- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Basic Industries industries

- within Corporate/Commercial Law, Food, Drugs, Healthcare, Life Sciences and Strategy topic(s)

Foreword

Private companies encompass every sector across the globe and include family businesses, family offices, and 'Emerging Giants' (portfolio companies of private equity and venture capital funds). Many of these businesses are poised for significant growth, with confident, entrepreneurial leaders. This optimism prevails despite an uncertain, volatile geopolitical and economic environment, notably tariffs and trade disputes, international conflicts, inflation and high interest rates, regulatory change, climate events and supply chain disruption.

For those players with an eye on mergers and acquisitions (M&A) and divestment, interest rate uncertainty casts doubt on credit availability. Their portfolio companies are also coping with inflationary costs that could impact their profitability. For family businesses/family offices, there's the added pressure of succession planning and leadership transition, and whether CEOs want to pass the business onto the next generation or pursue a sale.

The 2025 CEO Outlook survey highlights how the CEOs of private companies are addressing the major economic, technological, geopolitical, regulatory, and talent challenges. Artificial Intelligence (AI) has become a central issue, as a means to improve operational performance, boost innovation, and manage risks. AI is also a booming sector for investment, boosted by government incentives to attract AI start-ups across numerous sectors. However, AI also brings certain challenges, such as concerns over trust, and return on investment (ROI).

Private companies have long recognized the importance of sustainable growth, driven by strong governance, ethical practices and social responsibility — with the reporting of non-financial metrics increasingly critical to investor confidence. Talent remains a big priority, to compete for the best people — especially for highdemand technology skills — and to continually upskill their own employees in AI and other emerging areas.

In an unpredictable world, CEOs need to be highly informed, and very agile in order to overcome challenges and take advantage of new opportunities to accelerate growth.

Executive summary

Despite continuing economic and geopolitical headwinds, CEOs of private companies are highly optimistic over the growth prospects of their companies, their countries, and to a slightly lesser extent, the global economy. While M&A appetite remains strong, in comparison to publicly listed companies, there is a trend towards moderate and lowerimpact deals, signaling a trust in organic expansion.

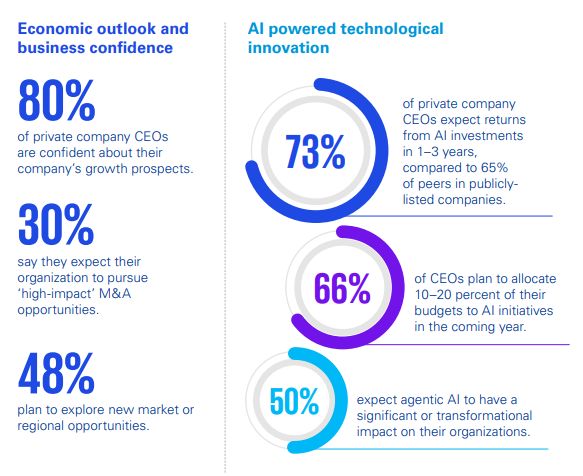

Our survey underscores how private companies are prioritizing their approach to technology — especially AI — with leaders investing significantly and now expressing greater confidence in its ROI potential, compared to their peers in public companies. However, they are less certain of their employees' ability to fully embrace AI, with concerns about generational skill gaps.

Private leaders are also embedding environmental, social and governance (ESG) into their strategy and operations. But, there are concerns over capabilities in this area, which may explain why private CEOs are less positive than their peers in public companies about their organizations' ability to hit net zero targets.

Ultimately, their entrepreneurial spirit and ability to move fast may be the superpower that gives Emerging Giants and established private companies a competitive edge.

Key findings

Economic outlook and business confidence

Faced with an uncertain economic environment, including inflation, high interest rates, trade barriers and regional conflicts, CEOs of private companies remain optimistic. The vast majority (80 percent) express confidence in their company's growth prospects, and 65 percent are confident about the global economy — slightly less than their peers in public-listed companies (69 percent).

Private company leaders often tend to be entrepreneurial, 'glass half full' types, further evidenced by a desire to explore new market and regional opportunities, with 73 percent either actively pursuing strategic expansion, or expecting to do so in the near term. Inorganic growth is another priority, with an overwhelming 85 percent showing an appetite for M&A. However, in comparison with public company CEOs, private company chief executives are considerably less likely to seek 'high-impact' transactions. Only 30 percent report enthusiasm for big transformative deals, a marked contrast to 2024, when almost half (45 percent) did so.

These feelings about M&A may reflect prevailing uncertainty, where economic forecasts can quickly change in reaction to tariffs and other geopolitical phenomena. There may also be a sense amongst private company leaders that they trust their in-house capabilities and possess the drive to achieve their ambitions. Without the need to constantly report to shareholders, private organizations can be nimbler and bolder and divert resources to new initiatives at pace. One example is the emergence of companies considering a presence in the US to mitigate tariff risk. In some cases, private companies that decide to go public are considering dual class stock structures to ensure the founders retain greater control.

