- within Government, Public Sector and Environment topic(s)

- with readers working within the Banking & Credit industries

The regulation on anti-money laundering and terrorism financing has not stopped developing over the last two decades, all while enlarging its scope of application to more and more professionals, active in financial as well as non-financial sectors.

The range of non-financial professionals particularly broadened. Other than the liberal professions (lawyers, auditors, notaries, bailiffs, who are governed by specific ethical rules), many other professionals of very diverse categories are hence finding themselves subject to anti-money laundering and terrorism financing obligations (AML/TF), such as, among others, asset traders, the advisory and service provider professions in various sectors, or real estate professions.

While the Law of 12 November 2004 on the fight against money laundering and terrorism financing, as amended (the "Law") distinguishes between professionals depending on their activity, the three professional obligation mainstays remain a common core applicable to all:

(1) the duty of care (obligation de vigilance); (2) the duty to have adequate internal organisation; and (3) duty to cooperate with authorities.

(1) The duty of care is essentially composed of identifying and verifying the client/agent(s), identifying the ultimate beneficial owners, understanding the transaction, following up with the client due diligence as well as the storage of the documents.

Identification of the client, the agent or the ultimate beneficial owner and the verification of the identity of these persons must be done based on documents and information from reliable and independent sources. The importance of timing must be emphasised here: this due diligence must be effectuated prior to the establishment of the business relation and lasts for the duration of the relationship. The duty of care, the complexity of which has been increased over the last several years, particularly after the 4th and 5th European AML/CTF Directives, constitutes the cornerstone of the professional obligations in the issue.

With certain clients, agents or ultimate beneficial owners, particularly those located in risky geographic zones or having certain risk factors defined by the Law, a professional must apply a heightened duty of care. Consequently, it must obtain in-depth and duly documented information on those persons, update the identification data and renew the verifications at shorter intervals, obtain information on the origin of the funds and the reasons for the contemplated of necessary transactions, and increase the number and frequency of monitoring.

We underline the fact that the process of initial identification when entering into the relationship allows one to assess the type of client and its intentions, and then allows for an adequate risk follow up. Thus, the process should be carried out with the greatest of rigor.

The constant duty of care applies during the entire business relationship. In the context of that duty, a professional must during the entire time examine the consistency of the client's transactions and activities with its initial declarations with respect to the goal of the relationship, the origin of the funds or other factors, pay particular attention to any unusual transactions, update the documents, data or other information allowing the identification of the purpose and nature of the transactions, maintain updated identity documents and keep them for 5 years after the end of the relationship.

(2) the professional's internal organisation must be adequate and complete, such that it allows the professional to comply with its obligations and guarantee that the mechanism protects from any violation. First, internal AML/CTF policies and procedures must be put into place. The interal procedure must essentially contain: a description of the internal measures to apply to ensure the duty of care to be exercises by the business's employees, whether it be in the beginning or during the relationship; a description of the risk indicators and factors; a description of the verifications to effectuate and their frequency depending on the level of risk attributed to the client; a description of grounds for suspicion, the appointment and role of the person responsible for AML/CTF at the management level, the appointment and role of the Compliance Officer, participation in AML/CTF training for personnel; a description of the AML/CTF analysis and risk assessment adapted to the professional's activity.

This procedure will constitute a guide which will allow all of the organisation's employees to understand the steps to take, to apply them rigorously and methodically, and given them the means to react rapidly when a risk of money laundering or terrorist financing is spotted. In this case, the role of the Compliance Officer, to whom all suspicions must first be reported, is essential.

When a new business relationship is entered into, each professional must carry out its own risk assessment. The assessment must be completed meticulously.

The risk-based approach is at the heart of the legislation on the prevention of money laundering and the financing of terrorism. Applied by professionals it must allow the, to prioritise the risks inherent in their own activities and the characteristics of the clientele so that they may more clearly identify the AML/CTF risks to which their activity is exposed.

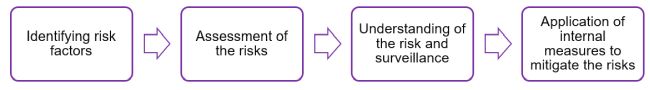

The risk-based approch must comply with and contain the various points stated below:

This assessment particularly takes into account the various high-risk factors presented in Annex IV Law (high-risk geographic zones, countries on which sanctions are imposed, PEP clients, high-risk professions ...)

