- within Government, Public Sector, Energy and Natural Resources and Employment and HR topic(s)

BACKGROUND

Under the extant tax law, a unit in the International Financial Services Centre ('IFSC') is eligible for availing a 100% tax deduction on certain eligible income for a period of 10 consecutive years out of 15 years from the year of registration (subject to conditions).

In spite of the above tax exemption, there is no specific exemption provided as on date with respect to withholding of tax on payments made to such eligible units. To align the withholding tax mechanism with the above tax exemption provision, the Central Board of Direct Taxes ('CBDT'), in March 2024, had notified certain payments made by a payer to an eligible IFSC unit on which there shall be no requirement to withhold taxes, subject to satisfaction of certain conditions and compliances.

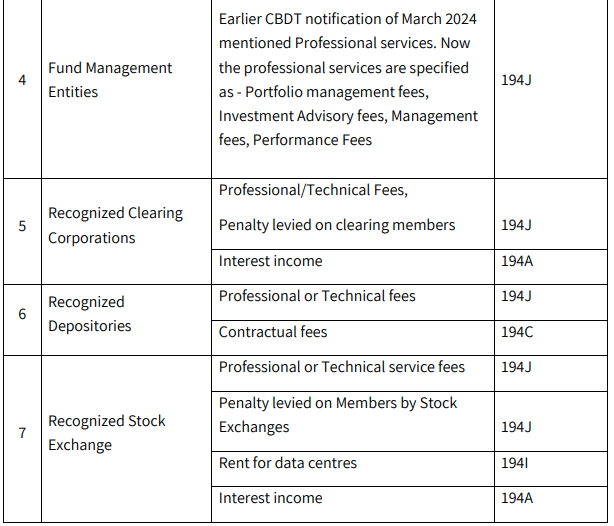

In furtherance to the above notification, CBDT has vide a recent Notification dated 20 June 2025, notified additional category of payments made to IFSC units on which withholding tax provisions shall not apply (with effect from 1 July 2025). Refer this additional list of payments herein below.

LIST OF ADDITIONAL PAYMENTS NOTIFIED AS EXEMPT FROM TDS

Additional category of payments notified by CBDT which shall be exempt from Tax deduction at source ('TDS') requirements

Compliance by the IFSC Unit (Payee):

- Submit Form No 1 (statement cum declaration) to each payer giving details of 10 consecutive financial years opted by the IFSC unit for claiming deduction; and

- Furnish and verify above Form No 1 for each financial year opted for claiming deduction

Compliance by the Payer:

- The Payer shall not deduct tax at source on payment made to the IFSC unit, after the date of receipt of Form No. 1 from Payee; and

- Furnish quarterly TDS returns reflecting all the payments made to the Payee on which tax has not been deducted

The exemption would be available to the IFSC units only during the ten consecutive financial years for which tax holiday would be claimed and the same has been declared in Form No. 1 by the IFSC Unit.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.