Recently, a full page advert was placed in several Nigerian newspapers by six electricity generation companies (Gencos), warning of an impending shut down of their operations due to an outstanding N145.7 billion debt owed to them for power generated so far. Collectively, these Gencos, including the three hydro stations, account for almost 65% of Nigeria's entire available generation capacity today. The balance 35% is from the IPPs – Shell Afam, Ibom Power and Agip Okpai, as well as a few of the completed NIPP power plants that still have gas to generate power. Both the IPPs and the NIPPs are owed huge sums as well for power generated till date. For instance, the NIPPs alone are owed over N90billion!

Besides being owed huge debts, the Gencos also are operating under very harsh monetary and fiscal conditions, occasioned by the economic realities that face the country today. Then there is the issue of the Niger Delta Avengers and other militant groups operating in the Niger Delta, which has severely constrained gas supply. Gencos are not the only parties being owed in the power sector; TCN as well as gas suppliers are also owed huge sums for transmission services and gas supplied to the power sector.

How Did We Get Here?

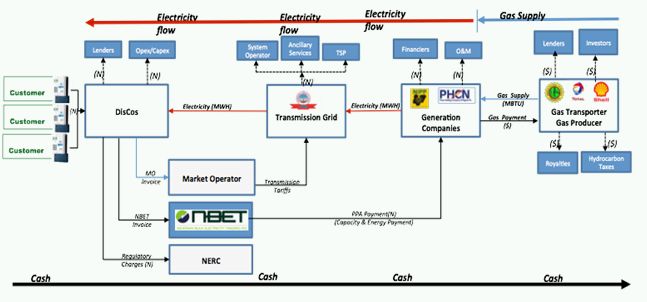

To understand the genesis of the revenue shortfall crisis, one must understand the structure of the power sector value chain from gas production to electricity distribution. The diagram below depicts the gas-to-power value chain and the various market participants.

As the diagram depicts, while electricity flows in one direction from the generating companies, the revenues to pay all market participants in the electricity value chain flow in the opposite direction and comes from the electricity consumers paying their electricity bills to the Discos. Thus, one Disco's inability to fully pay for power sold to it for whatever reason will create a revenue shortfall across the entire power sector value chain.

Therefore, the crisis in the power sector is as a result of persistent revenue shortfalls arising from the inability of Discos to pay fully for electricity generated by Gencos since the conclusion of the privatization of the PHCN successor companies in 2013. From the last data released by NBET, average payment by Discos to NBET for power is less than 29% of the total market invoice.

The inability of Discos to pay their market invoices (hence that of NBET to pay Gencos) in full can be attributed to a combination of the following factors:

- High distribution and non-distribution losses across the distribution and transmission value chain;

- Inadequate generation capacity as a result of poor gas supply (arising mainly from vandalism of oil & gas infrastructure), limited transmission infrastructure and lack of new generation capacity. Total available generation capacity since February 2016, fluctuates between 1,900 MW to 3,000 MW, which is less than half of the 7,000 MW projected in the MYTO 2016 in setting the retail electricity tariffs.

- Lack of cost reflective electricity tariffs and arising customer resistance to the new electricity tariffs introduced in February 2016.

- Low collection efficiency and a corresponding lack of significant investment by Discos in metering customers to improve their collection efficiencies.

- Huge debt owed to Discos by MDAs, State and Local Governments.

Data from distribution loss studies recently conducted by Discos and provided to NERC show that average aggregate distribution and non-distribution losses across all Discos are in excess of 50%. To put it in layman's perspective, more than 50% of power generated is theoretically lost, stolen or simply not paid for. No industry in whatever sector can sustain these high revenue losses and still be expected to stay afloat as a going concern without any form of intervention.

The Role of Government in the Power Sector

Revenue shortfalls are typical in a transitional electricity market. In a nascent, transitional electricity market like the Nigerian electricity market, government's role is overarching and critical to the stability of the market and also in stimulating investments in the sector. Government's roles include putting in place cost reflective tariffs, ensuring the activation and effectiveness of contracts in the electricity market and adequate regulations that enforces the sanctity of such contracts.

