- within Law Department Performance, Consumer Protection and Wealth Management topic(s)

- with readers working within the Retail & Leisure industries

Mozambique's new Mining Law (Law No. 20/2014 of 18 August) introduces changes largely aimed at re-balancing the terms under which mining activities are conducted in favour of Mozambique and Mozambicans, following the trend started by the so-called "Mega Projects Law" (Law No. 15/2011 of 10 August 2011)

Prior to the entry into force of the New Mining Law, the performance of mining activities in Mozambique was governed by Law No. 14/2002 of 26 June 2002 (the "2002 Mining Law").

Since the 2002 Mining Law was enacted, Mozambique experienced unprecedented growth in its mining sector mainly thanks to the discovery of enormous coal reserves in the Tete basin in approximately 2005. Mozambique's coal reserves are among the largest undeveloped coal reserves in the world. International mining companies such as Vale and Coal India are in the process of developing world scale thermal and coking coal mines which could allow Mozambique to export between 20-50 million tonnes of coal per annum. However, the development of these coal reserves presents significant challenges, particularly due to the lack of infrastructure in the country. The US$3 billion write down and subsequent sale by Rio Tinto of its Benga mine is a clear example of how these challenges can adversely affect even the largest and most experienced mining companies.

Nevertheless, the country's huge coal export potential has led the Government of Mozambique to re-evaluate the regime applicable to mining operations. Consistent with the approach taken under the Mega Projects Law and the new Petroleum Law1, the Government has sought, through the new Mining Law, to make the regime overall more favourable to Mozambique and Mozambicans. The new Mining Law repeals the 2002 Mining Law and any other pre existing inconsistent legislation. Implementing regulations are to be approved within 90 days of the new Mining Law taking effect. Mining rights granted under the 2002 Mining Law remain in force. Holders of mining rights are entitled to choose to submit their mining titles to the new legal regime within one year from the date of the new Mining Law taking effect.

The new Mining Law does not affect the tax and fiscal incentives regime applicable to mining operations. This has been reformed by a new Mining Tax Law (Law No. 28/2014 of 23 September 2014) which will come into force on 1 January 2015. The new Mining Law introduces changes that focus on the following three issues:

- promoting local development and participation in the mining sector;

- imposing more stringent requirements on undertakings involved in mining operations; and

- expanding the scope of activities regulated under Mozambican mining legislation.

Increasing Local Development and Participation in the Mining Sector

The main focus of the new Mining Law is increasing local participation in mining operations, both in the public and private sector. Many of the requirements imposed under the new Mining Law reflect the requirements recently introduced in the oil and gas sector, which was reformed at the same time. As in the oil and gas sector, some of the more controversial requirements imposed by the new Mining Law did not appear in early drafts of the law but rather were introduced late in the legislative process.

Local Content Obligations

The new Mining Law sets out local content requirements for the procurement of goods and services for mining activities which are designed to promote the development of Mozambican businesses and know-how. These include a requirement for foreign persons to associate themselves with Mozambican persons to supply goods and/or services to the mining sector in Mozambique (Article 53(2)) and for operators in the mining sector to give preference to Mozambican goods and services to the extent that they are of comparable quality and available in the timeframes and quantities required Art 22(4)). Early drafts of the law made this requirement subject to the price of Mozambican goods and services not exceeding 10% of comparable imported goods or services. Its deletion in the new Mining Law could be problematic for operators as it seems they would be required to choose Mozambican goods and services over imported ones even if they are significantly more expensive. As concerns the development of local know-how, operators in the mining sector are required to provide employment and technical training for Mozambican nationals, with a preference for the population residing in the immediate vicinity of the concession area (see Art 33(2) and Art 36(c)). The new Mining Law does not, however, provide any detail of how many Mozambican workers are required to be trained and employed to discharge these obligations. It is unclear whether and to what extent the new Mining Law imposes more stringent obligations than those currently in force under Mozambique's labour laws (which include a quota regime for the employment of local and foreign workers). However, this regime follows the legislative trend in the oil and gas sector as evidenced by similar reforms in the new Petroleum Law (Law No. 21/2014 of 18 August 2014).

IPO

Another similarity to the regime recently introduced in the oil and gas sector is the requirement that all holders of mining concessions be listed on the Mozambican Stock Exchange. This was one of the requirements introduced shortly before the law was passed. The law does not provide any further details of the timeframes for the listing or how much of the share capital is to be listed. This will need to be understood more fully by investors so they can take it into account in structuring their investments. For instance, investors looking to develop projects on a project finance basis will need to understand the impact of this requirement on the share security and completion support available to lenders. While there is precedent in other jurisdictions on how to address similar issues, it is not clear whether such precedent solutions would be permitted in Mozambique.

Minerals Processing in Mozambique

The new Mining Law requires that, if economically viable, any processing activities relating to minerals produced in Mozambique must be undertaken in Mozambique (Art. 57). This was not a requirement in early drafts of the law. Early drafts contemplated an incentive-based mechanism to encourage foreign investors to process minerals in Mozambique.

It is unclear how this requirement is intended to operate and whether this would constitute an absolute prohibition on the export of unprocessed minerals of the type seen in other jurisdictions such as Indonesia. This may be clarified in the implementing regulations. However, we would expect this to cause significant concerns for investors, particularly for mining companies who are not in the business of processing and treating minerals.

Holders of Mining Titles

The new Mining Law also provides that rights to undertake any mining activities ("mining titles") can only be granted to Mozambican natural or legal persons (although legal persons can be foreign owned). Previously foreign incorporated companies could hold exploration licences.

