Abhirup Dasgupta’s articles from HSA Advocates are most popular:

- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- in United States

HSA Advocates are most popular:

- within Intellectual Property, Tax and Corporate/Commercial Law topic(s)

- with readers working within the Law Firm industries

STATUTORY UPDATES

Insolvency and Bankruptcy Board of India (Model Bye-Laws and Governing Board of Insolvency Professional Agencies) (Second Amendment) Regulations, 2022

- In exercise of the powers conferred by Clause (t) of

Sub-Section (1) of Section 196 read with Section 240 of the

Insolvency and Bankruptcy Code, 2016 (31 of 2016)

(IBC), the Insolvency and Bankruptcy Board of

India (IBBI) on October 31, 2022 notified the

following amendments into the IBBI (Model Bye-Laws and Governing

Board of Insolvency Professional Agencies) Regulations, 2016

(Principal Regulations):

- Substitution of the existing Sub-Regulation (3) of Regulation 7 of the Principal Regulations with the following: '(3) The compliance officer shall submit to the Board, a compliance certificate annually in the format issued by the Board, verifying that the insolvency professional agency has complied with the provisions referred to in Sub-Regulation (1): Provided that the annual compliance certificate shall also be signed by the managing director of the insolvency professional agency.'

- Insertion of the following Sub-Clause (3), in Clause 6 (Duties

of the Agency) of the Schedule to the Principal Regulations:

'(3) The Agency shall:

- Facilitate receipt of relationship disclosures from its professional members in accordance with Insolvency and Bankruptcy Board of India (Insolvency Professionals) Regulations, 2016

- Disseminate the above-mentioned disclosures on its websites, within three-working days of the receipt of the same

- Ensuring receipt of confirmation from its professional members to the effect that every other professional has been made at arm's length relationship.'

- The amendment further provides a table of Disclosure of Relationship by an Insolvency Professional, which has to obtained by the IP Agency under Sub-Clause (3) of Clause 6.

- An explanation to Clause 23A of the Schedule (Suspension of authorization for assignment) has been inserted, the same states that 'A disciplinary proceeding shall be considered as pending against the professional member from the date he has been issued a show cause notice by the Agency or the Board, as the case may be, till its disposal by the Disciplinary Committee of the Agency or the Board, as the case may be.'

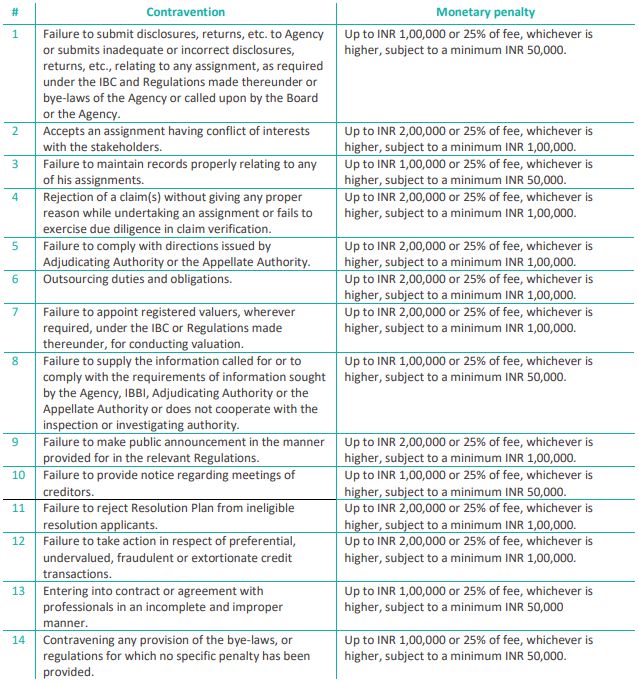

- Further, in Sub-Clause (2) of Clause 24 (Orders that may be passed by the Agency with regards to its Disciplinary Policy), under item (d) (Imposition of monetary penalty), amendments have been brought to the monetary penalty for contravention of the various procedures laid down by way of the Principal Regulations and subsequent amendments:

Review of Regulations

- In order to facilitate the Insolvency Professionals

(IP) to carry out process under the IBC, the IBBI

vide Circular dated November 09 2022, rescinded certain amendments

which were notified by the IBBI from time to time in exercise of

powers provided under Section 196 of the IBC. The purpose for

rescinding the amendments is that these amendments were not

required in the first place and were deemed to be understood basis

the existing regulations. The particulars of the previous

amendments which now stand rescinded by virtue of the present

circular are as under.

