FRS 102 is the single standard that will replace all current SSAPs, FRSs, and UITFs. It will also bring UK GAAP closer to EU- adopted IFRSs as it was originally based on the IFRS for SMEs.

Since the first exposure draft was issued in 2010, the standard has been amended quite substantially to take into account comments received on the original and revised proposals.

The standard we now have includes a number of accounting options permitted in existing UK GAAP but which do not form part of the IFRS for SMEs.

The standard is mandatory for periods commencing on or after 1 January 2015 and early adoption is permitted for periods ending on or after 31 December 2012. Where an entity is within the scope of a SORP, early adoption is permitted, providing it does not conflict with the requirements of the current SORP or legal requirements.

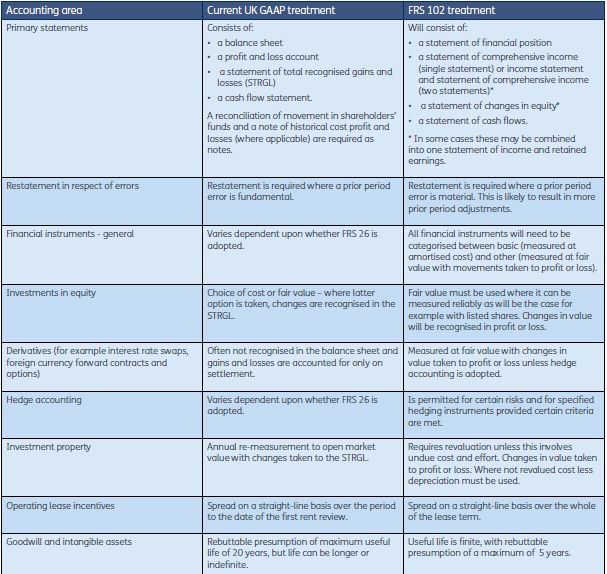

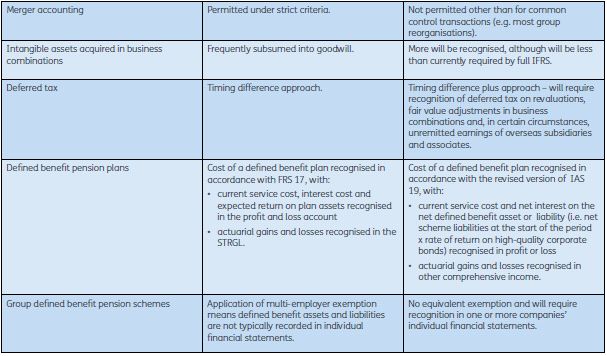

Key differences to existing UK GAAP

While there will be much that is familiar to UK GAAP preparers there are going to be some areas of significant change which will have an effect on the reported results and financial position of many entities. Some of the major differences are considered in the table below.

Transition to FRS 102

The first set of FRS 102 compliant financial statements that an entity produces will need to include restated comparatives. The general principle is that all amounts and disclosures must be restated - however some exemptions do exist. An entity can choose which, if any, exemptions they wish to take advantage of.

In addition, extra disclosure will be required in the first set of FRS 102 compliant financial statements to assist users in understanding the impact that the standard has had on the entity's financial statements. These disclosures include:

- a reconciliation of equity shown under the previous financial

reporting framework to equity determined in accordance with FRS

102

- at the date of transition*

- at the end of the comparative period presented in the financial statements

- a reconciliation of the profit or loss determined in accordance with the previous financial reporting framework and the new framework for the comparative period.

* The date of transition is the beginning of the earliest accounting period for which comparative information is presented. For example, an entity with a December year end that does not adopt the standard early will have a transition date of 1 January 2014.

Reduced disclosure for parent and subsidiary Companies

Subsidiaries and parent companies applying FRS 102 will be able to take advantage of certain disclosure exemptions, provided that they are included in the consolidated financial statements of an entity whose financial statements give a true and fair view and are publically available. These exemptions, and the circumstances in which they may be taken, mirror the concessions offered to IFRS preparers in FRS 101 as discussed in the following article.

Public benefit entities

The ASB had originally suggested a separate, supplementary standard containing guidance specific to public benefit entities (PBEs), for example charities and registered providers. However, the final version of the standard includes this guidance as part of a separate section in the standard (Section 34 on 'Specialised Activities').

Further amendments to the standard

The UK FRC has indicated that they intend to amend the financial instrument sections of FRS 102 to bring it in line with the hedge accounting and impairment provisions in the new standard on financial instruments in full IFRS (IFRS 9 Financial Instruments) that is currently being developed by the IASB. This will result in FRS 102 being amended prior to its effective date although the exact timetable of any amendments is dependent upon when the IASB finalises these remaining parts of IFRS 9.

|

Smith & Williamson commentary This is a fundamental change in accounting that will affect a large range of entities of all sizes and across all business sectors. While there will be some areas of the new standard that will be familiar from current UK GAAP there are also a number of significant differences. Entities should not underestimate the effect these differences may have on their financial statements and their reported performance. Early preparation will be key not just in understanding what the standard requires but also in getting a detailed appreciation of how figures that are currently well understood may change. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.