- with readers working within the Law Firm industries

- within Privacy, Accounting and Audit and Insurance topic(s)

- with Finance and Tax Executives

We are delighted to share this week's AKP Banking & Finance Weekly Digest. Please feel free to write to us with your feedback at info@akandpartners.in.

1. Regulatory Updates

1.1. India

Reserve Bank of India (RBI)

1.1.1. RBI issues notification to bring State and Central Co-operative Banks under the Reserve Bank–Integrated Ombudsman Scheme

The Reserve Bank of India ("RBI"), notified that State Co-operative Banks and Central Co-operative Banks will be covered by the Reserve Bank–Integrated Ombudsman Scheme, 2021 (RB-IOS, 2021) with effect from November 1, 2025; with this inclusion, the scheme now applies to all Commercial Banks, Regional Rural Banks ("RRBs"), State and Central Co-operative Banks, Scheduled and Non-Scheduled Primary (Urban) Co-operative Banks (UCBs) with deposits of at least INR 50 crore (Indian Rupees Fifty Crore only), all Non-Banking Financial Companies ("NBFCs") that either accept deposits or have a customer interface with assets of at least INR 100 crore (Indian Rupees One Hundred Crore only) excluding Housing Finance Companies, all System Participants, and Credit Information Companies ("CICs").

1.1.2. RBI releases draft Reserve Bank - Ombudsman Scheme, 2025

RBI has issued the draft Reserve Bank - Ombudsman Scheme, 2025 for consultation, proposing to replace the Reserve Bank - Integrated Ombudsman Scheme, 2021 and inviting public comments until October 28, 2025; the draft applies to Regulated Entities ("REs") including banks, NBFCs with stated exclusions, System Participants, and CICs, removes any cap on the claim amount while capping compensation for consequential loss at INR 30,00,000 (Indian Rupees Thirty Lakhs only) and for time, expenses and harassment at INR 3,00,000 (Indian Rupees Three Lakhs only), requires customers to first approach the RE and permits filing within 1 (one) year of the RE's last communication, sets a 10 (ten) day window for the RE's written response, provides advisory, settlement and award mechanisms with appeals available only to the complainant.

1.1.3. RBI issues draft Reserve Bank of India (Scheduled Commercial Banks - Capital Charge for Credit Risk – Standardised Approach) Directions, 2025

RBI issued for consultation the draft Reserve Bank of India (Scheduled Commercial Banks - Capital Charge for Credit Risk – Standardised Approach) Directions, 2025, to implement Basel reforms by the Basel Committee on Banking Supervision (BCBS) with effect from April 1, 2027; the draft tightens links between credit ratings and Probability of Default (PD), revises Credit Conversion Factors (CCFs) for off-balance sheet items, adds "transactors" to the regulatory retail class, and sharpens risk weights across corporates, Micro, Small and Medium Enterprises (MSMEs) and real estate while retaining examples such as 0 per cent (zero per cent) for Central Government and 20 per cent (twenty per cent) for State Government-guaranteed claims; a companion draft on Asset Classification, Provisioning and Income Recognition proposes an Expected Credit Loss ("ECL") framework with staging, prudential floors, limited capital impact, and a 5 (five) year glide path, with public comments due by November 30, 2025.

1.1.4. RBI drafts Reserve Bank of India (Scheduled Commercial Banks and All India Financial Institutions) - Asset Classification, Provisioning and Income Recognition Directions, 2025

RBI issued for consultation the draft Reserve Bank of India (Scheduled Commercial Banks and All India Financial Institutions) - Asset Classification, Provisioning and Income Recognition Directions, 2025, proposing a shift from the incurred-loss approach to an ECL regime with staging while retaining extant Non-Performing Asset (NPA) classification and updating income recognition including the Effective Interest Rate (EIR) method; applicability is to Scheduled Commercial Banks (SCBs) except RRBs, Small Finance Banks (SFBs) and Payments Banks with an effective date of April 1, 2027 for SCBs, and the framework embeds prudential floors using regulatory Probability of Default (PD), Loss Given Default (LGD) and Exposure at Default (EAD), forward-looking information, governance and model-risk controls, data and segmentation requirements, disclosures and transition arrangements, with the draft placed in the public domain for wider consultation.

