- with Finance and Tax Executives

- in Turkey

- with readers working within the Banking & Credit industries

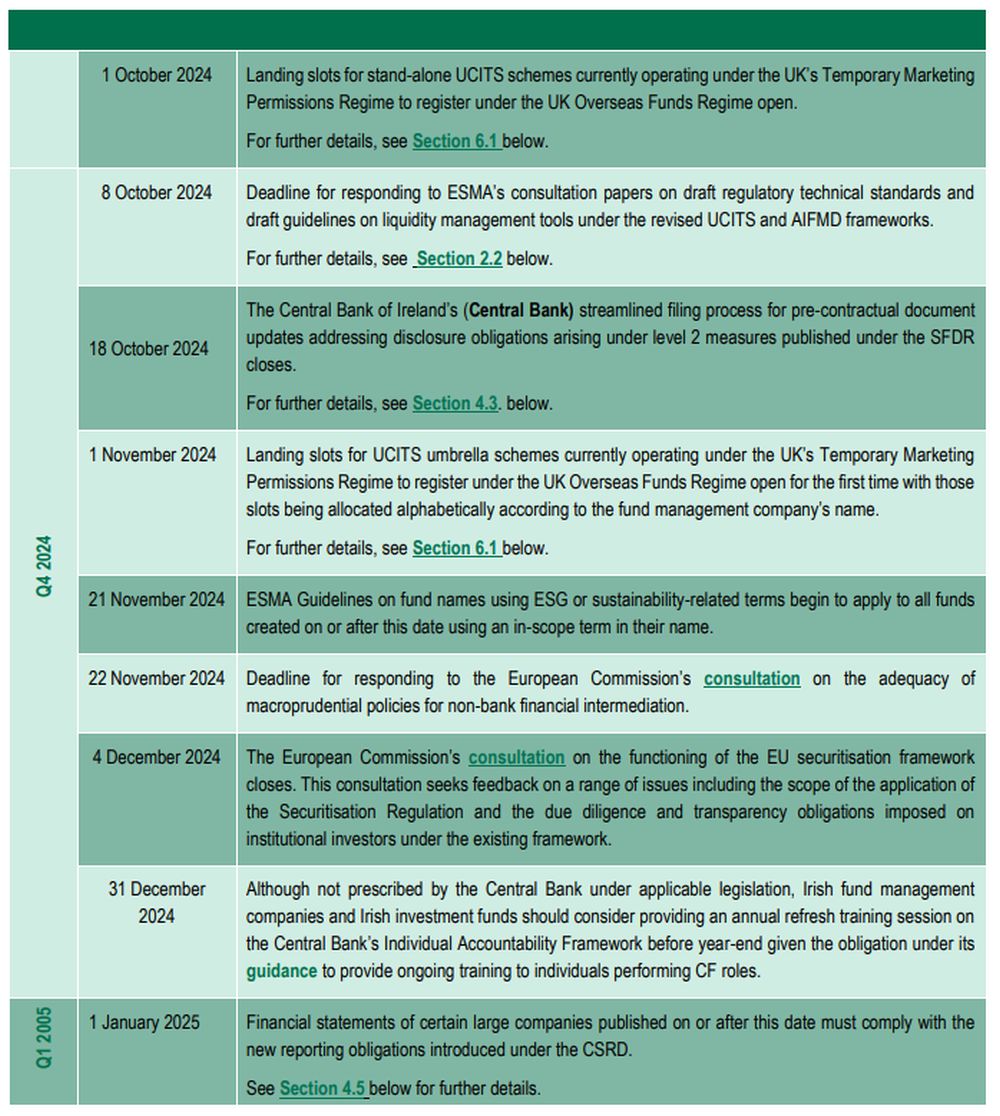

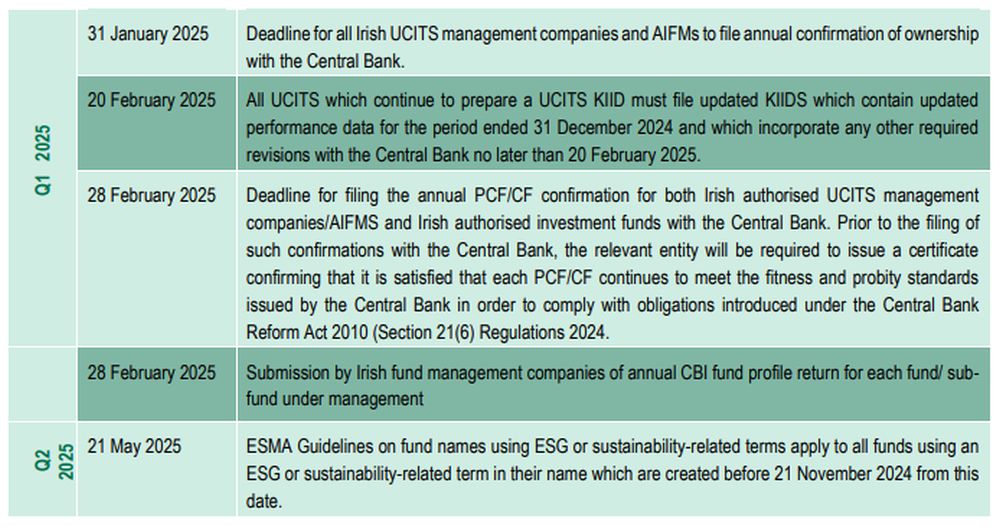

1. APPROACHING DEADLINES 12

2. UCITS & AIFMD

2.1 ESMA consults on rules governing the use of liquidity management tools by fund management companies

Directive (EU) 2024/927 (Omnibus Directive) introduces a number of changes to both the AIFMD and UCITS directives, including an obligation on UCITS management companies and those AIFMs managing open-ended AIFs to provide for the ability to use at least two liquidity management tools (LMTs) in the documentation of the relevant fund which must be drawn from a specific list of LMTs detailed in the Omnibus Directive.

The Omnibus Directive entered into force on 16 April of this year and must be transposed into Irish law by 16 April 2026.

Under the Omnibus Directive, ESMA is tasked with preparing the regulatory technical standards (RTS) which specify the characteristics of each of the LMTs listed in the Omnibus Directive.

It is also tasked with drafting guidelines on the selection and calibration of such LMTs by UCITS management companies and in-scope AIFMs.

On 8 July 2024, ESMA published two consultation papers on the use of LMTs by in-scope fund management companies.

The first of the consultation papers contains its draft RTS specifying the characteristics of each of the LMT listed in the Omnibus Directive under which it sets down proposed constituting elements of each LMT, such as calculation methodologies and activation mechanisms.

The second consultation paper contains draft guidelines on how in-scope management companies should select and calibrate LMTs in light of their investment strategy, their liquidity profile and the redemption policy of the relevant fund.

Responses to the consultation papers must be submitted to ESMA by 8 October 2024.

ESMA must then deliver its finalised draft RTS and guidelines to the European Commission for its consideration by 16 April 2025.

A copy of the consultation papers are available here.

2.2 ESMA publishes new Q&A on UCITS and AIFMD