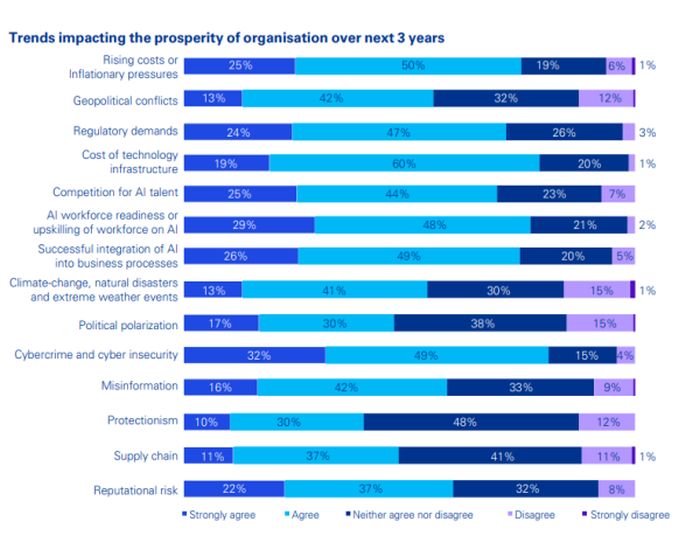

In an age of fast-evolving technology, it's little surprise that some of the trends most impacting future prosperity are cybersecurity (81 percent), cost of technology infrastructure (79 percent), and AI workforce readiness (77 percent). Rising costs and inflationary pressures are additional concerns, reflecting underlying economic conditions.

It's a very dynamic environment, with geopolitics impacting on business decisions to a greater extent than most of us can remember. CEOs are considering how they can future-proof their organizations against future tariffs, trade wars and other events. One option is to swiftly pivot to new markets to take advantage of favorable regulatory and trading conditions."

Greg Limb

Global Head of Family Office and Private Client,

KPMG International and Partner, KPMG in the UK

Regulatory compliance: risk management or foundation for growth?

It's tempting to view regulation and compliance as 'defensive' items, when they actually have the potential to be the building blocks for growth. With the pace of regulation increasing in many parts of the world, private companies must meet rising expectations of strong governance, transparency, and commitment to responsible and sustainable business. The growing use of technology places a greater spotlight on data privacy, protection, and ethical and fair use of AI.

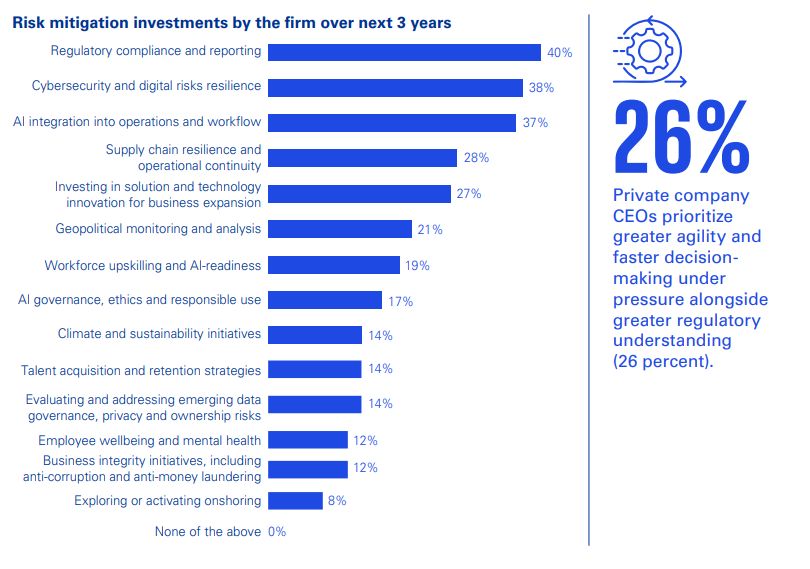

The CEOs taking part in this year's survey acknowledge these challenges, and say their companies are increasing investment in regulatory compliance and reporting (40 percent), cybersecurity and digital risks (38 percent), and integrating AI into operations and workflow (37 percent).

What kind of leadership is required to tackle these pressing business issues? Private company CEOs prioritize greater agility and faster decision-making under pressure (26 percent) alongside greater regulatory understanding (26 percent). Adaptability is highly relevant, given the speed of change and unpredictability of factors like tariffs, supply chain disruptions, and new competitive threats. Other key capabilities include transparent communication (vital to satisfy stakeholder scrutiny) and digital and technological literacy.

To full the view pdf, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.