- within Government and Public Sector topic(s)

- with readers working within the Retail & Leisure industries

- in Turkey

India is the Global Business Powerhouse in the making. With its unmatched scale, reforms, and demographic advantage, India is fast emerging as one of the most compelling business destinations globally. As the world's fifth-largest economy by nominal GDP - and one of the fastest-growing nations - India combines economic resilience with a vibrant consumer base of over 1.4 billion people, with significant number of people under the age of 30.

From tech to manufacturing, services to sustainability, the Indian market offers a dynamic ecosystem for innovation, investment, and long-term growth. Backed by progressive policy initiatives, a thriving startup scene, and digital transformation at scale, India is no longer just a market of the future — it's a business imperative today.

Economic Overview

Backed by over a trillion dollars in Foreign Direct Investment (FDI) since 2000, a thriving digital ecosystem, and a demographic advantage unmatched globally, India offers unparalleled opportunities across sectors. For investors and enterprises looking to expand into high-growth, innovation-driven markets, India stands out as a destination that blends scale, resilience, and long-term potential.

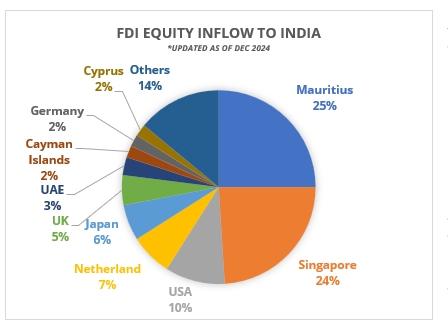

A key indicator of this momentum is the surge in FDI into the country. FDI inflows into India have crossed the USD one trillion milestone in the period from April 2000 to September 2024, underscoring investor confidence in India's long-term growth story. According to data from the Department for Promotion of Industry and Internal Trade (DPIIT), the cumulative amount of FDI — comprising equity inflows, reinvested earnings, and other capital — stood at an impressive USD 1,053 billion as of December 2024.1

India also made significant strides in improving its business environment. According to the World Bank's Doing Business Report 2020, India ranked 63rd out of 190 countries, leaping 79 places from 142nd in 20142.

Favorable Fundamentals for Investment

- Competitive Costs: India offers a favorable cost index, particularly in labor-intensive sectors, with significantly lower manufacturing and operational expenses compared to many Western economies. For instance, the average cost of living in India is about 53% lower than in China ($429 vs $656), making it a cost-effective alternative in global supply chains3.

- Demographic Dividend: With a median age of around 29 years4, India is home to a dynamic and digitally savvy workforce. The labor pool is not only vast but increasingly skilled, supported by national skilling initiatives and partnerships with global institutions.

India's talent advantage is underscored by its vast and growing education infrastructure, comprising over 1,100 universities and over 42,000 colleges. States like Tamil Nadu, Maharashtra, Uttarakhand, and Kerala lead in higher education output, with robust university ecosystems and specialized technical institutions. The emergence of technology clusters in India, backed by premier institutes like IITs, IIMs, and NITs, has transformed India from a cost-competitive back-office into a global R&D and innovation hub.

- Policy Push: Pro-business initiatives like Make in India, Digital India, Startup India, and Atmanirbhar Bharat continue to unlock opportunities in sectors ranging from electronics to renewables, manufacturing to fintech.

- Further, India has introduced sweeping reforms to liberalise FDI, particularly in key sectors like insurance (FDI limit raised to 100%) and defence (up to 74% under automatic route). The government has also reduced regulatory red tape, streamlined approval timelines, and decriminalised several non-compliances to encourage investor confidence.

- Geopolitical and Economic Resilience: Despite global uncertainties and rising trade tensions, India remains relatively insulated due to its strong domestic demand, stable macroeconomic framework, and robust consumption and investment trends5. The country is increasingly seen as a resilient and neutral destination for global investors seeking long-term stability amid shifting supply chains and financial market volatility.

- Trade and Tariff Outlook: While global tariff uncertainty may weigh on international trade, India continues to maintain a competitive tariff structure—particularly on strategic imports. Its growing network of trade partnerships, coupled with its role in diversified global value chains, positions India favorably as a manufacturing and export hub. India is actively expanding its trade footprint through a new wave of FTAs with key global economies. These agreements aim to lower tariff barriers, open up services markets, and promote smoother cross-border investments.

