- within Corporate/Commercial Law topic(s)

- with readers working within the Banking & Credit and Technology industries

The Directive on Corporate Sustainability Due Diligence (the 'Directive') was published in the Official Journal of the European Union last Friday, 5 July. Therefore, the Directive will enter into force on 25 July, from which date the two-year period for transposition into the national law of the Member States will begin.

When transposing the Directive, Member States must refrain from introducing provisions that diverge in pejus from the due diligence requirements of the Directive; instead, Member States are allowed to adopt more stringent provisions (Art. 4).

As is well known, the Directive came at the end of a long tug-of-war between the EU institutions - the Commission, the Council, and the Parliament - mainly due to the opposition of some Member States, which resulted in a progressive weakening of the obligations and responsibilities deriving from the Directive approved just before the recent European elections.

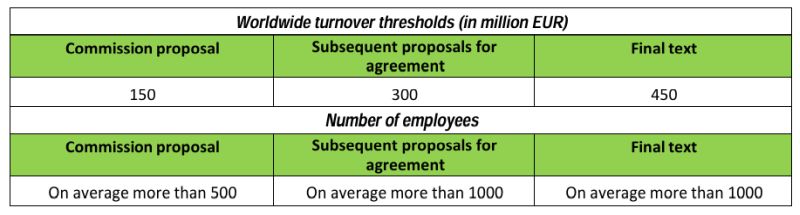

The following are some relevant differences between the initial proposal of the Directive and the final text published last week.

In-scope companies

The scope of application to 'in-scope' companies has been considerably reduced, as follows:

The aforementioned thresholds apply not only to individual companies, but also at the consolidated group level, i.e. where the company is the ultimate parent company of a group that reached those thresholds in the last financial year for which consolidated annual financial statements have been or should have been adopted (Art. 2, para. 1, lett. b).

Compared to the initial proposal, companies that entered into franchise or licensing agreements in the Union with independent third-party companies, with a value of more than EUR 22.5 million (with respect to the last annual budget) and which ensure a common identity, a common business concept and the application of uniform business methods, and provided that they are part of a group with a worldwide net turnover of more than EUR 80 million (Art. 2, para. 1, lett. c).

Similar requirements also apply with respect to companies not established in a Member State, except that (a) the reference turnover corresponds to that achieved within the Union and (b) the requirement of the number of employees does not apply (Art. 2 para. 2).

Compared to the initial proposal, there are also four very important differences in the Directive published on Friday:

(i) at least for the time being, companies in the finance sector have been excluded from the due diligence obligations of the Directive, to which the obligations for climate transition plan still apply;

(ii) the special provisions that made the Directive applicable to companies operating in 'high risk' sectors, where the turnover thresholds were lowered to EUR 40 million and the number of employees to 250, including, inter alia, the sectors of (a) textiles, (b) mining and processing of mineral resources, and (c) agricultural and livestock products, were removed;

(iii) the notion of 'value chain' in the initial proposal has been replaced by that of 'chain of activities'. Thus, the scope of due diligence obligations has been limited, for the downstream part of the business chain, to direct business relations only;

(iv) product disposal activities were excluded from the scope of the due diligence obligations (recital 25).

As a result of the changes introduced and the reduced scope of the Directive, it is estimated that the number of in-scope companies now amounts to approximately 5.300.

However, the Directive will also have an important effect with respect to companies that are not considered in-scope, which may still be impacted by the Directive as contractors or subcontractors of in-scope companies.

In particular, on this point, the Directive provides for a series of accompanying measures aimed at facilitating also financially small and medium-sized enterprises (SMEs) that are 'business partners' of in-scope companies (Art. 10 para. 2, lett. e) and Art. 20).

In addition, since the Directive will necessarily have an impact on contracts between in-scope companies and their business partners, the European Commission is expected to adopt guidelines on voluntary standard contractual clauses by 26 January 2027.

Subject of the Directive

As is well known, the Directive states:

(i) an obligation for companies to identify and assess (in addition to the proposal) the actual and potential negative impacts caused (a) by their own business and that of their related companies, and (b) if related to their own business chain, by the business of their business partners (Art. 8). In this sense, companies are obliged to perform risk-based due diligence (Art. 5) aimed precisely at identifying and mitigating such risks ("due diligence obligations"), the non-fulfilment of which could give rise to administrative and civil liability. Due diligence obligations consist of: (i) a phase of identification and assessment identification and assessment of actual negative impacts (Art. 8), (ii) a phase of prioritisation of the identified actual and potential negative impacts (Art. 9) (iii) a phase of prevention of potential negative impacts (Art. 10) and (iv) a phase of mitigation and halting of actual negative impacts (Art. 11);

(ii) obligations for in-scope companies to adopt and implement a transition plan for climate change mitigation by adapting business strategies with the transition to a sustainable economy, as far as possible in line with the Paris Agreement's goal of limiting global warming to 1.5 °C ("obligation to prepare and implement climate transition plans") (Art. 22).

Liability regime

The monitoring of compliance with the obligations laid down by the Directive will be entrusted to a supervisory authority duly designated by each Member State (Art. 24), which will be given the power to order the cessation of violations, as well as to impose sanctions, including pecuniary sanctions with a maximum limit of not less than 5% of the worldwide net turnover of the company in the financial year preceding the decision imposing the pecuniary sanction (Art. 27).

Furthermore, the Directive introduces a specific civil liability in the event of a breach of the obligations to prevent, reduce, minimise and/or stop the 'negative impacts' of business activity. The minimum limitation period for taking legal action to enforce this liability must be at least five years (Art. 29).

Entry into force - Progressive application

The application of the obligations of the Directive will be gradual (Art. 37), with deadlines calculated from its entry into force, as follows:

(i) 3 years, for companies with more than 5.000 employees and a turnover of more than EUR 1.500 million;

(ii) 4 years, for companies with more than 3.000 employees and a turnover of more than EUR 900 million;

(iii) 5 years, for companies with more than 1.000 employees and a turnover of more than EUR 450 million.

Consistent with Art. 2 of the Directive, the same turnover requirements apply to non-EU resident companies, whereas the requirements on the number of employees do not apply.

With the publication of CS3D and the imminent implementation of CSRD (whose transposition in Italy will be delayed until September), the framework of European sustainability legislation is more clearly defined, which poses significant operational and cultural challenges for companies operating within the EU.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.