In our view, Government's predominant role is to create market confidence and ensure the viability and credit worthiness of the power sector particularly during the transitional phase of the market.

In the design of the current power sector model in 2005, revenue inadequacy (revenue shortfalls) was anticipated by the designers due to the high ATC&C losses in the entire value chain. The shortfall between actual revenues collected and expected revenues was to be funded by the Federal Government via monthly subsidies.

In a notice of the proposed rulemaking on transitional trading arrangement and financial settlement system published by NERC in the Financial Standard newspaper of Thursday, July 31st, 2008, NERC stated as follows:

"...Given the revenue inadequacy which will now be funded by the subsidy in the first three years of the MYTO, the shortfall between the obligated payment and actual revenues collected, will be met by the Government on a monthly basis beginning from July 1st, 2008...."

In addition to monthly subsidies, it was anticipated that the Government will provide and also arrange guarantees either locally or from the World Bank to meet systemic or market risks such as regulatory risks, gas supply risks, revenue risks, etc.

Today, the Federal Government has been unable to provide subsidies to fund the shortfall thus far due to budgetary constraints. Market participants across the entire value chain are faced with both systemic and market risks without the anticipated Government subsidies, Guarantees or World Bank PRG as envisaged under the transitional trading arrangement by NERC. We must quickly add, however, that the use of subsidies is not a sustainable means to fund the revenue shortfall and should not be contemplated.

Under the transitional electricity market, Government plays a big role in the electricity market through the Bulk Electricity Trader. The Bulk Trader is an entity set up to ensure bankability of the electricity market by ensuring that revenue shortfall by a Disco do not affect Gencos and other market operators in the electricity value chain.

What is the Bulk Trader?

The Nigerian Bulk Electricity Trading Plc (NBET), popularly called the Bulk Trader, is a creation of the Electric Power Sector Reform Act (EPSRA) and was incorporated on July 29, 2010 to carry out, under license from NERC, the bulk purchase and resale of electricity contemplated by the EPSRA (http://nbet.com.ng/about-nbet/who-we-are/).

NBET's key role is to generate market confidence through well-negotiated and well aligned contracts with fair risk allocation that protects market participants from credit risks and systemic risks. In the absence of bi-lateral contracts between Gencos and Discos, NBET is designed to act as a credible and credit worthy off-taker of power to be procured from Gencos under effective Power Purchase Agreements (PPA) and sell the power to Discos, with the objective of protecting Gencos from Disco payment risks and de-risking the power sector.

In his statement on the inauguration of NBET Board in 2011, the former President Goodluck Ebele Jonathan expressed his confidence that NBET will faithfully execute its mandate of serving as a bulwark against the potential payment default by distribution companies until they become financially strong to directly enter into power purchase agreement on bilateral basis.

Without doubt, NBET's primary aim is to act as a backstop the kind of payment default we now see endangering the entire electricity value chain.

NBET has a capitalization by the Federal Government of Nigeria in excess of $800 Million. In the event of revenue shortfalls from Discos, the Bulk Trader is expected to use its capitalization to bridge the revenue shortfall and ensure Gencos and other market participants are paid in full for power generated.

For NBET to be successful in its mandate to bridge revenue shortfalls in the power sector, it must have enough capital to meet its payment obligations to Gencos in a sustainable manner. This, in reality means that its payment obligations to Gencos under effective PPAs needs to be fully guaranteed by the Federal Government.

Will There Be Any Improvement in the Revenue Shortfalls Soon?

Currently, monthly revenue shortfalls in the electricity value chain are in excess of N20billion and will rise further once electricity tariffs are adjusted upwards to reflect the effects of the floating of the Naira (particularly on the price of natural gas) and rising inflation. Naira devaluation and inflation are direct pass through costs to electricity customers. With the current state of the Nigerian economy, we can expect that monthly revenue shortfall to Gencos and other market participants will cross the N30billion mark by the end of August, 2016.

Unfortunately, the revenue shortfall situation may likely not improve anytime soon except the following actions are taken:

- The issues surrounding the implementation of the recent tariff increase are fully addressed by the Regulator and the Courts;

- Discos aggressively address their losses and become more efficient in their collections through metering;

- MDAs, State and Local Governments are able to pay their indebtedness to Discos;

- The federal government successfully deals with, and put an end to the issue of militancy and pipeline vandalism in the Niger Delta.

