MALTA 2013 - A YEAR IN REVIEW

The financial services industry in Malta has continued to grow throughout 2013 despite the persisting challenges and increasing competition in this sector. Financial services account for some 12 per cent of Malta's GDP and is worth more than €1 billion to the Maltese Islands in direct and indirect revenue and approximately 10,000 people are employed in the sector. In this review, we look at reflections, analysis and studies carried out about Malta, its economy and its financial services industry, by various reputable institutions and credit rating agencies throughout 2013.

The first months of the year, particularly as a follow up to the banking crisis in surrounding Mediterranean states, Malta was subject to strict scrutiny from international institutions and credit rating agencies. The first to report on Malta, in April 2013, was credit rating agency Fitch Ratings. In its report, the agency remarked that the Maltese banking sector was placed on a strong footing– an important reflection in view of what events taking place in neighbouring Mediterranean states. The agency stressed that banks in Malta would not be expected to face problems that could jeopardise their viability and would therefore not be expected to require support.

It noted that domestic banks in Malta are less reliant on non-resident deposits or capital markets than its foreign counterparts and consequently have much more limited exposure to foreign securities and loans. This outlook was confirmed by the European Commission, in its Alert Mechanism Report. In its in-depth analysis of Malta's financial sector, the EC noted that the financial sector is internationally-oriented with very little link to the domestic economy, and therefore does not pose large risks for domestic stability.

The domestically-oriented financial sector, "which invests in resident assets and funds itself in Malta, is significantly smaller, relatively well-capitalised and profitable. Moreover these banks have strong liquidity as evidenced by the very high ratio of liquid assets to short-term liabilities". The Commission's outlook on the Maltese economic performance was generally upbeat: "The Maltese economy demonstrated resilience throughout the crisis. Economic growth in Malta in the years before the crisis was in line with the average for the euro area."

A few weeks later, Standard and Poor's confirmed Malta's Stable Outlook, based on – according to its own words, Malta's relatively strong institutional and governance effectiveness, and its prosperous economy. Malta's growth performance has been one of the strongest in the eurozone with real GDP per capita averaging just below 1% annually between 2007 and 2012. S&P defined "Malta's domestic financial system as stable".

"The presence of internationally oriented banks poses little threat to the government by way of contingent liabilities; these institutions have little or no interaction with the domestic economy. The subset of the system that is partly funded by domestic deposits (that fall under the deposit compensation scheme) and short-term foreign lines, but with no domestic assets, could become increasingly systemically important", concluded the agency.

In June, it was the International Monetary Fund's turn to carry out and in-depth analysis of Malta's economy and financial services industry. "Malta has shown remarkable resilience in the face of a major crisis in Europe. Since the beginning of the crisis, the average growth of the Maltese economy has been one of the best in the euro area and the unemployment rate remains one of the lowest. This resilience was under-pinned by robust service sector export growth and a sound banking sector. As a result, the current account balance has improved gradually in recent years, turning into surplus" claimed the IMF.

In September, the influential World Economic Forum's Global Competitiveness Report confirmed Malta's placing as a top-20 financial services jurisdiction. Specifically Malta was highly ranked in terms of soundness of its banking institutions (14th), the regulation of Securities Exchanges (17th) and the strength and reporting standards (13th).

This was followed up by an OECD report, highlighting the quality of the Maltese tax framework stating that it was in full conformity with the requirements related to International transparency standards and exchange of information for tax purposes. Malta climbed six places in the overall classification placing 41st out of 148 countries. It has also maintained its status of an innovation-driven economy.

The last review by a credit rating agency, Moody's took place in October, with Malta's Sovereign Outlook Rating being improved from Negative to Stable. The key drivers underpinning Moody's were its expectation that debt metrics will stabilize in 2014 given an economic recovery; Malta's lack of funding stress and limited contagion risk from the euro area as well as the resilience of the Maltese banking system, with banks following a very conservative and traditional banking model that has not presented problems for the sovereign even through the worst of the financial crisis.

Commenting specifically on the Maltese banking sector, Moody's noted that the banking sector continues to report favourable indicators. Although its size and concentration risk are vulnerabilities, the system is very well capitalized and has a very limited reliance on wholesale funding due to its ample liquidity.

High deposit levels (at about 185% of GDP) highlight the amount of domestic wealth available to cover the sovereign's financing needs and anchor systemic liquidity. Moreover, banks follow a very conservative and traditional banking model that has not presented problems for the sovereign even through the worst of the financial crisis."

