- within Corporate/Commercial Law topic(s)

- within Environment, Transport, Government and Public Sector topic(s)

I. Overview

Ireland's M&A market performed robustly and in line with the global trend.

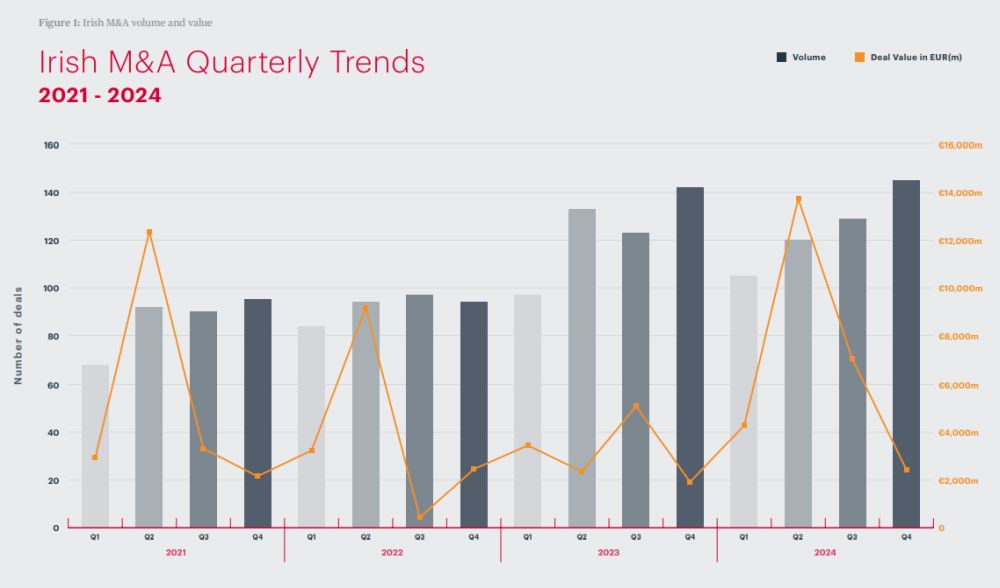

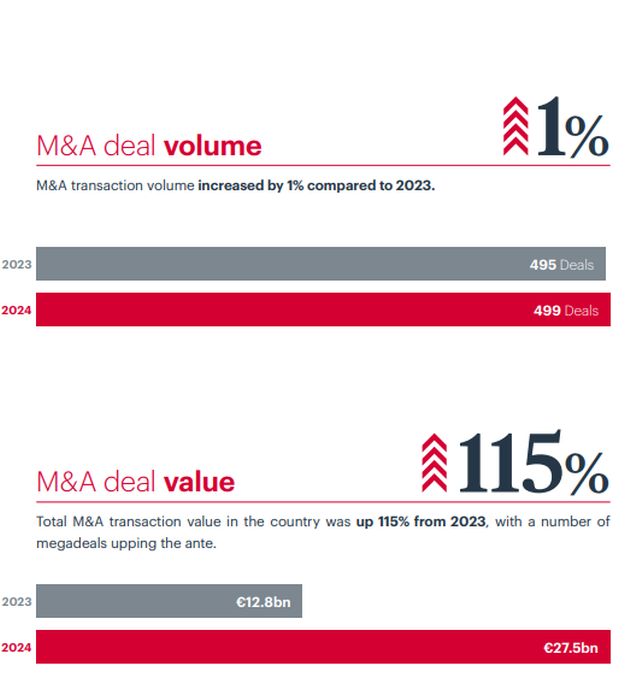

M&A activity in Ireland proved extremely resilient in 2024 – particularly in terms of value. There were 499 reported deals over the course of the year, a 1% increase compared to 2023. These transactions were collectively worth €27.5bn, a 115% rise compared to the previous 12 months, although this figure has been inflated by a handful of unusually large deals.

Ireland's M&A market performed robustly and in line with the global trend, despite a number of challenges which had the effect of extending deal timelines and impacting valuations for high-quality targets.

Geopolitical tensions continued to unnerve many dealmakers, with concern about the US's relationship with China as well as the implications arising from the conflict in the Middle East despite the recent ceasefire agreement in Gaza. Economic uncertainties also weighed heavily, with the International Monetary Fund (IMF) describing global growth as "stable but underwhelming", though falling inflation and interest rates in many markets are now giving rise to greater optimism.