Key Investment sectors

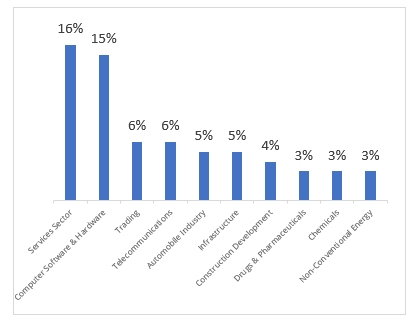

As of December 2024, the leading sectors drawing the highest FDI equity inflows include services, computer software and hardware, telecommunications, trading, and construction development. These sectors reflect India's growing digital economy, expanding consumer base, and strong infrastructure push—making them strategic focal points for both domestic and international investors.

Legal and Regulatory Framework

India follows a federal structure of governance, where both the Central Government and State Governments play critical roles. The Central Government handles matter like foreign trade, corporate law, taxation, and finance, while States manage land, local labor laws, and infrastructure.

When setting up a business in India, understanding the legal landscape is crucial. The most common form of business for foreign investors is a corporate entity — typically a private limited company — governed by the Companies Act, 2013, under the oversight of the Ministry of Corporate Affairs (MCA).

Key Regulatory Authorities and Legal Framework

- Ministry of Finance (Department of Revenue): Administers direct and indirect taxes, including income tax under the Income-tax Act, 1961 and Goods and Services Tax (GST) via the Central Board of Indirect Taxes and Customs (CBIC).

- Ministry of Corporate Affairs (MCA): Oversees company law compliance and corporate governance.

- Securities and Exchange Board of India (SEBI): Regulates capital markets and public listed companies.

- Reserve Bank of India (RBI): Manages monetary policy and foreign exchange under FEMA.

- Department for Promotion of Industry and Internal Trade (DPIIT): Facilitates industrial policy, investment promotion, and ease of doing business reforms.

- Judicial and Quasi-Judicial Bodies: Includes courts and tribunals like NCLT and ITAT for regulatory appeals and disputes.

- Digital Personal Data Protection Act, 2023 (DPDP Act): Governs the handling, storage, and processing of personal data by businesses.

Businesses may also need to adhere to:

- Sector-specific regulations (e.g., for telecom, pharma, or financial services)

- Local state-level regulations

Where to setup in India?

Choosing the right location to establish operations in India depends on your industry, target market, and logistical needs.

Focus Areas:

| Bengaluru | Information technology, R&D / innovation |

| Chennai | IT/ITeS, BFSI, ER&D and Manufacturing & Industrial |

| Delhi NCR | IT, BFSI, e-commerce and retail, healthcare, consulting, or education sector |

| Hyderabad | Information technology, biotechnology, and pharmaceuticals |

| Mumbai | Financial Services |

| Pune | Information technology, engineering, and manufacturing |

Businesses should consider factors such as talent availability, infrastructure, regulatory environment, and sector-specific incentives when selecting a location.

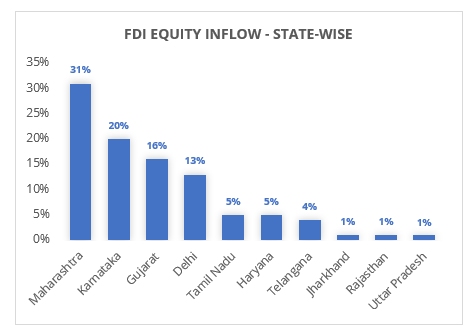

States like Maharashtra, Karnataka, Gujarat, Delhi, and Tamil Nadu consistently lead in attracting FDI, driven by strong infrastructure, policy support, and industry-specific ecosystems. Emerging states are also gaining traction as investors diversify into new geographies.

