- with readers working within the Banking & Credit industries

- within Litigation and Mediation & Arbitration topic(s)

ABSTRACT

Today, electronic commerce has surged in the wake of widespread use of the internet. A multitude of innovations also emerged along with this development. The concepts of digital money and cryptocurrencies entered our lives as an alternative to conventional payment instruments in money transfer. Based on blockchain technology, cryptocurrencies quickly turned into investment instruments. Current researches are on the brink of unveiling the nature of cryptocurrencies as an asset. Therefore, it is important to examine the existing articles on cryptocurrency trading and to comprehend the studies.

INTRODUCTION

On the strength of developing technology in the twenty-first century, money in concrete form has become abstract and turned into cryptocurrency. Cryptocurrency is boosting its popularity progressively and is viewed as a currency with a mounting rate of preference not only in Turkey but all over the world. With their extended use, cryptocurrencies attract the attention of traders and investors with their ease of use and advantages.

The first chapter of this study reaps the benefits of the researches and academic articles on cryptocurrency to present a conceptual framework. To get a grasp of the subject in conceptual terms, the Chapter seeks to convey technical information on cryptocurrency.

The second chapter incorporates explanations and reviews of the legal arrangements on cryptocurrencies, including litigation and prosecution matters. This chapter enquires into the extent to which cryptocurrency assets are dealt with in the present legal system and into the legal aspects of cryptocurrency assets in international law.

The study put forwards the Conclusion and Recommendations in the closing part.

CHAPTER 1: RESEARCHES ON CONCEPTUAL FRAMEWORK

1.1. The Concept of Cryptocurrency

Crypto, which means encrypted money in Turkish, is a combination of the words crypto and currency (Turan, 2018). Cryptocurrencies are a collection of data written in code that has a monetary value. They are abstract, untouchable coins but can be converted into physical currencies. Its use consists of password-based buy and sell transactions. Cryptocurrency is a system based on blockchain technology (Özdemir, 2021). This system resembles the banking system. Money can be sent from one account number to another. The system records how much money individuals have in their accounts in the database and allows them to send money to another account number with the defined account number (Özyürek, 2021). This process of sending money is not a physical transaction, only numbers are transferred. The reason why cryptocurrencies make use of Blockchain technology is to achieve decentralization, transparency and immutability (Meunier, 2018).

Cryptocurrencies used as a means of payment are virtual money systems that provide payment methods to individuals without being connected to a centralized system, and many companies around the world use cryptocurrencies as a means of payment. (Atabaş, 2018). Cryptocurrencies hinge on transmission of digital data and follow a set of rules established using encryption methods (Farell, 2015).

Going through the upsides and downsides of cryptocurrency, the upsides include ease of access. It allows users to access it easily from anywhere. Thanks to fast and facile payment, it is sufficient to know the wallet's address of the user who is the intended payee. In terms of swap, it appears to be easier compared to other swap instruments. Its private nature, meaning that private information cannot be shared without the users' permission can be counted among upsides (Kaya, 2018). Transactions in the cryptocurrency system are carried out with low commission fees. As this system is not backed by the state with legal grounds, it is also observed to bring tax advantages (Kaplanhan F. , 2018).

On the downside, it carries a great risk for users due to the sudden price fluctuations (Tüfek, 2017). Since investors' virtual wallets are on the internet, they are at constant risk of being hacked. The illegal use of cryptocurrencies also facilitates their use in money laundering (Öztürk, 2014). Examples of these illegal uses include drug trafficking, corruption, tax evasion (Tarakcioglu, 2021). Because it is not controlled by any law and does not operate as state-backed system, it carries potential risks (Carkacioglu, 2016). It is not widespread because not many users use it and its practical use is minimal. However, the use of cryptocurrencies is expected to become prevalent in the coming years.

CHAPTER 2: STUDIES RELATED TO THE LEGAL NATURE OF CRYPTO CURRENCY

2.1. Legal Position of Crypto Assets

The question of whether cryptocurrency is money in the legal sense has triggered a doctrinal debate. Money can be defined as a medium of exchange that has been utilized for goods and services since ancient times. Money is a tool whose value is known and used internationally. However, cryptocurrencies cannot be regarded as a currency as a medium of exchange in the literal sense as they do not have a tangible existence (Sahin, 2018).

