- with readers working within the Basic Industries industries

Over the past 18 months businesses have shown extraordinary resilience amidst a succession of economic shocks. But could huge spikes in inflation be the straw that breaks the camel's back?

Our recent analysis, supported by discussions with manufacturers and retailers, paints a worrying picture, with direct materials costs forecast to rise by 10% over the next six months. This could translate to a 20-30% reduction in EBITDA for consumer product manufacturers, and potentially even more for retailers.

Compounding this looming crisis, many businesses have inadequate oversight of their true exposure to inflation risk. Securing and maintaining oversight of this much heightened exposure must become a priority for all executive boards.

Where will the estimated 10% cost uplift burden fall?

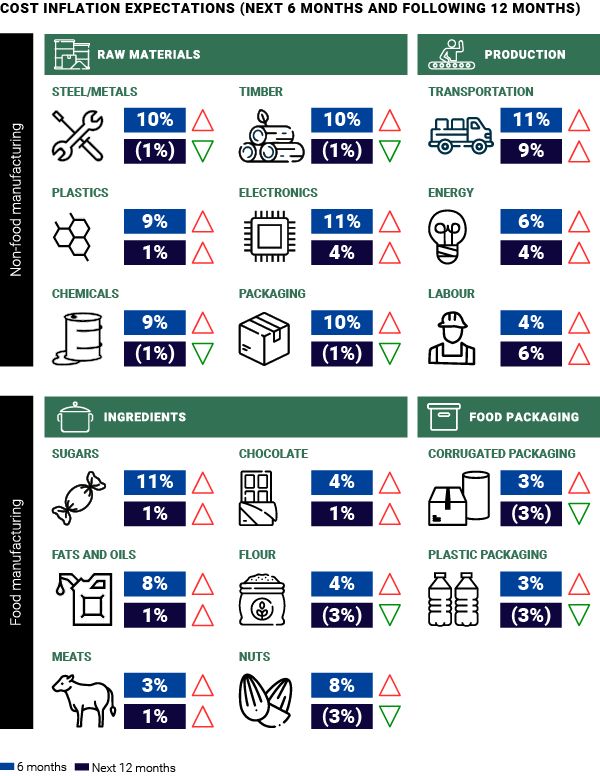

For manufacturers, the next six months could see further increases of more than 10% in the cost of materials including sugar, wheat, steel and timber, due to a combination of increased demand, reduced supply, and increased speculation in some traded commodities.

Inflation is also affecting packaging, utilities, freight and labour. The cost of sea freight from East Asia has increased tenfold since last year, while sea haulage times have doubled, with driver shortages leading to rising prices and delays on trucking routes.

The graphic below provides a breakdown of how our analysis suggests that materials and production cost increases may play out over the year ahead.

For retailers, trucking and warehouse costs are up by between 5% and 10%, while the scarcity (and increasing cost) of labour is an additional strain.

Market volatility can obscure the picture when it comes to inflation risk

A fundamental challenge for many businesses is that procurement teams often only have sight of cost changes at contract renewal periods. As market conditions evolve ever more quickly, there is a risk that previously acceptable mechanisms for tracking price increases may no longer be sufficient to ensure these increases can be accounted for quickly and mitigated.

Supplier behaviour is also changing. Businesses are normally able to protect themselves against market volatility by forging strong supplier relationships and entering into long-term contracts covering price and volume. However, as the cost and availability of some key materials has become pressurised, some suppliers are limiting supply, deprioritising certain customers, reneging on contracts, and even filing for bankruptcy in some instances. Inflation risk is therefore compounded by supply risk.

In addition, while some cost increases may not be permanent, structural changes in markets such as transport, labour and utilities are likely to keep prices high well into 2022 and possibly 2023. Raw materials costs are expected to stay high for the next two years before a slight drop of 1-2% by 2024.

What mitigation levers are available to businesses?

Finding the right solutions now begins with asking the right questions. For example:

- Do we have full visibility of impending cost increases?

- Do we have robust risk management mechanisms (e.g. cover extension/hedging)?

- Have we properly covered the risk of supplier failure? Are there viable alternative suppliers?

- How much cost can we pass on to customers?

- (For food manufacturers) What level of reduction to pack sizes will the market accept?

- (For retailers) What is the current cost exposure to each part of our assortment and expected level of consumer sensitivity to pricing?

- How are our competitors affected and how are they responding?

- What other options do we have?

In the short-term, the priority must be to assess the risk and cost of inflation impact over the next 18 months and stabilise supply (e.g. through cover extensions). This will help reduce the margin gap, but it will not eliminate it entirely. Businesses will therefore have to consider a range of measures to bridge the remaining gap, including cost increases, product re-engineering and demand reduction.

Over the long term, the focus should be on building greater inflation management muscle to protect margin – for example, predicting future supply bottlenecks and securing stock cover from existing suppliers or identifying alternatives. When commodities are in short supply, as we are seeing today, strategic negotiation is off the table.

Buyers can also drive greater value by tuning into supplier interests beyond sales and price, including leveraging group buying power and key account manager reward factors, or identifying avenues for collaboration, such as joint investment in growth opportunities or product development.

Inflation risk dictates a crisis management mindset

Ultimately, to keep inflation risk under control, businesses should be looking to assess and prioritise every area of risk, from supplier default to stock shortages, and map potential solutions.

But the first step every company must take is to recognise inflation risk for what it is – a crisis – and also remain acutely aware that their customers will be feeling the pinch as the cost of living continues to creep up. There will be a delicate balance to strike in terms of tactically navigating these medium-term financial pressures against the goal of retaining customer loyalty for the long term – which, if damaged, could take significantly longer to rebuild.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.