Ireland itself also faced a degree of political uncertainty with a general election in November. However, the new government announced in January, which sees a coalition between Fianna Fáil, Fine Gael and some independents, will reassure dealmakers that Ireland continues to be a business-friendly environment.

Against this backdrop, dealmakers in Ireland, as elsewhere, continued to proceed with caution during 2024, though activity was broadly in line with long-term trends. As in previous years, for example, most Irish M&A activity took place in the mid-market.

However, 2024 saw a greater number of high value transactions. In particular, Apollo Global Management agreed a deal with Intel to take a 49% stake in its Ireland-based semiconductor firm Fab 34; a deal valued at €10.1bn.

II. Key Trends in Irish M&A

III. Deal Focus

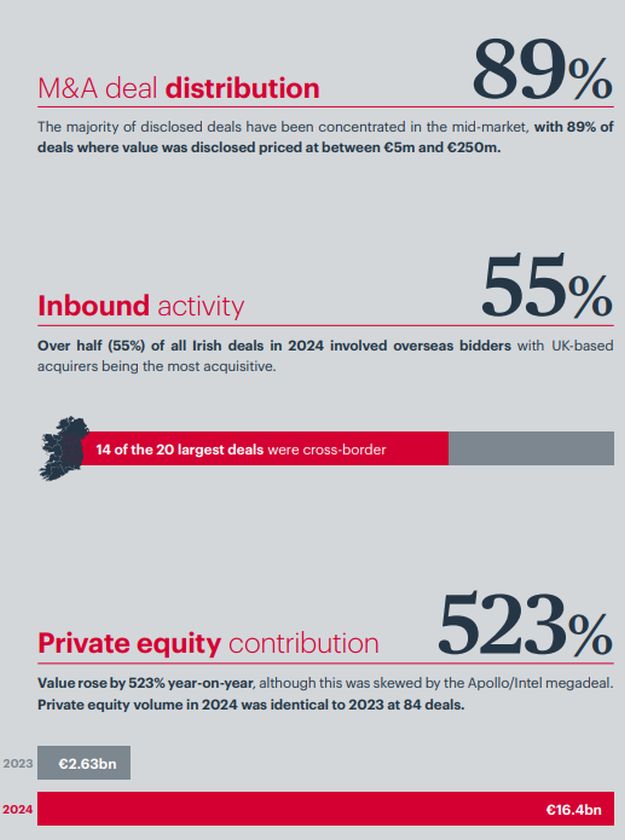

While Ireland saw 17 deals in 2024 valued at €250m or more, the majority of transactions where the value was publicly disclosed – some 89% – fell squarely into the mid-market category, worth between €5m and €250m.