In the case of Turkish law, money must be printed by the Central Bank for use between natural and legal persons. The reasons why cryptocurrency does not operate as money -which is used as a medium of exchange- are that cryptocurrencies are not exported as official currency issued by the state, are not accepted by the society like money and have a limited use (Turanboy, 2019). Foreign and Turkish doctrines concur on the idea that cryptocurrencies should not be counted as money (Tarakçıoğlu, 2021). Cryptocurrency should not also be considered to be electronic money or negotiable instruments by its nature. (Özdemir, 2021). Because, in the digital environment, electronic currencies represent physical money, while cryptocurrencies do not represent any tangible value used in real life, cryptocurrencies should not be treated as electronic money (Carkacioglu, 2016).

There are clarifications in both Turkish and foreign legal doctrine that virtual currencies should not be treated as fiat money. According to the Capital Markets Law, security is defined as "a negotiable instrument that affords partnership or claim rights, represents a certain amount, is used as an investment instrument, generates periodic income, is exchangeable , is issued in series, has the same legend and whose conditions are set by the Board..." (Turanboy, 2019).

Drawing on this definition, the characteristics of securities can be listed as providing the right of partnership and claim right, representing a certain amount of money, being used as an investment instrument, generating income periodically, i.e. at certain intervals, having the same legend, being issued in series, possessing an exchangeable nature and having the nature of negotiable instruments (Adıgüzel, 2022).

In our opinion, characterizing crypto assets as money is not possible. As in the case of modern laws, special consequences are attached to the concept of money in our law as well. Broadening the legal object that is liable to special consequences and characterizing it as money creates an inconvenient situation. One of the reasons why crypto-assets are not considered money under state sovereignty is due to the fact that the concept of money is a centralized concept.

On top of that, cryptocurrency comprises of these features: it does not provide the purchaser with the right of partnership or claim rights, it does not represent a certain amount of money, it does not have a fixed value and its prices vary according to market conditions, and it does not have an element of periodically generating income (Üzümcü & Yıldırım, 2022). For the reasons above, cryptocurrencies cannot be treated as securities (Dülger & Özkan, 2020). As for securities, if cryptocurrency is accepted as a commodity or security, it can be assessed within the scope of the proprietary rights and can be suggested as the subject of the crime in property related criminal incidences such as theft, looting, damage to property (Kaplanhan, 2018). Since cryptocurrencies do not have an intrinsic value and change as per supply and demand, assessing them as commodities may not be received favorably (Durdu, 2018).

In terms of Turkish legislation, the "Regulation Prohibiting Payments Through Crypto Assets" was published in the official gazette numbered 31456 in 2021. This regulation set the nature of cryptocurrencies and defined crypto assets as "intangible assets that are created virtually using distributed ledger technology or a similar technology and distributed over digital networks, but are not qualified as fiat money, dematerialized money, electronic money, payment instrument, security or other capital market instrument". According to Turkish law, it is not possible to qualify cryptocurrency as securities, electronic money, commodities, fiat money with this definition (Balcı & Göcen, 2017).

A search into the position of cryptocurrency in relation to criminal law reveals that studies have been carried out in this realm, but legal gaps exist today. Cryptocurrencies can be used as a tool in concealing elements of crime. In this context, for it is easily convertible into cash, it is preferred in crimes including fraud, theft, drugs, arms trafficking (Engle, 2016). Criminals take advantage of the facilities offered by the cryptocurrency system and use it to conceal the elements of crime and to monetize the financing of the crime. Where cryptocurrencies are the subject of litigation in a legal dispute, it becomes difficult for the court to obtain evidence in crimes committed through cryptocurrency exchanges. A study demonstrated that criminals using the cryptocurrency market mostly committed fraud and theft crimes, victimizing people by causing losses in the amount of $1,900,000 in 2020 (Braaten, 2019).

The cryptocurrency system, which is viewed as the most convenient tool among criminals implementing money laundering methods, is used to convert illegally obtained money into cash for the purpose of disguising the crime without raising suspicion. It enables the emergence of different types of crimes in practices for laundering the proceeds of crime and causes the disappearance of evidence in the fight against these crimes. Terror organizations also invoke this method to launder the financial resources they require in order to mobilize their ideas and actions (Narayanan, 2016).

