INVESTMENT AND DEAL ACTIVITY ANALYSIS

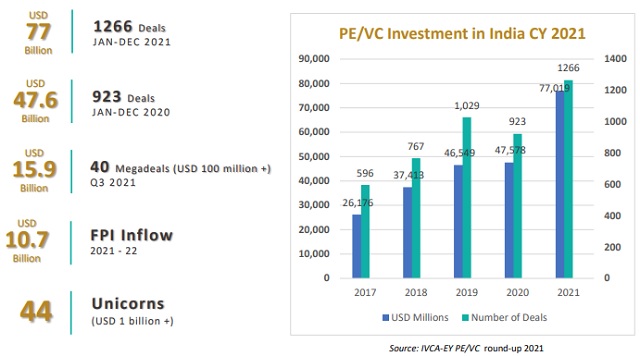

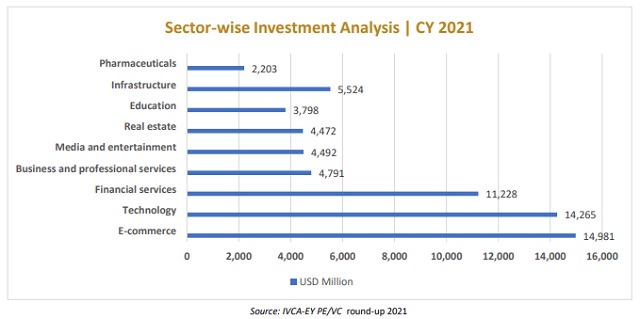

- DEAL ACTIVITY | CY 2021

- EXITS | CY 2021

CORPORATE & COMMERCIAL

- Pooled investment vehicles and amendments to the SCRA 1956

- Fresh guidelines for social media intermediaries and OTT

- E-commerce rules - Proposed amendments and implications

- Companies (CSR Policy) Amendment Rules, 2021

- Companies (incorporation) Fifth Amendment Rules, 2021

Pooled investment vehicles and amendments to the SCRA, 1956

Pursuant to the Finance Act, 2021, the Securities Contracts (Regulation) Act, 1956 (SCRA 1956) underwent certain amendments recently. These pertain to changes brought about by the inclusion of 'pooled investment vehicles' within the ambit of the SCRA's governance. The key changes are provided herein below:

Revised definitions

New Section 2(da) has been inserted in the SCRA, which defines a 'pooled investment vehicle' as a fund established in India in the form of a trust or otherwise (for example, mutual fund, alternative investment fund, collective investment scheme or a business trust as understood under Section 2(13A) of the Income Tax Act, 1961 and registered with the SEBI) or such other fund, which raises or collects monies from investors and invests the same in accordance with SEBI regulations in this regard. Consequent thereto, the definition of 'securities' has been amended, whereby:

- In Section 2(h)(i) of the inclusive definition, 'pooled investment vehicle' has been inserted. It may be noted that Section 2(h)(i) of the SCRA pertains to forms of marketable securities.

- New Section 2(h)(ida) has been inserted to include units or any other instrument issued by any pooled investment vehicle.

Section 30B

Section 30B has been inserted into the SCRA in relation to debt fund raising by pooled investment vehicles. It states that a pooled investment vehicle (whether constituted as a trust or otherwise) that is registered with SEBI would be allowed to borrow and issue debt securities in line with regulations that SEBI may prescribe. Interestingly, this allowance is stated to override not just the Indian Trust Act, 1882 (the foundation legislation for private trust law in the country) and any other law being in force at the time, but also any judgment, decree or order by any court, tribunal, or authority. In addition, the pooled investment vehicle would also be allowed to create security interest in favor of a lender, whereby such lender could enforce such security interest against the trust property in case of a default by the pooled investment vehicle.

Observations

With these changes coming in, there are a few aspects to further consider.

