- within Tax, Real Estate and Construction and Immigration topic(s)

- with readers working within the Law Firm industries

01. GOODS AND SERVICES TAX

NOTIFICATIONS AND CIRCULARS

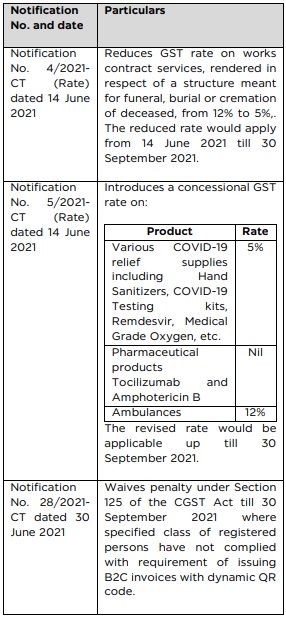

Key GST Notifications pursuant to the 44th GST Council Meeting

CASE LAWS | SUPREME COURT & HIGH COURTS

Constitutional validity of the place of supply in respect of intermediary services

The Division bench of the Bombay High Court expressed divergent views on the constitutional validity of Section 13(8)(b) of the IGST Act which stipulates that the place of supply of intermediary services is determinable basis the location of the supplier.

Justice Ujjal Bhuyan opined that Section 13(8)(b) of the IGST Act falls foul of the overall scheme of the GST Law, runs contrary to Articles 245, 246A, 269A and 288(1) of the Constitution of India and is therefore unconstitutional. Contrarily, Justice Abhay Ahuja pronounced that Section 13(8) of IGST Act is constitutionally valid and operative for all purposes. Due to a difference in the opinion of the division bench, the matter has been placed before the Hon'ble Chief Justice on the administrative side.

KCO is arguing the matter on behalf of the Petitioner, ATE Enterprises Private Limited.

[Dharmendra Jani, ATE Enterprises Private Limited vs UOI and Ors]

No ITC reversal on inherent loss of inputs during manufacturing

The Hon'ble Madras High Court quashed an assessment order that rejected a portion of ITC that pertained to loss by consumption of inputs in the course of manufacturing. While denying the ITC as mentioned above, Revenue invoked Section 17(5)(h) of the CGST Act which contemplates a credit blockage qua goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples.

The High Court observed that a loss that is occasioned by consumption in the process of manufacture is one which is inherent to the process of manufacture itself and did not fall within the purview of Section 17(5)(h) of the CGST Act. In view of the above, the Madras High Court held that the ITC reversal by the Revenue was misconceived.

[ARS Steels & Alloy International Pvt Ltd vs The State Tax Officer]

Levy of GST on entire bet amount is unconstitutional

By virtue of Rule 31A(3) of the CGST Rules, the entire bet amount paid to a totalisator suffers a levy of GST. In a challenge to the foregoing provision, the Karnataka High Court adverted to the settled law that there must be a nexus between the measure of tax and the taxable event.

The High Court observed that Rule 31A(3) makes totalisators liable to a levy of GST on the entire bet value despite the totalisator's consideration for supplies being restricted only to the component of commission. The Karnataka High Court quashed Rule 31A(3) of the CGST Rules and held that the totalisator was liable to pay GST only on the portion of commission.

[Bangalore Turf Club Limited vs State of Karnataka]

Representation to the Government for bringing petrol, diesel under GST

In a recent PIL, the Kerala High Court has directed the GST Council to forward the representation filed by the Petitioner, seeking inclusion of petrol and GST under GST regime, to the Union of India. The Kerala High Court has further directed the Union of India to take a decision on said representation within a period of six weeks.

[Kerala Pradesh Gandhi Darshanvedhi vs UOI]

Period of limitation for filing appeal under GST stands extended

The Supreme Court, vide judgment dated 23 March 2020 in a Suo Motu Writ Petition (Civil) No(s) 03/2020, had extended the period of limitation under various laws from 15 March 2020 till 14 March 2021.

Vide judgment dated 27 April 2021 in Miscellaneous Application No. 665/2021 in SMW(C) No. 03/2020, the period of limitation has been further extended until further orders. In light of the above, the Madras High Court reinstated the GST appeal that was rejected by the Appellate Authority on grounds of time barring under Section 107 of the CGST Act.

[Hitachi Payment Services (P) Ltd vs The Joint Commissioner of Central Tax (Appeals – II)]

Belated filing of certified order not a ground for appeal rejection

In terms of Rule 108(3) of the CGST Rules, a certified copy of the order appealed against shall be submitted within seven days to the Appellate Authority. On a failure to comply with the timeline stipulated in Rule 108(3), the date of filing of the appeal shall be the date of submission of such certified copy.

The Hon'ble Orissa High Court condoned the procedural lapse that arose on account of delayed submission of certified order copy with the First Appellate Authority. The High Court observed that in Covid times, when there is a restricted functioning of Courts and Tribunals in general, a more liberal approach is warranted in matters of condonation of delay.

[Shree Udyog vs Commissioner of State Tax]

Anticipatory bail granted since there was no prior criminal record

The Delhi High Court allowed an anticipatory-bail application of the Directors of a Company who were allegedly involved in availment of wrongful input tax credit. The High Court took into consideration the fact that no prior criminal antecedents of the concerned petitioners were brought on record and the petitioners had cooperated with the Revenue's investigation upon receipt of summonses.

[Pawan Goel & anr vs Directorate General of GST Intelligence]

CASE LAWS | AAR / AAAR

Placement of non-transferable medical instruments in hospitals without consideration constitutes a supply

The Kerala AAR was posed with a question as to whether the placement of medical instruments by the Applicant to unrelated parties like hospitals and labs for use without any consideration is to be treated as a supply. The Kerala AAR observed that in the specific facts of the case, the hospitals in question were obliged to purchase a minimum quantity of consumables exclusively from the Applicant's distributors and discharge a deficit amount in case of shortages. According to the Kerala AAR, the foregoing contractual term qualified as non-monetary consideration in lieu of the medical instruments that were placed in hospitals by the Applicant. Thus, the Kerala AAR held that the placement of such instruments was a supply of goods.

[Re: Abbott Healthcare Pvt Ltd]

Click here to continue reading . . .

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com