In 2021, the "Regulation Amending the Regulation on Measures to Prevent Laundering Proceeds of Crime and Financing of Terrorism" was published in the Official Gazette wherein cryptocurrency assets were included in the scope of crime (Tarakcioglu, 2021). The use of cryptocurrency assets for criminal purposes can be averted by austere and strict rules, but it can be said that albeit the definition of the legal use of the cryptocurrency system in the provisions of law, it will not thwart illegal use to a great extent (Brito, 2013).

Japan is the first country that comes to mind insofar as cryptocurrency regulations across the globe are concerned. This is because it is the first country to define crypto assets and recognize Bitcoin as a means of payment. In 2016, studies were carried out on cryptocurrency assets and in 2017, it enacted the law on the use of these assets as a means of payment (Durdu, 2018).

There is no federal law on cryptocurrencies in the US, but there are state-level practices. Examples include enactment of the Blockchain Technology Act in the state of Illinois to deal with legal aspects of blockchain-based contracts and evaluation of crypto assets in the state of Wyoming with a liberal perspective in the Utility Token Bill (Aytekin & Arslan, 2021).

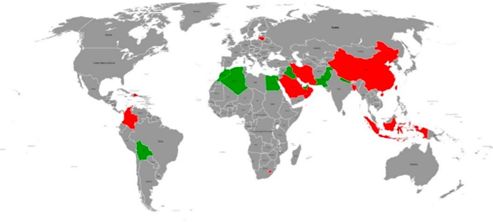

Figure 6: Countries that completely ban (Green) and partially ban (Red) the use of cryptocurrency (Regulation of Cryptocurrency around the World, 2022).

The European Union has made regulations and studies on cryptocurrency assets. Those regulations are proposing to include crypto assets in the tax system to a significant extent (Durdu, 2018).

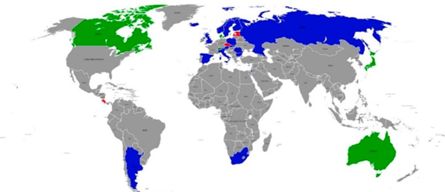

Figure 7: List of Countries Handling Cryptocurrencies Within the Framework of Tax Laws (Blue), Countries with Laws on Money Laundering and Terrorism (Red), Countries with Tax and Criminal Laws on Cryptocurrencies (Green) (Regulation of Cryptocurrency around the World, 2022).

2.2. Cryptocurrencies as a Subject of Litigation and Prosecution

In cryptocurrency assets, for determining the type of case, the nature of the cryptocurrency must be determined first. In light of the information explained above, cryptocurrency cannot be accepted as negotiable instruments, commodities or electronic money. If the cryptocurrency is considered to be property, it can be handled as assets and lawsuits of this nature can be filed in the civil courts of first instance. However, when it is considered within the scope of assets, a lawsuit for the protection of possession can also be filed in the civil court of peace in terms of possession. Even if cryptocurrencies are considered to have the nature of property, difficulties may arise in establishing the value of cryptocurrencies due to their volatile structure and utterly inconsistent value (Helvaci, 2019).

In the case of partial claim and indefinite receivables lawsuits, there is an ongoing debate as to which of the foregoing lawsuits should cover cryptocurrencies. If cryptocurrencies are considered to be property, it should be investigated in the legal sense whether the property is divisible or not. As per doctrinal opinions, goods can be divided if it does not cause a decrease in their value. If it is accepted that cryptocurrencies are capable of being divided without a value decrease, they may be included in partial claims lawsuits. In the context of the indefinite receivables lawsuits, these lawsuits can be tried where it is not possible to determine the amount of the receivable by the letter of the law. However, cryptocurrencies cannot be assessed within the scope of these lawsuits since their value at the time of filing the lawsuit is determinable (Üzümcü & Yıldırım, 2022).