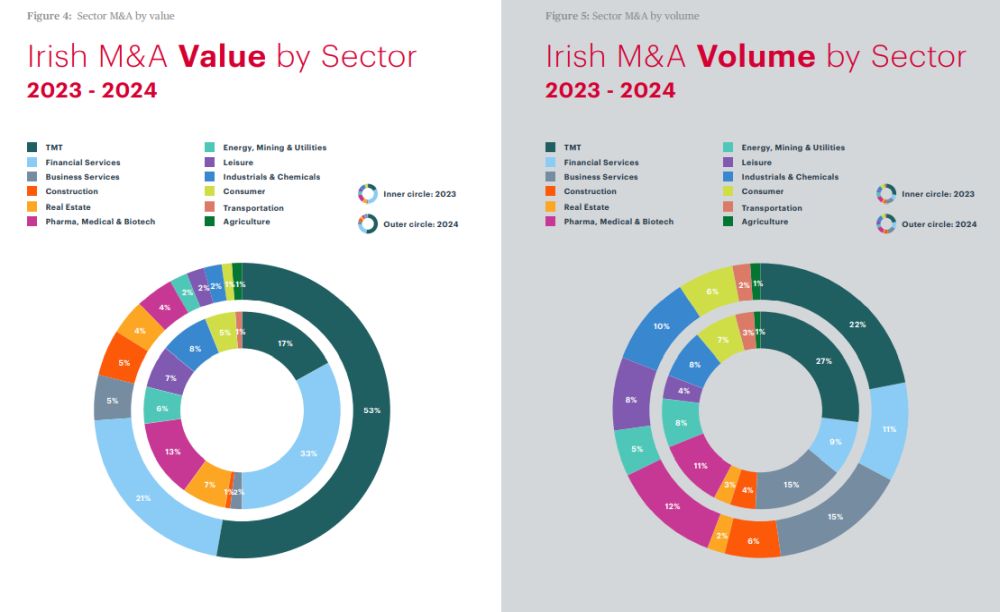

By sector, the technology, media and telecoms (TMT) industry was once again the busiest area of the Irish M&A market. However, while it accounted for 22% of all deals by volume – well ahead of the next most active sector, business services, on 15% – this share was down from 27% in 2023.

Moreover, although 53% of M&A by deal value took place in the TMT sector, this figure was heavily skewed by the Fab 34 transaction, which accounted for almost three-quarters of TMT deal value during 2024.

The Fab 34 transaction stood out as the largest M&A deal in Ireland in 2024.

Indeed, the Fab 34 transaction stood out as one of the largest M&A deal in Ireland for six years, with the private equity firm Apollo agreeing to pay Intel €10.1bn for a 49% stake in a joint venture related to the technology giant's manufacturing facility in Leixlip, Co. Kildare, Ireland. The facility is at the forefront of Intel's latest manufacturing process advances, with the company having invested around €17.5bn in the plant to date.

The second largest deal of the year, meanwhile, saw Avolon Holdings acquire Castlelake Aviation for €4.1bn1 . The deal underlines Ireland's importance in the global aircraft leasing sector. Avolon, along with AerCap and SMBC Aviation Capital, is one of three Irish aircraft leasing companies that dominate the market. The acquisition of Castlelake saw it attain assets worth €4.75bn, including 118 aircraft.

The third biggest deal of 2024 was another TMT transaction. A consortium of investors agreed to pay €2.5bn for Keyword Studios, a gaming company that has helped to develop games such as Fortnite and Call of Duty. The consortium included Swedish private equity firm EQT, Singapore's state-backed fund Temasek, and the Canadian pension fund CPP Investments.

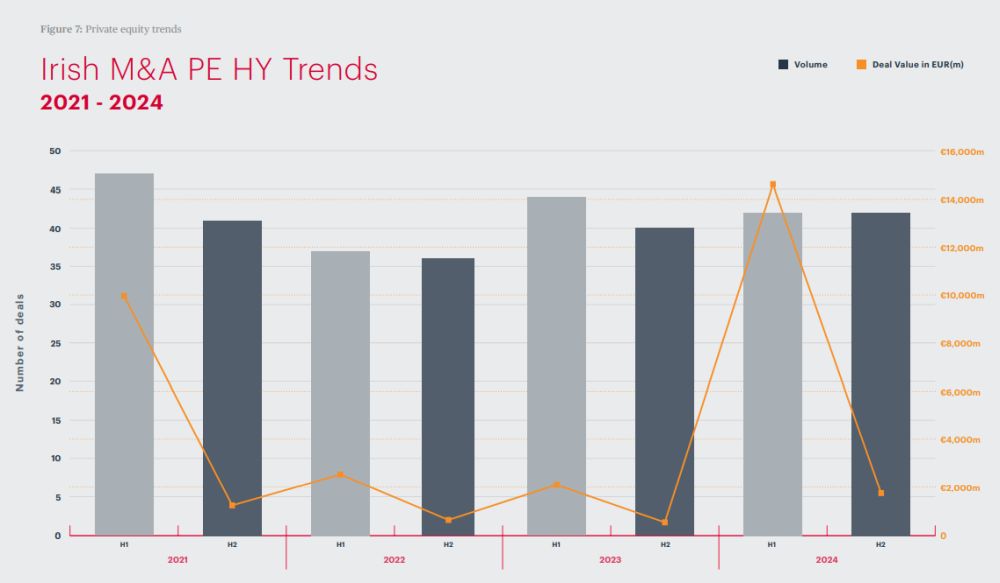

The size of the Fab 34 and Keyword transactions contributed to a 523% increase in the value of private equity activity in Ireland's deal market during 2024. Private equity investors were involved in €16.4bn worth of deals over the course of the year.