1.1.5. RBI cancels Jijamata Mahila Sahakari Bank licence

RBI cancelled the licence of Jijamata Mahila Sahakari Bank Ltd., Satara, Maharashtra, after a prior cancellation was set aside on October 23, 2019 subject to a forensic audit for Financial Year 2013–14 that remained incomplete due to non-cooperation; citing inadequate capital and earning prospects and non-compliance with the Banking Regulation Act, 1949, and finding that continuance would be prejudicial to depositors and public interest, the bank is prohibited from conducting banking, the Registrar of Co-operative Societies, Maharashtra, has been requested to order winding-up and appoint a liquidator, and on liquidation each depositor will be entitled to insurance up to INR 5,00,000 (Indian Rupees Five Lakhs only) from the Deposit Insurance and Credit Guarantee Corporation (DICGC), with 94.41 per cent (ninety-four point four one per cent) of deposits covered as of September 30, 2024.

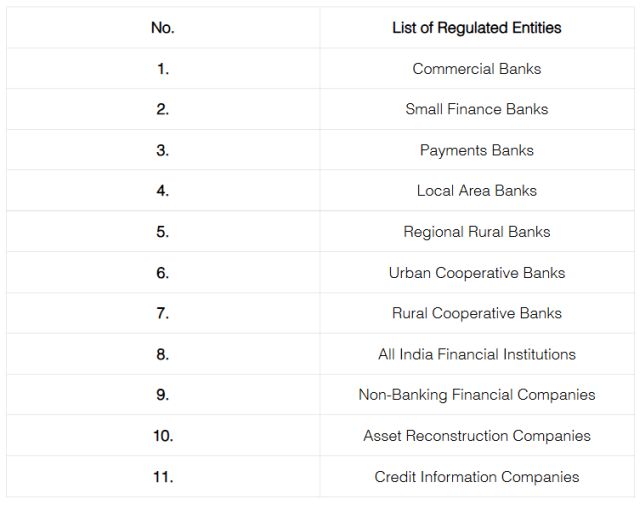

1.1.6. RBI consolidates regulations into 238 Draft Master Directions across 11 RE types

RBI announced a consolidation of regulatory instructions administered by the Department of Regulation (DoR), merging issuances up to October 9, 2025 into 238 (two hundred and thirty-eight) Master Directions spanning 11 (eleven) categories of regulated entities and up to 30 (thirty) functional areas, with approximately 9,000 (nine thousand) circulars proposed to be repealed; the exercise is intended to cut compliance costs and improve navigability, with drafts and repeal lists published for comment and stakeholder feedback invited online until November 10, 2025.

1.1.7. RBI issues draft Internal Ombudsman Directions for REs

RBI released for consultation the draft Master Direction titled Reserve Bank of India (Internal Ombudsman for Regulated Entities) Directions, 2025, to strengthen internal grievance redress by requiring an Internal Ombudsman ("IO") and Deputy IO with fixed terms of 3 (three) to 5 (five) years, independence from management, Board oversight, and annual internal audit. Applicability covers Banks with 10 (ten) or more banking outlets, deposit-taking NBFCs with 10 (ten) or more branches, Non-Deposit taking NBFCs (NBFCs-ND) with asset size of INR 5,000 crore (Indian Rupees Five Thousand Crore only) and a public customer interface, Non-bank System Participants (NBSPs) with more than 1 (one) crore Pre-paid Payment Instruments (PPIs) outstanding as of March 31, 2023, and all CICs.

Securities and Exchange Board of India (SEBI)

1.1.8. SEBI consults on streamlined stock-exchange administration

Securities and Exchange Board of India ("SEBI") issued a consultation to simplify administration for Market Infrastructure Institutions ("MIIs") by scrapping legacy exchange "2 (two)-digit" codes, easing Public Interest Directors' (PIDs) meeting norms and shifting to exception-based filings, merging equity and commodity Investor Protection Funds (IPF) with a 3 (three) year look-back for eligible default claims, tightening timelines for Exclusively Listed Companies (ELCs) on the Dissemination Board and promoter liability, updating the exit-policy turnover trigger to INR 1,000 crore (Indian Rupees One Thousand Crore only) with power to revise upward, clarifying outsourcing as minimum standards, and segregating Clearing Corporation provisions into a separate master circular; public comments are due by October 29, 2025.

