- within Tax topic(s)

- with readers working within the Construction & Engineering industries

- with readers working within the Advertising & Public Relations, Media & Information and Retail & Leisure industries

- within Technology, Litigation and Mediation & Arbitration topic(s)

Introduction

In exercise of the powers conferred on him, the Honorable Minister of Finance and Coordinating Minister of the Economy, Mr. Adebayo Olawale Edun, OFR, made the Deduction of Tax at Source (Withholding) Regulations, 2024 (the "Regulations") which took effect on July 1, 2024.

The Regulations replace all prior existing rules or regulations relating to deducting tax at source (other than Pay-as-You-Earn) and is aimed at providing clarity and resolving ambiguities around deduction of taxes from payments made to taxable persons under the Companies Income Tax Act (CITA), Capital Gains Tax Act (CGTA), Personal Income Tax Act (PITA), and Petroleum Profits Tax Act (PPTA), which ambiguities have given rise to controversy in previous times. The Regulations also aim at reducing tax rates for small businesses in Nigeria, encouraging tax compliance among individuals and corporate entities, reducing the incidence of tax evasion, and promoting the ease of doing business within the Nigerian economic landscape.

Withholding tax is, simply put, the deduction of taxes at source from the income of a taxpayer. As the name implies, it is the process of "withholding" a certain percentage as tax from the income of a taxpayer at source and remitting same to the relevant tax authority.

Introduced in 1977, withholding taxes in Nigeria serve as a mechanism of the Government aimed at curbing tax evasion, and monitoring the affairs of resident and non-resident taxpayers while raising revenue for the country. Albeit well-intentioned, the withholding tax regime in Nigeria has been met with a lot of difficulties in its administration. This is in light of the ambiguities created under previous laws and the huge tax burden placed on businesses which made compliance with the previous withholding tax regime a subject of controversy over the past years. Thankfully, with the introduction of the Regulations, taxpayers will receive more clarity on the operation and administration of withholding taxes in Nigeria which would, hopefully, engender a more efficient regulation and administration of withholding taxes and its compliance in Nigeria.

This article is aimed at providing an overview of the new framework introduced by the Regulations and the implications.

Definition of Terms

For the purpose of this article, the following words shall have the following meanings;

"Deduction" shall mean the process of deducting withholding taxes at source from taxable persons for the purpose of remitting same to the relevant tax authority.

"Person(s)" shall include individuals, companies, and other bodies or organisations liable to pay tax in Nigeria.

"Remittance" shall mean the process of remitting taxes deducted at source to the relevant tax authority.

"WHT" shall mean withholding taxes.