- The CBN continues its disbursement from the its Nigerian Electricity Market Stabilisation Facility (NEMSF), being provided to service providers in the power value chain to address shortfalls in power sector revenues, settle legacy gas debts and shortfalls in revenue and to hasten the advent of a contract-based electricity market.

Notwithstanding the above, without any equivocation, there will still be revenue shortfalls (hence payment risks) across the entire power sector value chain for the next 3 – 5 years due to the huge transmission and distribution losses in the power sector, possible occurrence of Availability Events under the PPA (weak transmission infrastructure and gas constraints), foreign exchange uncertainties arising from the floating of the Naira, potential tariff rate shocks and a weak economy.

Unfortunately, NBET's current capitalization, which is in excess of $800m is not sufficient to address current payment defaults by Discos beyond 8-12 months at current shortfall levels. NBET's ability, to continue to serve its primary goal in meeting these revenue shortfalls as and when they occur is most imperative for the survival of our transitional power sector.

Addressing the Revenue Shortfalls in the Power Sector

A sustainable way to address the revenue shortfalls and credit risk in the power sector is to put in place a liquidity and payment support structure that would:

- Support NBET's payment obligations to Gencos under respective PPAs, which in turn, would enable Gencos meet their payment obligations to their Gas Suppliers under respective GSAs;

- Settle outstanding debts to Gencos and their Gas Suppliers;

- Cover anticipated revenue shortfalls which threaten the stability and sustainability of the power sector;

- Guarantee full payment to other market participants (Gencos, TCN, Market Operator and Gas Suppliers);

- Provide re-investible funds for Discos to fund their capital programs to reduce distribution losses and improve collection;

- Provide market confidence to investors in the power sector

The proposed liquidity and payment support mechanism is for NBET, as the Bulk Trader of electricity, to fully bear existing and future revenue shortfalls and payment risks to the market during the transitional electricity market until such a time that Discos significantly improve their revenue collection and become more efficient in their operations.

The NBET Bond Program – A Local PRG & Liquidity Solution

NBET's liquidity and payment support mechanism can be structured as a medium-term notes issuance program by NBET (NBET MTN Program), with an embedded partial risk guarantee from the CBN.

Medium-term notes (MTNs) are debt instruments usually issued under a program that allows the issuer to offer its MTNs to investors from time to time without producing extensive legal documentation at the time of each issuance of notes, thus offering the issuer and investors more flexibility to the issuer and investor both in terms of structure and documentation.

Under the NBET MTN Program, NBET will issue tranches of debt instruments with tenors not less than 10 years, to fund existing and future revenue shortfalls.

This is not a new solution, as we understand that NBET has in fact commenced the structuring of a bond program to enhance its capitalization. Unfortunately, the House of Representatives, in its wisdom, have put the implementation of the bond program on hold.

The advantage of the NBET bond program is that it unlocks sustainable long term funding from the Capital Markets (particularly Pension Funds and Institutional Investors) rather than the use of subsidies and intervention funds such as the N213billion CBN intervention, which are not sustainable in the long term.

In the second part of this article, we shall put out our ideas on the structuring of the NBET MTN and embedded PRG.

Conclusion

Revenue shortfalls, credit risk and gas supply constraints in the power sector under a transitional electricity market is to be, and was anticipated. However, resolving the revenue shortfalls has proved a bit of a challenge, and a long-term and sustainable solution will take time and significant investments by the private operators and the Government. However, Government, through NBET, must stand ready to firmly assure investors across the power value chain and the banks who are behind these investors that such investments in the power sector will be fully recoverable.

As it stands, without the deployment of NBET's US$800 million capitalization to meet the revenue shortfalls, as well as the full disbursement of the N213 billion CBN facility to the power sector, Gencos as well as their gas suppliers, may have no other option than to shut down operations and plunge Nigeria into darkness.

Even at that, such intervention will be temporary relief only. Without an NBET MTN Program as proposed, or any form of long-term funding intervention by the Federal Government, the power sector may well be heading for a total collapse.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.