On the topic of litigation costs, while public services are free of charge, certain fees must be paid at certain rates. There is an application fee that must be paid in advance when filing a lawsuit (Pekcanıtez, 2017). Where the cryptocurrency has been subject of litigation and the case has been adjudged, judgment fee and proportional post-judgment fee must be deposited. In addition to the fees, expenses such as in respect of documents, expert witnesses, etc. must also be paid during the trial process as litigation costs. If cryptocurrencies are to be assessed as evidence, litigation costs include the advance on evidence. Article 119 of the Code of Civil Procedure reads as: "Any written or printed text, deed, drawing, plan, sketch, photograph, film, image or sound recording, data in electronic media and similar data carriers that is capable of substantiating the facts in dispute constitute documents according to this Law." In light of the letter of law, it is possible to categorize the blockchain technology based data as evidence. However, it is controversial in the doctrine that cryptocurrencies are evidence. In the matter of whether cryptocurrencies fall within the scope of evidence, one opinion suggest that the data used and intercepted in blockchain technology should be regarded as documents being in the form of electronic data. Another opinion maintains that putting these data in the scope of evidence is not correct because it is not possible to find out who performed the transactions in the assessment of data in blockchain technology (Bilgili & Cengil, 2019).

In the matter of seizure of cryptocurrencies, pursuant to enforcement and bankruptcy law, it is important that which goods are subject to seizure. There are goods that cannot be partially and completely subjected to seizure. Of these goods, Article 82 of the Enforcement and Bankruptcy Law enumerates those that cannot be completely seized which include the goods that are essentially needed by persons, the items that must be compulsorily used to carry on their profession, and the necessary items owned by family members they live with. The partially seizable goods are specified in Article 83 of the same law which include the debtor's salary, beneficial interests, the goods that the bailiff appreciates, except for the items used by the family as necessary. As it is clear from the letter of the law, there is no prohibitive situation regarding the seizure of cryptocurrency assets. Cryptocurrencies are not among the goods that cannot be seized. Therefore, considering the legal regulations, it can be said that seizure of cryptocurrencies is possible (Özsoy, 2019).

In the seizure of cryptocurrency, it is important to go by the procedure like normal goods. A notice of attachment is served upon the intermediary institution where the cryptocurrency is traded. However, the cryptocurrency asset in question must be named by the debtor in the property declaration. In response to this notice, the intermediary institution must disclose the value of this cryptocurrency if the debtor actually has cryptocurrency assets. This response is followed by the commencement of seizure of the cryptocurrency asset in the amount owed by debtor. However, abrupt changes in market value of cryptocurrency pose another problem in the seizure of cryptocurrency. Majority opinion holds that action should be taken according to the market value of the cryptocurrency on the day the notice is received by the intermediary institution to which the cryptocurrency is attached. In the matter of whether enforcement with or without judgment should be commenced, if the cryptocurrency would be accepted as money, enforcement proceedings without judgment can be pursued (Helper, 2019).

CONCLUSION

With the development of technology, people have started to use different payment and investment instruments. Traditional exchange of goods and services with money is now replaced by new and different instruments. One of these changes is the emergence of cryptocurrencies. Cryptocurrencies are used by individuals in their daily lives and commercial transactions for the purchase of goods and services and are used by companies as a means of payment.

The cryptocurrency system is based on blockchain technology. With this technology, users' transactions are kept confidential for security purposes and the transaction is not visible to other people. With blockchain technology that is not controlled by any center, cryptocurrencies are not considered physical money and these coins are kept in virtual wallets as virtual money. The number of users making transactions with cryptocurrencies is consistently increasing due to the fast transfer facility and low cost of cryptocurrencies.

It has been observed that companies using traditional systems in international trade fail to keep pace in competition with other companies. Companies that keep up with the developing technology and guide their business within this system earn much more profit. One notable issue here is that, given the developing technology, the blockchain-based cryptocurrency system should be used consciously. Relevant studies and academic researches in the literature on the use of cryptocurrency are guiding for investors and operators.

With the progressively advancing blockchain technology, the interest of users is stepping up and the source of this interest is inefficiency in the market. International trade has turned to different technological solutions due to this inefficiency. Today, new solutions have surfaced with blockchain technology and its use is becoming widespread in many areas of international trade by reason of cost and speed.

REFERENCES

Acar, A. (2020). Preliminary Investigation of Digital Hoarding Behaviors of University Executives. European Journal of Digital Economy Research .

Adıgüzel, B. (2022). Capital Market Law. Ankara: Adalet Publishing House.

Al-Amaren (2019). Is the Blockchain Revolution a Game-Changer in Letter of Credit (L/C)?. International Journal of Advanced Science and Technology.

Alptekin, V., & Metin, İ. (2018). Cryptocurrency Economy. Eğitim Publishing House.

Arikan, A., & Konat, G. (2021). An Evaluation on Problematic Cryptocurrency Trading in Turkey and the World. Journal of International Trade and Economics Researches.

