- within Corporate/Commercial Law and Criminal Law topic(s)

- with readers working within the Law Firm industries

Merchanting trade, more popularly known as 'intermediary trade', is a common trading model yet becoming increasingly difficult for government agencies to digest and accept as a genuine business. Recent times have seen several huge business houses shut down their merchanting trade verticals owing to regulatory, tax, and legal pressures. This article attempts to analyze the different facets of merchanting trade, and the instrumentalities involved viz., bills of lading and letters of credit.

I. What is Merchanting Trade?

Merchanting trade is a trade which involves purchase of goods by an Indian company from a person located in another country (say, Country A) and sale of the very same goods to a purchaser located in another country (say, Country B), without the goods physically entering India. In merchanting trade, the goods move directly from Country A to Country B.

Commission earned, title in goods, and possession: The margin earned by the merchanting trader in this purchase and sale of goods is also referred to as 'commission' in some foreign jurisdictions. However, this terminology is a misnomer and does not, in any way, mean that the merchanting trader is a mere service provider in the transaction and is not buying and selling the underlying goods. The merchanting trader gets a title in the underlying goods being traded, albeit for a very short period of time. In trade parlance, this is also referred to as flash title. In an MT trade, the merchanting trader never takes physical possession of the goods as the underlying goods, rather the goods are sold and purchased using documents and only constructive possession (through such documents) is with the merchanting trader.

II. Rationale behind merchanting trade

Confidentiality and parties' identities: There are multiple commercial reasons why MT trade is undertaken. Firstly, the actual buyer of goods may not want to disclose his financial capability and share confidential documents with the supplier of goods. This apprehension may arise if the supplier is in similar line of business and is a competitor of the buyer. In such scenarios, using a merchanting trader helps the buyer to purchase the goods while also maintaining confidentiality and not having to disclose its identity to the seller of goods.

Financial capabilities of the merchanting trader: Secondly, a buyer may negotiate the contracts with the intermediary stage by stage, i.e., it can first obtain prices, quotes, payment terms and even an offer to consider before entering into a contract. On the other hand, a seller may make immediate demands regarding the financial capabilities and may seek upfront payment before the goods are even shipped. Thus, presence of a merchanting trader with strong financial capabilities is justified.

Knowledge of locales and geographies: Thirdly, language barriers, knowledge and understanding of safe trading practices, knowledge about local customs, jurisdictional procedures and regulations are also good reasons why merchanting traders exist in international trade. Also, merchanting traders would simply exist in international trade owing to their business relationships and having access to various geographies where sellers in one country might not have access to buyers in another country.

Bridging gaps between the financial expectations of the buyer and seller: Lastly, international trade is generally volatile and prone to multiple risks. Further, the size of purchase and sale transactions are also quite substantial and may run into multiple crores for single trade. Since credit from banks is often based on the personal lending policies of each bank (which may be complicated or time-consuming), a buyer may find it difficult to get loan approval in anticipation of a future buying opportunity, which may or may not arise. Considering the time lag in getting loan approvals, the buyer may end up losing the opportunity by the time the credit is sanctioned. In these cases, a merchanting trader with sound financial capability becomes very useful to the buyer. Thus, merchanting traders fulfil the gap between the financial expectations of the buyers and sellers in contracts relating to the traded goods.

III. How is Merchanting Trade carried out?

Passing of title through bills of lading: Under Indian law as well as in international trade law, bill of lading is recognized as a title document. In simple terms, it is understood that whoever possesses the bill of lading is considered the owner of the goods. It is also well accepted that the title in goods can be transferred from one person to another by way of endorsement of bill of lading by one person to another. In MT trade, the title in the goods may also pass from the seller to the merchanting trader and from the merchanting trader to the buyer by way of endorsement of bill of lading.

Multiple intermediaries or parties involved: Further, in a merchanting trade, multiple intermediaries can be involved in a single trade. For example, supplier/manufacturer of goods in Country A may transfer the goods to a selling agent in Country A. Such selling agent may sell the same goods to a merchanting trader in Country B, who in turn may sell the goods to another merchanting trader located in Country C. The merchanting trader in Country C may sell the goods to a buying agent in Country D, who would in turn transfer the goods to end-buyer/consumer in Country D. In this example, the transactions between merchanting traders located in Country B and C is valid even though neither of them is actual supplier/manufacturer or actual end-buyer/consumer of the goods.