1. Deduction of Tax at Source

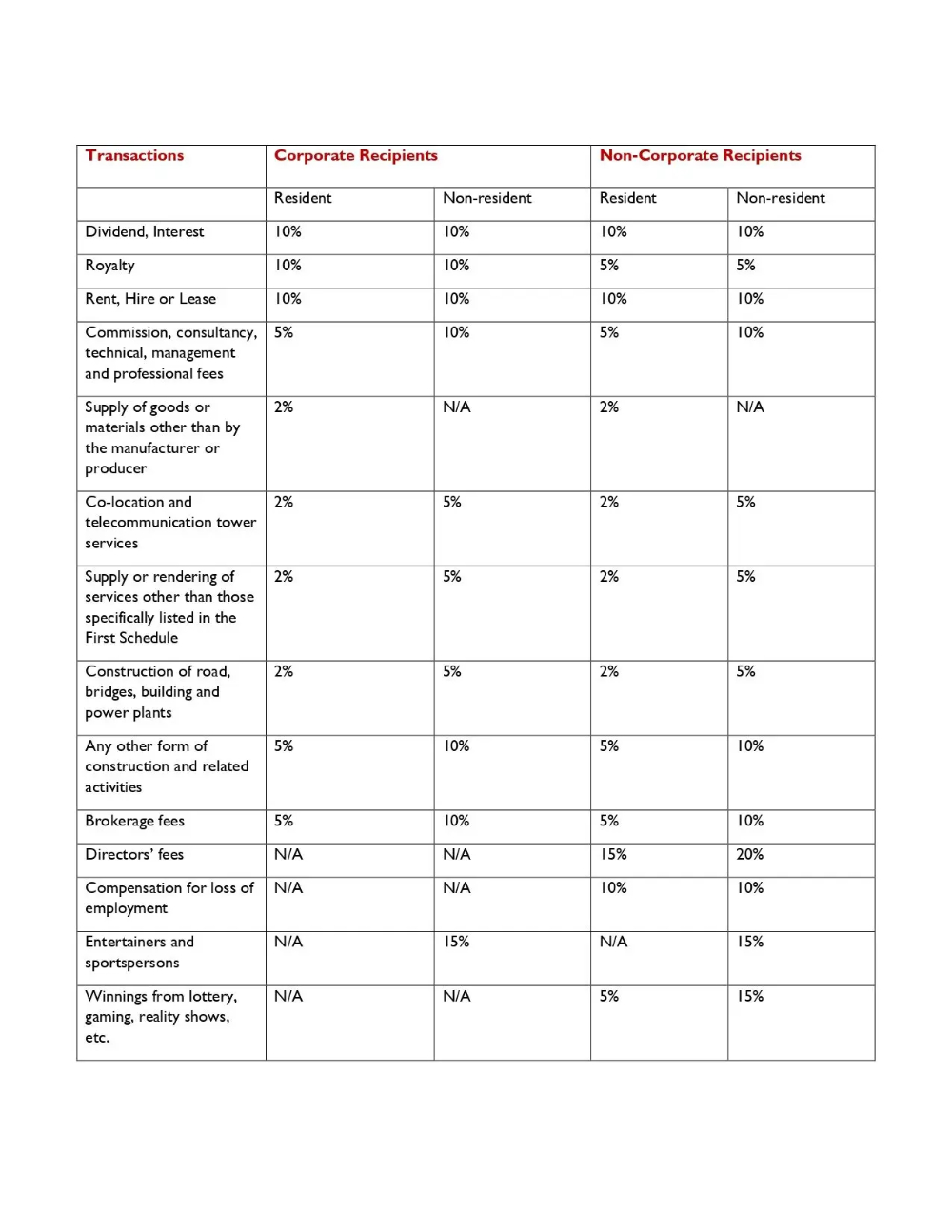

The First Schedule of the Regulations specifies the eligible transactions at which deductions are to be made and the applicable rates. It identifies categories of taxable persons as either corporate or non-corporate recipients who are either resident or non-resident in Nigeria. Accordingly, the applicable tax rates will depend on what category the taxable person falls under.

The eligible transactions and applicable tax rates are as follows:

It is important to note that under the Regulations, any reduced rates existing under any treaty between Nigeria and any other country for the purpose of avoiding double taxation (Double Taxation Treaties) shall continue to apply to an eligible resident to the extent that the rates are contained in the relevant treaty or protocol duly ratified by the National Assembly.

Also, the Regulations provide that any amount to be deducted at source from the income of any eligible transaction involving non-passive income, shall be double the rate specified above where the recipient has no Tax Identification Number (TIN). This is innovative as it highlights the need for tax payers to have a TIN.

2. Persons Required to Make Deductions at Source

Under the Regulations, the following persons are required to make deductions at source on eligible transactions:

a. A body, corporate or unincorporated, other than an individual;

b. A government ministry, department or agency;

c. A statutory body;

d. A public authority;

e. Any other institution, organisation, establishment or enterprise including those exempt from tax; and

f. A payment agent on behalf of any of the aforementioned entities.