Finally, one of the best accolades for the present year was provided by the illustrious Hedge Funds Review Service Provider Rankings (HFR SP) 2013 published in late November. Malta has been named European domicile of choice amongst investors and managers with a total of 22.1 per cent of all European votes cast in the annual survey.

Margie Lindsay, Executive Editor of Hedge Funds Review said: "It is clear many more hedge funds are considering Malta as a first-choice domicile from the voting patterns this year. "Malta's attractiveness as a domicile lies in its competitive advantage on cost as well as a regulator that is open to new strategies and approachable by fund managers who are just starting out."

Further details on these various reports are available in the MFSA Newsletters published in the respective month of the year.

SIGNIFICANT CHANGES LOOMING FOR THE ASSET MANAGEMENT INDUSTRY

The asset management industry is on course to witness some significant changes over the coming years, particularly as managers seek to adapt to the developing financial services industry in the post-crisis world.

The asset management industry is on course to witness some significant changes over the coming years, particularly as managers seek to adapt to the developing financial services industry in the post-crisis world.

MFSA Chairman Joseph Bannister highlighted the expected key changes while addressing the European Funds Conference "Future of Asset Management", organized by IIR & IBC, defining the present time as a "critical juncture" which will be facing the immediate future of the fund industry. Discussing the major changes envisaged, Prof Bannister indicated that the main element underpinning this shift is the significant convergence between traditional and alternative investment strategies.

This shift is a direct consequence of recent changes to the capital markets, to investor preferences, and to industry regulations which are pushing investors towards products that display the characteristics of both traditional funds and hedge funds. Investment managers have responded by introducing a new breed of hybrid funds that combine the exotic strategies of hedge funds with the transparency and relative stability of traditional funds.

"The key challenge is how asset managers will successfully integrate their alternative strategies into their long-only business, and how much longer hedge fund managers can rely on prime brokers to support their operations."

The blurring of the definitions of traditional long-only asset managers and hedge fund managers is being accelerated by changes in distribution strategies and regulatory pressure.

In looking to diversify their product mix (albeit for different reasons), both groups will need to reassess their operating processes to support new strategies" continued Prof Bannister. Asset managers are now routinely introducing hedge fund techniques to their core investment approaches to complement traditional long-only strategies. At the other end of the investment spectrum, hedge fund managers are seeking to launch products with greater liquidity, transparency and control.

As a direct result, hedge fund managers, either through their own prudence or as a result of underlying investor pressure, are now much more interested in the credit standing of their counterparties, how and where their assets are held, and whether these assets will be recoverable in the event of bankruptcy.

"Convergence is therefore about the reorganisation of managers' operating models to accommodate these challenges and exploit their clear opportunities. As a result, traditional managers are increasingly turning to their service providers to help them understand how to overcome these challenges.

Conversely, hedge fund managers, under pressure from both regulators and investors to increase transparency, will be required to have operational structures that can stand up to the same level of intense scrutiny as those used by traditional asset managers." In parallel, hedge fund managers are increasingly becoming attracted to UCITS because they provide the transparent and regulated environment that many investors are now looking for as they seek greater protection for their assets. Prof Bannister warned that this is not an easy move. UCITS managers already have established sophisticated distribution channels and marketing strategies, while the distribution of regulated funds is new to hedge fund managers.

UCITS regulations require risk management and reporting which may be onerous new requirements for hedge fund manager whose previous primary focus was management of portfolios.

Institutional investors have demanded higher transparency and better governance from managers, particularly after the crisis, prompting for instance hedge funds to abandon their 'black-box' approach to investing in order to expand or retain their business.

In the coming years, additional changes in regulation that were adopted to take stock of the lessons learned notably in the financial crisis (such as the AIFMD) are expected to deepen convergence.

The registration requirements, conduct of business rules and transparency obligations that used to operate only for traditional managers have been extended to the alternative space, thereby reducing the gap in terms of administrative burden – which acted as a major disincentive for alternative managers to launch their own mutual and UCITS funds.

The Chairman concluded that while the AIFMD addresses the prudential concerns in the fund management industry, regulatory focus will shift to investor choice and investor protection, particularly with the introduction of PRIPs and the review of MiFID. These events will ease the access of non-harmonised funds to institutional investors.