Armknecht, A. (2015). Ripple: Overview and Outlook, Trust and Trustworthy Computing. In Lecture Notes in Computer Science.

Aslan, A. (2018). Cryptocurrency Phenomenon and Blockchain Technology, Reaction of Economic Actors. Hacettepe University Institute of Social Sciences. Ankara.

Atabaş, A. (2018). Blockchain Technology and the New Place of Cryptocurrencies in Our Lives. Istanbul.

Atali, M. (2020). Civil Procedure Law. Ankara: Seçkin Publishing.

Avşar, İ. İ. (2020). A Research on Cryptocurrencies and International Trade. Hasan Kalyoncu University and Gaziantep University Institutes of Social Sciences. Gaziantep.

Aytekin, B., & Arslan, R. (2021). The Legal Position of Crypto Assets in the World and Turkey. Baseak CORE Papers .

Balcı, M., & Göcen. (2017). Historical Development of International Trade and Production and Political Economy Analysis of Turkey in this Context. Ankara: Savaş Publishing House.

Berber, M., & Bocutoglu, E. (2014). Introduction to General Economics. Bursa: Ekin.

Bilgili, F., & Cengil. (2019). Bringing cryptocurrencies as capital to trading companies in the specific case of Bitcoin. Journal of Ankara Hacı Bayram Veli University Faculty of Law.

Bilir, & Çay, Ş. (2016). The Relationship Between Electronic Money and Financial Markets. Journal of Niğde University Faculty of Economics and Administrative Sciences.

Braaten, N. (2019). Convenience Theory of Cryptocurrency Crime. A Content Analysis of U.S. Federal Court Decisions (pp. 958-978).

Brauneis, A., & Mestel, R. (2019). Cryptocurrency-portfolios in a mean variance framework. Finance Research Letters.

Brito, P. (2013). Bitcoin, A Primer for Policymakers. Mercatus Center.

Carkacioglu, A. (2016). Cryptocurrency Bitcoin.

Çağlak, M. (2019). Seizure of Capital Market Instruments. Ankara: Seçkin Publishing.

Çağlar, Ü. (2007). Electronic Money: Developments in Information Technology and New Payment Systems. Kyrgyz-Turkish Manas University Journal of Social Sciences.

Çakır, K. (2016). The Crime of Laundering The Proceeds of Crime, PhD Thesis. Marmara University Institute of Social Sciences. Istanbul.

Çarkacıoğlu, A. (2016). Cryptocurrency Bitcoin. Ankara: Capital Markets Board Research Report.

Çütçü, İ., & Kılıç, Y. (2018). The Relationship Between Exchange Rates and Bitcoin Prices: Time Series Analysis with Structural Breaks. Journal of Management and Economics Research.

Doğan, & Buyrukoğlu (2018). Recommendations on Taxation and Accounting of Bitcoin Transactions in Turkey. Journal of Tax Issues.

Durbilmez, E., & Türkmen, Y. (2018). Blockchain Technology and its Status in the Turkish Finance Sector. Journal of Finance, Economics and Social Researches.

Durdu, E. (2018). Bitcoin as a Cryptocurrency Unit and Criminal Law, Master's Thesis. Istanbul.

Dülger, M., & Özkan. (2020). Cryptocurrency crimes: The legal dimension of cryptocurrencies and their evaluation in terms of Turkish Criminal Code. Seçkin Publishing.

Eksioglu, E. (2017, January 13). Economic Effects of Electronic Money Usage, An Application on Turkey. National Thesis Center. Sivas.

Engle, E. (2016). Is Bitcoin Rat Poison Cryptocurrency, Crime, and Counterfeiting. Journal of High Technology Law.

EPRS (2014). Bitcoin Market, economics and regulation. Retrieved from https://goo.gl/ kpyrfG

European Countries Join Blockchain Partnership. (2018). European Commission : Retrieved from https://ec.europa.eu/digital-single-

Farell, R. (2015). An Analysis of the Cryptocurrency Industry. Wharton Research Scholars, 1-23.

Fefer, R. (2019). Blockchain and International Trade. Retrieved from https://sgp.fas.org/crs/row/IF10810.pdf

Ganne (2018). Can Blockchain Revolutionize International Trade. World Trade Organization Publications.

