- in United States

- within Tax, Employment and HR and Corporate/Commercial Law topic(s)

- with readers working within the Construction & Engineering industries

CBIC notifies revised regulations on finalisation of Provisional Assessment under the Customs Act 1962 Notification No. 55/2025- Customs (N.T.) dated 12th September 2025

The Central Board of Indirect Taxes and Customs [CBIC] has issued the Customs (Finalisation of Provisional Assessment) Regulations, 2025, replacing the earlier 2018 regulations, with effect from their publication in the Official Gazette. These Regulations govern the manner, time-limits, and compliance framework for finalisation of provisional assessment under section 18 of the Customs Act, 1962.

Provisional Assessment under section 18 of the Customs Act allows importers/exporters to clear goods when critical documents, test results, or additional enquiries are pending. The new 2025 Regulations streamline timelines, strengthens accountability of both trade and customs, and introduce stricter closure and penalty provisions.

Key features of the 2025 Regulations

1. Applicability [Regulation 3]

These regulations shall be applicable on all provisional assessments pending on the date of notification, and provisional assessments made after enforcement. Each Bill of Entry [Import] or Shipping Bill [Export] is treated as one distinct case of provisional assessment.

2. Timeline and manner for Furnishing Documents for the purpose of finalisation of provisional assessment [Regulation 4]

| Particulars | Description |

|---|---|

| Initial Requisition of Documents by the Proper Officer | The Proper Officer would be required to seek the missing documents or information within 15 days of the provisional assessment |

| Filing of documents by importers/ exporters | The importer/ exporter is required furnish the documents within 2 months of the requisition by the Proper Officer |

| Extension for filing the documents by the importer/ exporter |

|

| Finalisation of Provisional Assessment |

|

3. Timeline to conclude enquiry for the purpose of finalisation of the assessment [Regulation 5]

- Where enquiry is required (classification verification, valuation checks, technical tests etc.), the designated officer must complete it within 14 months of provisional assessment.

- Relevant reports and documents must then be forwarded to the proper officer for finalisation.

4. Timeline and manner of submission of documents or information for the purpose of finalisation of provisional assessment pending as on 29th March 2025 [Regulation 6]

Where the duty on imported or export goods has been provisionally assessed by the Proper Officer under sub-section (1) of Section 18 of the Act, and such assessment is pending finalisation as on 29th March, 2025, then, the time limit for submission of documents (under Regulation 4) or completion of enquiry (under Regulation 5), as applicable, shall be calculated from 29th March, 2025.

5. Voluntary payments pending finalisation [Regulation 7]

- Importers/exporters may pay additional duty amounts on their own ascertainment during pendency of provisional assessments.

- Such payments will be adjusted at the time of final assessment.

- However, interest liability under Section 18(3) continues to apply where short payments are established.

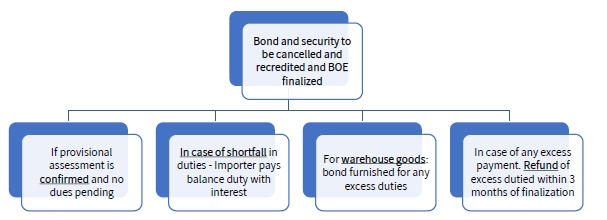

6. Finalisation of Provisional Assessment [Timeline and Manner] [Regulation 8 & 9]

| Timeframe |

Delays arising due to pending appeals, stay orders, court/tribunal directions, foreign authority inputs, or pending Settlement Commission applications will not count towards time-limit. |

| Manner of finalization |

|

7. Closure of Provisional Assessment [Regulation 10]

In case of non-payment for more than 90 days post-finalisation, dues (including interest/fine) can be enforced using security bonds or recovered under Section 142 of the Customs Act.

8. Penalty and Enforcement [Regulation 12]

Non-compliance, abetment, or failure to adhere to timelines can attract penalties under Section 158(2)(ii) [which extends up to Two Lakhs Rupees], apart from other actions under customs law. Customs Brokers and Authorised Representatives are directly accountable for any compliance lapses.