The past, present and future of European securities regulation was discussed by the Deputy Director of the Securities and Markets Unit of the MFSA, Mr Christopher P. Buttigieg. Mr Buttigieg explained that the scope of securities regulation is to protect investors, enhance systemic stability and ensure that markets are fair, efficient and transparent. These objectives will in turn help to establish an efficient and transparent internal market. Mr Buttigieg continued that the de Larosiere reforms post the financial crisis led to the movement towards a single rulebook approach, including the creation of the European Systemic Risk Board and the conversion from CESR to ESMA in 2010. Eventually, the coordination between different European bodies will lead to the establishment of a Single Supervisory Handbook.

Tackling the subject of new industry requirements for depositaries, Mr Peter Astleford, Partner of Dechert LLP, indicated that EU AIFMs need to appoint a depositary for EU AIFs while non-EU AIFs marketed in the EU are to appoint one or more entities to act as "depositary light". The depositary must be in the Member State of an AIF although until 2017 Malta will allow depositaries to be appointed from other Member States.

Mr Astleford explained that under the AIFMD, the depositary will be liable for any loss unless it can prove that an external event happened beyond its reasonable control. Consequently, a depositary can discharge itself of liability if there is an objective reason for such discharge.

Mr Andrew Dollery, Director of Newedge UK Financial Ltd, indicated that EMIR requires all counterparties of derivative contracts to report details of the contracts entered into. In this regard, counterparties are required to centrally clear OTC derivative contracts, once a central counterparty has been authorised under EMIR.

The main advantage of the AIFMD is to allow AIFMs and AIFs to make use of a passport in the European Union. Consequently, non-UCITS retail funds can benefit from a marketing passport as well. Moreover, opportunities for fund managers exist to market their funds in emerging countries including the Middle East, North Africa, South America and Asia.

FITCH MAINTAINS A STABLE OUTLOOK ON THE MALTESE BANKING SECTOR

Fitch Ratings have maintained a Stable Outlook on the Maltese banking sector, in a report published in December, supported by domestic banks ‟traditional business models that are fully funded by resident clients."

The Stable Outlook is also supported by outperformance of the Maltese economy versus the euro zone average in recent years, with a relatively resilient labour market and an unemployment rate of 6% in July 2013. While Fitch expects asset quality to deteriorate in 2014, it expected this to remain manageable, and considered that the banking system is sufficiently capitalised in view of the forthcoming AQRs, also in light of an asset quality assessment conducted by local authorities on core domestic banks in 2012.

The agency expects LICs to remain high in 2014, but below 2012 and 2013 levels when the central bank called for additional provisions against exposures to the real estate/construction sectors. Profitability is expected to remain relatively good in 2014, benefiting from a low cost/income ratio of around 45% and competitive funding costs. Capitalisation is assumed to remain high and of good quality, sustained by net income generation. The banks‟ funding and liquidity profiles are supported by a healthy LTD ratio (around 70% at end-2012) and limited reliance on wholesale funding.

Fitch Ratings said its outlook for southern European banks is mixed for 2014. Of its rated financial institutions in Spain, Italy, Portugal, Greece, Cyprus, Andorra and Malta, 60% are currently on Negative Outlook.

However, the picture varies markedly by country, with all banks in Greece and Malta on Stable Outlook, all Portuguese banks on Negative Outlook, and the majority of Spanish and Italian banks on Negative Outlook.

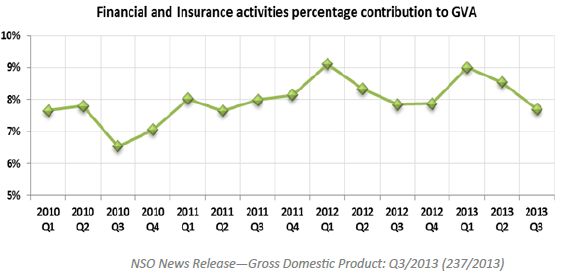

FINANCIAL AND INSURANCE ACTIVITIES CONTRIBUTION TO GROSS VALUE ADDED

Financial and insurance activities contributed 8.5 per cent to total Gross Value Added (GVA) during the second quarter of 2013 making the sector one of the major contributors to economic growth.

This reflects a 7 per cent increase in GVA of financial and insurance activities when comparing the second quarter with that of the previous year. Subsequently, during the third quarter of 2013 the sector contributed 7.7 per cent to total GVA, amounting to €126 million in absolute terms.

In comparison to the third quarter of last year, GVA of financial and insurance activities registered a one per cent increase.

INDUSTRY UPDATE - AIFMD

On 17 December 2013, the European Commission adopted the regulatory technical standards (RTS) on types of AIFMs pursuant to Article 4(4) of the AIFMD.