The most obvious consequence in relation to the amendments to Section 2(h) of the SCRA is that units or instruments issued by pooled investment vehicles would now fall within the purview of 'Security' under stamp laws, whereby making their transfers eligible to stamp duty payment. In particular, for Section 2(h)(i) of the SCRA, which pertains to marketable securities in an incorporated company, body corporate or pooled investment vehicle, it should be considered whether with private placement memoranda for alternate investment funds that typically contain conditions and restrictions around transfer, they could at all fall within the purview of 'marketable security'.

While the SCRA itself may not have a definition for this, the Indian Stamp Act, 1899, does. This definition, inserted last year in the legislation, states that a marketable security is one that can be traded on any stock exchange in India.

For Section 30B, the overriding of existing judgment, decree or order is an interesting position, as does the overriding of any other legislations in force at the time. Whether this has an effect on an entity that is in an insolvency process may have to be explored further. Whether further SEBI regulations and prescriptions would address this remains to be seen.

Conclusion

While both the changes were expected – bringing the units by pooled investment vehicles within the ambit of stamp duty regime, as well as clear recognition of debt fund raising by vehicles (including INVITs and REITs) – clarity on the potential inconsistencies shall, of course, be welcome.

Fresh guidelines for social media intermediaries and OTT

Amid growing concerns around the lack of transparency, accountability and rights of users related to digital media, the Government has introduced the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules 2021 (Rules). These Rules have been framed in exercise of powers under Section 87(2) of the Information Technology Act, 2000. The Rules aim at empowering social media users and ensure that Social Media Intermediaries (Intermediaries) and Over-The-Top (OTT) platforms create a safe environment digitally.

Social Media Intermediaries will fall into two categories – an Intermediary and a Significant Social Media Intermediary. This distinction is based on the number of users on the social media platform, and the government will soon notify the threshold of the user base that will distinguish the two.

Key guidelines for Intermediaries

- Applicability of 'safe harbor' provisions: Intermediaries have to follow the prescribed diligence protocols to ensure applicability of 'safe harbor' provisions. In case these are not followed, the safe harbor provisions (defined under Section 79 of the IT Act, 2000) providing immunity from legal prosecution for any content posted on their platforms, will not apply to them.

- Mandatory grievance redressal mechanism: The Intermediaries shall appoint a Grievance Officer to deal with complaints and will share the name and contact details of such officers, who shall acknowledge the complaint within twenty-four hours and resolve it within fifteen days from receipt.

- Ensuring online safety and dignity of users: Intermediaries shall remove or disable access within 24 hours of receipt of complaints of content that exposes the private areas of individuals, show such individuals in full or partial nudity or in sexual act or is in the nature of impersonation including morphed images etc. Such a complaint can be filed either by the individual or by any other person on his/her behalf.

- Additional Due Diligences for the Significant Social Media

Intermediaries:

- Appointments: The Significant Social Media Intermediaries need to appoint a Chief Compliance Officer, a Nodal Contact Person and a Resident Grievance Officer, all of whom should be residents of India.

- Compliance Report: The Intermediaries need to publish a monthly compliance report mentioning the details of complaints received, action taken on the complaints as well as details of content removed proactively.

- Enabling identity of the Originator: As per the guidelines, social media intermediaries providing services primarily in the nature of messaging shall enable identification of the first originator of the information. However, this is required only for the purposes of prevention, detection, investigation, prosecution, or punishment of an offence related to sovereignty and integrity of India, the security of the State, friendly relations with foreign States, or public order as well as incitement to an offence relating to the above or in relation with rape, sexually explicit material, or child sexual abuse material punishable with imprisonment for a term of not less than five years.

- Removal of unlawful information: An Intermediary upon receiving actual knowledge in the form of an order by a court or being notified by the Government or its agencies through authorized officer should not host or publish any information which is prohibited under any law in relation to the interest of the sovereignty and integrity of India, public order, friendly relations with foreign countries etc.

To read the full article click here

Originally Published by January 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.