Summary

On 29th April, 2020, the Federal Inland Revenue Service (FIRS) issued a series of Circulars to provide clarifications on the amendments introduced by the Finance Act, 2019 to the Nigerian tax laws (Click here to access the Circulars). We have provided some comments on the Information Circulars as follows:

Details

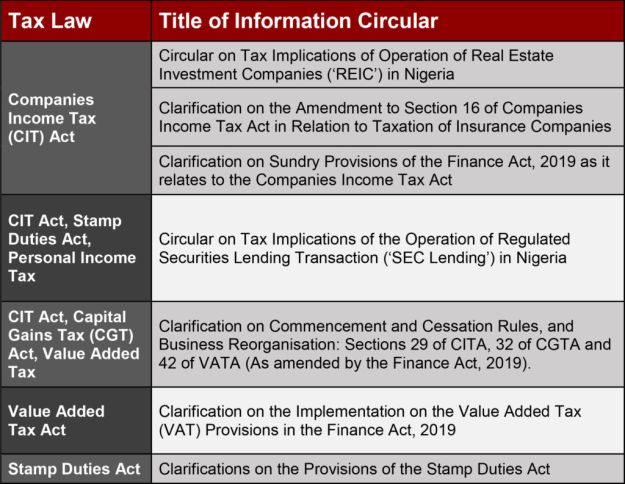

As you may be aware, the Finance Act, 2019 introduced changes to a number of Nigerian tax laws. The FIRS Circulars therefore seek to provide clarification on key tax provisions and changes to tax laws contained in the Finance Act, 2019. The Circulars are as set out below:

The Circulars essentially set out the FIRS' position on the new provisions introduced by the Finance Act, 2019 and provide clarity on how FIRS would the new provisions when dealing with taxpayers'.

For instance, the Information Circular on Value Added Tax provides the FIRS' position on the rate of tax and associated transitional issues. Based on the Circular, the new rate of 7.5% became effective 1st February, 2020. Thus, the FIRS has stated that the VAT rate for taxable supplies made prior to the 1st February, 2020 is 5%. However, the applicable VAT is 7.5%, where a contract of taxable supplies was signed prior to 1st February, 2020 and supplies or performance of the contract occurred on or after the 1st February, 2020.

On a related note, the FIRS clarified that the VAT rate for milestones achieved on or after 1st February 2020 is 7.5% for continuing contracts for which supplies or performance is measured based on milestone achieved.

The FIRS also provided clarifications on the long standing issue of excess dividend tax. Based on the FIRS' Information Circular on the issue, the following income types will be exempt in line with the provisions of Section 19 of the CITA:

- Dividends paid out of retained earnings of a company that has already been taxed under CITA, Petroleum Profit Tax Act (PPTA) or the Capital Gains Tax Act (CGTA);

- Dividend paid out of all tax-exempt incomes under CGTA, PPTA & Industrial Development (Income Tax Relief) Act;

- All franked investment income under CITA; and

- Distributions made by a Real Estate Investment Company to its shareholders from rental or dividend income received on those shareholders' behalf.

Taxpayers will therefore need to attach a schedule tracking the sources of dividend paid together with their annual CIT returns. The Circular also states that the profits of the current year will be considered first in relation to the excess dividend tax rule to determine the dividends that will be treated as having been paid from retained earnings. However, this interpretation appears to restrict the application of the clear exemptions granted by Section 19 of the CITA, as dividend is only distributable from: profits arising from the use of a company's property; revenue reserves (retained earnings); and sale of fixed assets in line with the provisions of Section 380 of the Companies and Allied Matters Act. Thus, a company can only validly distribute dividends from the highlighted sources and profits after tax of a company's current year should not be considered as directly distributable.

Similarly, the Circular provides that evidence of WHT deduction from dividend is a criterion for treating such dividends as Franked Investment Income for the purpose of minimum tax computation. However, the late payment or failure of a payer to remit WHT should not invalidate the exemption status of such dividend since the obligation to pay WHT is that of the payer and not the recipient in line with the strict wordings of the law.

Implication

The FIRS's efforts to provide detailed explanations and illustrations on the new tax provisions in the Finance Act through the Information Circulars is commendable, as it seeks to provide some certainty in respect of the interpretation of the provisions. Additionally, the FIRS, clarifies that these recent Circulars supersede other circulars, notices or publications previously issued by it to the extent of any inconsistency.

While the Circulars set out what FIRS believes to be the interpretation and application of the tax provisions in the Finance Act and relevant tax laws, it is important to note that the Circulars cannot derogate from the extant provisions of the law. Thus, it is pertinent for taxpayers to engage tax professionals for any clarification on the provisions of the Finance Act and how they impact their rights and obligations under the relevant tax laws.

Originally published May 19, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.