By volume, private equity investor activity in Ireland in 2024 mirrored the previous 12 months. Buyout firms were involved in 84 deals in both 2024 and 2023.

IV. Sector Watch

In value and volume terms, the TMT sector continues to lead performance in Ireland's M&A market. While it is important to be cautious about the TMT data – noting the outsized influence of the Fab 34 deal as well as the decline in the sector's share of total deal volumes – there is no doubt that investors and acquirers continue to take a keen interest in Irish businesses and TMTrelated infrastructure in this sector. Three of the five largest M&A transactions in Ireland during 2024 were in the TMT sector; overall, the sector saw 111 deals.

In practice, any slowing in TMT activity reflected global trends. In particular, a sell-off of US technology stocks in the late summer prompted some concern worldwide about elevated valuations in the sector. That gave investors pause for thought, though tech stocks subsequently bounced back – and TMT deals continued fairly robustly at a global level throughout the second half of the year.

In Ireland, meanwhile, the blockbuster deals at Fab 34 and Keyword Studios belied a more general trend towards M&A interest in areas of the technology sector geared towards the application of new tools in business and the broader economy. There is significant ongoing interest in Irish companies with intellectual property (IP) and skills in areas such as artificial intelligence (AI) and automation.

Three of the five largest M&A transactions in Ireland during 2024 were in the TMT sector.

Looking at other significant sectors in the market, it is the business-to-business area of the Irish economy that continues to generate strong M&A activity. By volume, the business services sector accounted for 15% of Irish dealmaking during 2024, sustaining its share at a consistent level with 2023. Business services transactions included the €791m stake acquisition of Echelon Data Centres by Starwood Capital Group Management, for example, as well as a host of smaller deals. Pharmaceuticals, medical and biotech (PMB), with a 12% share of the M&A market by volume, was once again the third busiest sector.

In deal value terms, financial services finished 2024 in second place to TMT, accounting for 21% of the total market. That reflected, in part, the €4.1bn deal for Castlelake Aviation, but there were also two large transactions at AIB, where the Irish government continues to sell down the stake in the bank that it acquired during the global financial crisis 15 years ago. After selling shares in two tranches – in deals worth €999m and €500m respectively in March and August – the Irish government's stake in AIB now stands at just over 18%, down from 71% at the beginning of 2022.

Elsewhere, business services was Ireland's third most active sector for M&A by value during 2024, accounting for 5% of transactions compared to only 2% in the previous year. That largely reflected the impact of two deals: the Echelon Data Centres buyout and the combination of advisory business Grant Thornton Ireland with its US counterpart.

By contrast, in the PMB sector, while volume remained relatively strong, by value, deals in the sector were down from 13% of the market to just 4%. It should be noted that the sector saw the second largest M&A transaction in Ireland in 2023, the Chiesi Farmaceutici's €1.3bn purchase of Amyrt Pharma. Last year, the biggest deal in the PMB sector – Macquarie Asset Management's acquisition of Beacon Hospital – was valued at €400m.

Spotlight on: Energy

While the energy, mining and utility (EMU) sector slipped year-on-year in terms of its market share of deal value and volume, the energy subsector has experienced a significant surge in high-profile deals, driven by the increased focus on sustainability. Of the top 20 deals in the energy sub-sector, 19 were focused on alternatives or renewable energy sources including solar, wind and battery energy storage systems.

The top two deals in renewables involved investments by UK-based Octopus Renewables Infrastructure Trust.

In February, the listed infrastructure fund acquired four newly constructed solar farms totalling 199MW, from Statkraft Ireland; and, in October, Octopus bought a Dublin-based solar farm from the same seller. The two deals for the five solar farms were valued at a total of €198m.

The third largest deal saw The Renewables Infrastructure Group sell its 100% stake in the Pallas onshore wind farm in Kerry to an undisclosed buyer for €62m.

In keeping with the renewables theme, another major cross-border deal saw Japanese multinational Sojitz purchase Irish electricity supply and residential solar company, Pinergy, for an undisclosed sum, from the UK's Coates family.

