- within Tax, Litigation, Mediation & Arbitration, Media, Telecoms, IT and Entertainment topic(s)

Tariff formation

These main directions of the tariff policy in the electric power industry of Uzbekistan for the period up to 2030 determine the practical mechanisms for the implementation of the state policy for regulating electricity pricing, taking into account the strategic objectives for sustainable energy supply to the population and further development of the energy infrastructure.

The main directions of the tariff policy have been developed in order to ensure the electric power security of Uzbekistan, taking into account the expansion, modernisation and diversification of generating capacities, bringing them to 20 thousand MW in the period until 2030 in accordance with the Decree of the President of the Republic of Uzbekistan dated October 23, 2018 No. PP- 3981 "On measures for accelerated development and financial stability of the electric power industry".

The tariff system includes regulated tariffs and non-regulated tariffs.

Regulated tariffs:

- tariffs for electricity and thermal energy, generated by generating companies;

- electricity distribution and sales service markup applied by distribution organisations;

- electricity tariffs for various groups of consumers, determined in accordance with the Rules for the Use of Electric Energy, approved by the Resolution of the Cabinet of Ministers of January 12, 2018, No. 22.

Non-regulated electricity tariffs include tariffs for electricity purchased and sold under international agreements, including interstate transit through national networks.

Regulation of tariffs is based on the obligation of separate accounting by organisations carrying out regulated activities, volumes of products and services, income, and expenses, as well as assets involved in the production of electricity and thermal energy, transmission, as well as distribution and sale of electricity.

Organisations carrying out regulated activities are required to keep separate records for the following activities:

- power generation;

- thermal energy generation;

- transmission of electricity through main power grids;

- distribution and sale of electricity to final consumers.

- During establishment of regulated tariffs, it is not allowed to re-record the same expenses for the specified types of activities.

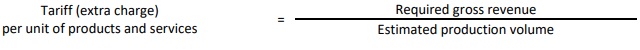

During regulation of tariffs, fixed rates are established per unit of products and services.

Regulated tariffs are calculated based on the size of the required gross revenues of organisations carrying out regulated activities and the estimated volume of production of the corresponding type of products and services for the period of regulation.

In this case, regulated tariffs (extra charge) are determined by dividing the required gross revenue by the estimated production volume according to the following formula:

Solar energy tariff

Tariffs for electricity generated from renewable energy sources are determined based on competitive bidding.

During formation of tariffs for electric energy for end consumers, all expenses for the purchase of electric energy from all sources of production, including from renewable energy sources, are considered.

Development of RES projects and private investors

State administration in the field of the use of renewable energy sources is carried out by the Cabinet of Ministers, the Ministry of Energy in the field of the use of renewable energy sources, as well as by the National and Regional Electric Grids.

The Cabinet of Ministers also ensures the implementation of a unified state policy in the field of public-private partnership.

State regulation of investment activities is carried out by government bodies, in particular by the Ministry of Investments and Foreign Trade, as well as by the recently created Agency for Strategic Development in order to implement an investment policy that ensures the fulfillment of state tasks of socio-economic development of Uzbekistan and its territories, increasing the efficiency of investments, ensuring safe conditions for investments in various investment objects on the territory of Uzbekistan.

Ministry of Energy, in turn:

- implements a unified state policy in the field of the use of renewable energy sources;

- develops and implements state and other programs in the field of the use of renewable energy sources;

- coordinates the activities of state and economic management bodies in the field of the use of renewable energy sources;

- develops and approves, within the limits of its authority, technical regulations, norms and rules in the field of the use of renewable energy sources;

- monitors the implementation of state and other programs in the field of the use of renewable energy sources;

- submits proposals to the Cabinet of Ministers of the Republic of Uzbekistan on issues of state support for energy producers from renewable energy sources, as well as manufacturers of plants of renewable energy sources, on price and tariff policy in the energy market, produced from renewable energy sources;

- maintains state records of renewable energy resources, energy produced from renewable energy sources, and plants of renewable energy sources;

- promotes the introduction of innovative technologies, scientific and technical developments in the field of the use of renewable energy sources;

- takes measures to increase the investment attractiveness of the use of renewable energy sources through the development of public-private partnerships, improvement of pricing and tariff policy, stimulating the formation of a favorable competitive and business environment in the market for energy, produced from renewable energy sources;

Single buyer of electricity - National Electric Grids:

- participate in the development and implementation of state and other programs in the field of the use of renewable energy sources;

- develop, approve and implement territorial programs in the field of the use of renewable energy sources;

- promote the creation and implementation of modern energy-efficient, energy-saving and innovative technologies in the use of renewable energy sources, organisation of production of plants of renewable energy sources;

- interact with renewable energy producers and renewable energy plant manufacturers;

- make decisions on the provision of land plots for the placement of plants of renewable energy sources.

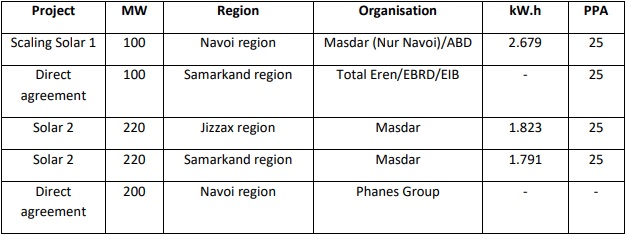

List of projects of the construction of solar power plants in Uzbekistan:

Power purchase agreement (PPA)

Risk mitigation is especially important in renewable energy projects due to their high capital requirements. Financial risk mitigation instruments accompanied by sound policies can lower the financial cost of renewable energy investments and help raise capital at scale.

Uzbekistan held its first auction for specific solar areas in 2018-19 with the assistance of IFC, a member of the World Bank Group, in structuring and implementing.

PPA is a contractual agreement between a guaranteed energy buyer and an alternative energy generator (seller).

As of today, there is no standard form of power purchase agreement (PPA). However, the PPA is expected to be developed and approved by the Ministry of Energy in the near future.

The main risks:

- Currency risk arises in situations where project income is denominated in one currency and loan payments are denominated in another. For renewable energy projects, the mismatch between the financing currency (hard) and the revenue (local) currency is often a problem for debt repayment. Because of these concerns, some multinational project developers will only sign hard currency contracts to insulate themselves from currency risk. While this can eliminate foreign exchange risk, it also increases the risk of non-payment if the buyer cannot pay the hard currency PPA price. Some governments take on some of the foreign exchange risk by offering tariffs in USD payable in local currency.

- Technical risk when connecting a RES facility to the grid, which investors should pay attention to: in the PPA, the Seller requires to ensure responsibility for the reception and transmission of electricity produced by RES facilities, and for the dispatching of the capacity of RES facilities, including certain obligations in the PPA.

Privileges

Energy producers from renewable energy sources are exempt from paying property tax for plants of renewable energy sources and land tax for areas occupied by these plants (with a nominal capacity of 0.1 MW or more), for a period of ten years from the date of their commissioning.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.