The Delegated Regulation determines whether an Alternative Investment Fund Manager (AIFM) is an AIFM of open-ended AIF(s) and/or closed-ended AIF(s). The distinction is important in order to determine the applicable rules under the AIFMD.

The RTS can be accessed through the following link: http://ec.europa.eu/internal_market/investment/docs/alternative_investments/131217_delegated-regulation_en.pdf

For any queries regarding the above, kindly contact: Mr Christopher P. Buttigieg, Deputy Director, Securities and Markets Supervision Unit, Tel: 2548 5229 cbuttigieg@mfsa.com.mt, or Mr Jonathan Sammut, Analyst, Securities and Markets Supervision Unit, Tel: 2548 5452 jsammut@mfsa.com.mt.

EBA WARNS CONSUMERS ON VIRTUAL CURRENCIES

The European Banking Authority (EBA) has warned consumers on a series of risks deriving from buying, holding or trading virtual currencies such as Bitcoins. The EBA said that consumers are not protected through regulation when using virtual currencies as a means of payment and may be at risk of losing their money.

It also added that there is no guarantee that currency values remain stable The warning was issued while the Authority assesses further all relevant aspects associated with virtual currencies, in order to identify whether virtual currencies can and should be regulated and supervised. According to the EBA, while virtual currencies continue to hit the headlines and are enjoying increasing popularity, consumers need to remain aware of the risks associated with them.

In particular, consumers should be aware that exchange platforms tend to be unregulated and are not banks that hold their virtual currency as a deposit. Currently, no specific regulatory protections exist in the EU that would protect consumers from financial losses if a platform that exchanges or holds virtual currencies fails or goes out of business.

The EBA added that the 'digital wallets' containing consumers' virtual currency stored on computers, laptops or smart phones, are not impervious to hackers. Cases have been reported of consumers losing significant amounts of virtual currency, with little prospect of having it returned. Also, when using virtual currency for commercial transactions, consumers are not protected by any refund rights under EU law.

The EBA also reminded that as transactions in virtual currency provide a high degree of anonymity, they may be misused for criminal activities, including money laundering. This misuse could lead law enforcement agencies to close exchange platforms at short notice and prevent consumers from accessing or retrieving any funds that the platforms may be holding for them. The EBA recommended that, if consumers buy virtual currencies, they should fully understand their specific characteristics and not use 'real' money that they cannot afford to lose.

EBA PUBLISHES OUTCOME OF 2013 EU-WIDE TRANSPARENCY EXERCISE

The European Banking Authority (EBA) has published information on 64 European banks from 21 countries of the European Economic Area (EEA). The data covers the first half of 2013 and is based on 730,000 data points including capital, Risk Weighted Assets (RWAs) and sovereign exposures.

Through this disclosure exercise, the EBA aims to promote greater understanding of capital positions and exposures of EU banks, thus contributing to market discipline and financial stability in the EU.

The data released by the EBA showed a continued positive trend in EU banks' capital position: Core Tier 1 (CT1) increased by more than EUR 80 bn between December 2011 and June 2013; combined with a reduction of EUR 817 bn in RWAs, this led to an improvement of the CT1 ratio by 170 bp, from 10% to 11.7%.

Total net sovereign exposures towards EEA countries declined by about 9% during 2011, but increased afterwards by 9.3%. Half of the sovereign exposures are held in the available for sale portfolios. The share of bonds issued by sovereigns under stress held by domestic banks has increased markedly between December 2010 and June 2013.

Exposures at default showed a modest reduction (-3% between December 2012 and June 2013). EU banks are mainly exposed towards corporates (32%), retail (31%) and sovereigns (19%).

The distribution of exposures across asset classes is stable over time. The ratio of total defaulted assets to total exposure is 3.8%; corporate and retail portfolios display the highest ratios - 6.9% and 4.2% respectively.

Further details on the individual banks covered by the exercise are available on the Website of the EBA: http://bit.ly/1a3aEsi

EUROPEAN SUPERVISORY AUTHORITIES PRESS RELEASES ISSUED DURING OCTOBER 2013

European Banking Authority (EBA)

15/12/2013 - EBA issues warning to consumers on virtual currencies

15/12/2013 - EBA agrees on definition of identified staff for remuneration purposes

16/12/2013 - EBA publishes outcome of 2013 EU-wide transparency exercise

18/12/2013 - EBA publishes reports on comparability of Risk Weighted Assets (RWAs) and pro-cyclicality

European Securities and Markets Authority (ESMA)