GIFT City: India's Emerging Global Financial Hub

Located in Gujarat, the Gujarat International Finance Tec-City (GIFT City) is India's first operational International Financial Services Centre (IFSC). Designed to compete with global financial hubs like Dubai and Singapore, GIFT City offers world-class infrastructure and a business-friendly environment. Regulated by the International Financial Services Centres Authority (IFSCA), it provides simplified regulations and significant tax incentives, including a 100% income tax exemption for 10 consecutive years out of 15 years of operation. Home to international exchanges, banks, and fintech firms, GIFT City is rapidly positioning itself as a preferred destination for global financial services.

Emerging State Incentives

Andhra Pradesh: Launched the Semiconductor & Display Fab Policy 2024–29 offering significant financial incentives and customized incentives to promote electronics manufacturing6.

Gujarat: At the Vibrant Gujarat Global Summit 2024, the state signed 41,299 MoUs amounting to ₹26.33 lakh crore in investments. The summit saw participation from 28 partner countries and 14 organizations, focusing on sectors like semiconductors, green hydrogen, e-mobility, renewable energy, and space technology7.

Maharashtra: In March 2025, Maharashtra proposed a New Industrial Policy targeting ₹40 lakh crore in investments and 50 lakh jobs over five years. The state also announced sector-specific policies (gems and jewellery, electronics, space, circular economy), INR 6,400 crore incentive package, development of logistics hubs, and plans to expand Mumbai Metropolitan Region into a global growth hub8.

Taxation Regulations

India's taxation system can be broadly divided into direct taxes and indirect taxes.

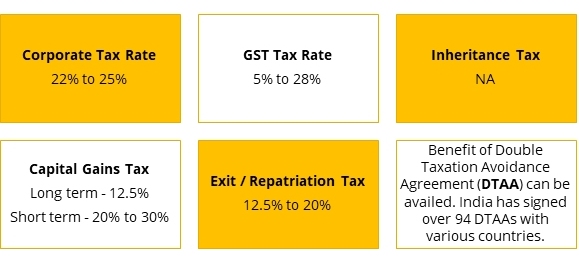

- Direct Taxes are governed by the Income-tax Act, 1961, covering corporate, personal, and related tax regulations. Corporate tax rates generally range between 22% and 25%, while the highest personal income tax rate is around 30% to 35%.

- Indirect Taxes are primarily streamlined under the Goods and Services Tax (GST), a unified tax structure with rates ranging from 5% to 28%, applied based on the nature of goods and services. The average GST rate in India has come down to approximately 11.6% by the end of the fiscal year 2023–249.

Key considerations:

Note: Tax rates mentioned above exclude applicable surcharge and health & education cess.

India's tax and compliance systems have been significantly modernised through digital-first reforms. The average processing time10 for tax refunds has dropped from over 26 days in FY 2021–22 to 16 days in FY 2022–23, with plans underway to reduce it to just 10 days. This has been made possible by faceless assessments, which eliminate personal interaction and ensure transparency through anonymous, tech-driven verification.

Alongside this, the government is accelerating digitalisation of approvals, reducing paperwork, and boosting MSME support through credit guarantees, simplified GST compliance, and online onboarding.

Infrastructure in India

India's infrastructure is rapidly evolving, serving as a key enabler of economic expansion and global competitiveness. With large-scale investments and strategic reforms, the country is strengthening its foundations across transport, digital, energy, and urban development.

Logistics infrastructure

Air: India's aviation sector is among the fastest-growing globally. The Airports Authority of India manages 133 airports, including 35 with international operations. Key global gateways include Delhi, Mumbai, Bengaluru, Hyderabad, and Chennai. The government is investing ₹92,000 crore in airport infrastructure, focusing on constructing new airports and expanding existing ones. Further, the Bharatiya Vayuyan Adhiniyam, 2024 is the new aviation law in India, which replaces the Aircraft Act of 1934, aiming to modernize India's aviation sector by aligning it with contemporary needs and global standards.

Rail: Indian Railways operates over 126,000 km of track with daily services of 13,500 passenger and 9,100 freight trains. In 2024, passenger connectivity was bolstered with the rollout of 136 Vande Bharat trains and the launch of the first Namo Bharat Rapid Rail, alongside 21,513 special trains during peak demand. Freight performance hit a new high with 1,473 million tonnes loaded—up 3.86% year-on-year—supported by over 72,000 train runs on the Eastern and Western Dedicated Freight Corridors.

