- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- with readers working within the Law Firm industries

- within Privacy, Employment and HR and Insurance topic(s)

Introduction

In a strategic push to streamline operation and boost efficiency in India's alternative investment ecosystem, the Securities and Exchange Board of India ("SEBI"), on September 09, 2025 has notified the SEBI (Alternative Investment Funds) (Second Amendment) Regulations, to the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012 ("AIF Regulations") to permit Category I and Category II Alternative Investment Funds ("AIFs) to facilitate co-investments via dedicated Co-Investment scheme ("CIV scheme") within AIF Regulations. This acts as an addition to the already existing co-investment pathway through Portfolio Managers under SEBI (Portfolio Managers) Regulations, 2020 ("PMS Route"). This circular shall come into force with immediate effect.

The amendment to the AIF Regulation catalyses enhanced capital deployment, streamlined deal-making, and potentially high returns for sophisticated investors. This development signals new avenues for businesses, corporations, and investors to amplify exposure in high-potential assets while mitigating risks.

What are Alternative Investment Funds?

AIFs refer to any funds established or incorporated in India as a trust, a company, a limited liability partnership, or a body corporate. It is a privately pooled investment vehicle that collects funds from investors, whether Indian or Foreign and invests them according to a defined investment policy for the benefit of its investors. AIFs are not covered under the SEBI (Mutual Funds) Regulations, 1996, the SEBI (Collective Investment Schemes) Regulations, 1999 or any other SEBI regulations for fund management activities.1

The following categories are not considered as AIFs: family trusts set up for the benefit of relatives as defined under the Companies Act, 2013; ESOP trusts established under SEBI (Share Based Employee Benefits) Regulations, 2014; ESOP trusts established under SEBI (Share Based Employee Benefits) Regulations, 2014, or permitted under the Companies Act; employee welfare or gratuity trusts; holding companies as defined under the Companies Act, 2013; other special purpose vehicles not set up by fund managers, including securitisation trusts regulated under specific frameworks; funds managed by securitisation or reconstruction companies registered with the Reserve Bank of India ("RBI") under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and any other fund pools directly regulated by another regulator in India.2

Enhancing Ease of Doing Business in AIFs

At its core, the framework builds on SEBI's objective to simplify operations for AIFSs, enabling them to launch CIV schemes within their existing structures. The dual route flexibility allows managers of AIFs to make co-investments for an investor in an investee company, either through the PMS or CIV schemes.

Applicability

The Circular permits Category I3 ( which invests in start-up or early-stage ventures, social ventures, or SMEs, social impact funds, or infrastructure funds) and Category II (those who are not included in Category I and Category III, and which do not undertake leverage or borrowing to meet day-to-day operational requirements)4 AIFs will launch a separate CIV scheme within the AIF Regulations to offer a co-investment facility to only "accredited investors."

Introduction to CIV Scheme

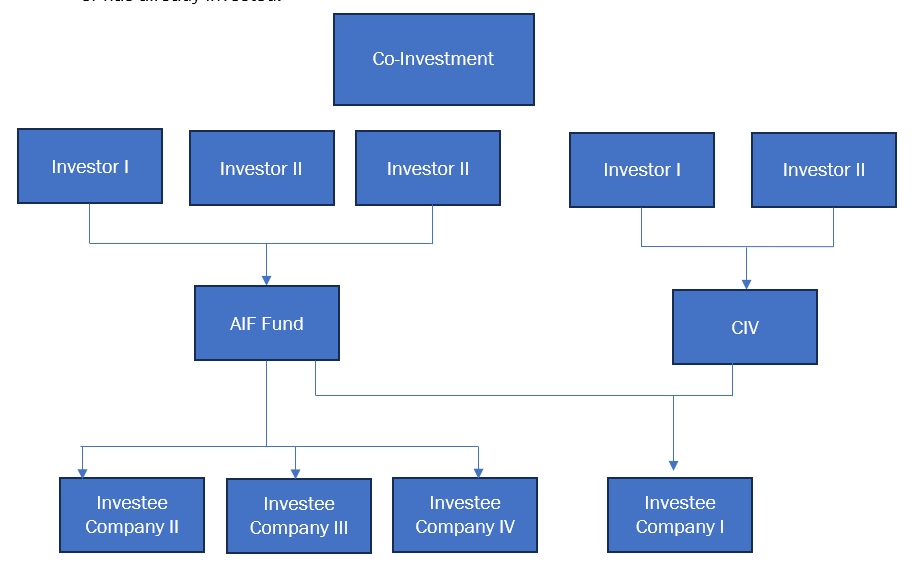

A co-investment scheme facilitates investors of a particular scheme of an AIF to invest in unlisted securities of an investee company in which the AIF is either making an investment or has already invested.5

Comparative Analysis

The following table outlines key distinctions between the PMS route and the newly introduced CIV scheme under the AIF framework. This comparison is intended to guide institutional investors, fund managers, and strategic stakeholders in evaluating the optimal route for co-investment based on regulatory structure, investor eligibility, governance, and operational flexibility.

|

Particulars |

PMS scheme |

CIV scheme |

Impact |

|

Regulatory Framework |

SEBI (Portfolio Managers) Resolutions, 2020.6 |

SEBI (Alternate Investment Funds) Resolutions, 2012.7 |

Regulatory oversight differs significantly, impacting compliance obligations and reporting structures. |

|

Eligible investors |

Investment under the PMS route is made by the fund managers on behalf of the investors for which minimum requirement is INR 50 Lakh8 under Discretionary and/or non-discretionary funds management services. |