Teh Registration Duties, Estates and VAT Authority (Administration de l'enregistrement, des domaines et de la TVA or "AED"), as other supervisory authorities, publishes the national assement of risks (évaluation nationale des risques or "ENR") estalished by the authorities of our country, while the European Commission publishes a supranational assessment of risks (the "SNR") at the European level. Both of these documents must be taken into consideration by all professionals when performing their risk assessments.

Following the risk assessment, a ranking according to which the risk profile of the client (for example, low risk, medium risk, high risk or any other internal risk ranking system chosen by the professional) must be effectuated. This ranking allows the application of the adequate degree of the duty of care or vigilance for each client.

It is important to note that the risk assessment must be adapted to the professional's activity and must remain proportionate to the nature and size of the business as well as to the client's profile and the significance of the transaction.

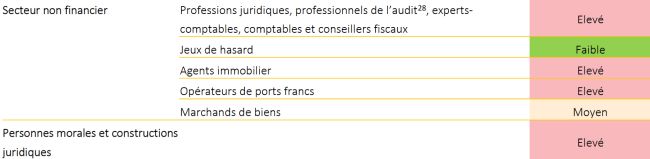

Here, the analysis of the risks made at the national level, the ENR, for 2020 shows that the professions of the non-financial sectors are exposed to significant money laundering and terrorism financing risks:

RESUME DE L'EVALUATION NATIONALE DES RISQUES DE BLANCHIMENT DE CAPITAUX ET DE FINANCEMENT DU TERRORISME 2020 publié par le ministère de la Justice, https://mj.gouvernement.lu/dam-assets/dossiers/blanchiment/ENR-2020-resume-en-francais.pdf

(3) Finally, each non-financial sector professional has the obligation to fully cooperate with the authorities. This cooperation results in an obligation to transmit information to the authorities upon their request, make spontaneous declarations of suspicion, abstain from implementing a transaction in case of suspicion, not disclose to clients or third parties that a declaration has been made.

Each professional must collaborate with its supervisory authority (which in most cases will be the AED for the non-financial sector) and with the financial intelligence unit (cellule de renseignement financier or "CRF"). The CRF receives and analyses suspicious transaction declarations, as well as any other information concerning facts which could indicate money laundering, the associated underlying infractions or terrorism financing.

Should that occur, a professional thus has the obligation to make a spontaneous declaration of suspicion (DOS). A DOS should be contemplated when, after careful examination of a suspicious transaction, the latter turns out to be likely linked to money laundering or terrorism financing. The reasons for that are various and could stem from the circumstances around the transaction, its nature or character, the client's activity, the origin of the funds or the capacity of the persons involved.

The professional should take into account various signs. When the transaction has no link to the client and/or its professional activity, or the economic purpose is not clear from the transaction, or the invoices presented show no services rendered, a real estate asset is undervalued or overvalued, or the conceals the true origin of the funds, the client is located in a black-listed State, la professional should be attentive and take the measures necessary to fully understand the situation and assess the risk of money launder and terrorism financing.

When these signs appear, a professional must request further information on the reasons for the transaction and the origin of the funds and document them. If the doubts continue, the professional must inform the CRF. The professional must them submit a DOS vía the goAML interface, and not reveal the submission to the client or any other person (no tipping off).

By virtue of its powers, the AED regularly carries out on-site inspections on the premises of professionals falling under its competence. It may also require the transmittal to it of all the documents it wishes to carry out its investigations. In this case, a professional must provide without delay to the authority all requested documents.

Finally, in case of non-compliance with professional obligations, a professional risks administrative and disciplinary sanctions including a fine of a maximum of one million euros. A decision to sanction taken by the authority is subject to appeal before the Administrative Tribunal, and the appeal must be filed within one month from the notification of the decision.

Additionally, should the Prosecutor's Office become aware of professional obligation violations, it may decide to initiate a criminal investigation. In that case, a professional risks a significant fine if it is found guilty (fine ranging from EUR 12.500 to EUR 5.000.000).

It should be noted that, if a professional subject to the Law knowingly participates in a money laundering or terrorism financing transaction, it risks the sanctions provided by the Criminal Code for those two serious infractions, prison (emprisonment of three to five years) and a fine of EUR 1.250 to EUR 1.250.000.

In light of the developments set forth above, a professional would be wise to take its AML/CTF obligations very seriously, beginning with the careful verification of its entire internal mechanism for prevention and in particular its internal AML/CTF procedure.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]