Road: India's 6.67 million km road network is the second largest in the world, handling 60% of freight and 87% of passenger traffic. Major initiatives like Bharatmala and PMGSY are enhancing connectivity and expressway development. The Indian government has allocated INR 2.78 lakh crore to the Ministry of Road Transport and Highways for the fiscal year 2024–25.

Ports & Waterways: With 14,500 km of navigable waterways, India is promoting inland and coastal shipping through the Sagarmala Project. Key ports include JNPT, Chennai, Visakhapatnam, and Paradip.

Digital Infrastructure: Under the Digital India program, the country has built a robust digital backbone—expanding broadband, digital payments, and 5G rollout. Programs like BharatNet and growing data center infrastructure support India's digital economy vision.

To further streamline the investment and regulatory landscape, India has introduced the National Single Window System (NSWS) — a digital platform launched by the Ministry of Commerce and Industry in 2021. NSWS enables businesses to identify, apply for, and track various approvals required from both 32 Central Departments and 29 State Governments through a unified online interface.

Energy Infrastructure: India has made significant strides in power generation and renewable energy, targeting 500 GW of non-fossil capacity by 2030. The Green Energy Corridor and solar/wind expansion reinforce energy security and sustainability.

Urban & Industrial Infrastructure: Initiatives like Smart Cities, AMRUT, and Industrial Corridors are modernizing urban landscapes and boosting manufacturing. Logistics parks, SEZs, and plug-and-play zones improve ease of doing business and supply chain strength.

Labour law reforms in India: India has undertaken a significant overhaul of its labour law framework to create a more flexible, secure, and globally aligned employment environment. India has signed Social Security Agreements (SSAs) with 20 countries including Germany, France, Australia, Japan, and Brazil.

Challenges and Risks

While India presents immense opportunities, businesses must navigate a few inherent challenges to succeed:

- Regulatory Complexity: India's legal and regulatory landscape can be intricate, with multiple layers of approvals and compliance obligations.

- Infrastructure Gaps: Despite improvements, logistics, power supply, and transport infrastructure can pose operational hurdles in certain regions.

- Diverse State Regulations: Business rules, taxes, and incentives often vary significantly between states, requiring localized strategies.

- Judicial Delays: Legal resolution, particularly in civil and commercial matters, can be time-consuming, though ongoing reforms are streamlining dispute resolution mechanisms.

A well-structured compliance strategy, combined with experienced local advisory support, can effectively mitigate these risks and ensure smoother operations.

Tips for Success in India

To optimize your business entry and operations in India, consider the following best practices:

- Choose the Right Entry Structure: Select the most suitable vehicle—liaison office, branch office, joint venture, or wholly-owned subsidiary—based on your strategic objectives.

- Engage Experienced Local Advisors: Legal, tax, and regulatory experts with local knowledge can help navigate complexities and ensure compliance.

- Establish Robust Compliance Systems: Given evolving regulations, having a clear internal compliance framework reduces operational risk and ensures business continuity.

- Leverage Government Schemes: Initiatives like Make in India, Startup India, Digital India, and PLI (Production-Linked Incentives) offer valuable incentives and support for investors.

Conclusion

India is rapidly cementing its position as a global business hub—powered by economic growth, demographic advantage, digital transformation, and policy reforms. While challenges exist, they are increasingly manageable with the right planning and partners. Businesses that enter India with cultural sensitivity, regulatory awareness, and a long-term vision stand to gain substantially.

With the right approach, India isn't just a market to enter—it's a market to lead.

Footnotes

1. https://dpiit.gov.in/publications/fdi-statistics

2.https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2003540#:~:text=India%20ranks%2063rd%20in%20the ,a%20span%20of%205%20years.

3. https://livingcost.org/cost/china/india

4. https://www.statista.com/statistics/254469/median-age-of-the-population-in-india/#:~:text=The%20median%20age%20in%20India ,47.8%20years%20old%20by%202100.

7. https://en.wikipedia.org/wiki/2024_Vibrant_Gujarat_Global_Summit#cite_note-12

10. https://taxonation.com/index.php/show-detail-news/1167474/common

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.