- within Strategy topic(s)

We have left behind the 25th anniversary of the Turkish Competition Authority ("TCA"). Data on investigations, seen as the most critical tool of the TCA's intervention in the markets, reveal some interesting trends. To better understand these trends, we have divided the data into sections according to the chairpersons of the TCA.

Our first observation is that while the number of investigations increased continuously in the first ten years of the TCA, it started to decline in the following eight years and returned to its previous trend in 2016 and onwards. In the 2007-2015 period, the TCA focused on informing the public about its mission, strengthening its institutional infrastructure and advocating for competition. As a result, we observe that direct intervention in corporate behaviour by opening investigations has been put on the back burner.

Figure I: Number of concluded investigations

The average annual number of investigations doubled to 20 in the post-2016 period compared to the 2008-2015 period. Having finalised 36 investigations in 2021, the TCA concluded last year with 27 investigations.

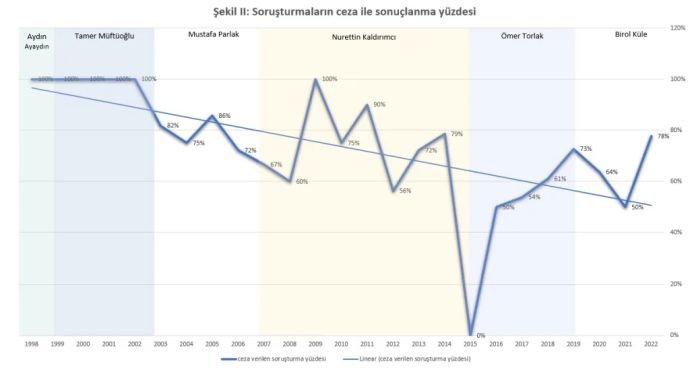

Our second observation is that the rate of investigations finalised by monetary fines bottomed out at zero in 2015 and remained low in the following years. The fact that 78% of investigations resulted in monetary fines last year may mean that this downward trend has been broken.

Figure 2: Percentage of investigations finalised by monetary fines

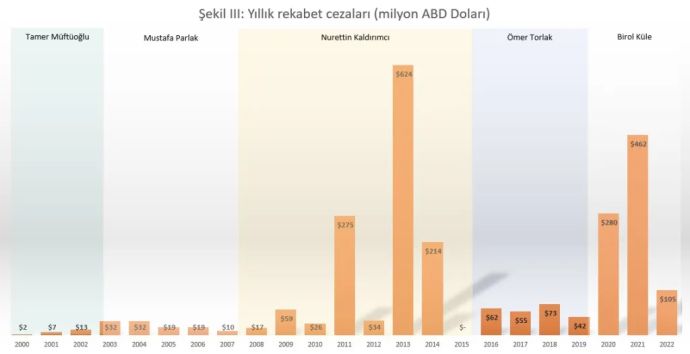

Our third observation is that the TCA's antitrust fines have been on an upward trend in the long run but have succumbed to the deprecation of the Turkish lira. This is probably the only meaningful conclusion that can be drawn from the long-term picture when we convert the fines into US dollars over a long period of 25 years and because we did not consider the economy's growth and hence the turnover of companies.

Figure 3: Antitrust fines (annual, million USD)

Still, if we look at it in sub-periods, according to the chairpersons,

- In the 2008-2015 period, investigations against a small number of high-profile companies resulted in high fines.

- In the 2016-2020 period, there has been a persistent increase in fines, although the deprecation of the Turkish lira has shrunk dollar-denominated fines.

- Since 2020, the annual penalty amount is now on a higher path, despite the large deprecation of the Turkish lira.

Conclusion

In its twenty-fifth year, the TCA has become a competition authority that intervenes in corporate conduct in the market through numerous investigations, resulting in high monetary fines. The probability of a company being fined at the end of an investigation increased the deterrence of the TCA on corporations and increased their efforts to comply with the competition.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.