- in United States

- within Media, Telecoms, IT, Entertainment and Technology topic(s)

I. Individuals

1.1 Personal Income Tax

Residents are subject to personal income tax on their worldwide income. Non-residentsaretaxedontheir Serbiansource income only. Income tax is assessed in the year, in which the income is earned on a current year basis.

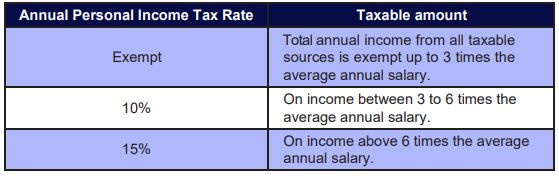

1.1.1 Rates

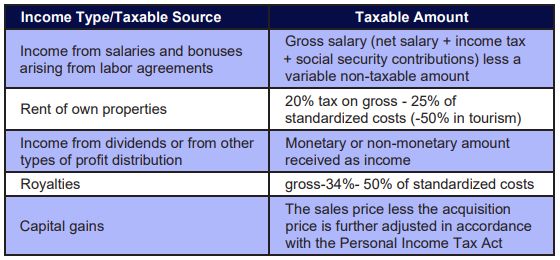

1.1.2 Taxable Income

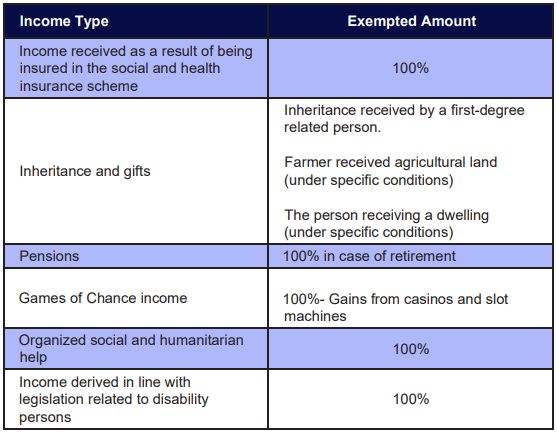

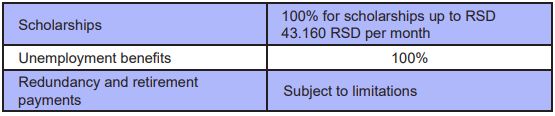

1.1.3 Exempt Income

Additionally, the following are the non-taxable amounts of payments/benefits done by the employer

- Daily allowance for business trips in the country – up to RSD 3.380 (approx. EUR 28) per day

- Daily allowance for business trips abroad – up to 90 EUR

- Business trip transportation cost – up to 9.855 RSD ( approx. EUR 84)

- Public transportation cost for coming to and going from work – up to RSD 5.630 (approx. EUR 48)

- Compensation for use of own vehicle for a business trip – 30% of the cost of 1l of gasoline per kilometer of trip

- Remuneration for accommodation and meal expenses on a business trip – must be justified by bills and is fully non-taxable Severance pay at time of retirement – either prescribed by the Company Act or two-fold average monthly salary (Labor Law prescribed)

- Redundancy severance pay – 1/3 of salary for each year of employment with the employer making the payment

- Compensation for expenses of burial of employee, his/ her spouse or child – RSD 98.534 (approx.. EUR 842)

- Solidaritybonus–incaseofthe deathofan employeeor member of his family or of a company retiree – RSD 98.534 (approx. EUR 842)

- Solidarity bonus in case of long or serious illness, rehabilitation, or disability – RSD 56.307 (approx.. EUR 480)

- Solidarity bonus for the abatement of consequences of flood or other acts of god or in other extraordinary circumstances

- Anniversary reward – RSD 28.152 (approx.. EUR 240)

- Loan for the purchase of heating material, school books, and winter supply of pickled vegetables and fruit preserves

- Christmas gifts for children of employees up to 15 years of age 14.077 (approx.. EUR 120)

- Scholarships for pupils and students – up to RSD 43.160 per month (approx.. EUR 368 )

- Additional health insurance and retirement plan premiums – RSD 8.449 (approx.. EUR 72) per month All non-taxable amounts are adjusted once a year during January and are valid for the next 12 months.

