- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in North America

- with readers working within the Chemicals, Oil & Gas and Transport industries

Table of contents

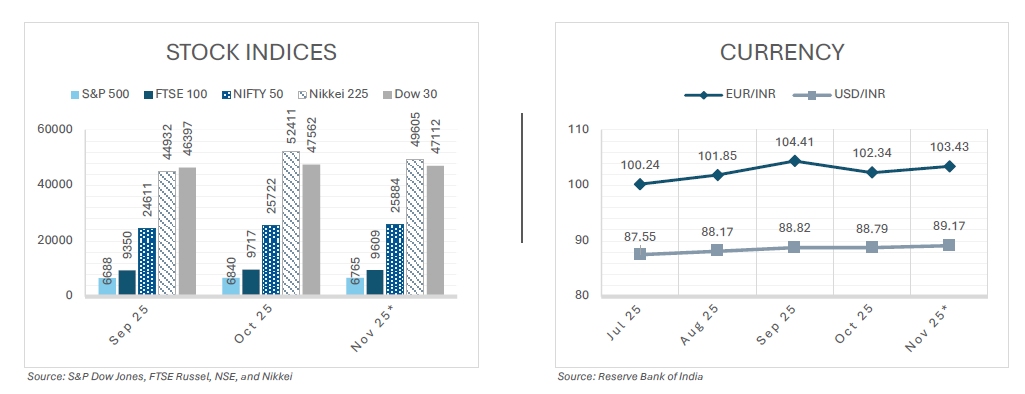

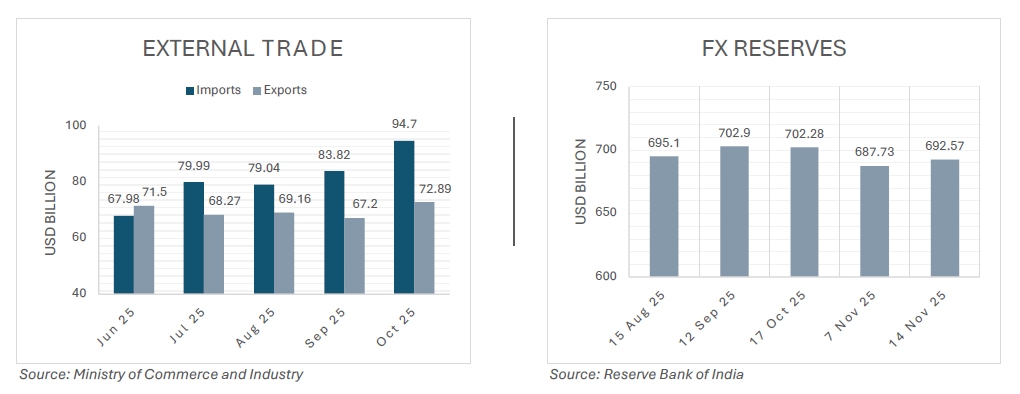

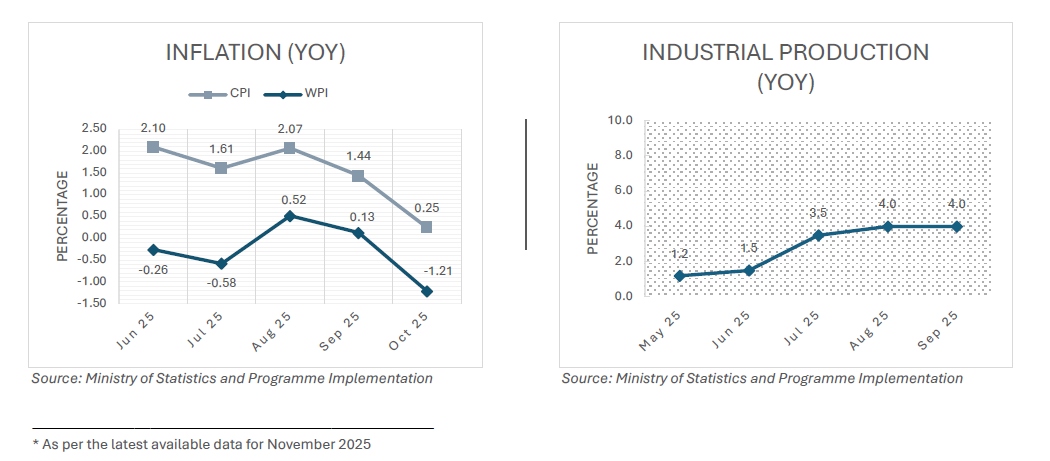

- Indian economy | November 2025

Snapshot of key indicators

- RBI increases flexibility in the External Commercial Borrowing framework

Draft Foreign Exchange Management (Borrowing and Lending) (Fourth

Amendment) Regulations, 2025

- Itemised consent notices are mandatory for data collection

Digital Personal Data Protection Rules, 2025

- SEBI revises Related Party Transactions compliance framework

SEBI (Listing Obligations and Disclosure Requirements) (Fifth Amendment)

Regulations, 2025

- RBI approval is not required for enforcing damages awarded in a cross-border commercial investment dispute

GPE (India) Ltd v. Twarit Consultancy Services Pvt Ltd

- IBBI allows Resolution Professionals to seek restitution of PMLA attached assets

