- within Law Department Performance, Corporate/Commercial Law and Technology topic(s)

If you are married in community of property, you are taxed on half of your own interest, dividend, rental income and capital gain, and half of your spouse's interest dividend, rental income, and capital gain.

As of the beginning of the 2023 filing season, SARS is now able to identify taxpayers who are married in community of property and can also retrieve the "Married in community of property" status from previous tax year declarations made by the taxpayer. SARS is collaborating with the Department of Home affairs to verify and confirm marital statuses.

Where a match is confirmed, you and your spouse will be linked. If investment income is identified for you based on third party data received (e.g., IT3(b) certificate for interest earned), the third-party data will also be prepopulated on your spouse's return if you have been linked on the SARS system and vice versa. The investment income will be apportioned accordingly and will reflect on the notice of assessment (ITA34) issued to you and your spouse, upon assessment.

Taxpayers who are separated from their spouses may inform SARS of the separation by completing RRA01 Form or by lodging a dispute. Taxpayers who are divorced may request for correction and amend their marital status from "Married in community of property" to "Not Married (Single, Divorced, Widow/Widower)" in the return.

You can exclude your spouse from communal estate (if you have an existing legal contract) by accessing your return where the 'Investment income' section appears. Search for the Interest Income that you wish to exclude from communal estate, then select "Mark here with an "X" if this amount should be excluded from the communal estate (if married in community of property)". The amount will then be taxed 100% in your hands upon assessment.

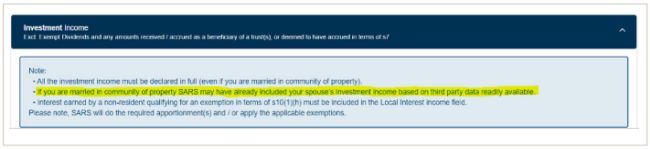

SARS will inform the primary spouse that 50% of his/her investment income is taxed due to being married in community of property (COP), and that the remaining portion will be taxed in the hands of the other spouse. The below note is included in the investment container which informs taxpayers of the obligation of apportionment with regards to 50/50 split.

The assessments of investment income of taxpayers who are Married in Community of Property will be subject to objection and appeal, for both spouses, should one of the spouses disagree with the assessment.

In compliance with POPI Act, SARS may notify the other partner where they are married in community of property about the interest on the investment concerned. Where appropriate, consent may be sought. However, where the exceptions allow for SARS to process the personal information concerned, consent will not be necessary as in terms of sections 12, 15 and 18 of POPIA, SARS is empowered to process personal information of a taxpayer in compliance with section 1 of the SARS Act.

Where the spouses are married in a civil union of community of property there is a certain level of oneness that they assume hence the provisions of section 7 of the Income Tax Act No 58 of 1962 (ITA).

Therefore, the information received from one spouse is information that by law the other spouse is supposed to be aware of by virtue of their marriage regime, meaning that there is no secrecy provision that has been compromised. SARS have developed FAQs for the Married in Community Spousal Assessments which can be accessed from their website.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.