Guseva, Y. (2021). The SEC, digital assets and game theory. The Journal of Corporation Law.

Güven, V., & Şahinöz, E. (2018). Blockchain Cryptocurrencies Bitcoin. Istanbul.

Helvaci (2019). Negotiable Instruments Law. Istanbul: Vedat Kitapçılık.

Hoffman, N. (2018). Supply Chain Finance and Blockchain Technology. Ténzy Publisher.

Irak, G., & Topçu, Y. (2020). The Impact of the Application of Block Chain Technology in Supply Chain on Costs. International Journal of Management Economics and Business.

Kaplanhan (2018). Evaluation of Cryptocurrency in terms of Turkish Legislation. Journal of Tax Issues.

Kaplanhan, F. (2018). Evaluation of Cryptocurrency in terms of Turkish Legislation. Journal of Tax Issues, 105-123.

Karaçalı, C. (2019). Accounting of Cryptocurrencies: An Application. BARTIN UNİVERSİTESI SOCIAL SCIENCES INSTITUTE BUSINESS ADMINISTRATION DEPARTMENT.

Karaoğlan, S., & Arar, T. (2018). Cryptocurrency Awareness in Turkey and Motivations of Businesses Accepting Cryptocurrency. Journal of Business and Economics Studies.

Kaya, S. (2018, January 26). Cryptocurrencies and Their Evaluation from a Fiqhi Perspective. ISAFEM.

Khalilov, M. (2017). A Review on Bitcoin and Digital Currency Studies in the World and Turkey. Proceedings of 19th Academic Informatics Conference. Aksaray.

Khandaker, S. (2019). How Blockchain Is Transforming CrossBorder Payments. Forbes: Retrieved from https://www.forbes.com/sites/forbestechcouncil/2019/03/12/how-blockchain-is-transforming-cross-border-payments/?sh=63ea161c7df2

(2019). Personal Data Protection Law and Blockchain Technology Report. Informatics Foundation of Turkey.

Kumar, R. (2021). Advance Concepts of Blockchain. In S. Bhatia, Blockchain for Business: How It Works and Creates Value, (pp. 360-370).

Meijer, C. (2016). Blockchain and the securities industry. Journal of Securities Operations & Custody.

Securities and Exchange Commission Statement of Claim. (2022, 5 5). Retrieved from https://www.sec.gov/litigation/complaints/2020/

Meunier, S. (2018). What Is Lockchain And How Does This Revolutionary Technology Work ? London Academic Press., 22-34.

Narayanan, A. (2016). Bitcoin and Cryptocurrency Technologies. Princeton University Press.

Nebil, F. (2018). Bitcoin Vr Crypto Coins. Istanbul: Pusula.

Nesbitt, J. (2018). How Bitcoin Could Shake Up International Trade. TradeReady. International Trade.

Oğuzman, M. (2016). Property Law. Istanbul: Filiz Bookstore.

Ortakarpuz, M. (2020). Current Developments Towards the Development and Facilitation of International Trade. In A. Gedik, Current Issues in Social Sciences. Konya: Eğitim Publishing House.

Ozatay, F. (2014). Monetary Economics Theory and Policy. Ankara: Efil.

Öncü, S., & Ektik, D. (2021). The Use of Cryptocurrencies for Investment Purposes: Risks and Returns. Manisa Celal Bayar University Journal of Social Sciences .

Özdemir, G. (2021). Property Nature of Cryptocurrency. SDÜHFD.

Özgenç, İ. (2021). The Legal Nature of Suspicious Transaction Notification, the Role of MASAK, Legal Assessments on the Crime of Laundering the Proceeds Derived from Crime. Journal of Ankara Hacı Bayram Veli University Faculty of Law.

Özsoy (2019). Seizure of Cryptocurrency Assets through Compulsory Execution. Başkent University Institute of Social Sciences, Department of Private Law. Ankara.

Öztürk, N. (2014). Money, Bank, Credit. Bursa: Ekin.

Özyüksel, S., & Ekinci, M. (2020). Examination of the Foreign Trade Impact of Block Chain Technology within the Framework of Sample Projects. Journal of Business, Economics and Management Researches.

Özyürek, H. (2021). Current and Possible Uses of Blockchain Technology. Journal of Anadolu University Faculty of Economics and Administrative Sciences, 31-50.

