The Turkish Competition Authority (TCA) has recently taken a decision that may potentially undo its previous steps to open up the market for payment systems. With this recent decision, the TCA is stepping aside to let the regulation and sectoral regulators maintain competition in the payment services market.

The TCA recently abolished its withdrawal decision on Interbank Card Center (BKM – Bankalararasi Kart Merkezi). The now abolished decision was withdrawing the individual exemption of the BKM Express service of the BKM. Due to the abolishing of the withdrawal, the BKM will benefit from the previous individual exemption for its BKM Express service.

What is BKM Express?

BKM was a partnership of public and private Turkish banks that aims to develop rules and standards within the card payment system. Turkish banks issuing credit cards are members of BKM, while BKM Express is a service that is open for these members. The main business of the BKM is the settlement of receivables that are arising from credit card payments between the banks.

BKM Express is a payment service including a digital wallet system where customers can save their card information, and use it during online shopping without having to submit the credit card information to the seller, hence, speeding up the shopping and securing the card information. Any bank member of the BKM can make use of BKM Express without a limitation. However, access of other fintech companies to the BKM Express has been limited.

What is the history of BKM Express and the TCA?

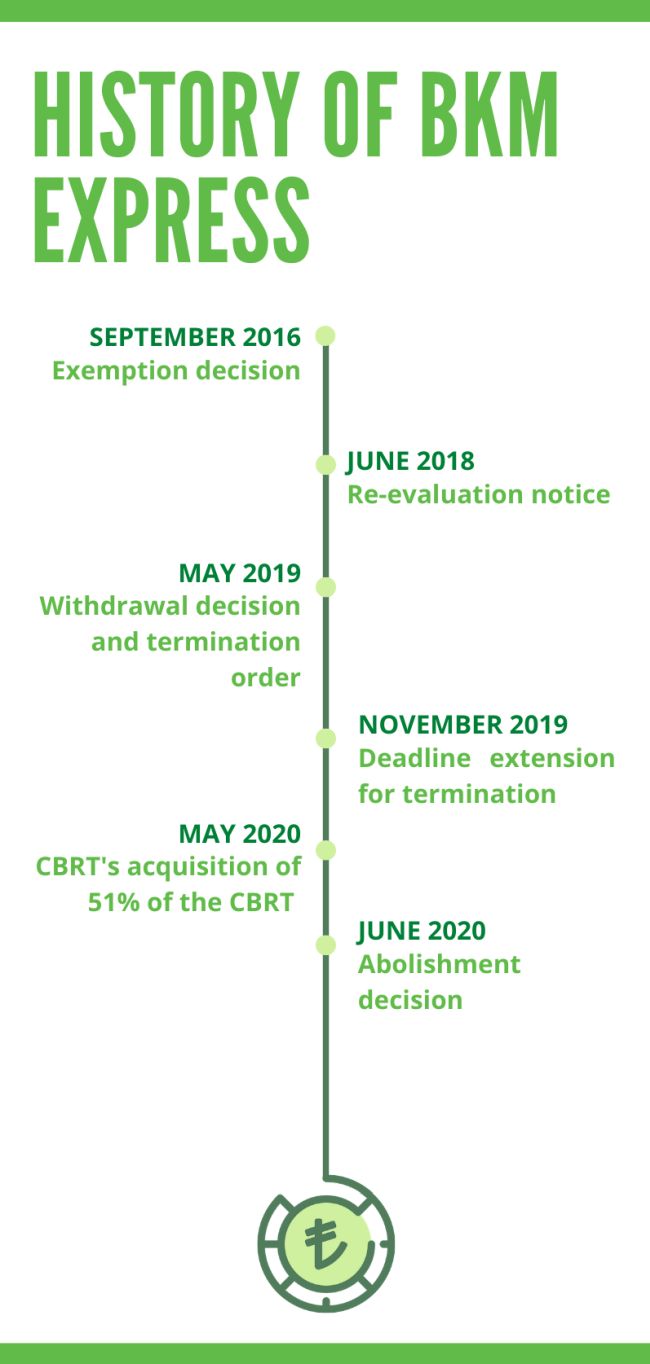

The TCA and the BKM are not unfamiliar with each other, and there is a history behind the recent decision of abolishment concerning BKM Express. The history behind the TCA's evaluation of BKM Express is as follows:

- September 2016 – The TCA granted an individual exemption to BKM Express ("Exemption Decision").

- June 2018 – BKM was requested to file a new exemption notification for the TCA to evaluate whether the conditions of the exemption are still met.

- May 2019 – The TCA withdrew the individual exemption of the BKM Express, and granted 60 days for termination of the service, until November 2019 ("Withdrawal Decision").

- November 2019 – Upon a request for re-evaluation, the TCA extended the termination period of BKM Express by 8 months, until June 2020.

- May 2020 – While the BKM Express service was expected to be terminated, the Central Bank of the Republic of Turkey (CBRT) acquired 51% of the BKM, and filed a request to the TCA for the abolition of the withdrawal decision. With its request, the CBRT expected to get the TCA's greenlight for BKM Express, avoiding the termination of the service.

- June 2020 – 14 days before the termination deadline of the BKM Express, the TCA abolished its Withdrawal Decision, enabling the CBRT to move forward with BKM Express ("Abolishment Decision"). The TCA published its Abolishment Decision last week, on 20 November 2020.

The CBRT did not have any powers to acquire any shares in payment companies until a recent amendment to the Act No. 6493 on Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions ("Payment Services Act"). Although the amendments to the Payment Services Act mainly aimed at increasing the competitiveness in the sector by aligning Turkish legislation with the EU's Payment Services Directive 2 ("PSD2"), the amendments also vested the CBRT with the power to be a shareholder in systemically important system operators.

