- with readers working within the Law Firm industries

- within Strategy, Real Estate and Construction and Privacy topic(s)

The Delhi High Court (HC) in Tiger Global III Holdings v Authority for Advance Rulings, 2024 SCC OnLine Del 5987 overturned the decision of the Authority for Advance Ruling (AAR) where AAR had taken a view that the transaction of sale of shares of Flipkart Private Limited, a Singapore entity (Flipkart) to Walmart International Holdings, Inc. constituted a prima-facie tax avoidance arrangement (please refer to our earlier ERGO on the AAR ruling).

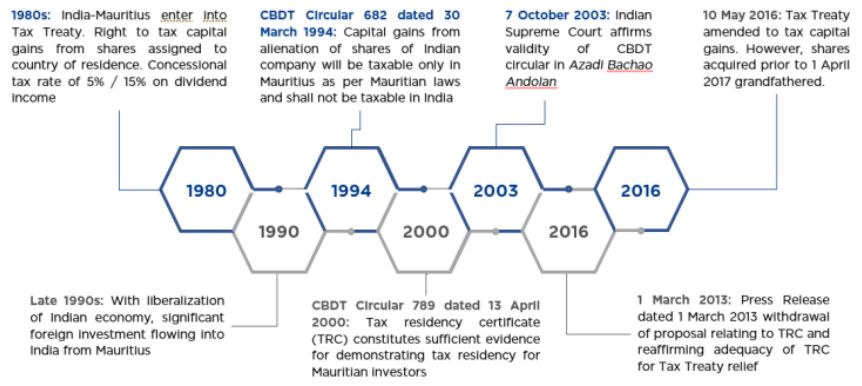

The HC followed well-established principles laid down in Azadi Bachao Andolan, (2004) 10 SCC 1, on the significance of a tax residency certificate (TRC) to claim benefits under the India-Mauritius tax treaty (DTAA). The HC also examined issues pertaining to 'Beneficial Ownership', applicability of General Anti-Avoidance Rules (GAAR), Limitation of Benefit clauses (LoB), and parent-subsidiary relationship.

Background

The Taxpayers are entities incorporated in Mauritius holding Category-1 Global Business License (GBL) issued by the Mauritius Government. Tiger Global Management LLC (TGM LLC), a US company, was the investment manager of the Taxpayers.

Key submissions of the Taxpayers

- TGM LLC did not hold any direct or indirect shareholding interest in Taxpayers, which are pooling vehicles comprising more than 500 investors spread across 30 jurisdictions.

- All decisions of the Taxpayers (including purchase/sale of Flipkart shares) were taken by Taxpayers' board which comprises of qualified individuals and thus, cannot be treated as 'mere puppets'.

- Taxpayers cannot be treated as sham/conduit entities since they incurred expenses of approximately MUR 36,436,182 which significantly exceeds threshold of MUR 1,500,000 under the LOB clause of the DTAA.

- The decision to authorize Mr. Coleman for bank transactions beyond specified thresholds was a conscious decision taken by the Taxpayer's board itself and all such transactions needed to be countersigned by Taxpayers' Mauritius directors.

- The Taxpayers hold TRC which constitutes sufficient evidence of

residency and beneficial ownership relying upon the following

statutory and legislative developments:

- The 'Beneficial Ownership' test does not apply to Article 13 (Capital Gains) unlike Article 10 (Dividends) and Article 11 (Interest). Further, Taxpayers do not have any contractual or legal obligation to pass on the sale consideration to another entity.

Arguments of the tax authorities

- The AAR merely gave a prima facie view and did not give any definitive findings regarding the chargeability of capital gains to income tax.

- Tax authorities reiterated the factual narrative of TGM LLC being the ultimate parent and holding company of the Taxpayers, and the Taxpayers being a mere facade of TGM LLC.

- In line with the AAR's findings, the tax authorities submitted that the ultimate control and management of the Taxpayers was with TGM LLC. The tax authorities emphasized on the role of Mr. Coleman (designated as the beneficial owner of one of the Taxpayers and has significant influence over the group's US entities) in control and management including specific authority for bank transactions beyond certain thresholds.

- Tax authorities also sought to apply GAAR provisions which came into force in 2017 on the premise that Rule 10U(2) of the Income Tax Rules, 1962 (IT Rules) overrides the exemption available to shares acquired prior to April 2017 on the premise that Rule 10U(2) specifically states that 'Without prejudice to to the provisions of clause (d) of sub-rule (1)..'.

HC ruling

On maintainability of the writ petition, the HC held that the detailed findings of the AAR would undoubtedly influence lower tax authorities and thus, AAR's view cannot be said to be a prima facie view. Consequently, the writ petition was held to be maintainable. On facts, the Court clarified that TGM LLC had no ownership or control over the Taxpayers.

On merits, the Court held as follows:

- TRC: TRC is sacrosanct while evaluating entitlement to DTAA benefits, including tax residency and beneficial ownership relying on various circulars issued by the tax department, legislative developments since 2013, as well as landmark rulings such as Azadi Bachao Andolan. Tax authorities can go beyond TRC to invoke the principle of substance over form only in cases of sham transactions and tax avoidance structures, and the onus is on tax authorities.

- Beneficial Ownership: The 'Beneficial Ownership' test is relevant only in instances where a taxpayer holds the shares as an assignee and/or there is a contractual/legal obligation to pass on the income to another person. In the present case, there is no doubt about the Taxpayers' beneficial ownership of capital gains and shares.

- Role of bank signatories and presence of non-Mauritius directors on the board: Merely presence of some US directors connected with Tiger Global's US entities does not ipso facto mean that Taxpayer is controlled by US entities. Further, Mr. Coleman was authorized by Taxpayer's board itself to approve bank transactions.

- Parent-Subsidiary relationship: A Parent company is naturally expected to exercise certain degree of influence over its subsidiaries. Such parent-subsidiary relationship cannot ipso facto mean that the subsidiary has no independence in decision making.

- GAAR and LoB: The HC held that GAAR provisions were not applicable to the present transaction because the investments were made prior to 1 April 2017 and that Rule 10U(2) should not be interpreted in a manner that defeats Rule 10U(1)(d) and overrides the DTAA.

- Jurisdiction of the investor: Merely investments being from a low tax jurisdiction (such as Mauritius) does not ipso facto mean that such investment is not bona-fide.

Comments

Entitlement to DTAA benefits continues to remain a deeply contested issue. and is pending before the Supreme Court in Blackstone's matter, as the Supreme Court stayed Delhi HC's judgment granting the benefits of the India Singapore DTAA to Blackstone relying on TRC issued by Singapore (see Asst CIT v Blackstone Capital Partners, MANU/SCOR01114/2024 and Blackstone Capital Partners v Asst CIT, [2023] 452 ITR 111(Delhi)).

The HC noted CBDT Circular No. 789 and applied well settled principles of DTAA eligibility based on TRC. The HC examined the factors laid down in Vodafone International, (2012) 6 SCC 613 as to whether the transaction was a sham, tax fraud, colourable device or involved round tripping and overruled AAR's finding that the transaction was a tax avoidance arrangement. The Court also aptly appreciated the legislative developments in the context of DTAA and the intent of both Governments to accord protection to grandfathered shares. It will be interesting to see how the Courts apply these principles around DTTA eligibility in the context of GAAR and principal purpose test.

It is important for tax authorities to strike a balance between 'form over substance' and 'substance over form' while examining a taxpayer's eligibility to DTAA benefits. Further, the ruling provides a clear indication on the applicability of pacta sunt servanda and for countries to honour treaty obligations in good faith.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.