1.1.9. SEBI overhauls Block Deal Framework

SEBI revised the stock-exchange Block Deal Framework by introducing two trading windows, 08:45 AM – 09:00 AM with the previous close as reference and 02:05 PM –02:20 PM using the Volume Weighted Average Price (VWAP) of 01:45 PM – 02:00 PM, setting a ±3 per cent (three per cent) price band around the applicable reference, fixing a minimum order size of INR 25 crore (Indian Rupees Twenty-Five Crore only) with compulsory delivery and no squaring off, mandating same-day post-close disclosure of scrip, client, quantity and price, extending the framework to the optional T+0 cycle, and requiring MIIs to apply normal-segment trading, settlement, surveillance and risk controls, with applicability from 60 (sixty) days after issuance.

1.1.10. SEBI rationalises and standardises broker penalties across exchanges

SEBI announced a revised exchange framework that removes inconsistencies in penalties, assigns a single lead exchange for common violations, and rebrands minor procedural lapses as a "financial disincentive"; in phase one, 235 (two hundred and thirty-five) existing penalty items were reviewed, penalties removed on 40 (forty) violations, 105 (one hundred and five) minor lapses retagged as financial disincentives, leaving 90 (ninety) violations where penalties were rationalised: 36 (thirty-six) adjusted, 7 (seven) converted to advisory or warning for a first instance, 6 (six) capped, 29 (twenty-nine) unchanged, and 12 (twelve) newly added, with applicability to ongoing enforcement proceedings, while the Samuhik Prativedan Manch (SPM) common-reporting platform, which went live with 40 (forty) reports on August 1, 2025, will add 30 (thirty) more from October 15, 2025 to reduce compliance burden.

International Financial Services Centres Authority (IFSCA)

1.1.11. IFSCA launches Foreign Currency Settlement System for IBUs

International Financial Services Centres Authority ("IFSCA") launched the Foreign Currency Settlement System ("FCSS"), authorising CCIL IFSC Limited ("CIL"), and appointing Standard Chartered Bank, IFSC Banking Unit ("IBU") as the Settlement Bank; the Bye-Laws, Rules and Regulations ("BRR") governing FCSS operations were notified with FCSS commencing in United States Dollar (USD) on a gross-settlement basis, operating 08:00 to 20:00 Indian Standard Time (IST) on business days, and using the International Organization for Standardization (ISO) 20022 messaging standard, while membership is open to IBUs meeting BRR access criteria who must apply to CIL and comply with ongoing instructions.

Insurance Regulatory and Development Authority of India (IRDAI)

1.1.12. IRDAI issues Insurance Fraud Monitoring Framework

Insurance Regulatory and Development Authority of India (IRDAI), issued the Insurance Fraud Monitoring Framework Guidelines, 2025, effective April 1, 2026, mandating all insurers and distribution channels to implement a zero-tolerance fraud risk framework with a Board-approved Anti-Fraud Policy, Risk Management Committee (RMC) oversight, and a Fraud Monitoring Committee (FMC) supported by a Fraud Monitoring Unit (FMU); classify and report frauds across 5 (five) categories; maintain incident databases and Red Flag Indicators aligned to the International Association of Insurance Supervisors (IAIS) Application Paper; strengthen cybersecurity for "cyber or new age" fraud; train employees and educate policyholders; participate in the Insurance Information Bureau (IIB) technology framework including a caution repository and industry-wide unique identifiers; file an annual Fraud Monitoring Report (FMR-1) within 30 (thirty) days of financial-year end and report to Law Enforcement Agencies as required.

Miscellaneous

Ministry of Corporate Affairs (MCA)

1.1.13. MCA amends IEPF Rules; replaces Form IEPF-5

Ministry of Corporate Affairs (MCA) notified the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Amendment Rules, 2025, effective October 6, 2025, substituting Form IEPF-5 with a revised, digitised claim format for unpaid amounts and shares transferred to the Investor Education and Protection Fund (IEPF); the new form standardises claimant identification and know-your-customer requirements (Aadhaar/Permanent Account Number for residents and passport/Overseas Citizen of India/Person of Indian Origin for foreign nationals and Non-Resident Indians (NRIs)), captures company or bank particulars, depository and bank account details for credit, mandates specified attachments (Client Master List, securities certificates, cancelled cheque, indemnity bond, and succession or probate documents where applicable), requires online filing followed by dispatch of originals to the company or bank's Nodal Officer, and reiterates liability for false statements.