Due to its stable regulatory environment and regular renewable energy support scheme auctions, Ireland is a prime location for investors seeking stable returns from green energy-generating assets with dealmakers from Japan, Denmark, Portugal and the UK among others investing in Irish renewable projects in 2024. Europe remains fundamentally committed to meeting its climate change targets and this is reflected in Ireland's ambitious renewable energy generation targets.

While the country has several challenges to overcome in relation to planning, Ireland's ambitious renewable generation targets and its sizeable existing data centre industry has opened up the prospect of it becoming a leading provider of green energy data centres. A number of billion euro plus transactions are expected in the energy sub-sector in Ireland in 2025, with the sales of Dublin-based all-island energy company Energia Group and the Greenlink electricity interconnector to the UK already reported as being in the pipeline for this year.

Ireland is a prime location for investors seeking stable returns from green energy-generating assets.

V. Inbound Activity

70% of the largest 20 deals of the year in Ireland involved an international acquirer.

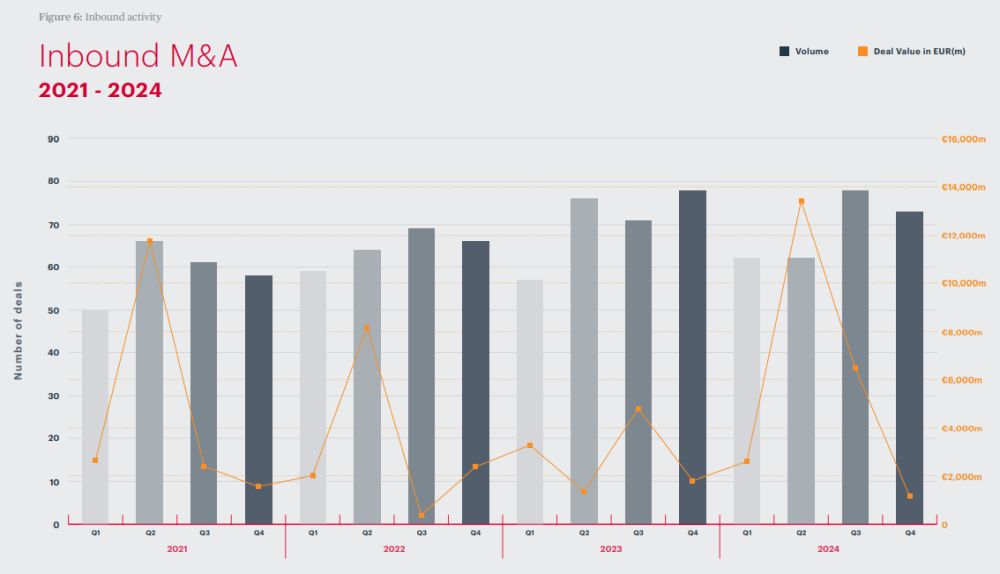

International buyers continue to look to Ireland for M&A opportunities. There were 275 inbound transactions worth a total of €23.6bn during 2024. In volume terms, that figure represented a 2% decrease on deals in 2023 but by value, inbound M&A was up 111%.

Just under three quarters, 70%, of the largest 20 deals of the year in Ireland (by value) involved an international acquirer, with buyers from the UK, US, China, Sweden, Turkey, Switzerland and Qatar featuring on the list.

Overall, UK and US buyers were the most active acquirers in Ireland, recording 101 and 64 transactions in 2024 respectively. US buyers led the way by deal value, with China in second place, although this statistic is driven by Avolon's acquisition of Castlelake Aviation2.

Looking towards inbound activity in 2025, dealmakers and businesses alike await with interest the extent to which Ireland's new rules on foreign direct investment (FDI) will have an impact on inbound M&A or on the shape of such deals. Ireland's FDI regime came into effect on 6 of January 2025, and gives the Minister for Enterprise, Trade and Employment powers to investigate, authorise, condition and even prohibit, foreign investment into Irish assets and businesses in certain sectors (including critical infrastructure, critical technologies or those with access to (or control of) sensitive information) based on a range of security and public order criteria. The rules require parties to a transaction to notify the Minister about a proposed FDI transaction falling within the relevant sectors if certain statutory thresholds are met.