On 2 July 2024, ESMA published additional Q&A on the UCITS and AIFMD frameworks. These Q&A confirm as follows:

- The six-month derogation period under which recently authorised UCITS can derogate from the risk-spreading rules set down under the UCITS framework runs from the date of authorisation of the UCITS rather than from its date of launch;

- Internally managed AIFs and self-managed UCITS funds must ensure that initial capital and additional own funds should not be included in the fund's net asset value and appropriate procedures and systems must be maintained to ensure compliance with the own funds requirements set down in the UCITS and AIFMD frameworks;

- where an AIFM establishes a branch in another Member State solely to carry out functions other than risk management or portfolio management, a notification to its home NCA under Article 33(1)(a), Article 33(2) or Article 33(3) is not required. However ESMA notes that it may be required to provide information to its home NCA under other AIFMD provisions.

All Q&A published by ESMA on the UCITS and AIFMD frameworks are accessible here.

3. CENTRAL BANK OF IRELAND

3.1 Independent review of Central Bank's Fitness & Probity Regime concludes

On 11 July 2024, the Central Bank published a report of the independent review of its Fitness & Probity (F&P) regime carried out by Andrea Enria (Review).

This Review was announced by the Central Bank following a judgment by the Irish Financial Services Appeals Tribunal in which it held that a decision by the Central Bank under its F&P process was flawed on account of an absence of fair procedures.

The Review concludes that the conduct of the F&P process at the Central Bank is broadly aligned with other peer jurisdictions across a number of dimensions. However, a number of areas were identified in which the operation of the F&P process was not always up to the requisite standards of fairness and transparency.

The recommendations put forward by Mr Enria in the Review have been accepted by the Governor of the Central Bank of Ireland who noted in his press release that the Central Bank will now look at the creation of a new unit to bring together F&P activities that are currently dispersed across the Central Bank.

