- within Employment and HR, Government and Public Sector topic(s)

- in India

Overview

The UAE introduced the Economic Substance Regulations (ESR) to restrict harmful tax practices, largely in line with Action Plan 5 of the BEPS Project.

Launched on 30 April 2019, ESR was applicable for accounting year starting on or after 1 January 2019. In August 2020, in an attempt to revamp the erstwhile Regulation, the Ministry issued an amended Regulation (vide Cabinet Resolution No 57 of 2020) and guidance (Ministerial Decision No 100 of 2020) that repealed and superseded the erstwhile Regulation and guidance with retrospective effect.

ESR was introduced to ensure that entities which are doing business in UAE, pursuant to obtaining trade license from the Authority (Licensee), meet the Economic Substance Test. The Resolution provides useful guidelines/ parameters to conduct such a substance test.

This Resolution was also a step to meet European Union's requirement to remove UAE from the EU blacklist (i.e., EU list of noncooperative jurisdiction for tax purposes). Subsequently, the EU had removed UAE from its blacklist.

Scope and Applicability

Applicability

ESR applies to all private/public shareholding companies, joint venture companies, partnership firms, etc. In other words, the Regulation does not cover individuals, sole proprietorship, trust, or a foundation under its ambit.

Exemption

The following categories of Licensee are exempt from the Regulation:

- Investment Fund;

- A company that is a tax resident of a country outside the UAE;

- A Licensee who is completely domiciled in the UAE (not part of an MNE group and no cross border activities);

- Branch of a foreign entity that is taxed outside the UAE.

However, the exemption to the above categories will be applicable only upon submitting evidence to fulfill the conditions prescribed for exemption.

Applicability to Branch

The Regulation has clarified that the UAE branch of a UAE entity is merely an extension of 'parent' or 'head office' and, therefore, not considered as a separate entity for this Regulation.

Applicability of ESR compliance to Branches are as below:

- Foreign branch of UAE entity - UAE entity is not required to consolidate activities/income of foreign branch for ESR provided that the income of such branch is subject to tax outside the UAE. In this context, the branch includes a Permanent Establishment or any other form of taxable presence for corporate income tax purposes.

- UAE branch of a foreign entity - An entity is required to comply with Regulation unless the Relevant Income of such branch is subject to tax outside UAE.

Key Parameters for Economic Substance Test

Licensee must satisfy the following criteria to meet the Economic Substance Test:

- Conduct core income-generating activities in UAE;

- Licensee shall be directed and managed in UAE

- Adequate frequency of Board of Directors meeting in UAE

- Directors should possess the necessary knowledge/ expertise to discharge duties;

- To employ an adequate number of qualified full-time

- employees or adequate outsourcing expenditure incurred for a third-party service provider;

- To possess adequate physical assets in UAE.

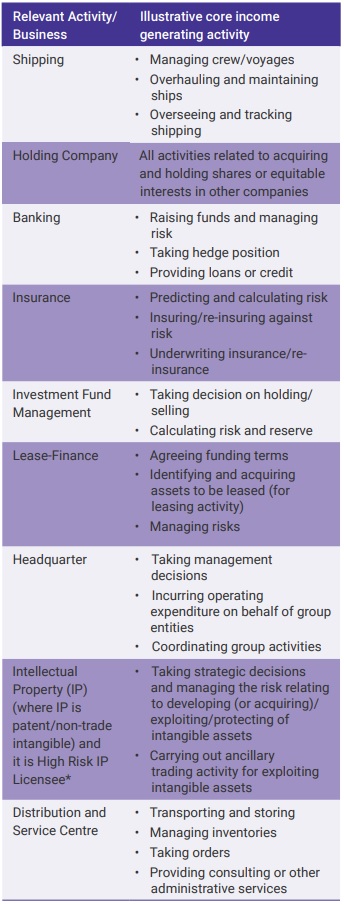

Relevant businesses and corresponding core incomegenerating activities

*High Risk IP Licensee has been defined under the Regulations in the following manner:

- A Licensee who has not created the IP Asset which it holds for the purpose of its business;

- Furthermore, the Licensee derives income from licensing or selling the intellectual property asset to one or more connected persons or otherwise earns separately identifiable income from a foreign-related party in respect of the use or exploitation of the Intellectual Property Asset; and

- The Licensee shall acquire such intellectual property from (a) Connected Person or (b) in consideration for funding research and development by another person situated in a foreign country.