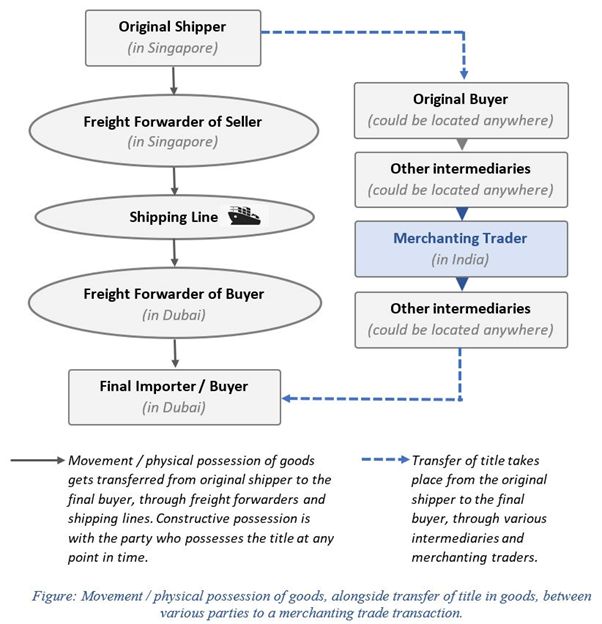

The parties involved, movement of goods, chain of custody, flow of title in the goods as discussed above can be better understood with the help of the diagram below:

Movement / physical possession of goods: The goods will first be handed over by the original seller to its freight forwarder for transportation. The freight forwarder may also be given the responsibility of inland transportation of goods, along with responsibility of transportation of goods by sea. Thereafter, freight forwarder in Singapore will hand over the custody of the goods to the shipping line, who will actually undertake the transportation of the goods from Singapore to Dubai. The shipping line will issue a Master bill of lading signifying that the goods have been loaded on to the ship. At this point, once the goods reach Dubai, the shipping line will hand over the goods to whoever presents the bill of lading endorsed in his favour.

Transfer of title in the goods amongst various parties: In the diagram above, the title in the goods will be transferred directly between the original shipper and the end buyer if there are no merchanting traders involved in the transaction. However, if merchanting traders are involved in the transaction, then the title in the goods will be transferred from the original seller to the MT intermediary and ultimately to the end buyer of goods. The title in the goods will be transferred by way of endorsement of bill of lading.

IV. Payments and charges in Merchanting Trade

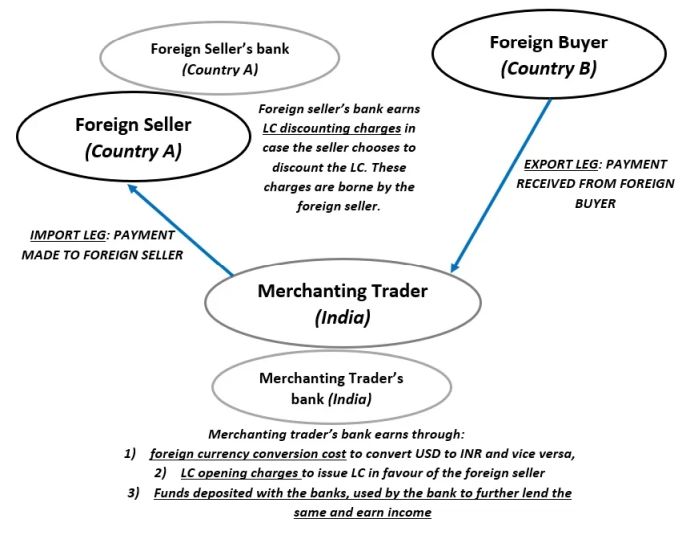

Import leg and export leg: MT involves the purchase of goods by an Indian company from a person located in another country (say, Country A) ('import leg') and sale of the very same goods to a purchaser located in another country (say, Country B) ('export leg'), without the goods physically entering India. In MT trade, the goods move directly from Country A to Country B. The payment flow and the financial costs (bank charges) involved are briefly summarized below.

Import leg

Foreign currency purchase cost: Generally, the payment to the foreign seller is required to be made in foreign currency (say, USD). As such, the merchanting trader would have to incur a cost to purchase the foreign currency from the bank.