Of relevance to Irish management companies and Irish-domiciled funds, the Review specifically includes a case study of the application of the F&P approval process in the case of funds and fund service providers and provides specific recommendations for the adaptation of the F&P interview process for the funds sector.

The following points are of particular interest:

- The Review recommends holding more F&P interviews in the funds sector as this would lead to a greater level of transparency and fairness in the process and de-stigmatise the interview process.

- The Review also notes that an increase in the number of interviews in the funds sector could also provide some form of F&P scrutiny on time commitments. The Central Bank should consider providing default interview criteria for those individuals holding multiple roles. The Review has suggested that this criteria should be applied if an individual attains 10 separate mandates or a lower number if families of funds are counted as a single mandate.

- The Central Bank should also consider conducting ongoing interview assessments (e.g. automatically interviewing every one hundredth application)

- Where the application relates to a fund/fund service provider with systemic impact and high assets under management, additional consideration could be given. The Central Bank should also consider engaging earlier in the due diligence process with a candidate who holds multiple roles

- Time limits should be applied by the Central Bank within which it will have processed all F&P applications to conclusion. Having considered other jurisdictions, this should be set at 90 days with "limited opportunities to stop the clock".

For a detailed analysis of the recommendations set down in the Review, please refer to our briefing on the topic which is available here.

A copy of the Review is accessible here.

A copy of the Central Bank's press release is available here.

3.2 Central Bank publishes Questions from Stakeholders on Individual Accountability Framework

On 1 July 2024, the Central Bank published an FAQ document in which it provides responses to questions raised by stakeholders on its Individual Accountability Framework (IAF).

While the FAQ relating to the SEAR framework will not be relevant to Irish fund management companies will not be relevant, those questions relating to the individual conduct standards may be of interest. These FAQ address:

- The application of conduct standards to those CF providing incoming services on a freedom of service basis.

- Guidance on the extent to which individuals in group entities are considered to exercise a significant influence on the conduct of a subsidiary or related firm's affairs.

- The delivery of training on the IAF in situations where the CF and/or PCF roles are outsourced.

A copy of the FAQ is accessible here.

4. SUSTAINABLE FINANCE

4.1 EMSA confirms application date of finalised guidelines on funds' names using ESG or sustainability-related terms and Central Bank of Ireland confirms applicable filing arrangements for related documentation

On 21 August 2024, ESMA confirmed the application date of its guidelines on funds names using ESG or sustainability-related terms (Guidelines).

The Guidelines require all funds using an ESG or sustainability-related term in their names (In-Scope Funds) to comply with two rules, namely:

- the application of an "80% threshold" rule; and

- compliance with the exclusion criteria applicable to either EU Paris-Aligned Benchmarks or EU Climate Transition Benchmarks.

Funds using the term "sustainable" or a derivative thereof must also "invest meaningfully" in sustainable investments within the meaning of the SFDR while In-Scope Funds using a transition-related term or impact-related term are also subject to additional requirements.

The criteria to be met by In-Scope Funds will depend on the specific term used in the fund name

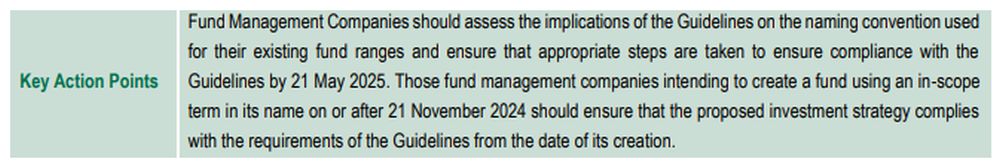

The Guidelines will apply to all funds using an ESG or sustainability-related term in their name which are created on or after 21 November 2024 with immediate effect.

All funds using an ESG or sustainability-related term in their name which are created before 21 November 2024 must comply with the Guidelines from 21 May 2025.

The Central Bank has separately confirmed that it will facilitate a streamlined filing process for the filing of fund documentation which are updated to comply with the Guidelines where such changes are limited to name changes only. Any other changes to the SFDR-related disclosures in fund documentation will be subject to review by the Central Bank under standard post-authorisation processes.

A copy of the Guidelines is available here.

A Dillon Eustace briefing providing a detailed analysis of the Guidelines is available here.

The Central Bank's Process Clarification Document is available here.

4.2 ESAs publish additional Q&A on the application of the SFDR

On 25 July 2024, the European Supervisory Authorities (ESAs) published a revised version of the Consolidated Questions and Answers (Q&A) on the SFDR and the SFDR Delegated Regulation.

