- 85% of fund managers expect greater use of IFCs for investment vehicles

- Biggest drivers are local skills gaps, potential tax increases resulting from Covid-19 and the impact of Brexit

- BVI, Barbados and the Cayman Islands are expected to attract the most capital from AIMs in the coming five years

An overwhelming majority (85%) of alternative fund managers expect to see increased demand for investment vehicles to be based in international financial centres (IFCs) over the coming three to five years, our global study of 100 senior-level alternative investment managers revealed. This will be driven by a skills gap and potential tax increases in their local jurisdictions to combat the impact of Covid-19.

On a regional basis, Asia-based fund managers are the most bullish about the use of IFCs for funds and other investment vehicles with 96% anticipating this, ahead of North America and Africa (both 92%), considerably ahead of Europe, which saw only 60% of investors expect to see an increase.

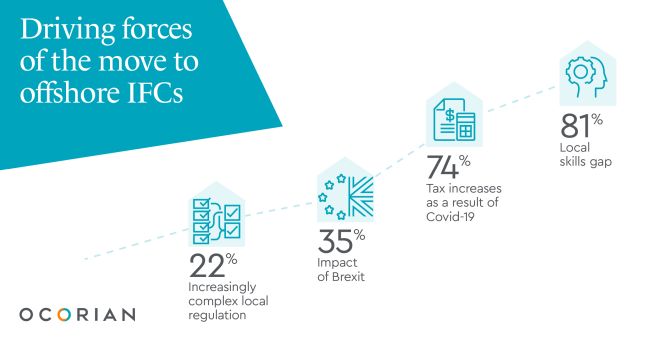

Local skills shortages in their existing jurisdictions were cited by 81% of respondents as the biggest driver behind the growing popularity of IFCs, closely followed by likely tax increases resulting from the economic impact of Covid-19 (74%). The impact of Brexit (35%) and increasingly complex local regulation (22%) are likely to have much less influence on their choice of IFCs.

The study highlights how investor preference is playing a crucial role in encouraging fund managers to redomicile their funds to an IFC, with 71% of respondents citing this factor, ahead of attractive structuring and distribution options (53% and 49% respectively).

According to the study, the three IFCs expected to attract the largest amount of new capital into their tax efficient structures in the coming three to five years are the British Virgin Islands, Barbados and the Cayman Islands, followed by Bahrain, Dublin and Curacao in fourth and joint fifth places respectively.

Table One: The 10 international financial centres expected to attract the most new capital over the next three to five years

|

International Financial Centre |

Percentage of investors who believe it will attract the most new capital over the coming five years |

|

British Virgin Islands |

34% |

|

Barbados |

30% |

|

Cayman Islands |

25% |

|

Bahrain |

24% |

|

Dublin |

23% |

|

Curacao |

23% |

|

Hong Kong |

22% |

|

Bermuda |

21% |

|

Guernsey |

20% |

|

Cyprus |

15% |

Simon Burgess, Head of Alternative Investments said: "International financial centres are already the preferred location for many alternative fund managers but there is every sign that the relationship will become even closer in the years to come as qualities including access to talent and competitive tax rates prove even more compelling. Against a highly competitive fundraising climate it is little surprise that fund managers will switch to a new international domicile that is in keeping with investor preference, too.

"When moving to a different domicile, it is important to do your research and keep abreast of all the regulatory and tax changes. This can be a labour-intensive exercise, but this is where a fund services provider can help, offering on-the-ground expertise. However, careful due diligence of service providers is key, because some are struggling to keep up with changing regimes and are receiving record fines."

In anticipation of the increased focus on IFCs, three-quarters (72%) of respondents believe that outsourcing will play an even more central role in the coming years. All the fund managers surveyed currently outsource elements of their work to a third party, with accounting (41%), company secretarial support, regulatory reporting and loan agency (all 38%) being the most popular activities.

Bespoke fund solutions

With specialist teams in key international jurisdictions, we provide a full range of fund administration and associated fund services to give our clients clear visibility and confidence in the performance of their investments. Find out more about how we can support your fund operations by contacting Simon below or view our full range of fund services.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.