However, a small company i.e., a company with an annual turnover of less than ₦25,000,000 (Twenty Five Million Naira) or an unincorporated body with equivalent attributes, are now exempt from the requirement to deduct tax at source from any transaction provided that the recipient has a valid TIN and the value of the transaction is ₦2,000,000 (Two Million Naira) or less. Thus, when these two conditions are met, a small company will be exempt from deducting tax at source. This further amplifies the need for individuals and organisations to obtain a TIN as this has the potential of reducing possible tax liabilities. It also helps to reduce compliance obligations on small companies thereby making it easier for small companies to carry on businesses without subjecting them to several tax obligations.

3. Withholding Tax Not to Serve as Extra Cost

There is a tendency for transacting parties to make an additional cost to the original contract fees in order to cover anticipated WHT deductions. In this regard, the Regulations provide that the deductions made on payments shall not be regarded as a separate tax or an additional cost of the transaction. It shall not be included in the contract price but shall be treated as the final tax of the supplier. For example, if the contract price for the supply of commodities is fixed at ₦1,000,000 (One Million Naira) (the "Contract Sum"), the contracting parties are not allowed to include an additional ₦200,000 (Two Hundred Thousand Naira) making a total of ₦1,200,000 (One Million, Two Hundred Thousand Naira) to cover for anticipated WHT deductions. The withholding taxes shall be on the Contract Sum. In other words, the WHT deductions for the purpose of that transaction shall be made from the Contract Sum and nothing additional.

4. Time for Deduction at Source

Under the Regulations, obligation to make deduction of taxes at source shall arise either when payment is made or the amount due is otherwise settled, whichever is earlier. For related parties, the obligation shall arise either at the time of payment or when the liability is recognised, whichever is earlier.

In the case of non-resident persons, the amount deducted shall be the final tax for the transaction unless where the non-resident person has a taxable presence in Nigeria.

5. Remittance of Deductions at Source

The Regulations specify a duration within which taxes deducted at source must be remitted to the relevant tax authority. For taxes paid to the Federal Inland Revenue Service (FIRS), remittance must be made not later than the 21st day of the month following the month of payment. By way of an example, where a deduction of tax for which the FIRS is the relevant tax authority is made on June 1, 2024, the same must be remitted not later than July 21, 2024.

With respect to payment to the Internal Revenue Service of a State (e.g., LIRS, FCTIRS, RISRS, and so on), remittance shall be made, in the case of Capital Gains Tax (CGT) not later than the 10th day of the month after payment was made and with respect to any other deduction, not later than the 30th day of the month following the month of payment. (The example highlighted above is applicable).

In addition to the above, the Regulations now require persons making deductions to submit returns to the relevant tax authority which should be accompanied by the evidence of remittance of the amount deducted. These returns are to be made using the template specified under the Second Schedule to the Regulations.

6. Issuance of Receipts

A person making a deduction from any payment shall, upon remittance to the relevant tax authority, issue a receipt for the tax so deducted alongside a statement, containing the name, address, TIN of the recipient, and where the recipient has no TIN, he/ she is to provide a National Identification Number (NIN) or RC number in the case of a company. The receipt should also reflect the nature of transaction in respect of which payment was made, the gross amount payable, the amount deducted as tax and the month to which the payment relates. The template provided in the Third Schedule to the Regulations is to be adopted for this purpose. The recipient may then submit the receipt to the relevant tax authority for the purpose of claiming tax credit for the amount so deducted. Interestingly, the Regulations further provide that where a recipient submits a receipt for a tax deducted but yet to be remitted to the relevant tax authority, the recipient shall be credited for the tax so deducted while the unremitted tax shall be treated as the tax liability of the person who made the deduction and shall be recoverable with penalty and interest.

7. Offences/ Penalties

Where a person who is required to make statutory deductions at source fails to do so or makes the deductions but fails to pay to the relevant tax authority on or before the due date, such person is liable to a penalty under section 40 of the FIRS (Establishment) Act (FIRSEA), 2007 or section 4 of the PITA whichever is applicable. Section 40 of the FIRSEA provides that any person who fails to deduct or deducts but fails to remit taxes within 30 days from the date on which the amount was deducted or the time on which the duty to deduct arose, shall be liable to a penalty of 10% (ten percent) of the tax withheld in addition to the withheld tax. The same provision applies under section 74 of PITA.