Governance Mechanism

Regulatory Authority and National Assessing Authority

- In order to implement the provisions of the ESR Regulations, the UAE Cabinet of Ministers appointed various authorities that are empowered to oversee the implementation, monitoring and enforcement of the ESR Regulations in respect of each Relevant Activity.

- Basis thereon, certain authorities are appointed in the capacity of 'Regulatory Authorities,' and the Federal Tax Authority (FTA) has been appointed as the National Assessing Authority (NAA).

- Role of the Regulatory Authorities - (i) To collect/ verify information/documents from the Licensee, which includes the Notifications/Economic Substance Reports and other information (ii) Reporting information and sharing information with the NAA in respect of Licensees who fail to submit the information required under the ESR Regulations.

- Role of the NAA - Undertakes the assessment for determining whether the Licensee has met the Economic Substance Test, imposing a penalty, or hearing appeals.

Exchange of Information

Information should be exchanged with foreign competent authorities under the following circumstances:

- Licensee fails to satisfy substance test;

- Licensee is High Risk IP Licensee;

- When an entity/branch of a foreign entity claims to be a tax resident outside the UAE.

Compliance Requirement

Notification to be submitted

Licensee shall annually notify the Authority which inter-alia includes the following:

- Whether or not it is carrying on Relevant Activity;

- If yes for above, gross income for Relevant Activity is subject to tax outside UAE;

- Financial year followed by Licensee;

- Details of Branch.

Report to be submitted

If Licensee is carrying out Relevant Activity, it is required to submit a detailed report annually within 12 months from the end of Financial Year, containing various operations related information, including but not limited to Employee details – experience, type of contract, qualifications, duration of employment, etc. and information on intangible related details of the Licensee.

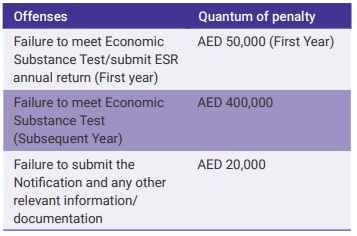

Penalty for Non-compliance

The Resolution has prescribed the following offenses and corresponding penalties as under:

Additionally, in certain cases, the penalty included sharing of information with foreign competent authority as well as suspension/cancellation of license.

However, before levying a penalty, the Authority must issue a notice (i.e., opportunity of being heard) to Licensee

Furthermore, Authority may neither determine the Economic Substance Test of Licensee nor levy a penalty post six years from the end of the financial year (unless there is deliberate misrepresentation/ fraudulent action by Licensee or any other person).

Licensee's Right to Appeal Against the Penalty

A Licensee or an exempted Licensee upon whom the Authority imposes an administrative penalty may appeal against it on any of the following grounds:

- it did not commit the violation;

- the administrative penalty imposed is not proportionate to the violation;

- the administrative penalty imposed exceeds the limited prescribed hereunder.

Presently, the Authority is yet to issue a resolution setting out the procedures for an appeal, including the mechanism for filing an appeal and other procedures relating to its review and decision in relation to an appeal.

Way Forward

- Recently, UAE has introduced Country-byCountry-Reporting (CbCR) Regulations in line with its commitment to implement Base Erosion and Profit Shifting (BEPS) standard for Action Plan 13. Now, with the introduction of ESR, UAE has most certainly sent a positive signal to the sovereigns of its trade partners in other jurisdictions.

- As referred to above, the introduction of the regulations has already led to UAE's name taken off of EU's blacklist. However, the implementation of these regulations in UAE, which till date does not have any taxationrelated law, is likely to pose a challenge.

- The relevant authorities have started issues notices where penalties have been levied on the Licensees for non-compliance with the ESR Regulations. However, the NAA hasn't released a resolution that sets out the procedure for filing an appeal, including the mechanism for filing an appeal and other procedures thereof.

- Despite the regulations providing useful guidelines, the Licensees will require a lot of judgment in a professional capacity to determine if the activity meets the substance test. It is recommended for multinationals to be proactive and revisit their existing operational activities to mitigate/avoid the potential risk of non-compliance with the above regulations.

- With this being the subsequent year of Regulations, it would be relevant to check and maintain consistency with respect to the positions adopted by the Licensee in the previous year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.