Under the CIV scheme, Category I and II AIFs can offer investment facilities to accredited investors only.9 |

The CIV route narrows the investor base. Only a sub-category of AIF Investors will be allowed to co-invest in the investee companies. |

|

Investment under the schemes |

The investors invest in companies via the funds managed by the Portfolio Managers. |

AIF Managers must create a separate co-investment scheme for investors to invest in their investee company.10 |

CIV introduces an additional setup. The AIF Managers shall start a separate scheme through which co-investments will occur, which was not a requirement earlier. |

|

Reports for Corporate Governance |

Portfolio Manager boards should submit a periodical compliance report to SEBI showing that investors' interests are protected.11 |

The Managers of AIF shall file a shelf placement memorandum ("SPM") relating to co-investments, governance structure framework for co-investments to SEBI.12 All the co-investments shall be made by different bank accounts and demat account following a ring-fenced method. |

CIV mandates enhanced governance and segregation of funds, reducing operational risk and improving investor confidence. |

|

Terms of exit |

The terms and timing of exit under an investee company's investment shall be identical to the terms of exit of the AIF.13 |

The timing of the co-investor's exit from the investee company shall be identical to that of the scheme of AIF in the investee company.14 |

CIV exit synchronisation may affect liquidity planning and exit strategy alignment for corporate entities managing multiple investor classes. |

|

Winding up timeline |

Treated as AIF winding-up when co-investors exit proportionately. |

The CIV Scheme shall wind up on exit from the co-investment under the SEBI (AIF) Regulations 2025. |

Winding up for co-investors has been regulated by the SEBI (AIF) Regulations 2025, while under the PMS Route, the same was treated as a wind-up by the AIF. |

|

Restrictions |

Restrictions through the PMS scheme were not imposed on categories of investors (like angel investors). |

No indirect investments that could not have been made directly under the CIV Scheme are allowed, including not receiving funds from any prohibited category of investors. |

The CIV scheme permits investments only through eligible investors who were permitted to invest through direct channels, enforcing stricter eligibility. |

|

Expenses |

Expenses incurred by the Portfolio Manager are borne directly by the client.15 |

Any co-investment expenses shall be shared proportionately between the AIF and CIV Scheme, in the respective ratio of their investments.16 |

CIV introduces cost-sharing models, impacting fund accounting and necessitating transparent expense allocation mechanisms for corporate fund managers. |

|

Investment Restriction |

No such investment restrictions in the categories are defined. |

CIV schemes have a capped investment of up to 3 times, except for categories in Multilateral or Bilateral Development Financial Institution, sovereign wealth banks and Central Banks. |

CIV imposes investment caps, requiring businesses to reassess capital deployment strategies and prioritise eligible institutional partners for larger exposures. |

Key Takeaway: Strengthening Investor Access and Governance

In response to global market expansion and the growing demand within India's fund management sector, co-investment opportunities have been integrated into the AIF framework.

For fund managers, the co-investment model offers a structured mechanism to scale investor engagement without diluting governance standards. The requirement to establish dedicated CIV schemes and submit shelf placement memoranda ensures operational clarity and regulatory compliance. Although current CIV schemes are limited to unlisted securities, regulatory evolution may soon expand their scope to include listed instruments, in line with existing permissions for Category II AIFs. For fund managers, this framework offers a structured and compliant pathway to broaden investor engagement without compromising governance standards.

As SEBI continues to refine the framework, stakeholders should view co-investments not just as a tactical tool, but as a strategic lever for long-term growth, innovation, and institutional credibility.

Footnotes

1. Regulation 2(b), Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012.

2. Regulation 2(b), Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012.

3. Regulation 3(4)(a) of the Securities and Exchange Board of India (Alternate Investment Fund) Regulations, 2012.

4. Regulation 3(4)(b) of the Securities and Exchange Board of India (Alternate Investment Fund) Regulations, 2012 defines "Category II Alternate Investment Fund"

5. Inserted by the Securities and Exchange Board of Inda (Alternative Investment Funds) (Second Amendment) Regulations, 2025

6. SEBI (Portfolio Managers) Resolutions, 2020 [Last amended on February 10, 2025]

7. SEBI (Alternative Investment Funds) Regulations, 2012 [Last amended on March 6, 2017]

8. SEBI Master Circular for Portfolio Managers dated Jun 07,2024

9. SEBI/HO/AFD/AFD-POD-1/P/CIR/2025/126

10. Inserted via Circular No SEBI/HO/AFD/AFD-POD-1/P/CIR/2025/126 dated Sep 09,2025

11. Regulation 5.2.2.1 SEBI/HO/IMD/IMD-POD-1/P/CIR/2024/80

12.Inserted via Circular No (2.2) SEBI/HO/AFD/AFD-POD-1/P/CIR/2025/126 dated Sep 09,2025

13. Inserted by the Securities and Exchange Board of India (Portfolio Managers) (Fourth Amendment) Regulations, 2021 w.e.f 08.12.2021.

14. Regulation 17 (8) inserted via SEBI/HO/AFD/AFD-POD-1/P/CIR/2025/126 dated Sep 09,2025

15. Schedule 4, clause 11, SEBI (Portfolio Managers) Regulations, 2020

16. SEBI (Alternate Investment Funds) (Second Amendment), Regulations, 202

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.