In May 2020, the CBRT used its new power to acquire 51% and the management control of the BKM. In the competition law community, this transaction was generally considered insignificant for the TCA's approach to the BKM Express decision, since it did not affect the competitive concerns on the surface. Also, the CBRT thought to become a market player due to its move. However, the TCA saw the transaction from another angle and published its Abolishment Decision to the surprise of many.

What were the reasons for the withdrawal, or the exemption in the first place?

In its 2016 Exemption Decision, the TCA considered the BKM as an association of undertaking formed by the banks, and the BKM Express service as conduct restricting competition in the market. The TCA also acknowledged the benefits of BKM Express and electronic wallet systems as they are enabling customers to save time and increase the security of card information. The TCA considered that the BKM Express service as meeting all of the conditions for an individual exemption:

(I) Ensuring efficiencies (these efficiencies may be new developments or economic or technical improvements)

(II) Securing consumer benefits from these efficiencies(III) Not eliminating competition in a significant part of the relevant market

(IV) Not restricting competition more than necessary to achieve the efficiencies and consumer benefits.However, the TCA withdrew its exemption in 2019, with a significant focus on the lack of competitiveness in the face of BKM. There is a number of competitive concerns towards BKM, which the TCA discussed in detail in its Withdrawal Decision as follows:

- The main concern is the possible restriction of competition through the unique integration between BKM and its member banks.

- BKM uses the banking infrastructure of its members to place favorable features in its digital wallet service, which provide an advantage to BKM Express compared to the other services in the market (no need for the full credit card number, automatic update of the expiration date, SMS-OTP application that is specific to BKM Express).

- The above-mentioned features can only be provided due to the integration between BKM and its member banks.

- The mentioned integration services have not been offered − at least in practice − to the other digital wallet services.

- Opening up the mentioned features to other digital wallet services through the BKM cannot be a solution, since such practice makes the non-bank fintech companies dependent on BKM. Putting such measures in place instead of terminating BKM Express makes non-bank fintech companies mere resellers, and this approach would limit the innovation that may provide diverse value-added services.

- The entrance of BKM to new markets with the financial power generated from the BKM's settlement business may heavily affect competition. The books of BKM being inseparable in terms of business lines contributes to these concerns.

Upon these evaluations, the TCA decided for the termination of the BKM Express service, and also ordered BKM to distinguish financial records on the basis of businesses.

Why did the TCA abolish the Withdrawal Decision?

Since the Withdrawal Decision was fully equipped with competitive concerns, one would expect to see the previous concerns addressed in the Abolishment Decision. In fact, the TCA's evaluations are rather concise, and it is not clear if the TCA decided that the benefits are outweighing its previous competition law concerns.

The TCA considered a number of factors when abolishing the Withdrawal Decision, which can be summarized as follows:

- The shareholding and management structure of the BKM has been changed.

- Since the element of the reason for the administrative action is now changed with the CBRT being a majority shareholder of BKM, The Withdrawal Decision is legally open to amendments or repeal.

- The CBRT is planning to steer the BKM away from being a competitor in the questioned markets. Instead, BKM is expected to help the development of specific CBRT projects in financial technology: The creation of the Central Bank Digital Currency, development of an end-to-end instant payment system.

- BKM Express may still be used by the CBRT to reach the goals in financial technology.

- The CBRT promised to find ways to address the TCA's competitive concerns, and also vowed to keep in touch with the TCA in the future.

- The CBRT is planning to develop sector-specific regulations to address competitive concerns, which will be aligned with the PSD2. The 11th Development Plan1 consists of these anticipated steps for the fintech ecosystem. Alignment of the Payment Services Act and regulations with the PSD2 will bring measures to address competition law concerns.

- The CBRT established the General Directorate of the Payment Systems and Financial Technologies for sectoral oversight.

There are still some questions on whether the previous concerns have been addressed properly in the recent decision. One can view the main theme of the recent decision as the TCA's trust in the CBRT. The TCA seems to think that the answer to the problems in the payment systems sector is not the antitrust enforcement, but the regulations with the backbone of open banking and the sectoral oversight of the CBRT. Abolishing of the Withdrawal decision may prove problematic for the fintech companies aiming to establish their spot in the market, if the competitive concerns are not addressed with the regulations to come.

The CBRT: Regulator, or market player?

The regulatory powers which were previously exercised by the Banking Regulation and Supervision Agency (BRSA) are now transferred to the CBRT. The CBRT is now regulating the payment service providers along with the system operators.

As per the Regulation on the Operations of Payment and Settlement Systems, additional services to be provided by the system operators must be approved by the regulator. Therefore, the CBRT approves or declines the additional service requests of the system operators. From the sectoral regulation standpoint, the CBRT is the regulator who will decide which system operator can do what, and to what extent.

Following the CBRT becoming the majority shareholder of the BKM, in September 2020, the CBRT approved the BKM's application and granted it to perform "innovative infrastructure/platform services" along with its system operations. However, one might question the CBRT for regulating BKM, which is controlled by the CBRT.

Defining the role of the CBRT plays a key role here. Should the CBRT fail to steer the BKM away from the market as an economic actor, there is an even more thorny path ahead of the payment service sector. Because this time, the CBRT will be a market player who will not only be regulating itself but also its competitors. In such a scenario, as the TCA did with its Abolishment Decision, the market participants will have no choice but to place their hopes on CBRT to be impartial while regulating the market in which it competes.

Footnote

1. The Development Plans are prepared to reflect the mid-term plans and strategies of the government, and serve as a rough guideline for authorities in their regulatory work. The 11th Development Plan is covering the years of 2019-2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.