National Payments Corporation of India (NPCI)

1.1.14. NPCI unveils new UPI features for simpler authentication and cash access

National Payments Corporation of India ("NPCI") announced at the new Unified Payments Interface ("UPI") capabilities: on-device biometric authentication allowing users to authorise payments via handset security instead of a UPI personal identification number, Aadhaar-based face authentication for setting or resetting the UPI personal identification number using the Unique Identification Authority of India ("UIDAI") FaceRD application with later extension to transactions, and cash withdrawal through Micro Automated Teller Machines ("Micro ATMs") at UPI Cash Points where a Business Correspondent ("BC") displays a dynamic Quick Response ("QR") code for approval in the UPI application; the offerings are opt-in, each transaction is validated by issuing banks through cryptographic checks, and the cash-withdrawal mode complements Aadhaar Enabled Payment System ("AePS") and card-based options while adding to existing UPI-enabled cash deposit and withdrawal at ATMs.

1.1.15. NPCI launches UPI Multi-Signatory, UPI Lite on smart glasses, and Forex on Bharat Connect

NPCI announced the launch of 3 (three) digital payment features: UPI) Multi-Signatory for approval-based payments from joint or corporate accounts across any UPI or bank application; small-value payments on wearable smart glasses using UPI Lite (UPI Lite) for hands-free QR scan and voice authentication with off-core execution; and "Forex on Bharat Connect," which links the Clearing Corporation of India Limited (CCIL) FX-Retail platform with NPCI Bharat BillPay Limited's Bharat Connect (Bharat Connect) so retail users can buy USD as currency notes, load forex cards, or make outward remittances through participating Authorised Dealer Category-I banks.

1.1.16. NPCI unveils UPI HELP, IoT Payments, Banking Connect, and UPI Reserve Pay

NPCI announced the launch of 4 (four) offerings: Artificial Intelligence ("AI") based UPI HELP using a Small Language Model (SLM) for payment assistance, mandate management and dispute resolution; Internet of Things ("IoT") Payments with UPI to enable transactions from connected devices; Banking Connect, an interoperable net-banking solution by NPCI Bharat BillPay Limited (NBBL) to streamline bank–merchant integration, settlement and dispute handling; and UPI Reserve Pay to let users block and manage portions of credit limits across merchant and UPI applications for greater transparency and control.

1.1.17. NPCI overhauls UPI Autopay with mandate portability and MIC

NPCI announced changes to UPI Autopay that let users view all active mandates in any UPI app and port mandates between apps, and allow merchants to port and execute mandates via their preferred Payee Payment Service Provider ("PSP"); payer PSPs must offer full lifecycle management, require UPI personal identification number entry for payer-initiated actions, keep porting strictly user-driven from the "View Mandate" screen, prohibit inducements and any other use of mandate data, and enforce a rolling 90 (ninety) day one-time porting limit, while payee PSPs must assign a Merchant Identifier Code ("MIC") to every merchant, make MIC mandatory for purpose code "AZ," enable execution in any UPI app, and permit UPI ID updates without changing the MIC, with portal changes allowed only by regulatory direction or service discontinuation; existing mandates continue during transition, the framework applies to new and existing mandates, and members must enable the revised features by December 31, 2025.

1.1.18. NPCI extends UPI Circle to IoT devices and software

NPCI expanded UPI Circle, delegated payments for secondary users, to IoT devices and software profiles under a "Full Delegation" model, requiring explicit user action for debits, compliance with RBI TAT norms and ODR, reconciliation with purpose code "BH" and permitting only NPCI-approved devices; limits include a maximum monthly cap of INR 15,000 (Indian Rupees Fifteen Thousand only) per delegation and a maximum per-transaction cap of INR 5,000 (Indian Rupees Five Thousand only), plus a 24 (twenty-four) hours cooling period with a cumulative cap of INR 5,000 (Indian Rupees Five Thousand only), with authorisation auto-revoked after 6 (six) months of inactivity or on security concerns, Primary UPI applications must show device or software details, capture consent with Two-Factor Authentication (2FA), provide lifecycle controls and allow up to 5 (five) linked devices or software, Secondary PSP banks must onboard only after due diligence and verify the registered mobile number via OTP, and only domestic Person to Merchant (P2M) transactions are allowed, with issuer banks validating device or user identifiers before debit.

2. Key Asian Markets - Sri Lanka and Bangladesh

2.1. Bangladesh

2.2.1. Bangladesh Bank allows local insurers to underwrite open-account export risk

Bangladesh Bank's Foreign Exchange Policy Department permitted Authorised Dealers (ADs) to arrange payment undertakings or payment-risk cover from insurance companies operating in Bangladesh for exports on open-account terms, with policies issued in foreign currency, premia paid from exporters' Exporters' Retention Quota (ERQ) accounts, and claims realised in foreign currency; insurers must obtain appropriate external reinsurance and may maintain foreign-currency accounts to receive premia, remit reinsurance, receive claim settlements, and pay ADs, with unencumbered funds encashed to Taka, while ADs may remit reinsurance premia and extend early-payment facilities, including via Offshore Banking Units (OBUs), with all other instructions unchanged.

