- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Banking & Credit, Media & Information and Retail & Leisure industries

- within Corporate/Commercial Law topic(s)

- with readers working within the Media & Information, Retail & Leisure and Law Firm industries

- within Corporate/Commercial Law topic(s)

The growing use of electronic contracts (or e-contracts) presents unique challenges for compliance with India's stamp duty laws. Typically, applicability of stamp duty on contracts depends on various factors including the place of execution and the subject matter. However, in the fluid, borderless realm of e-contracts, often signed remotely by parties across various jurisdictions, the question that arises: Are e-contracts liable to payment of stamp duty? And if yes, what would be the applicable stamping jurisdiction and applicable stamp duty?

This article aims to address these questions using the provisions of the Maharashtra Stamp Act, 1958 ('MH Stamp Act') as an example, read with the provisions of the Information Technology Act, 2000 ('IT Act').

I. Requirement of payment of stamp duty for e-contracts:

Section 2(l) of the MH Stamp Act provides an explanation to the definition of "instrument", which explicitly includes any electronic record as per the IT Act.1 Further, the definition of "execution" under the MH Stamp Act takes into account e-signatures as described in the IT Act.2 While the definition of "instrument" or "execution" under the Indian Stamp Act, 1899 does not provide for an explanation similar to the MH Stamp Act, stamp duty laws of some states (including Tamil Nadu, Rajasthan, Karnataka and Gujarat) do provide for explanations similar to the MH Stamp Act. This principle has also been reaffirmed in various judgements relating to stamp duty applicability for e-contracts.3

II. Existing Framework for Stamping Physical Contracts:

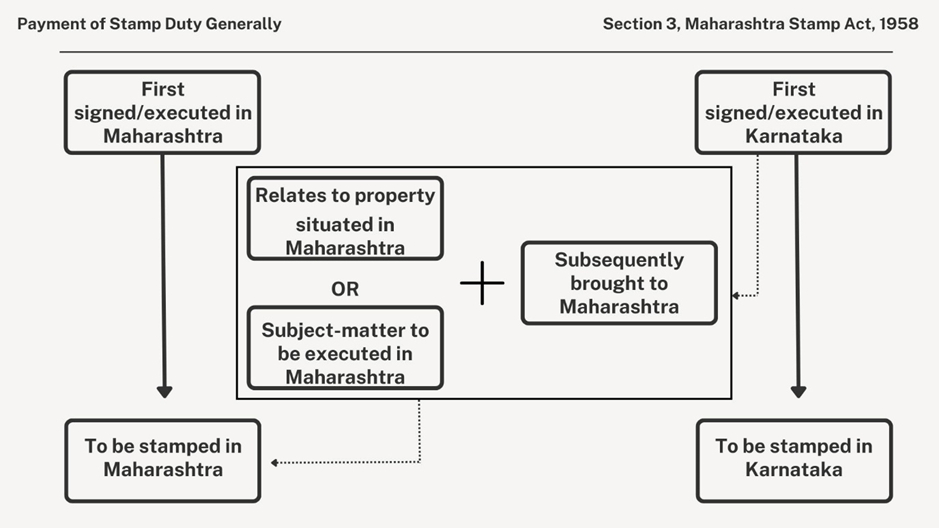

As per Section 3(a) of the MH Stamp Act,4 if a contract is executed first in Maharashtra, then it must be stamped as per the MH Stamp Act. However, if the contract is executed first outside Maharashtra (for instance in Karnataka) and then brought into Maharashtra, Section 3(b) mandates stamping in Maharashtra only if the contract relates to:

- Any property situated in Maharashtra, or

- Anything done or to be done in Maharashtra.

See the flowchart below representing the above.

III. Scheme of the IT Act vis-à-vis Electronic Contracts:

In the case of an e-contract, both parties sign the contract digitally. To apply the abovementioned principles in the MH Stamp Act (or stamp acts of other states), we must ascertain who the signatory of the contract is and where such signatory digitally signed the e-contract.

As per Section 115 of the IT Act, the originator of an electronic record (which includes a signed e-contract) is one who either (i) sends the e-contract, (ii) authorizes any other person to send the e-contract, or (iii) uses an information system to send the e-contract automatically. The third condition is relevant where an electronic signature is being attached to an e-contract (through a software). Therefore, an information system (including any software), placed and operating from any location will be attributed to its originator (i.e. the party executing the electronic contract). Hence, when a signatory to an e-contract signs such contract and shares the signed e-contract with the other party (whether directly or through an authorized person or a software), such signatory can be deemed to be the originator of the signed e-contract.

