly extolled as smoothing the journey through regulatory compliance by taking the strain out of redocumentation.

However, there is a sense of growing unease and concern amongst the rocket heads at D2 Legal Technology that all might not be well on the launch pad. We need to look into the engineering blueprints further to explain why....

The Basic Protocol Blueprint

In the basic form of a protocol, firms that wish to partake request to join the particular protocol 'club'. After accepting the request, ISDA include the name of the new member with their date of acceptance in one of the protocol-specific "adhering parties" webpages. Links are provided to adherence letters of each member often outlining extra detail. Any two member parties will have an implied match, which they themselves are responsible for interpreting. By the rules defined for a protocol, this pair-match clarifies and establishes the scope, and potentially form, of dated deemed changes to contractual terms. A simple enough model - one that should not be too much trouble for a capable rocket engineer..... but over recent years the blueprint has been growing in page number, and there's more to get to grips with than might meet the eye.

Layering on Protocol Complexity: Paint by Numbers or Rocket Science?

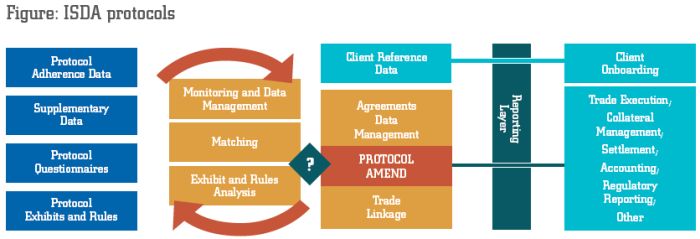

Whilst admittedly in response to increasingly intricate regulation, over the years the complexities of protocols have increased in respect of additional optionality that combines across parties in matching, and more recently bilateral exchange of referential data and optionality choices by the completion of predefined questionnaires. The decision trees and rules underlying protocols have progressively increased in their complexity, and will continue to do so, in terms of: scope (agreement applicability based on type, certain terms and facts); optionality matching (combination and fallback logic); supplementary information required; form of bilateral exchange; multiplicities of underlying exhibits; and creation of new annexes and master agreements. As the industry waits for the complex 'buy side' addition(s) to the "Resolution Stay" protocols1, and further anticipates the introduction of the most ambitious protocol yet, to address the BCBS/ IOSCO2 Variation Margin (VM) requirements for non-centrally cleared derivatives - it's clear the trend for increased complexity is continuing.

A strategic approach: "Look before you launch"

Despite the belated introduction of systems and processes around legal contract data, most large financial firms are still failing3 to take into account the implications of protocols. Joining the club is easy.... but the outcome is not explicit or uniform, but rather variant and embedded in online reports, rules, adherence letters, questionnaires, existing agreement details and various other content and reference data. As a result, critical legal data can be left in a highly uncertain state. The climate of EMIR and Dodd-Frank has required institutions to deal more intimately with protocol data, but remediation activity has tended to be narrow and tactical. The risks demand a strategic approach - full time engineers who know how to make the blueprints work for them and keep the rocket sound.

Rocket to remedy, or weapon of mass data destruction?

Our allegorical rockets built on the ISDA blueprint do not come with an auto-pilot, a fact that those who add their agreements onto the payload and climb onboard for launch surely understand. However, what many are failing to understand and provide for is the burden of regular maintenance and inspection checks that are required to keep their mechanical integrity sure. As the battering forces of regulatory and financial risk grow ever stronger, such risk controls are more critical than ever. Without taking action, the tail fin may just come free, sending their rocket spiraling out of control. At D2 Legal Technology, we recognize that although the drivers and risks may be shared across the industry - each firm is unique in its needs, capabilities and resources.

There is no 'one size fits all' solution - but our first-hand experience in the challenges presented with protocols has helped us to formulate a range of accelerators and analysis methods such that we can effectively and efficiently: run current state analysis of how protocol data is stored, monitored and linked to agreements data management; tailor bespoke Target Operating Models; and recommend a plan of action to realize sophisticated and extensible processes and systems.

Footnotes

1 The ISDA Resolution Stay Jurisdictional Modular Protocol, which will enable parties to amend the terms of their agreements to recognize the contractual stays determined by cross-border application of "special resolution regimes" applicable to certain financially significant companies when in distress

2 Rules published by the Basel Committee on Banking Supervision (BCBS) and the International Organization of Securities Commissions (BCBS/ISOCO)

3 A legal contract data survey conducted by D2 Legal Technology concluded that over 85% of respondent firms failed to have robust processes/systems to be able to adequately manage their adherences to protocols.

Rocket " Edition 6 | Spring 2016

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.