- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Law Firm industries

- within Energy and Natural Resources and International Law topic(s)

- with readers working within the Technology and Law Firm industries

In recent years, we have seen progressive regulatory reforms easing the pathway for take-private deals in India. Despite these reforms, a clear and effective "squeeze-out" mechanism remains absent. This article co-authored by Yashasvi Mohanram and Sumnima Kataruka analyses the key legal hurdles as well as the recent judicial rulings highlighting the pressing need for a structured framework akin to other jurisdictions to help controlling shareholders acquire full ownership post-delisting.

Over the past few years, SEBI has made commendable strides in liberalizing the framework for take-private transactions involving listed companies. The 2021 amendments to the Takeover Regulations enabled consolidated takeover and delisting offers. More recently, last year's introduction of a fixed-price delisting regime in the Delisting Regulations addressed a long-standing industry demand. Yet, despite these reforms, the absence of a reliable squeeze-out mechanism continues to frustrate controlling shareholders aiming for full ownership. This gap is particularly stark in the context of delisted companies, where minority shareholders linger despite multiple exit opportunities.

Recent cases underscore the problem. In September 2024, the NCLT Kolkata rejected Philips India's capital reduction scheme which would have resulted in the Dutch parent increasing its shareholding from 96% to 100%. Philips India has since filed an appeal before the NCLAT against this decision. In contrast, Bharti Telecom secured a favorable NCLAT ruling in April 2025 to purchase the 1% stake held by the minority shareholders, overturning a 2019 denial by NCLT Chandigarh. However, the specter of further appeals and delays remains even for Bharti Telecom.

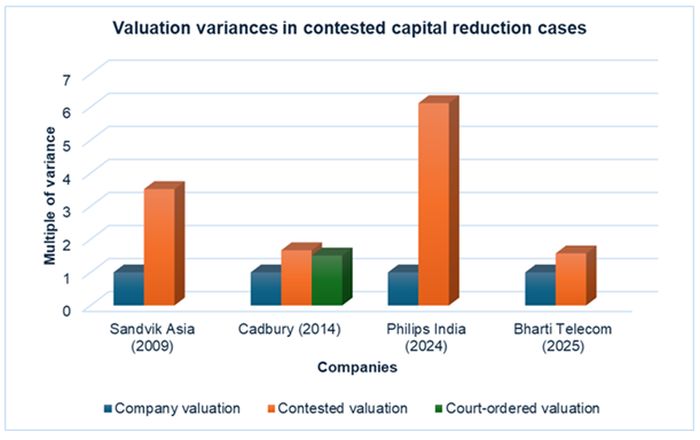

Notably, both companies have been delisted for over two decades, but the controlling shareholders, despite providing numerous exit opportunities to the remaining public shareholders, still face hurdles in achieving full ownership. As the table below illustrates, other companies have faced similar delays previously.

* Process still ongoing

Capital Reduction versus Compulsory Acquisition

The primary reason for the uncertainty and delays in this regard can be attributed to the exclusive reliance on the capital reduction mechanism under Section 66 of the Companies Act to compulsorily buy out public shareholders who choose not to sell in a delisting offer. Capital reduction schemes are required to follow an elaborate process involving an application to the NCLT, representations from statutory authorities and interested parties, and finally an approval order from the NCLT. Given the contentious and long-drawn out nature of NCLT proceedings, the capital reduction route is not effective as the default mechanism for controlling shareholders seeking to acquire 100% shareholding in their delisted subsidiaries.

Unfortunately, the alternate mechanisms under the Delisting Regulations and the Companies Act involving a direct acquisition of the remaining minority shareholding are not adequate to reliably ensure a full sell out. The Delisting Regulations provide a "right" – but not an "obligation" – for the remaining public shareholders to sell their shares to the controlling shareholder at the delisting price for a minimum period of one year from the delisting date. Section 236 of the Companies Act, which ostensibly allows controlling shareholders holding 90% or more to acquire minority stakes, is riddled with ambiguity. Apart from providing that the minority shareholders "may" – rather than "shall" – sell their shares, its placement within the chapter on schemes of arrangement further clouds its applicability post-delisting. The need of the hour is a clear mechanism akin to Chapter 3 of the UK Companies Act, 2006 which provides for a structured squeeze-out mechanism to be triggered by a controlling shareholder upon reaching the 90% threshold in a takeover offer. India would benefit greatly from a similar calibrated approach — one that balances rights and obligations on both sides.

Valuation: The Flashpoint

Valuation disputes are the most common – and most contentious – obstacle in minority buyouts. While controlling shareholders rely on independent valuers and fairness opinions, minority shareholders often counter with inflated valuations from valuers of their choice. Despite clear judicial precedents which limit the role of courts and tribunals in valuation scrutiny, in practice, valuations for capital reduction are frequently challenged and overturned. Minority shareholders often use the valuation exercise as a negotiating tactic to extract a better price from the controlling shareholders. As the table below illustrates, the variance is of the order of several multiples in contested cases, a result of the varying valuation methods which are deployed (DCF, NAV, comparable multiples etc.) as also the varying underlying valuation assumptions which are used.

Note: In cases such as Reckitt Benckiser (2005) and Syngenta (2020), while the minority shareholders did not furnish a separate valuation of their own, they nonetheless questioned the valuation furnished by the company.

The Delisting Regulations offer some relief by anchoring post-delisting exits to the delisting price for one year. Subject to the rules being amended to provide a corresponding right for the controlling shareholder to purchase the shares of the minority shareholders, the delisting price serves as an effective benchmark to avoid potential valuation mismatches. However, a shorter window – say, three months rather than one year – would better balance certainty for acquirers and fairness for minority shareholders.

Shareholders' Approval: Clarifying the Threshold

While the Companies Act requires capital reduction schemes to be approved by way of only a special resolution (i.e., three-fourths majority), in practice, NCLTs are often influenced by the extent of minority shareholders' support. For the sake of consistency in dealing with capital reduction schemes, it would be prudent to avoid insisting on a "majority of minority" approval from the shareholders.

In contrast, the Delisting Regulations already require two-thirds approval from voting public shareholders. Accordingly, no further approval of the shareholders would be necessary to approve the purchase of the remaining shares by the controlling shareholder in the limited window period following the delisting. Only controlling shareholders who choose not to acquire the remaining shares during such window period would risk any subsequent attempts being subject to the vagaries of a capital reduction exercise.

Way forward

The divergent outcomes in recent cases illustrate not only a lack of judicial consistency but also the broader risks that companies face when relying on the capital reduction route. The procedural delays and uncertainties associated with NCLT proceedings serve as a deterrent, raising the transaction cost and execution risk for controlling shareholders who seek to achieve full ownership. A bespoke mechanism allowing controlling shareholders to acquire the remaining public shareholders at the delisting price in the immediate aftermath of a delisting exercise cannot come any sooner.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.