With GST being finally implemented, the government has brought into force certain notifications. A gist of the various notifications released by the Central Board of Excise and Customs (CBEC) is given below:

Notification No. 15/2017 dated 1 July 2017 - Amendments to the Central Goods and Services Tax (CGST) Rules, 2017

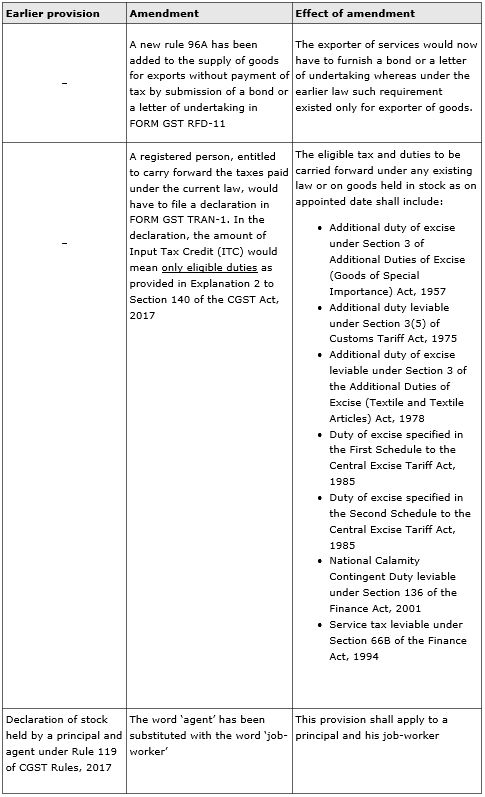

Following are the key amendments to the CGST Rules, 2017:

Other key GST-related amendments

Update with regard to the GST-SEZ exemption

The CBEC has released three notifications in order to provide clarification regarding the exemption on import of goods and/or services by Special Economic Zone (SEZ) unit. The final trail in regard to the same subject is given below:

SKP's comments

- The reduction in the rate of GST as applicable on fertilisers would prove to be a boon to the economically strained agricultural sector.

- The exemption of Education Cess and Secondary and Higher Education Cess from a levy on IGST in the case of imports is a welcome move.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.