LC opening charges: In case the payment is being made through a credit route e.g. using a Letter of Credit ('LC'), the merchanting trader would need to pay LC opening charges to its bank in India, which would then open the LC and issue the same in favour of the foreign seller.

LC discounting charges: In case the foreign seller chooses to discount the LC, it would approach its bank in its own country and discount the same. The foreign seller would need to pay LC discounting charges to its bank. Whether discounting is to be done (to receive the payment instantly) or not (in such case the foreign seller would have to wait for the entire credit period) is fully a decision of the foreign seller. The LC discounting charges are also borne by the foreign seller.

Export leg

Foreign currency sale cost: If the payment from the foreign buyer is received in foreign currency, the merchanting trader would have to sell the same to its bank in order to receive the payment in INR, and the merchanting trader would have to bear the cost / charges involved in the said sale.

LC discounting charges: As explained above, in case the foreign buyer gets an LC issued in favour of the merchanting trader, the trader might choose to get the same discounted to receive and early payment. These charges would be borne by the merchanting trader.

Funds deposited with the banks: In cases where the merchanting trader receives payment for the export leg in advance, he may choose to place these funds with the banks. The bank, having taken the deposit of such amounts and its primary business being that of earning through lending would utilize these funds for its own business purposes, thereby earning income through such amounts.

V. Significance of Bills of Lading

Legal provisions regarding bills of lading: In India, the basic law governing sale and purchase of goods is the Sale of Goods Act, 1930. Section 2(4) of the Sale of Goods Act, 1930 defines 'document of title to goods' to include bill of lading. In other words, the Sale of Goods Act, 1930 recognizes that bill of lading is a title document and the property in the goods can be transferred by way of endorsement.

Further, the Bills of Lading Act, 1856 also specifies that the endorsee of a bill of lading in whose favor the bill of lading has been endorsed shall have rights like right to sue (Section 1). Further, the said Act also provides that the bill of lading in favor of a bona fide consignee shall be conclusive evidence of such shipment against the master or the person signing the same, even though the goods may not have been so shipped (Section 3).

What does a BL signify?: Thus, from the above legal provisions and authoritative textbooks, it is clear that in a cross-border trading transaction like MT trade, the bill of lading is critical. A bill of lading basically signifies the following:

- That the goods have been received by the shipping line.

- That there is a valid contract of carriage contract between the shipper and the carrier.

- That the person who possess the bill of lading in his favour is the owner of the goods i.e., he has the title in the said goods. In other words, bill of lading signifies the ownership in the goods. The buyer who is mentioned as a consignee in the bill of lading requires this document to receive the goods from the shipping line at the port of destination.

Types of Bills of Lading: There are various types of bills of lading used in international trade. The types of bills of lading vary mainly due to different contractual terms with the shipper. Some of the type of bill of lading are discussed below:

- Master Bill of Lading: A Master Bill of Lading (MBL) is issued by the carrier (ship owner or operator) and represents the contract of carriage between the shipper and the carrier. It's important to note that the cargo shipper will only receive a Master Bill of Lading if they are working directly with a mainline carrier. The MBL is one of the most reliable documents in maritime transportation because it is printed and signed by the carrier, and once the carrier confirms that it's received the cargo, the MBL is released to the entity who made the booking. This can either be the shipper of the goods or its freight forwarder who has made the booking with the shipping line on its behalf.

- House Bill of Lading: A House Bill of Lading (HBL) is a B/L issued by an Ocean Transport Intermediary such as a freight forwarder or non-vessel operating company (NVOCC) and is issued to the supplier once the cargo has been received. ?The HBL is an essential document in shipping as it's the formal acknowledgment of the receipt of goods being shipped.

Difference between a Master BL and House BL: The main difference between the HBL and MBL is that an HBL is issued by an NVOCC or freight forwarder and usually lists the actual shipper and consignee, whereas the MBL is issued by the carrier. Both the HBL and MBL contain the same accurate, precise, and detailed information about cargo (the number of containers, seal numbers, weight, measurements, etc.). It's also worth noting that the shipper, consignee and notify party are the main details that will be different in the HBL and MBL.

Amendment of Bills of Lading is routinely done: It is quite common to amend a bill of lading already issued by the shipping liner, depending upon the changes in the transaction. The amendment can be done to change/modify the shipment description and certain information such as to the condition of the cargo, payment terms, place and date of loading, Incoterms, etc.