2.3. Sri Lanka

2.3.1. Central Bank of Sri Lanka 's 2025 Financial Stability review highlights sector resilience amid expanding private credit and easing rates

Central Bank of Sri Lanka (CBSL) released its Financial Stability Review (FSR) 2025, noting stronger sector resilience in 2025 as private credit expanded, rates eased and market stress stayed subdued, with stock indices elevated on domestic participation, a lower and steadier Government yield curve, improved foreign-exchange liquidity despite rupee depreciation, and positive money-market liquidity; banks and finance companies reported higher profitability, capital and adequate liquidity, though Stage 3 (three) loans remained elevated but declining, while household and institutional credit grew, insurance premiums rose and listed corporates' profitability improved; recent policy actions included designating systemically important banks, revising vehicle Loan-to-Value caps, tightening bank governance, consumer-protection and cyber measures, and launching a refreshed sustainable-finance roadmap, and the outlook projects further stability gains with fiscal consolidation, tempered by external-sector risks and a widening credit gap that warrants close monitoring.

3. Trends

3.1. PSB consolidation likely by fiscal end

Government discussions point to restarting public-sector bank ["PSB"] mergers by March 2026, with an initial phase that may combine three to four smaller PSBs into larger entities to build two top 20 global banks over time. This remains a policy signal, not a concluded action.

3.2. Nationwide climate-linked insurance under discussion

The Central Government is exploring a parametric, climate-linked scheme with insurers and National Disaster Management Authority (NDMA).

3.3. RBI flags Unified Markets Interface and onboarding standards

At Global Fintech Fest 2025, the RBI Governor signalled a Unified Markets/ Lending Interface and said work is underway on standardised digital onboarding.

4. Sector Overview

4.1. Rupee steady near record low as RBI caps volatility

RBI kept the Indian Rupee (INR) close to 88.80 (eighty-eight point eight zero) per United States Dollar (USD) by intervening in spot and non-deliverable markets, with 10 (ten) day realised volatility under 2 per cent (two per cent) and one-month implied near the year's low.

4.2. Foreign exchange reserves dip below USD 700 billion

India's Foreign Exchange (FX) reserves fell by USD 276 Million (United States Dollars Two Hundred Seventy-Six Million only) to USD 699.96 Billion (United States Dollars Six Hundred Ninety-Nine Billion and Nine Hundred Sixty Million only) in the week ended October 3, 2025, as per RBI weekly data referenced by multiple outlets; foreign currency assets declined while gold holdings rose.

4.3. World Bank lifts India Financial Year 2026 growth to 6.5 per cent

The World Bank (WB), in its South Asia Development Update, raised India's gross domestic product growth forecast to 6.5 per cent (six point five per cent) for Financial Year (FY) 2025-26, while trimming FY 2026-27 to 6.3 per cent (six point three per cent), a net revision of +0.2 (zero point two) and −0.2 (zero point two) percentage points respectively, citing trade-policy risks; see press note and the accompanying forecast table.

5. Business Updates

5.1. Tata Capital IPO closes nearly 2x subscribed

Tata Capital's Initial Public Offering by the NBFC closed at 1.95 (one point nine five) times subscription, led by Qualified Institutional Buyers (QIBs), for an issue size of INR 15,512 Crore (Indian Rupees Fifteen Thousand Five Hundred Twelve Crore only); listing is scheduled for October 13, 2025.

5.2. Bajaj Finserv rebrands insurance arms after Allianz exit

Bajaj Finserv completed the rebrand of its insurance joint ventures to Bajaj General Insurance and Bajaj Life Insurance after acquiring Allianz's 26 per cent (twenty-six per cent) stake, taking ownership to 100 per cent (one hundred per cent), following regulatory clearances from the IRDAI and the Competition Commission of India.

5.3. Airtel Payments Bank and others debuts RuPay biometric card at GFF 2025

At the Global Fintech Fest (GFF) in Mumbai, Airtel Payments Bank, Hitachi Payment Services, and IDEX Biometrics launched India's first RuPay card using fingerprint authentication on NPCI domestic network, marking a live product rollout in card payments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]