In our earlier alert dated 1 July 2017, a gist of all the notifications pertaining to CGST Act, 2017, CGST (Rate), IGST Act, 2017 and IGST (Rate) was provided. This alert discusses the additional provisions inserted in the rules which have been notified vide Notification No. 10/2017 and were not covered in the draft rules.

Furthermore, the GST has Notification No. 11/2017 dated 28 June 2017 notified the following:

- Chapter, Section or heading of the services;

- Corresponding description of service;

- Percentage applicable to such service; and

- Conditions (if any) applicable to a service

SKP's comments

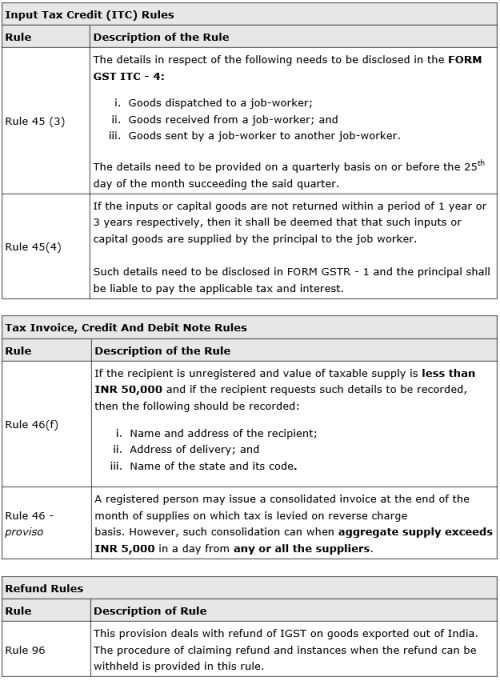

- The amendment in the GST rules has provided more clarity with regard to the ITC, tax invoice, debit notes, credit notes and refund mechanism.

- The industry should keep a track of the developments to avoid any non-compliance

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.