- within Corporate/Commercial Law topic(s)

- in European Union

- within Corporate/Commercial Law, Litigation, Mediation & Arbitration, Media, Telecoms, IT and Entertainment topic(s)

- with readers working within the Insurance industries

The Securities and Exchange Commission issued Memorandum Circular No. 10, series of 2022, entitled "Amendments to SEC Memorandum Circular No. 15, s. 2019 (The 2019 Revision of the GIS) Increasing the Penalties and Imposing Additional Non-Financial Penalties and Providing Further Guidelines for Submission" (SEC MC No.10- 2022 or the "Circular"). The Circular took effect on January 1, 2023. It increased the penalties imposed under the 2019 Circular and imposed additional non-financial penalties.

DISCLOSURE OF BENEFICIAL OWNERSHIP INFORMATION

All corporations registered with the SEC are required to take reasonable measures to obtain and hold up-to-date information on their beneficial owners and to disclose the same in a timely manner in the GIS. Failure to comply with this disclosure requirement is subject to penalties as prescribed by the SEC, which will be discussed further below.

UPDATING OF BENEFICIAL OWNERSHIP INFORMATION

The SEC shall be timely apprised of relevant changes in the submitted beneficial ownership information as they arise. An updated GIS shall be submitted to the SEC within thirty (30) calendar days after such change occurred or became effective. The 2019 Circular has been amended to prescribe a uniform period for the updating of beneficial ownership information. The "30 calendar days" now applies even to corporations that do not have multiple layers of corporate stockholders.

INCREASED PENALTIES

Failure to Disclose

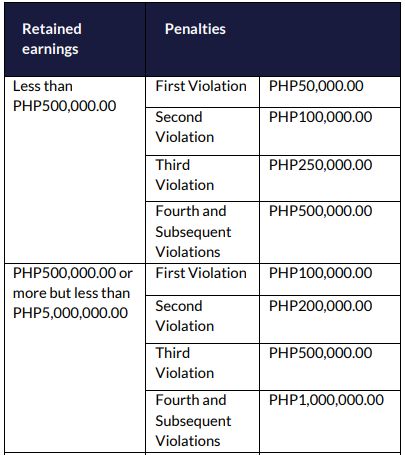

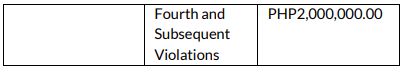

The penalties for failure to disclose, without any lawful cause, beneficial ownership information shall be based on the retained earnings (whether appropriated or unappropriated) or fund balance of the reporting corporation. The penalties have been increased to the following:

Download : The SyCipLaw Corporate Services Bulletin - February 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.