Pal, A. (2021). Blockchain for business Management, Applications, Challenges and Potentials. The Journal of High Technology Management Research.

Pathak, S. (2021). Blockchain for Business, How It Works and Creates Value. Blockchain Enabled Supply Chain Management.

Pekcanıtez, H. (2017). Civil Procedure Law. Istanbul: Oniki Levha Publishing.

Prowse, P. (2020). International Cryptocurrency Regulation.

Regulation of Cryptocurrency around the World. (2022, 5 10). US Library of Congress: Retrieved from https://www.loc.gov/research-centers/law-library-of-congress/about-this-research-center/

Sekmen, F. (2012). Monetary Theory, Concepts-Theories-Models. Ankara: Seckin .

Sharma, T. (2022, 5 12). Top 10 Countries Leading Blockchain Technology in the World. Blockchain Council: Retrieved from https://www.blockchain-council.org/blockchain/top-10-countries-leading-blockchain-technology-in-the-world/

statista. (2022, 5 5).

statista. (2022). statista: Retrieved from https://www.statista.com/

Şahin, O. (2018). Bitcoin and Other Cryptocurrencies in the Light of TAS and TFRS in terms of Accounting, Tax and Audit. Journal of Accounting Science World.

Tarakcioglu, Z. E. (2021). Crypto Asset and Criminal Law Responsibility. AkdHFD, 295-352.

Tarakçıoğlu, E. (2021). Crypto Assets and Criminal Law Responsibility. Journal of Akdeniz University Faculty of Law.

Topcu, A., & Sarıgül, S. (2020). A General Evaluation on Blockchain Technology, Financial Sector, Foreign Trade and Tax Regulations in the World and Turkey. European Journal of Science and Technology.

Turan, Z. (2018). Cryptocurrencies, Bitcoin, Blockchain, Petro Gold, Digital Money and Usage Areas. Journal of Ömer Halisdemir University Faculty of Economics and Administrative Sciences, 1-5.

Turanboy, A. (2019). Emergence and Legal Characteristics of Cryptocurrencies. Journal of Banking and Commercial Law.

Tüfek, B. (2017). Electronic Payment Instruments and Future Approach Cryptocurrency. Bahçeşehir Istanbul University Institute of Social Sciences. Istanbul.

Uysal, Ü. (2019, July). Cryptocurrency and the Use of Cryptocurrency in Trade: Investigating the Attitudes of Entrepreneurs and Investors towards Cryptocurrency. MUĞLA SITKI KOÇMAN UNİVERSİTESI SOCIAL SCIENCES INSTITUTE DEPARTMENT OF BUSINESS ADMINISTRATION .

Ünsal, E., & Kocaoğlu, Ö. (2018). Blockchain technology, Usage areas, vulnerabilities and future prospects. European Journal of Science and Technology.

Üzümcü, R., & Yıldırım, Y. (2022). LEGAL STATUS OF CURRENCIES AND THEIR PLACES IN CONTRACTS. Süleyman Demirel University Vizyoner Journal.

Wass, S. (2018). Maersk and IBM go live with global blockchain trade platform TradeLens. Global Trade Review: Retrieved from https://www.gtreview.com/news/fintech/maersk-and-ibm-go-live-with-blockchain-supply-chain-platform-tradelens/

Weinland, D. (2018). HSBC Claims First Trade-Finance Deal with Blockchain. Financial Times: Retrieved from https://www.ft.com/

Yalcin, S. (2019). Accounting of Crypto Exchange Instruments. Journal of Accounting and Finance.

Yardımcı, T. (2019). Assertion of bitcoin claim through enforcement proceedings and seizure of the debtor's Bitcoin. Journal of Ankara Hacı Bayram Veli University Faculty of Law.

Court of Cassation, 2009/11-93 (Court of Cassation 11 17, 2009).

Yavuz, N. (2019). Turkey's First Financial Blockchain Network Goes Live. Retrieved from Coincolik: https://www.coinkolik.com/takasbank-aciklama-yapti-turkiyenin-ilk-finansal-blockchain-agi/

Yermack, D. (2017). Corporate Governance and Blockchains. Review of Finance.

Yildiz, Y. (2018). Taxation of Cryptocurrencies (bitcoin). Tax Report Journal.

Zeadally, & Abdo, J. (2019). Blockchain: Trends and future opportunities. Internet TechnologyLetters.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]