- within Employment and HR, Finance and Banking and Corporate/Commercial Law topic(s)

- with readers working within the Law Firm industries

India's dynamic and rapidly growing economy, supported by a robust capital market, continues to attract Non-Resident Indians (NRIs) seeking to diversify their portfolios and participate in the country's growth story. Indian equities and mutual funds present compelling long-term wealth creation opportunities, backed by a strong regulatory framework, accelerating digitization and the increasing global visibility of Indian companies.

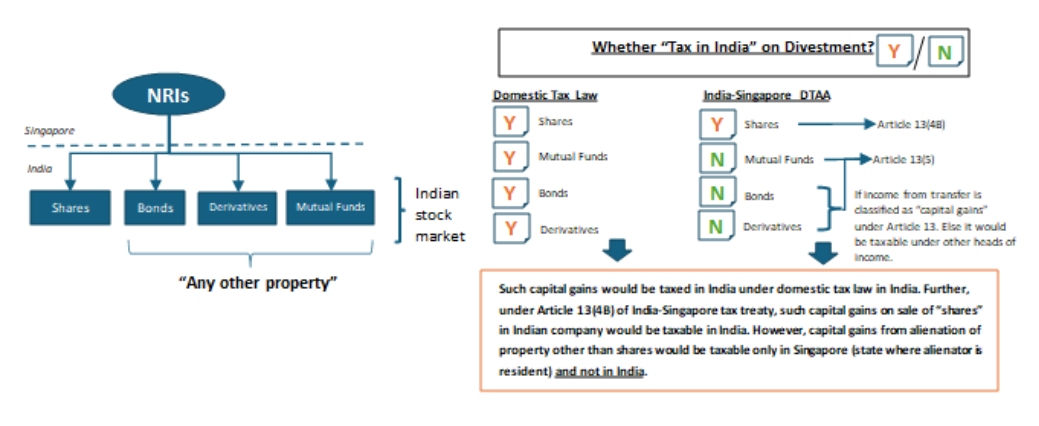

NRIs earning income from investments in shares, mutual funds, or other instruments in the Indian capital market are subject to tax under Indian income-tax law, specifically the Income-tax Act, 1961 (IT Act). However, taxation for NRIs is often moderated by the provisions of the relevant Double Taxation Avoidance Agreement (DTAA) between India and the country of residence of NRI. DTAA offers relief in specific scenarios, particularly with respect to investment income such as dividends and capital gains.

NRIs are increasingly turning to Indian capital markets as a viable avenue for long-term wealth creation. Investments are typically made through equity shares and mutual funds, both of which offer the potential for attractive returns. However, these investments also come with corresponding tax obligations under IT Act.

Capital gains taxation under Article 13 of India-Singapore DTAA

Article 13(4B) provides that in case of capital gains arising to resident of a contracting state (say, Singapore) on account of transfer of shares (which are acquired on or after April 1, 2017) held in a company located in the other contracting state (say, India), such gains shall be taxable in state in which such company is resident, i.e. in India.

However, Article 13(5) provides that gains arising from alienationof "any other property"shall be taxable only in the state in which seller is resident (i.e. in Singapore).

Further, Singapore does not levy any tax on capital gains under its domestic tax law.

Shares vs Mutual Fund units: Treaty Interpretation

- In the recent judgment ofAnushka Sanjay Shah v/s. ITO, Int Tax Ward 4(2)(1)(Appeal No. ITA No. 174/MUM/2025, dated 26.03.2025), the Mumbai Income Tax Appellate Tribunal (ITAT) ruled in favour of the assessee, who had claimed exemption under the Article 13(5) of India- Singapore DTAA on capital gains arising from short-term investments in equity and debt mutual funds.

- The Mumbai ITAT, upheld the assessee's claim for exemption

under Article 13(5) of India-Singapore DTAA, providing the

following key observations:

- Units of mutual funds are not treated as shares under Indian law;

- Article 13(5) of the India-Singapore DTAA applies, under whichgains arising from property other than shares are taxable only in the state of residence of seller(i.e., Singapore in this case);

- Several precedents1have held that capital gains from mutual fund units are exempt from tax in India under treaty provisions similar to those in the India-Singapore DTAA.

Our Thoughts

While Indian tax law provides for comprehensive taxation of income arising in India, the DTAA framework offers certain reliefs. Investors and tax practitioners must evaluate the treaty benefits before computing tax liability, especially in cross-border investment scenarios. The language deployed in Article 13(4B) and 13(5) of India-Singapore DTAA is very clear and unambiguous and needs to be interpreted accordingly.

The recent Mumbai ITAT ruling highlights the critical role of the India-Singapore DTAA in determining the taxability of capital gains for non-resident investors, particularly Singapore residents. By distinguishing mutual fund units from shares and confirming their eligibility for tax exemption under Article 13(5), the Tribunal has provided valuable clarity for cross-border investors. As India's capital markets continue to attract global interest, it is essential for NRIs and foreign investors to evaluate the nature of their investments and understand applicable treaty provisions.

Footnotes

1. ITO v. Satish Beharilal Raheja (2013) 137 Taxmann.com 296 (Indo-Swiss DTAA) and DCIT v. K.E. Faizal (2019) 178 ITD 383 (Coch) (India-UAE DTAA)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.