- within Family and Matrimonial, Employment and HR and Energy and Natural Resources topic(s)

- in United States

Between October and December 2022, the National Assembly approved and forwarded the Business Facilitation Bill ("the Bill") to the President, President Muhammadu Buhari for assent. On 15th February 2023, President Buhari gave his assent to the Bill, making it a full-fledged Act. The Business Facilitation Act (the "Act" or "BFA") is a result of close cooperation between public and private stakeholders and incorporates the principles outlined in Executive Order 001 (EO1) on Transparency and Efficiency in Public Service Delivery.

The Act serves to consolidate and revise various business-oriented laws, while also supplementing the Nigerian government's initiatives to enhance the ease of doing business in the country, through the Presidential Enabling Business Environment Council (PEBEC). Nigeria's ranking in the ease of doing business currently stands at 131 among 190 economies, a noteworthy improvement from its previous rank of 146 in 2018.

The Act incorporates provisions that prioritise transparency and efficiency, and revises the following existing legislation:

- Companies and Allied Matters Act.

- The Nigerian Export Promotion Council

- The Custom and Excise Management Act

- Export Prohibition Act

- Financial Reporting Council Act

- Foreign Exchange (Monitoring and Miscellaneous Provisions) Act

- Immigration Act

- Industrial Inspectorate Act

- Industrial Training Fund Act

- Investment and Securities Act

- National Housing Fund Act

- National Office for Technology Acquisition and Promotion Act

- National Planning Commission Act

- Nigerian Customs Service Board Act

- Nigerian Investment Promotion Commission Act

- Nigerian Oil and Gas Industry Content Development Act

- Nigerian Port Authority Act

- Patent and Designs Act

- Pension Reform Act

- Standard Organization of Nigeria Act

- Trademarks Act

This article delves into the provisions of the BFA and examines its potential impact on the ease of doing business in Nigeria, highlighting noteworthy features.

Transparency and Efficiency

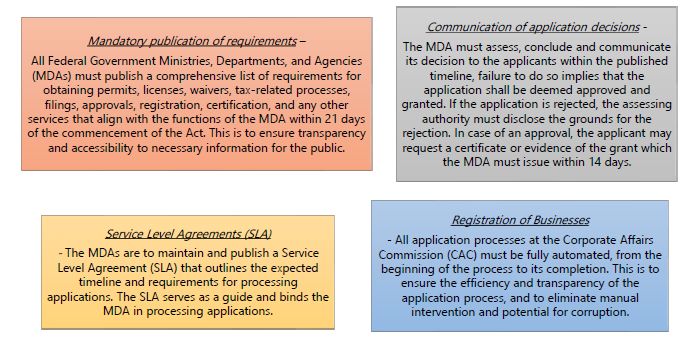

Some of the notable provisions on transparency and efficiency under the BFA include:

Review/amendments to the Companies and Allied Matters Act

The Companies and Allied Matters Act No.3 of 2020 (CAMA) is among the key legislations that improve the ease of doing business in Nigeria, by providing a regulatory framework for business operations within the country. With the passage of the BFA, certain significant provisions of CAMA have been impacted, including:

- Insertion of new qualification for foreign companies intending to carry on business in Nigeria - Under Section 78 of CAMA 2020, it is compulsory for foreign companies to establish a local entity in Nigeria before engaging in business or exercising the powers of a registered company. Nonetheless, Section 78(3) of CAMA exempts foreign companies that were previously granted exemptions under the old CAMA or under any treaty in which Nigeria is a signatory. The BFA has now introduced a third category of exempted companies, stating that companies that are exempted under any existing law passed by the National Assembly are not required to in corporate a local entity.

