- within Tax topic(s)

- in Middle East

- within Tax topic(s)

- within Tax, Corporate/Commercial Law and Environment topic(s)

Introduction

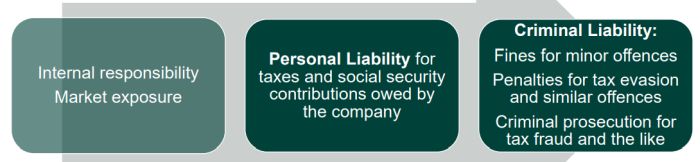

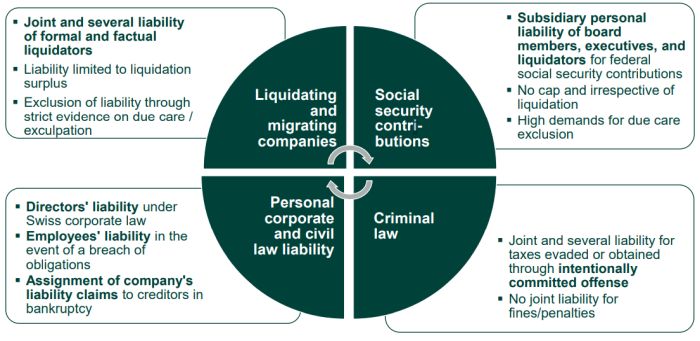

What do board members, executives, and in-house counsels risk if the company does not meet its tax reporting or payment obligations?

Authorities & Scope

Federal Authorities

- Federal withholding taxes (Verrechnungssteuern)

- Federal stamp duties (Stempelabgaben)

- Value added taxes

- Customs duties

- Federal special excise taxes

Cantonal/Municipal Authorities

- Federal income taxes

- Cantonal and municipal income and capital taxes

- Federal and cantonal social security contributions

- Other taxes and contributions governed by cantonal and municipal law

Pillar Two (QDMTT/IIR)

[This presentation covers the above-mentioned taxes in bold letters, which are governed or harmonized by Swiss federal law]

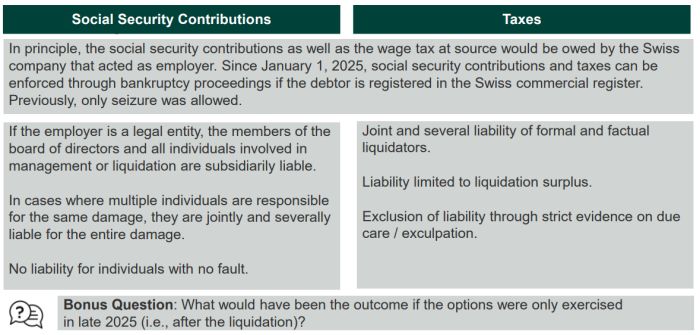

Personal Liability for Company Taxes

Personal Liability for Company Taxes – Overview

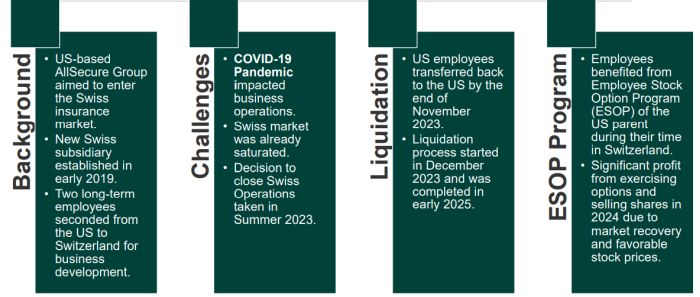

Personal Liability for Company Taxes – Case Study

Personal Liability for Company Taxes – Case Study

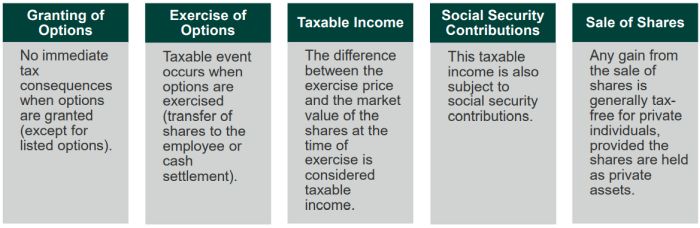

ESOP Taxation in Switzerland

- If the employee is no longer a Swiss tax resident at the time of exercise, Switzerland may still tax the portion of the income that relates to the period of employment in Switzerland.

- The taxable income from the exercise of options is also subject to Swiss social security contributions if the options were granted during the period of Swiss employment.

Personal Liability for Company Taxes – Case Study

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.