Background

The Companies Act, 2013 ('Companies Act') read with the Companies (Restriction on Number of Layers) Rules, 2017 ('Layering Rules') provides that a company is not allowed to have more than 2 (two) layers of subsidiaries. This restriction was introduced to prohibit companies from misusing multiple layers of subsidiaries, by creating shell companies for diverting funds or money laundering.

The Layering Rules exempts specified companies from this restriction. Exemptions are for certain type of companies, acquisition of foreign companies and one layer of wholly owned subsidiary/ subsidiaries ('WOS').

Provisions under the Companies Act and the Companies Rules dealing with restriction on number of layers

Section 2(87) of the Companies Act defines a subsidiary company, in relation to the holding company, as a company in which the holding company either (i) controls the composition of the board of directors; or (ii) exercises or controls more than 50% (fifty percent) of the total voting power, either on its own or together with one or more of its subsidiary companies.

The exaplanation to the section further clarifies that a company shall be deemed to be a subsidiary company of the holding company even if the control referred to above, is of another subsidiary company of the holding company.

Such holding companies should not have layers of subsidiaries beyond the prescribed number.

The section further defines a layer in relation to a holding company as a subsidiary or subsidiaries.

Rule 2 of the Layering Rules restricts the number of layers for certain classes of holding companies. It states that no company is permitted to have more than 2 (two) layers of subsidiaries.

Companies that had layers of subsidiaries in excess of 2 (two) layers prior to the publication of the Layering Rules were required to file a return in Form CRL-1 disclosing the details of the same, within a period of 150 (one hundred and fifty) days from the date of publication of the Layering Rules.

Additionally, such companies could thereafter, not have any additional layer(s) of subsidiaries in excess of the layers already existing, at the time of notification of the Layering Rules.

Non-adherence with any provisions of the Layering Rules will attract fines on the company and every officer of the company who is in default.

Companies exempt from restriction on number of layers

The following classes of companies are exempt from restriction on number of layers:

- A banking company;

- A non-banking financial company which is registered with the Reserve Bank of India and considered as systematically important non-banking financial company by the Reserve Bank of India;

- An insurance company being a company which carries on the business of insurance; and

- A Government company.

Exemption for acquiring foreign companies

A company is not restricted from acquiring a company incorporated outside India with subsidiaries beyond 2 (two) layers as per the local laws of such country.

Exemption for WOS and Analysis

A layer of a company that consists of 1 (one) or more WOS will be exempt while computing the number of layers of that company.

The proviso to rule 2 of the Layering Rules that provides for this exemption essentially states that, a company may have a layer of WOS in addition to having 2 (two) layers of subsidiaries.

Breaking down the language of the proviso, a layer of a company, consisting of 1 (one) or more WOS, will be exempt.

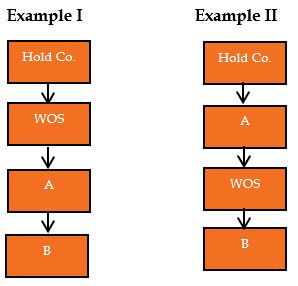

This proviso may be interpreted in 2 (two) different ways. The first is that the WOS should be immediately below the holding company (as illustrated in Example I below). The second is that the WOS could be at any layer and does not need to be immediately below the holding company (as illustrated in Example II below).

The proviso provides for an exemption of one layer of WOS. There is uncertainty with respect to which layer is referred to here. Whether this should be interpreted to mean the first layer under the holding company (Example I), or if it may be interpreted to mean any layer in the structure and not the one immediately following the holding company (Example II).

In Example I, we see that the WOS is immediately after the holding company. Regardless of which interpretation is taken, there is no doubt that the WOS will be exempt while computing the number of layers of the holding company.

In Example II, we see that the WOS is not immediately after the holding company.

As previously mentioned, a 'layer' is defined under the Companies Act in relation to a holding company as a subsidiary or subsidiaries.

Persons relying on the view that only the immediate WOS is exempt, would argue that the definition of 'layer' requires the WOS to be considered in relation to the holding company which is being examined. That is, the WOS must be a direct WOS of the holding company, and only then can the WOS be exempted (as in Example I). Since the WOS in Example II, is a WOS of company A and not the holding company, the WOS cannot be exempted. The structure in Example II would not be permissible as per this view.

However, as per the second view, it could be argued that the provision exempts one layer of WOS, which may be read to mean any layer. Such an interpretation may arise on a reading of the definition of 'layer' and 'subsidiary'. To reiterate, 'layer' in relation to a holding company means its subsidiary or subsidiaries. A subsidiary, in terms of the definition of subsidiary, also includes a step-down subsidiary, i.e., the subsidiary of a subsidiary, is also a subsidiary of the holding company. Accordingly, the 'one layer' of WOS which may be exempt, could be a step-down WOS since the WOS is also a subsdiary of the holding company. If such an interpretation is taken, then the WOS here may also be exempt.

Further, while interpreting the Layering Rules, we must also consider the legislative intent behind introducing the said rules. The Layering Rules were introduced to restrict the number of layers of subsidiaries with a view of prohibiting companies from misusing the multiple layers. We note that this purpose is achieved regardless of which view is taken.

That is, in either view, the overall number of layers below a company in a structure remains the same, i.e., 3 (three). The holding company would have 1 (one) layer of WOS and 2 (two) layers of subsidiaries. Whether the WOS is in the first layer or third layer, the total number of layers (including WOS) cannot exceed 3 (three).

Jurisprudence shows that under certain circumstances, a WOS may be considered to be a part of or essentially the same entity as its holding company. A WOS is under complete control of its holding company. Hence, we understand that the intent of the legislature behind excluding 1 (one) layer of WOS could be that a WOS is considered to be the same entity as its holding company, and is not to be counted separately. Again, both views would satisfy the goal of this legislative intent.

Another arugment taken by persons of the view that 'any layer' of WOS and not the 'first layer' of WOS is exempt, is that, if the intent of the legislature was to exempt only the first layer, the same would be clarified. That is, the proviso would state 'first layer' of WOS and not 'one layer' of WOS is exempt.

In the absence of any clarity on the above however, the same remains a matter of debate.

Generally speaking, most people favour the interpretation that the WOS should be immediately following the company for which the number of layers is being computed. Clarity on the same through the legislature or through judgments is much awaited.

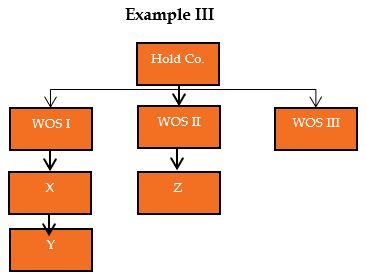

It should also be noted that layers mean horizontal layers and not vertical layers (as illustrated in Example III below). A single layer may have multiple subsidiaries. Hence, while computing the number of layers pursuant to the Layering Rules, the number of layers is considered and not the number of subsidiaries in a particular layer.

Accordingly, in Example III above, all 3 (three) WOS of the holding company, in a single layer would be exempt.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.