02/12/2013 - ESMA identifies deficiencies in CRAs sovereign ratings processes

12/12/2013 - ESMA appoints new Securities Markets Stakeholders Group members

12/12/2013 - ESMA clarifies reporting of on-exchange derivatives under EMIR

European Insurance and Occupational Pensions Authority (EIOPA)

12/12/2013 - EIOPA updates on financial stability in (re)insurance and occupational pensions sector

20/12/2013 - EIOPA proposes changes to capital requirements for debt

European Central Bank

15/12/2013 - ECB Press Release - Danièle Nouy appointed as Chair of the Supervisory Board

19/12/2013 - New Euro Retail Payments Board will reinforce market governance

MFSA LICENCES - NOVEMBER 2013

LICENCES ISSUED

Banking

Financial Institutions

- Financial Institution licence issued to Swish Payments Ltd.

Collective Investment Schemes

Professional Investor Funds targeting Qualifying Investors

- Collective Investment Scheme licences issued to Innocap Fund SICAV plc in respect of two sub-funds.

- Collective Investment Scheme licences issued to NBCG Fund SICAV plc in respect of two sub-funds.

- Collective Investment Scheme licence issued to Himalaya SICAV plc in respect of one sub-fund.

- Collective Investment Scheme licence issued to Bluechip SICAV plc in respect of one sub-fund.

Investment Services

- Category 2 licence issued to FX International Ltd.

- Category 2 licence issued Scotstone Fund Managers Limited.

Insurance

Insurance Undertakings

- Licence issued to European Insurance Solution PCC Limited to carry on business of insurance in one class of the general business.

Cells

- Approval of WEEE Cell as a cell of European Insurance Solution PCC Limited to carry on business of insurance in one class of the general business.

Pensions

Retirement Schemes

- Certificate of Registration issued to Harbour Protected Retirement Scheme.

- Certificate of Registration issued to Harbour US Qualified Retirement Scheme.

- Certificate of Registration issued to The Centaurus Lite Retirement Benefit Scheme.

- Certificate of Registration issued to Pathfinder Retirement Scheme.

- Certificate of Registration issued to US Pathfinder Retirement Scheme.

- Certificate of Registration issued to Explorer Retirement Scheme.

- Certificate of Registration issued to US Explorer Retirement Scheme.

Retirement Fund Administrators

- Certificate issued to Praxis Fund Services (Malta) Ltd.

Retirement Fund

- Certificate issued to Trireme Pension SICAV plc.

- Certificate issued to Trireme Pension (US)SICAV plc.

SURRENDERED LICENCES

Collective Investment Schemes

Professional Investor Funds targeting Qualifying Investors

- Surrender of licence issued to Axiom Capital Partners SICAV plc.

- Surrender of licence issued to Abundance & Prosperity SICAV plc.

- Surrender of licence issued to Novium Opportunity Umbrella SICAV plc in respect of one sub-fund.

- Surrender of licence issued to Level E Capital SICAV plc in respect of one sub-fund.

Retail Non-UCITS

- Surrender of licence issued to La Valette Funds SICAV plc in respect of one sub-fund.

Investment Services

- Surrender of Category 2 licence issued to True Value Fund Management Limited.

EXTENDED AND REVISED LICENSES

Collective Investment Schemes

- Licence issued to Amalgamated Investments SICAV plc - Amalgamated Growth & Income Fund was revised from a Profes-sional Investor Fund targeting Experienced Investors to a Professional Investor Fund targeting Qualifying Investors.

Insurance

Cells

- Extension of licence issued to Ocado Cell, a cell of Atlas Insurance PCC Limited, to carry on business of insurance in three additional classes of the general business.

Trustees & Fiduciaries

- Extension of licence issued to Custom House Global Fund Services Limited to include acting as an administrator of private foundations.

REGISTRY OF COMPANIES - NEW REGISTRATIONS - NOVEMBER 2013

| Companies | Partnerships | Total |

| 436 | 3 | 439 |

MFSA ANNOUNCEMENTS

MFSA Consultation

Consultation Document

Feedback Document

MFSA Circulars

MFSA Media Releases

10/12/2013 - Update to investors who hold investment in ARM Asset Backed Securities SA

Warnings

05/12/2013 - Warning against Forex Worldwide Ltd and ToroPROfit

MFSA Listing Authority Announcements

06/12/2013 - Extension of period of Suspension of public offer - A25 Gold Producers Corp

23/12/2013 - Extension of period of Suspension of public offer - A25 Gold Producers Corp

Forthcoming Events

Education Consultative Council (ECC)

Training by members of the ECC:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.