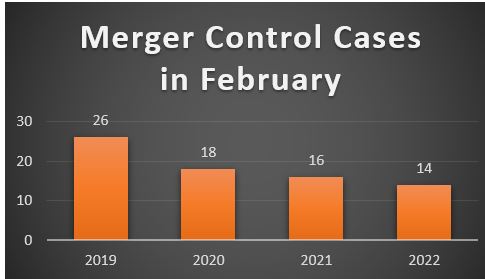

In February, the Turkish Competition Board (the "Board") approved 14 merger control filings and published 8 reasoned decisions.

The most important recent development is that the Turkish merger control thresholds have been updated with other significant changes. Although it was published on March 4th (not in February), as it is a very significant development please find our take on the new merger control thresholds here.

Another important development in Turkish competition law in February is that the application regarding the acquisition of sole control of Sörmas Sögüt Refractory Materials A.S. by RHI Magnesita NV, has entered Phase II review.

"No Exemption for You": Does the Turkish Competition Board's Practice on Platform Sales Bans Deviate from the EU?

The Board's decision on BSH, a home appliance manufacturer, is another significant decision that highlights that the Board has digital marketplaces on its radar. The Board rejected the request of BSH for an exemption against the restrictions on internet sales by retailers. BSH had prohibited its authorised dealers from selling on digital platforms such as N11, Amazon, Trendyol, Morhipo, and Hepsiburada via a circular prepared by BSH.

The circular states that if an authorised dealer violates the sales ban, BSH will warn the authorised dealer in writing to end the violation. If the violation is not resolved within the specified time despite the written warning, BSH may terminate the contract executed with the relevant dealer for just cause.

The Board assessed the possible effects that selective distribution agreements may have on competition and found that the system implemented by BSH may potentially harm intra-brand competition by way of restricting the number of distributors and prohibiting sales to unauthorised distributors. The Board stands with the CJEU following its Metro decision and states that prohibiting passive sales in selective distribution systems cannot benefit from the block exemption. Consequently, the Board defines this practice as a hard-core restriction, even though such a definition is not made within Communiqué No. 2002/2. For detailed information, please see our article here.

The Board has its eye on pharmaceutical undertakings

The Board launched an investigation against four undertakings in the pharmaceutical industry to determine if they have infringed the law by way of horizontal and vertical agreements. Two of the undertakings, Deva and Haver, operate as manufacturers in the Turkish human pharmaceutical sector, whereas the other two undertakings, Gül and Sonuç, operate as pharmaceutical warehouses that carry out distribution activities in the hospital channel. The allegations include that Deva, Haver, Gül and Sonuç established an organisation that engaged in anti-competitive activities, particularly in the procurement of medicines by public hospitals and in the relevant sector in general.

The Board stated that:

- while Deva and Haver operate as manufacturers in the generic drug production market, Sonuç and Gül operate as pharmaceutical warehouses in the drug distribution market. In other words, Deva and Haver are competitors at the manufacturing level, whereas Sonuç and Gül are competitors at the distribution level.

- The documents obtained included communications between Sonuç and Gül which included statements such as "don't let the hospitals get between us", which indicates a mutual intention to prevent price competition in hospital sales and to determine the price of the pharmaceutical subject to sale.

The Board concluded that Sonuç and Gül determined commercial factors, such as the sales price for pharmaceuticals and sales and marketing conditions, outside of competitive market dynamics and against the dynamics of effective competition and decided to impose an administrative monetary fine of approximately EUR 294,000 on Sonuç and approximately EUR 90,000 on Gül. The Board found that Deva and Haver did not engage in any infringement of the law and therefore did not impose an administrative monetary fine on them.

Freedom for resale prices!

The Board concluded its investigation in February concerning allegations that Duru Bulgur, a pulses manufacturer, had violated Turkish Competition law by way of determining the resale price in its sales for retail chains located in the Konya and Karaman regions. The Board decided that Duru Bulgur cannot benefit from the exemption and had indeed engaged in a violation of competition. Correspondingly the Board imposed an administrative monetary fine of approximately EUR 282,000 for determining the resale prices of undertakings operating at the retail level. This decision is especially interesting considering its background, as the Board had previously launched an investigation against Duru Bulgur and decided that there was no violation of the law concerning its resale price maintenance (RPM) practices. Subsequently, upon the application of a competition law consultant, the administrative court annulled the Board's decision, and the Board re-launched an investigation that has now been concluded with a violation decision and penalty for Duru Bulgur.

No escape for Coca Cola

The Board has included Coca-Cola in its investigation launched against various undertakings operating as manufacturers, suppliers and retailers in Turkey's FMCG sector, following a review of documents obtained during on-site investigations carried out as part of its on-going investigation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.