9. Comparative Insights of 2018 and 2025 Regulations

| Provision | 2018 Regulations | 2025 Regulations |

|---|---|---|

| Time limit to submit documents | No fixed 15 days requisition | 15 days requisition + 2 months filing, extendable within 14 months |

| Enquiry Window | No clear outer time limit | 14 Months mandatory |

| Finalisation | Discretionary, often delayed | 3 Months + 2 Year Cap (+1 Year by the Commissioner) |

| Voluntary payment of the duty | Not clearly specified | Explicitly permitted with interest adjustment |

| Closure and Bond release | General | Detailed cancellation/ recredit, 90 day recovery clause |

| Penalty | General Penalty Provisions | Explicit Penalty under Regulation 12 [Extendable to Two Lakhs under section 158(2)(ii) of the Customs Act] |

Aurtus comments:

The Customs (Finalisation of Provisional Assessment) Regulations, 2025 mark a significant procedural reform, as they establish for the first time a statutory outer time-limit for finalisation of provisional assessments. Protracted enquiries without closure timelines, a common grievance under the 2018 regime, are now addressed through the amendment. Historically, provisional assessments under Section 18 of the Customs Act remained open for prolonged periods, often stretching over a decade, due to extended investigations or pending departmental enquiries. The amendment is a response to the mounting pendency on finalization of provisional assessments, leading to revenue loss for the Government and also various judicial precedents, which have held finalization of provisional assessment [and raising of demands] beyond the time limit of 6 months and subsequently 2 months, as prescribed under para 3.1 of the Customs Manual Instructions and Rule 5 of the erstwhile 2018 Regulations, to be time barred [M/s Bihar Foundry & Castings Ltd. v. Union of India [2024 (3) TMI 371 -Jharkhand HC], which has been also upheld by the Hon'ble Supreme Court].

By requiring finalisation within two years (extendable by one additional year in exceptional circumstances), the framework decisively addresses a primary trade concern regarding the indefinite pendency of provisional assessments. This reform is expected to have wide-ranging implications across sectors, particularly in industries with high-volume imports claiming benefits under various schemes, where provisional assessments are regularly invoked, such as in matters of valuation or classification.

Implications for Special Valuation Branch (SVB) Cases

- Concentration of Pending Assessments: A substantial portion of unresolved provisional assessments stems from SVB investigations in related-party import transactions, where authorities examine the accuracy of declared values. Though there is a proposal to do away with the SVB process, the timelines now set should also help govern the new process that may be put in place of SVB.

- Chronic Pendency Resolved: In many instances, Bills of Entry have remained provisional for years, pending SVB determinations, resulting in blockage of funds (bonds/securities), accounting complexities, and ongoing compliance uncertainty.

- Time-bound Closure: The newly introduced 2+1-year cap mandates resolution of such cases within a predictable timeframe, save for carved out exclusions such as pending appellate outcomes, foreign authority references, or Board-issued directions. However, the carve out/exceptions created in the main Customs legislations for matters or issues that are pending in litigation or pending verification from international authorities [for e.g., in case of origin verification for benefits claimed under Trade Agreements] would mean that the issue of delayed assessments could still continue for a few.

In parallel, Customs authorities are also bound by enquiry and finalisation deadlines, which should lead to faster cancellation of bonds, return of securities, and quicker refund processing. The inclusion of an explicit penalty mechanism places equal responsibility on importers, exporters, and brokers to ensure timely compliance.

Thus, Importers should proactively audit their pending provisional assessments (especially SVB-linked cases), engage with authorities to furnish outstanding documents, and realign compliance strategies to the new time-bound regime. Importers/exporters must adopt stricter document management systems to adhere to short submission windows. Customs brokers may need fresh SOPs to avoid contraventions and lapses.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.