On paper, the FDI regime is wide-ranging – the Minister has powers to call in FDI deals retrospectively. However, the practical impacts of the regulation will be determined by the appetite of the new government to exercise these new powers. Equally, while the regime does not expressly discriminate against any particular 'third country' – all foreign and foreign-controlled buyers are potentially affected – it is anticipated that dealmakers from certain countries will attract more attention on deals involving certain types of assets or infrastructure which are within scope.

Turning to domestic deals, there was an increase in the number of all-Irish transactions last year; the volume grew 5% to 224. The biggest domestic transaction of the year – worth €999m – was the largest of the two AIB plc stake sales by the Irish government. Other notable domestic deals included the acquisition of classified advertising company Distilled by Blacksheep Fund Management for a reported €500m.

VI. Private Equity

Some of the biggest names in global private equity completed crossborder transactions in Ireland last year.

Private equity investors continue to be a major presence in the Irish M&A market. There were 84 transactions involving private equity firms during 2024, the same number as in the previous year. In value terms, however, private equity investment in Irish companies surged 523% to €16.4bn – though more than €10bn of that total figure came from a single transaction, Apollo's deal with Intel in relation to the Fab 34 high-volume manufacturing facility, with the Keyword Studios transaction accounting for another €2.5bn given its significant levels of private equity involvement.

The bigger picture demonstrates that international private equity firms continue to see Ireland as an attractive market for dealmaking. While many firms globally struggled with the relatively slow pace of the deal cycle during 2024 – their inability to secure exits at full valuations inhibited their ability to raise new funds and to complete new deals – Ireland remains on the private equity sector's buy lists. Some of the biggest names in global private equity – including Apollo, Blackstone and Starwood – completed cross-border transactions in Ireland last year, along with state-backed funds such as Temasek Holdings and the Qatar Investment Authority.

Indeed, eight of the 20 largest M&A transactions last year involved a private equity investor in one form or another. The sector accounted for five buyouts and three exits. While many private equity firms have been proceeding cautiously over the past 12 months – perhaps taking longer to make final decisions about M&A processes – deals have continued to get done.

It should also be acknowledged that Ireland has its own active domestic private equity sector, with a number of Irish investors also completing transactions last year. One notable example is MML Growth Capital Partners, which sold the Kyte Powertech business to Switzerland's R&S Group. The deal for the industrial company saw MML exit at a reported €250m valuation after four years of ownership.

VII. Outlook

Pent-up demand for dealmaking may be released from both corporations and PE firms.

Dealmakers are cautiously optimistic about the outlook for M&A in 2025 – both in Ireland and internationally.

Certainly, there are reasons to be positive. The global economic picture is starting to look a little brighter, with central banks in North America and Europe now moving to ease monetary policy, reducing the cost of capital. The IMF sees growth accelerating in Europe in 2025 compared to 2024 – including a jump to 2.2% growth in Ireland from a 0.2% contraction this year – and has recently raised its forecast for the US too.

Political uncertainties have also begun to ease. While 2024 was the year of elections – with more than half the world's adult population eligible to vote – the political direction of travel in most countries is now clearer.

It is also possible that pent-up demand for dealmaking may be released from both corporations and private equity firms. The latter continues to hold record levels of undeployed capital that needs to be invested.

The counterargument is that the geopolitical environment is uncertain, particularly given President Trump's intention to reset US relations across the globe. The President's intentions on tariffs, for example, could have a dramatic effect on global trade and investment. Elsewhere, conflicts in Ukraine and the Middle East remain a concern.

However, given the stable political environment in Ireland, the potential in the renewables sector, the ongoing strength of the TMT market and consolidation in areas such as business services, there is the genuine optimism for a further uplift in Irish dealmaking in 2025.

Footnotes

1. Avolon Holdings is an Irish subsidiary of Bohai Leasing Company, a China-based leasing company focused on aircraft, ship, and other transportation. As the parent company is China-based, this has been noted as a cross-border deal for the purposes of this report.

2. Avolon Holdings is an Irish subsidiary of Bohai Leasing Company, a China-based leasing company focused on aircraft, ship, and other transportation. As the parent company is China-based, this has been noted as a cross-border deal for the purposes of this report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.