Issuance of fresh BLs and Switch BLs: Further, in international trade, the concept of issuing fresh bills of lading is quite common. In the book titled 'Bills of Lading' by Richard Aikens, Richard Lord and Michael Bools, the authors explain the rationale for issuance of switch bills of lading, in the following words:

Splitting / cancelling / "switch" bills

3.131 A party to a bill of lading may wish to cancel it or "split" or "switch" it or issue a new bill of lading or set of bills of lading. Where it is anticipated in advance that this may occur, provision for it can be made in the relevant charter. Reasons for such an occurrence may include the fact that the bill of lading holder wants to change the identity of the receivers and/or the quantities each will receive as a result of a commercial transaction concluded after shipment, that two parcels of cargo are consolidated or blended, that the cargo is discharged and reloaded other than at the original loadport or that the buyer and reseller wants to hide from his purchaser the identity of the original supplier and shipper of the goods, as in The Atlas. There is no reason in principle why this should not be done provided that there is agreement between all those parties to the bill of lading contract and that it does not affect adversely parties who may have relied on representations in the bill of lading. So, for example, in Finmoon v Baltic Reefers218 the parties, for reasons of convenience, cancelled (straight) bills issued at the loadport and had them reissued at the discharge port. This was regarded by the court as legitimate and unexceptional.

VI. Role of Letters of Credit

The problem of payment assurance: In international maritime trade, the 'letter of credit' provides an effective assurance of payment from a financially responsible third party. For example, an electronics seller located in Japan may have an apprehension that the overseas buyer, say Walmart in US will refuse to pay once the goods have been shipped. Cross-border transactions magnify the concern because the difficulties of litigating in a distant forum will hinder the manufacturer's efforts to force the distant buyer to pay.

LC provides the payment assurance: The manufacturer-seller in Japan solves that problem by obtaining a letter of credit from a reputed bank. A reputed bank is unlikely to default on its obligation to pay the seller, and the seller knows that it has an absolute right to payment once it ships the goods - conditioned only on the seller's presentation to the bank of the specified documents (typically the invoice, a packing list, an insurance certificate, and a transport document such as a bill of lading). Thus, the seller is rest assured that it will be paid even if the buyer does not voluntarily pay.

Banks vouch for their customers by issuing LCs: There are two more justifiable reasons why letters of credit are used in international trade. Firstly, when issuing letters of credit, the issuing banks effectively vouch for their customers on whose behalf the letters of credit have been issued. The banks risk their reputation for their customers when they give assurance to foreign seller. Thus, looked at from this perspective, it can be said that the issuing banks thoroughly examine the documents relating to the transaction and vouch for their authenticity when issuing the letter of credit. In other words, the issuance of a letter of credit, signifies that the buyer of the goods will voluntarily pay for the goods even if there are certain discrepancies at the end of the seller.

Banks verify transactions while issuing the LCs: Secondly, the issuance of the Letter of Credit also indirectly verifies the authenticity of the cross-border sales transaction. In simpler words, letters of credit also serve as a verification institution. The local government or a trader may use a letter of credit as an indirect device for limiting the risk of loss from fraudulent or illegal transactions by taking advantage of the superior information available with the beneficiary i.e. foreign sellers' bank. With a letter of credit, the government also obtains an indirect verification of the legitimacy of the transaction because the local bank often would not take the risk of participating in a transaction that seemed likely to involve any illegal transfer of funds. Thus, by the use of letters of credit, the government's law enforcement agenda is also advanced considering the banks involvement in the transaction. In fact, in some Latin American countries in the past, there was a specific mandate that the cross-border transactions had to be compulsorily done using letter of credit.

Interplay between BLs and LCs: In a situation where relationship between the trading parties is new and there is lack of mutual trust, the seller would naturally always want that the payment is in advance or a comfort in the form of letter of credit be issued before he endorses the bill of lading in favour of the buyer. On the other hand, if there is a long-standing business relationship and trust between the parties, the seller may agree to endorse the bill of lading in favour of the buyer while the Letter of credit may be issued subsequently. Thus, endorsing the bill of lading in favour of the buyer only implies that the seller trusts the buyer and has transferred the title in the goods without getting the payment or a comfort for such payment. This is perfectly justifiable in recurring transactions or long-standing business relationships.

January 31, 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.