1.1.4 Deductible Expenses

Expenses arre non-deductible forpersonalincome tax purposes.

1.1.5 Allowances

Personal deduction for the purpose of the annual personal income tax equal to 40% of the average annual salary is automatically deducted. Additional allowance equal to 15% of the average annual salary may be claimed for each dependent family member. The total amount of the allowances may not exceed 50% of the aggregate taxable income.

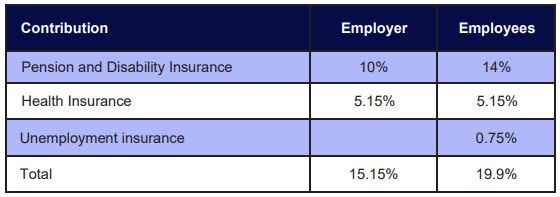

1.2 Social Security and Health Insurance Contributions

Contribution rates are as follows:

1.3 Submission of Tax Returns

The deadline for the submission and payment of tax returns varies depending on the income type and the income payer.

The deadline for submission of annual personal income tax returns for income generated in 2024 is 15 May 2025.

Tax return is submitted electronically on the Tax Authority's portal and the instruction for payment is automatically generated.

II. Corporate Taxation

2.1 Corporate Income Tax

Resident companies are subject to profit tax on a fixed rate of 15%. Capital gains, dividends, interests, and royalties are included in the income of companies and are taxed as part of corporate tax. Tax returns should be submitted no later than 30 June of the year for the previous year.

2.1.1 Residency

Taxresidency isestablished when a companyhas aregistered business or permanent establishment, orthe management and control are exercised in Serbia.

2.1.2 Tax Rates

The rate of corporate income tax in Serbia is flat at 15%.

2.1.3 Taxable Income

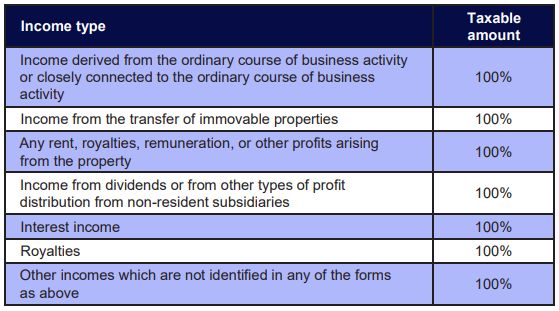

Under Serbian laws, the following types of income are subject to taxation:

2.1.4 Exempt Income

The following incomes are exempt from corporate income tax:

- Income up to RSD 400,000 derived by non-profitable organizations.

- Dividend income from shares in resident companies as well as capital gains arising from the sale of state-issued bonds or bonds issued by the National Bank, provinces, or local municipalities; and

- Interest income arising from the abovementioned securities

2.1.5 Deductible Expenses

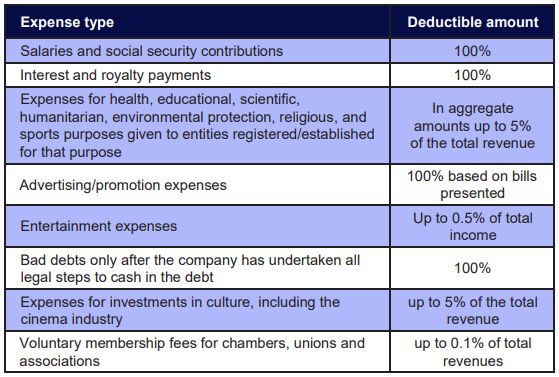

All expenses incurred wholly and exclusively for business purposes are allowed for tax purposes if supported by relevant documents such as invoices, foreign invoices, receipts issued by state entities, or other documents compiled and issued according to the Ministry of Finance Directives.

Deductible expenses include:

2.1.6 Non-deductible Expenses

Expenses that were not incurred wholly and exclusively for business purposes or have not been documented properly are not deductible for tax purposes.

Non-deductible expenses include:

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.