More Stringent Requirements on Mining Operators

The unprecedented investor attention that Mozambique has been receiving in recent years has increased the Mozambican State's leverage over investors into the country's mining sector. The Mozambican State has sought to use this leverage to impose more stringent requirements on mining operators and increase its control over mining operations.

More Stringent Obligations

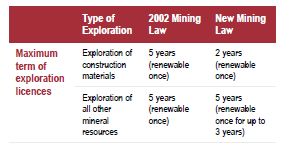

Under the new Mining Law operators are given shorter timeframes in which to conduct exploration activities, an example of which is in relation to the maximum term of exploration licences (as detailed in the table below).

Significantly more stringent timeframes also apply to the commencement of mining activities once a discovery has been made. The consequence of failing to meet these timeframes is also more draconian as it can entitle the State to revoke the applicable mining title.

Consistent with the approach taken in other recent Mozambican law reforms (such as under the new Petroleum Law), the new Mining Law imposes more stringent environmental requirements. Mining operators are required to submit a decommissioning plan for approval by Mozambican authorities and to provide financial guarantees to cover decommissioning costs (Art 71). The new Mining Law does not specify when such a guarantee would need to be provided. This may be covered in the implementing regulations.

The environmental compliance requirements applicable to mining activities have also been restructured with the new Mining Law imposing different requirements on operators depending on the type of mining title they hold rather than the environmental impact of each project (as was the case under the 2002 Mining Law (Art 69)).

The new Mining Law also imposes significantly more stringent obligations on any operators requiring to resettle people within an area affected by mining operations, including with respect to the compensation payable to people affected by resettlement (see Arts 29-32).

Increased State Control

The new Mining Law reinforces the Mozambican State's control over the country's mineral resources. For instance, it introduces a right for the State to require mining operators to sell mineral products to Mozambique to the extent necessary for use in Mozambican industry (Art 21). Greater Mozambican State control is also exercised over transfers of interests in mining titles. The 2002 Mining Law only required the Government's consent for transfers of interests by the title holder and not in the case of transfers of shares in the title holder. The new Mining Law now clearly states that any transfer of a direct or indirect stake in the title holder also requires the Government's prior consent (Art 62(2)). This would appear to be the case irrespective of the amount of shareholding interest transferred. In the context of a project financing, the lenders may wish to have the Government agree in a direct agreement to certain objective criteria relating to the identity of a transferee which, if satisfied, would constitute consent of the Government.

Compliance with the requirements of Mozambican mining law is more strictly policed under the new Mining Law as it specifically contemplates criminal liability for breaches of mining laws (such as conducting exploration, production, processing or marketing of mineral resources without the necessary authorisations).

The circumstances of mining titleholder default in which the Mozambican State has the right to revoke a mining title are also more extensive. For instance, under the new Mining Law the State is entitled to revoke a mining title if the holder of the mining title is indebted to the State (Art 64(1)(e)).

Less Extensive Investment Protection

The investment protection regime applicable under the 2002 Mining Law was, in some respects, more beneficial than the general investment protection regime available to investors in other sectors. For instance, the 2002 Mining Law included undertakings by the Mozambican State not to change the tax regime applicable to a mining title holder and to indemnify mining title holders from adverse financial consequences resulting from changes in mining legislation.

These additional investment protections have been removed under the new Mining Law. In fact, the investment protection regime applicable to the mining sector is now less extensive than that generally applicable to other sectors under Mozambican law.

The types of investment subject to investment protection only cover cash investments to the extent such cash is applied in payment of development costs. Cash investment per se (e.g., subscription of share capital) does not appear to constitute foreign investment for the purposes of investment protection under the new Mining Law.

Broader Scope of Regulated Activities

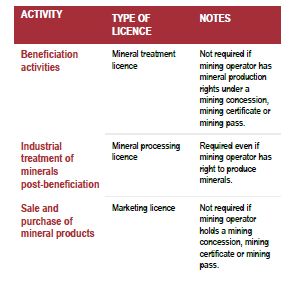

The scope of application of the new Mining Law is broader than that of its predecessor as it also regulates the beneficiation, processing and sale and purchase of mineral resources on a stand-alone basis within Mozambique.

The regulations implements the new Mining Law should provide additional details of the terms of these new licenses.

Conclusion

The new Mining Law follows the trend set by other recent Mozambican legislation (such as the Mega Projects Law and the new Petroleum Law) pursuant to which the Government of Mozambique is seeking to make the terms under which mining activities are conducted more beneficial to Mozambique and Mozambicans. However, while the new Mining Law does impose some potentially onerous new requirements which may be controversial for investors (such as concerns the IPO requirement and the requirement that all mineral processing be undertaken in Mozambique), it is not a radical overhaul of the Mozambican mining regime. In particular, it does not affect the tax and fiscal incentives regime applicable to mining operations which has been reformed separately pursuant to a new Mining Tax Law which will come into force on 1 January 2015. Instead, it is mostly focused on reforming the way in which mining operators conduct their activities. These reforms are aimed both at requiring greater Mozambican participation in the mining sector and at imposing more stringent requirements on mining operators.

Footnotes

1 You may wish to refer to "Mozambique's New Petroleum Legislation – Are investors ready to hit the gas?", our recent publication on the impact of the new Petroleum Law and Petroleum Tax Law on foreign investors. Please feel free to contact any of the above or your regular Shearman & Sterling contact for additional information.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]