The newly added Q&A provide additional guidance on a range of topics, including the following:

- The responsibility of the fund management company to determine whether an investment meets the test of a "sustainable investment" set down under Article 2(17) of the SFDR in situations (i) where a delegate investment manager has been appointed or (ii) the fund in question is a passively managed fund tracking an index.

- Whether investment in another fund can be categorised as a sustainable investment.

- The provision of a worked example demonstrating how the calculations of sustainable investment can be done either at economic activity level or investment level.

- The provision of a worked example demonstrating how to calculate the share of a sustainable investment that qualifies as environmentally sustainable under the EU Taxonomy, both for the purposes of the pre-contractual disclosures and the periodic report disclosures.

- The use of hedging or liquidity investments by funds falling within the scope of Article 9 of the SFDR.

- The categorisation of funds which do not passively track a Paris-aligned Benchmark or a Climate Transition Benchmark but which apply all of the requirements applicable to those categories of benchmarks set down in the Benchmarks Regulation framework3 .

- The responsibility of the fund management company to determine whether an investment meets the test of a "sustainable investment" set down under Article 2(17) of the SFDR in situations where a delegate investment manager has been appointed.

- Specific guidance on certain elements of PAI reporting at entity level under Article 4 of the SFDR.

A copy of the Q&A is available here.

4.3 Central Bank confirms closure of existing SFDR fast-track process

On 27 September 2024, the Central Bank confirmed that the streamlined filing process which it first established in 2022 for pre-contractual document updates addressing disclosure obligations arising under level 2 measures published under the SFDR will close on 18 October 2024.

Thereafter, any submissions related to must be submitted to the Central Bank in accordance with standard post-authorisation processes.

A copy of its communication is accessible here.

4.4 ESMA issues opinion on the functioning of the EU sustainable finance framework

On 24 July 2024, ESMA published an opinion on possible long-term improvements which it believes should be made to the EU sustainable finance framework in order to improve its usability and coherence (Opinion).

The recommendations set down in the Opinion focus on improvements needed to the EU sustainable finance framework as a whole, with ESMA noting that any such revisions to the framework must address existing complexities and simplify the existing framework.

Some of the key recommendations put forward by ESMA to the European Commission in the Opinion include:

- A product categorisation system should be introduced which caters to sustainability and transition, based on a set of clear eligibility criteria and binding transparency obligations for each category.

- The EU Taxonomy should become the sole, common reference point for the assessment of sustainability and should be embedded in all sustainable finance legislation (including the SFDR, the Benchmarks Regulation etc).

- The EU Taxonomy should be completed for all activities that can substantially contribute to environmental sustainability. In addition, an EU social taxonomy should be developed.

- The definition of "sustainable investment" under the SFDR should be phased out as this definition fails to ensure a consistent minimum sustainability ambition of financial products and hampers comparability between them. In the medium term (until the EU Taxonomy is completed), the key parameters of a "sustainable investment" under the SFDR should be made more prescriptive.

- A definition of transition investments should be incorporated into the framework to provide legal clarity and support the creation of transition-related products.

- The European Commission should also consider the creation of high-quality EU labels for transition bonds and sustainability-linked bonds, based on its experience with the EU Green Bond Standard.

- All financial products should disclose some minimum basic sustainability information which should consist of a "small number of simple sustainability KPIs" which could include for example GHG emissions, Taxonomy alignment and human rights and labour rights.

A copy of the Opinion is accessible here.

To view the full article, click here.

Footnotes

1. The “Approaching Deadlines” section does not include filing requirements in respect of any filing where the filing date is determined with reference to the relevant entity's annual accounting date (such as the filing of annual and semi-annual financial statements with the Central Bank) nor does it address any tax-related deadlines to which funds and fund management companies may be subject. Periodic reviews of matters such as the risk management framework, business plan and policies and procedures of fund management companies as well as any other actions required to be taken under the Irish Funds Corporate Governance Code are also excluded from the remit of this section as the dates for completion of same are determined by the relevant fund management company/fund rather than being set down in relevant legislation or guidance.

2. To the extent that they have not already done so, funds falling within the scope of Article 8 or Article 9 of the SFDR must file updated pre-contractual annexes contained in Commission Delegated Regulation 2023/363 which contain additional disclosure obligations relating to exposure to Taxonomy-aligned fossil gas and nuclear energy economic activities with the Central Bank “as soon as possible and at the earliest opportunity”.

3. Commission Delegated Regulation (EU) 2020/1818

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]