Further, where a required deduction is not made but the amount is paid to the recipient, only an administrative penalty and one-off annual interest on the amount not deducted is due and payable. Also, where a deduction is made but not remitted, the deducted amount, alongside an administrative penalty and annual interest, must be paid in accordance with the applicable legislation.

8. Exemptions

Under the Regulations, there are several categories of transactions that are exempt from deduction at source, they are as follows:

a. Compensation payments under the Registered Securities Lending Transaction;

b. Distributions or payments to a Real Estate Investment Trust or Real Estate Investment Company;

c. Over-the-counter transactions as defined to mean any transaction between parties without any prior existing contractual relationship and for which payment is made instantly or on the spot in cash or via electronic means (e.g., online transfers);

d. Fees paid to a Nigerian bank by way of direct debit of funds domicile in the bank (such as administrative fees charged by banks on debit and credit transactions);

e. Goods manufactured or materials produced by the person making the supply. In essence, where a manufacturer is the supplier of the same goods, he shall be exempt from paying withholding taxes. This is also commendable as it encourages the production and distribution of Nigerian-made products;

f. Imported goods where the transaction does not create a taxable presence in Nigeria for the foreign supplier;

g. Any payment in respect of income or profit which is exempt from tax;

h. Out-of-pocket expenses distinguishable from the contract fees which are normally incurred directly by the supplier;

i. Insurance premium;

j. Supply of liquefied petroleum gas, compressed natural gas, premium motor spirit, automotive gas oil, low pour fuel oil, dual purpose kerosene and jet-A1;

k. Commission retained by a broker from monies collected on behalf of the principal in line with the industry norm for such transactions; and

l. Winnings from a game of chance or a reality show with contents that exclusively promote entrepreneurship, academics, technological or scientific innovation. Again, this is commendable in that it further promotes these activities by not subjecting incomes accrued therefrom to taxes.

However, the fact that a transaction is exempted from deduction at source does not exempt such transaction from the applicable income taxes unless as provided under the enabling laws. Therefore, certain transactions may still be subjected to other taxes even if they are exempt from withholding taxes. The effect of this is that, a supplier of goods manufactured by such supplier who has enjoyed an exemption from paying withholding taxes by virtue of the Regulations, may still be required to pay taxes under the PITA, CGTA, CITA or the PPTA. Such person cannot argue that he has already been exempted under the Regulations.

Conclusion

In comparison with the previous withholding tax regime, the Regulations provide a more robust framework for the regulation of withholding taxes in Nigeria. The Regulations introduced certain key provisions which have a significant impact across several sectors of the Nigerian economy such as oil and gas/ energy sector, manufacturing of goods, the public sector as well as the taxation of non-residents in Nigeria. One key innovation identifiable from the new provisions is the need for taxpayers to register with the relevant taxing authority and obtain a TIN so as to ensure that all taxpayers are properly registered in order to curb the incidences of tax evasion. The Regulations have also included provisions that create tax reliefs for small businesses thereby allowing for ease of doing business in Nigeria. The Regulations further clarify the ambiguities surrounding "sales in the ordinary course of business" created under the former the regime by outlining a list of transactions exempt from deductions of withholding tax. Under the old regime, the Personal Income Tax (rates, etc., of tax Deducted at source (withholding tax)) Regulations, 1997 imposed a tax rate of 5% on all types of contracts and agency arrangements, other than "sales in the ordinary course of business". The former regulation did not provide clarity as to what amounts to "sales in the ordinary course of business" and this gave room for much controversy on the issue of exemption from withholding taxes. The exemption list provided under the new regulations has helped to clarify the hitherto existing confusion as to who is to pay withholding taxes and who is exempt.

This reflects a step in the right direction towards creating a more efficient framework for regulating withholding taxes in Nigeria.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.