- Vide Circular dated January 3, 2018, the IBBI incorporated the Clause 15A of 'Code of Conduct' specified in First Schedule to IBBI (Insolvency Professionals) Regulations, 2016 (IP Regulations) requiring an IP to prominently state in all his communications, whether by way of public announcement or otherwise to a stakeholder or to an authority, his name, address, email, Registration Number etc.

- Vide Circular dated January 3, 2018, the IBBI incorporated the Clause 27A and 27B of 'Code of Conduct' specified in First Schedule to IP Regulations directing IPs to exercise reasonable care and diligence and take all necessary steps to ensure that the corporate person undergoing any process under the Code complies with the applicable laws. The Circular further clarified that any loss, including penalty, if any, because of non-compliance of applicable laws, shall not form part of IRPC or liquidation process cost under the Code and that IP will be responsible for the non- compliance of applicable laws if it is because of his conduct.

- Vide Circular dated January 3, 2018, the IBBI directed IPs to not outsource any of his duties and responsibilities under the Code as already covered under Regulation 7 (2) (bb) of IP Regulations.

- Vide Circular dated January 16, 2018, the IBBI incorporated the Clause 25B, 25C and 26A of 'Code of Conduct' specified in First Schedule to IP Regulations clarifying that an IP shall render services for a fee which is a reasonable reflection of his work, raise bills/invoices in his name towards such fees, and such fees shall be paid to his bank account and that Any payment of fees for the services of an IP to any person, other than the IP, shall not form part of the IRPC. Also, any other professional (such as registered valuer) appointed by an IP shall raise bills/invoices in his/its name towards such fees, and such fees shall be paid to his/its bank account.

- Vide Circular dated January 16, 2018, the IBBI incorporated the Clause 8A, 8B, 8C and 8D of 'Code of Conduct' specified in First Schedule to IP Regulations directing IPs and every other professional appointed by the IP and Clause 6(3) in the Schedule to the Model Bye Laws Regulations. It directed IPs and every other professional appointed by an IP for a resolution process to make certain disclosures to the IPA of which he is a member within a stipulated timeframe. Further, it requires IPA to facilitate receipt of the disclosures and disseminate such disclosures on its website within stipulated timeframe.

- Vide Circular dated January 16, 2018, the IBBI directed IPs whether acting as IRP , RP or Liquidator, except to the extent provided in the Code and Rules, Regulations or Circulars issued thereunder, (i) to keep every information related to the processes confidential; and (ii)not to disclose or provide access to any such information to any unauthorised person.

- Vide Circular dated May 2, 2019, the IBI declared the issue of temporary surrender to be redundant with the introduction of authorization of agreement advising IPAs to not ordinarily accept temporary surrender of professional membership, where the IP is conducting a process under the Code. Certain forms were stipulated. In this regard, the Board has issued clarification dated April 11, 2022

- Vide Circular dated April 19, 2018, the IBBI issued Stipulations regarding annual compliance certificate to be submitted by IPAs to IBBI. However, the Circular was rescinded and the IBBI issued a revised Circular dated November 2, 2022 containing the format of annual compliance certificate aligning with latest Regulations.

- Vide Circular dated July 28, 2021, the IBBI, in light of amendment to Clause 24(2)(d) of the schedule to the Model Bye-Laws Regulation, issued directions upon IPAs to amend their Bye- laws to provide for the maximum and minimum monetary penalty, in stipulated circumstances.

- Vide Circular dated April 23, 2018, the IBBI inserted explanation to the Clause 23A of the schedule stipulated in the Model Bye-Laws Regulations clarifying that (i) a disciplinary proceeding is considered as pending against an IP from the time he has been issued a show cause notice by IBBI till its disposal by the disciplinary committee; and (ii) an IP who has been issued a show cause notice shall not accept any fresh assignment as IRP, RP, Liquidator, or a bankruptcy trustee under the Code.

- Vide Circular dated September 7, 2019, the IBBI, with respect to amendment to Regulation 21(2)(c)(ii) of IU Regulations, approved the MCA 21 database of the Ministry of Corporate Affairs and the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI) registry for the purposes of Regulation 21(2)(c)(ii) of IU Regulations.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.