Formulation of an undertaking by RPs in consultation with the ED

- Renewable-Energy Implementing Agencies to directly sign PPAs with developers

Ministry of Power addresses the issue of stranded solar and wind projects

- Buyout price mechanism proposed as an alternative to Renewable Consumption Obligation

Buyout price to be slightly above the average market rate for RECs

- RBI enhances transparency and efficiency in cross-border inward payments

Draft circular on guidelines to facilitate faster cross-border inward payments

- SEBI heightens conflict of interest disclosure measures

Report of the High-Level Committee on conflict of interest, disclosures, and related matters in respect of members and officials of SEBI

Indian economy | November 2025

Snapshot of key indicators

RBI increases flexibility in the External Commercial Borrowing Framework

Draft Foreign Exchange Management (Borrowing and Lending) (Fourth Amendment) Regulations, 2025

The Reserve Bank of India (RBI) released the draft amendments to the current External Commercial Borrowing (ECB) framework vide the Foreign Exchange Management (Borrowing and Lending) (Fourth Amendment) Regulations, 2025 (2025 Amendment), aimed at liberalising the existing foreign borrowing structure and accommodating more Indian players in the global market.

ECBs refer to commercial loans, bonds, and other such instruments obtained by eligible Indian resident entities from recognised foreign lenders, subject to compliance with prescribed requirements. They are regulated by the Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 (2018 Regulations) and administered by the RBI. The current framework is stifled with compliance complexities and restrictive cost structures, resulting in nonalignment with global standards and reduced ability of Indian entities to tap foreign capital efficiently.

Key proposed changes

- Eligible borrowers: Schedule-I earlier restricted eligible borrowers to entities permitted to receive Foreign Direct Investment (FDI) under the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017. The draft now expands eligibility to any person resident in India (other than an individual) incorporated or registered under Central or State law, entities covered under approved restructuring or insolvency resolution plans, and entities under investigation, adjudication, or appeal for alleged violations. Such borrowers must inform their Authorised Dealer (AD) Category-I bank, which must notify the relevant enforcement agencies.

- Currency of borrowing: While Schedule-I continues to permit ECBs in freely convertible foreign currency and INR, the draft introduces flexibility to change the borrowing currency between foreign currencies, or between foreign currency and INR at either the prevailing exchange rate or a lower-liability rate.

- Borrowing limits: The fixed cap in Schedule-I of USD 750 million per financial year (USD 3 million for start-ups) is proposed to be replaced with a higher and more flexible limit of USD 1 billion or total outstanding borrowing up to 300% of last-audited net worth, whichever is higher. These revised limits do not apply to entities regulated by financial sector regulators.

- Revised prohibition on end-use of borrowed funds: The 2018 Regulations included a general negative list restricting the use of borrowed funds for activities such as chit funds, Nidhi companies, agricultural or plantation activities, and real estate. Regulation 3A now expands these restrictions by additionally prohibiting on-lending and transactions in listed or unlisted securities. The exceptions to this are where the investments are permitted under the Foreign Exchange Management (Overseas Investment) Rules, 2022 (OI Rules 2022) and the Foreign Exchange Management (Overseas Investment) Regulations, 2022 (OI Regulations 2022), or are undertaken pursuant to mergers, acquisitions, or amalgamations under the Companies Act, 2013, the Securities and Exchange Board of India (SEBI) (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (SAST Regulations), or the Insolvency and Bankruptcy Code 2016 (Code), or involve subscription to primary market instruments issued by non-financial entities for on-lending.

- Recognised lenders: Schedule-I previously limited lenders to residents of Financial Action Task Force/International Organisation of Securities Commissions compliant jurisdictions, certain multilateral/regional institutions, and foreign branches/subsidiaries of Indian banks. The 2025 Amendment significantly broadens this by allowing any non-resident to lend, including foreign or IFSC branches of entities whose lending activities are regulated by the RBI.

- Minimum Average Maturity Period (MAMP): Schedule I's standard 3-year MAMP is retained. A targeted relaxation is proposed for the manufacturing sector, allowing ECBs with a maturity between 1 and 3 years, capped at USD 50 million in total outstanding amount. The draft also clarifies that call and put options cannot be exercised before the minimum maturity period, except in limited cases such as conversion into non-debt instruments, repayment using non-debt instrument proceeds, debt waiver, or closure, merger, acquisition, resolution or liquidation of the lender or borrower.

Impact

The draft amendments invite more flexible developments with the removal of fixed benchmarks and linking borrowing limits to a company's net worth. This helps strong and well-managed companies raise funds more easily, as borrowing will be proportional to the financial strength of the borrower.

- These amendments simplify the currency exchange rate and add explicit, borrower-favourable mechanics to change one foreign currency to another, and even to INR and vice versa.

- The draft amendments also widen the pool of eligible borrowers and lenders and introduce a short-maturity window for manufacturing.

The expanded scope and relaxations under the new ECB framework are expected to boost participation from both borrowers and lenders by easing compliance and widening access to foreign capital. This is a shift from a restrictive regime to a more liberal, market-oriented approach that strengthens cross-border financial integration. It diversifies funding options and reduces reliance on domestic borrowing.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.