- Increase of Issued Share Capital (Board of Directors to pass resolution for increase) - Section 127(1) of CAMA stipulates that a company may only increase its share capital through a resolution passed by the members in a general meeting. However, the BFA has revised the provisions of Sections 127(1) and 149(1) of CAMA, allowing a company to increase its issued share capital by issuing new shares, either through a general meeting or by a board resolution, subject to any relevant conditions or directions in the Articles or the company's general meeting. This change streamlines the process of increasing share capital to accommodate investments. However, if the company's articles do not already provide for the directors to increase share capital, it may be necessary to amend the articles. Alternatively, the members can pass a resolution authorizing the directors to increase share capital and establish the parameters for doing so.

- Pre-emptive Rights of Existing Shareholders applicable to private companies - The provisions of Section 142(1) of CAMA 2020 require companies, whether public or private, to offer newly issued shares to their existing shareholders in proportion to their existing holdings. However, this provision has been particularly onerous for public companies, as it suggests that any issue of new shares, whether by way of a public offer or a private placement, must be preceded by a rights offer to existing shareholders. The BFA has modified this section by inserting the word "private," thereby limiting the application of Section 142(1) CAMA to private companies. Additionally, the BFA has amended Section 142(2)(c) CAMA by specifying a timeframe of twenty-one (21) days as the "reasonable time period" for existing shareholders to accept the offer.

- Return of allotment of shares - The BFA has brought about a change to the timeline for filing returns on the allotment of shares to the Corporate Affairs Commission (CAC). Prior to the amendment, Section 154(1) of CAMA stipulated a period of one (1) month for such filing. However, the BFA has now shortened this period to fifteen days, meaning that companies must ensure that all necessary returns and filings are made within this timeframe to remain compliant with the law.

- Share Certificates - The BFA has introduced a provision for the issuance of share certificates in electronic form, thereby providing companies with an option to issue share certificates in electronic format, in addition to the traditional paper-based format.

- Amendment of Section 222 - The BFA makes significant changes to the existing provision of Section 222 (13) of the CAMA by introducing key definitions of terms such as financial collateral, financial instruments, and security interest.

- Place of meeting - The existing CAMA allows private companies to hold general meetings electronically, provided it is stated in their Articles of Association. However, Section 240(2) of CAMA is silent on whether public companies can also hold electronic general meetings. The BFA has now removed the word "private" from the provision, meaning that both private and public companies can now hold their general meetings electronically. If a public company wants to take advantage of this provision, it will need to amend its Articles of Association.

- Service of Notice - The BFA has updated the provisions of Section 244(1) of CAMA to include electronic service as a valid mode of serving notices of meetings. This means that companies can now serve notices of meetings to their shareholders via electronic means, in addition to the traditional methods of delivery such as postal service or hand delivery.

- Procedure of voting - The BFA has expanded the options for voting on a resolution at a general meeting under Section 248(1) of CAMA by introducing "electronic voting" in addition to the traditional method of "show of hands".

- Independent Directors in Public Companies - Section 275(1) of the CAMA requires a public company to have a minimum of three independent directors. However, the BFA has modified this provision to require that at least one-third of the total number of directors of a public company must be independent directors.

- Disqualification of Directorship - The BFA has provided clarity on instances where a person may be disqualified from being a director of another company under Section 283 (c) of the CAMA. Previously, an individual removed as a director in accordance with Section 288 was disqualified from being a director of any other company. However, the BFA has now specified that disqualification only applies where the removal was on the grounds of fraud, dishonesty, or unethical conduct.

- Accounting standards for a company's financial statement - The BFA has amended Section 378(1) of CAMA to state that a company's financial statements must comply with the accounting standards prescribed by the Financial Reporting Council of Nigeria (FRCN). This means that companies are no longer required to comply with the accounting standards outlined in the First Schedule of CAMA.

CONCLUSION

The Business Facilitation (Miscellaneous Provisions) Act represents a significant legislative effort to facilitate Nigeria's progress towards becoming a more business-friendly environment that fosters the ease of starting and developing enterprises. If executed successfully, this legislation has the potential to revolutionise the business regulatory landscape.

In subsequent series, we will explore the implications of the BFA on other existing business legislation mentioned earlier.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.