- within Employment and HR topic(s)

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of new manufacturing units in the state. Such incentives are in the form of capital subsidies, interest subsidies, subsidized electricity tariffs, and more. The purpose of such incentive schemes is to attract investment thereby enabling infrastructure development, generating employment, developing focus sectors, and largely facilitating the overall economic development of the state.

To enable the availability of a quick summary of such general incentives offered by various Indian states, Nexdigm is releasing a series of documents focusing on providing a brief overview of such incentives offered by respective State Governments in India. This document covers information about incentives offered by Rajasthan under the 'Rajasthan Investment Promotion Scheme 2022'.

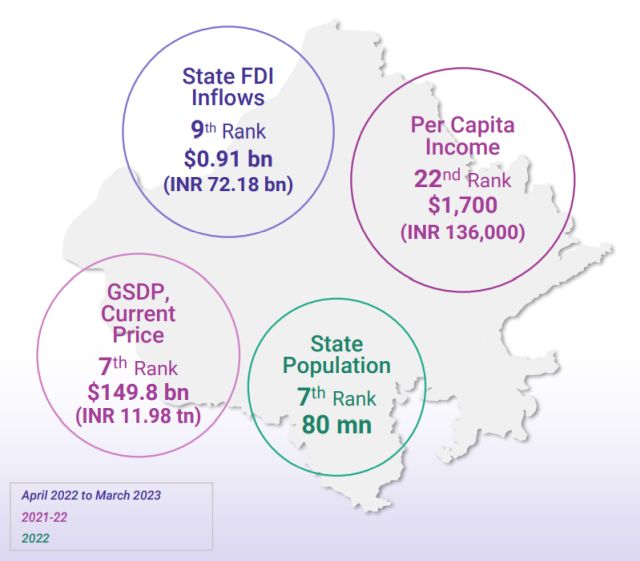

Key Statistics | RAJASTHAN

Policy Overview

Rajasthan aims to attain a 15% annual growth rate in both manufacturing and services, generate employment opportunities for one million people by 2027, and become a pioneer in climate and sustainability by incentivizing green initiatives and promoting sectors such as green hydrogen, alternative energy, and medical devices. To support these goals, the State Government released 'Rajasthan Investment Promotion Scheme 2022', effective from 7 October 2022 to 31 March 2027.

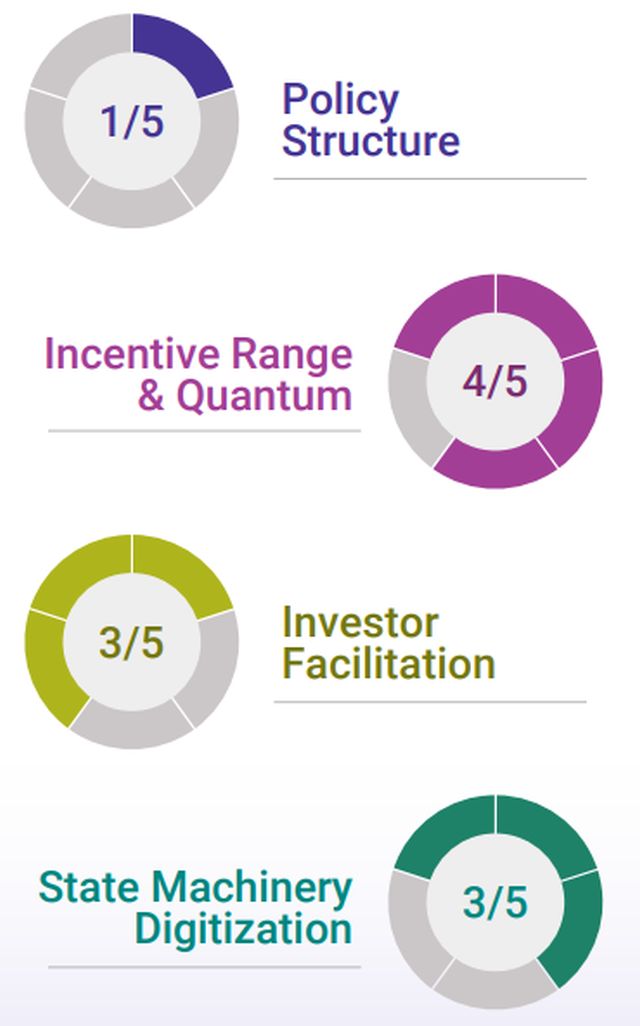

Nexdigm Ratings and Observations

Note: The information/data used for the ratings is subjective based on our assessment of the policy, the experience of Nexdigm professionals in dealing with State Authorities, digitization of select statutory requirements, etc.

This policy has identified the following eight priority/focus categories for the standard incentive package:

- Manufacturing

- Services

- Sunrise sectors

- MSMEs

- Startups

- Logistics Parks, Warehousing & Cold Chains

- R&D, Global Capability Centers (GCCs) & Test Labs

- Renewable Energy Plants

The incentives for companies in the manufacturing and service sector are primarily categorized into three parts:

- Asset creation incentive (investment subsidy, capital subsidy, and turnover-linked incentive)

- Special incentives (employment booster, green incentives, and cluster incentives)

- Other exemptions (electricity duty, stamp duty, etc.)

In comparison to other states, Rajasthan provides one of the most attractive incentive packages to eligible service sectors.

Enterprises engaged in manufacturing activities as outlined in Appendix 3 will not be eligible for incentives.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]