For the purpose of identifying the place of execution by such signatory, we must examine Section 13(3) of the IT Act, which identifies the 'place of dispatch and receipt' of an e-contract. This section provides that the place of dispatch and receipt of the electronic record shall be deemed to be where the originator has his/her place of business. Section 13(5) clarifies:

- If the originator has more than one place of business, the principal place of business shall be considered;

- if the originator does not have a place of business, the place of residence shall be considered; and

- the usual place of business for a body corporate shall mean the place where it is registered.

Hence, based on the provisions of the IT Act, we are able to link a signed e-contract to the signatory and subsequently ascertain the place of execution based on the signatory's 'place of business'

IV. Multiple instances of payment of stamp duty

The principle under Section 3 of the MH Stamp Act is also provided in similar provisions under the stamp act of other states. Hence, if there is a contract that is executed by two parties with their place of business in different states, the e-contract will be subject to two instances of payment of stamp duty – provided that the conditions of Section 3(b) of the MH Stamp Act (or similar provision in the relevant state's stamp act) are satisfied.6

For instance, 'A' has his place of business in Maharashtra, whereas 'B' has his place of business in Karnataka. 'A' attaches its electronic signature in execution of the contract for services to be provided in Karnataka. 'B', in receipt of such executed e-contract attaches its electronic signature and countersigns the e-contract. Irrespective of where the signatures for execution of the e-contract were actually attached on behalf of both the parties, the stamping of this contract will necessarily occur in the states of Maharashtra and Karnataka. This is by virtue of these states being where the parties have their respective places of business. Further, since the conditions under Section 3(b) are met in both Maharashtra and Karnataka, the liability of payment of stamp duty arises twice.

In such instances, it is important to note that a provision for differential payment of the stamp duty exists in the MH Stamp Act (and stamp acts of other states), to ensure no duplication of stamping occurs. This means the contract attracts the higher stamp duty. If the first instance of stamping proves to be inadequate, the stamp acts expect only the differential amount to be paid on the second instance of stamping.

V. Key Takeaways:

- E-contracts need to be stamped.

- E-contracts are stamped based on the stamp duty applicable in the first place of execution.

- Liability of payment of stamp duty can occur twice if the e-contract is executed first in one state but the subject matter of the e-contract is in another state and the e-contract is executed second in such other state.

- Place of execution is place of business.

- The e-contract will be deemed to have been received at Party B's place of business, irrespective of where the Party B's signatory is physically located or where its system receiving such e-contract is placed.

While the above combined reading of the stamp duty legislations and IT Act can be used to determine stamp duty liability of e-contracts, it would be ideal if the current stamp duty legislations are amended to bring in more direct clarity on stamping of e-contracts. In fact, some movement has been made in this direction with the introduction of the Indian Stamp Bill, 2023 which seeks to expand the definitions of "Execution", "Signed" and "Instrument" to include, (a) Electronic records as defined in Section 11 of the IT Act, and (b) Electronic signatures as defined in Section 2(1)(ta) of the IT Act.

Footnotes

1 Section 2(l): "instrument" includes every document by which any right or liability is, or purports to be, created, transferred, limited, extended, extinguished, or recorded;

Explanation – The term "document" also includes any electronic record as defined in clause (t) of sub-section (1) of section 2 of the Information Technology Act, 2000.

2 Section 2(i): "executed" and "execution" used with reference to instruments, mean "signed" and "signature";

Explanation -The terms "signed" and "signature" also include attribution of electronic record as per section 11 of the Information Technology Act, 2000.

3 N.N. Global Mercantile Private Limited v. Indo Unique Flame Ltd. [(2021) 4 SCC 379]

Tamil Nadu Organic Private Ltd v. State Bank of India [(2018) 3 CTC 1]

4 Subject to the provisions of this Act and the exemptions contained in Schedule I, the following instruments shall be chargeable with duty of the amount indicated in Schedule I as the proper duty therefore respectively, that is to say—

(a) every instrument mentioned in Schedule I, which not having been previously executed by any person, is executed in the State on or after the date of commencement of this Act,

(b) every instrument mentioned in Schedule I, which not having been previously executed by any person, is executed out of the State on or after the said date, relates to any property situate, or to any matter or thing done or to be done in this State and is received in this State.

Provided that a copy or extract, whether certified to be a true copy or not and whether a facsimile image or otherwise of the original instrument on which stamp duty is chargeable under the provisions of this section, shall be chargeable with full stamp duty indicated in the Schedule I if the proper duty payable on such original instrument is not paid

5 11. Attribution of electronic records. —

An electronic record shall be attributed to the originator—

(a) if it was sent by the originator himself;

(b) by a person who had the authority to act on behalf of the originator in respect of that electronic record; or

(c) by an information system programmed by or on behalf of the originator to operate automatically.

6 Section 3(b) of the MH Stamp Act requires the contract to be stamped in Maharashtra only if the contract relates to:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.