In the end of 2020, the Ukrainian Parliament has adopted a new law, which is soon to be enacted and will introduce a new type of investment agreement to be entered into between the investor and the state. Under that agreement, Ukraine shall provide support to the investment project, which may lie in exemption from taxes and customs duties, obligation of the state to grant lease title to land plots or to construct infrastructure at the budget's expense, in exchange for the investor making the investment in term and manner specified in the agreement.

That new law of Ukraine "On State Support of the Investment Projects with Significant Investments" (the "Draft Law") was adopted on 17 December 2020 and is expected to be signed by the President in the nearest future.

Per the Draft Law, foreign and domestic investors may enter into a special investment agreement with the state of Ukraine represented by the Cabinet of Ministers of Ukraine (the "Special Investment Agreement") for a certain project bearing significant investments (the "Major Project"). The state shall provide support for developing the Major Project if the investor complies with the Special Investment Agreement terms, namely invests the designated costs within the defined term.

Apart from the state support, the Special Investment Agreement terms may provide for dispute resolution in international arbitration and the stabilization clause. This will be advantageous to secure the investment against unfavourable legislative changes, which is usually sought by the investors in the constantly changing economic and political environment.

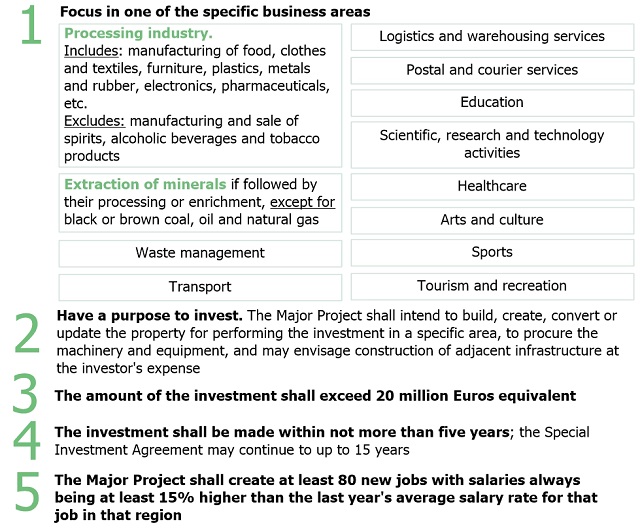

Eligible Projects

To be eligible for the state support, the Major Project must meet all five criteria below.

Application Process

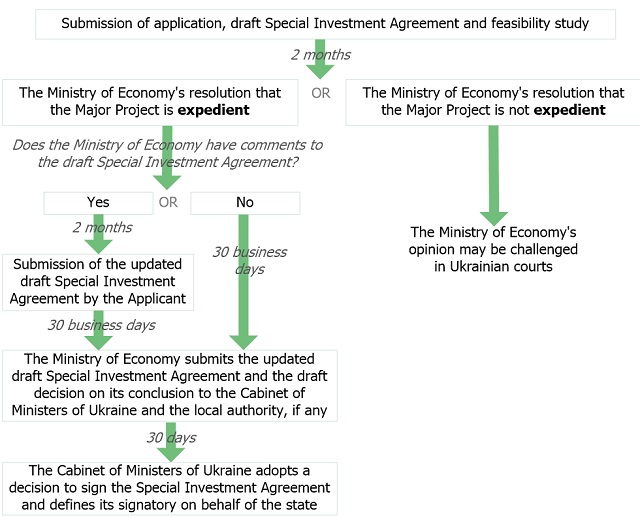

To enter into the Special Investment Agreement, the investor shall submit an application to the Ministry for Development of Economy, Trade and Agriculture of Ukraine (the "Ministry of Economy") together with the draft Special Investment Agreement, the feasibility study for the Major Project and proof of the investor's incorporation and structure.

The investor shall enter into the Special Investment Agreement through two companies: the parent company or several companies being the applicant (the "Applicant"), and its special purpose vehicle incorporated for the purpose of serving as an investor making the significant investment for the Major Project (the "Major Investor").

The Applicant shall submit the application, which is reviewed and processed as illustrated below.

Types of State Support

Four types of state support may be offered under the Special Investment Agreement:

- exemption from certain taxes and levies;

- exemption from import duties for new machinery and equipment imported;

- granting the lease title to the land plots necessary for the Major Project, together with the pre-emptive right to purchase them after the Special Investment Agreement is terminated except if it was terminated early; and

- construction of infrastructure, that is roads, electric, gas, water and heating networks, engineering and telecommunication networks at the expense of the state or local budget.

The state providing the lease title to land plots is the most ready-to-employ way of support, since the Draft Law introduces the necessary amendments to the Ukrainian laws allowing those land plots to be granted outside of otherwise necessary land auctions. The Draft Law explicitly allows the Major Investor to terminate the Special Investment Agreement if the title to the land plots is not formalized within six months after its execution unless caused by the Major Investor's failing, which shall incentivise the state to ensure all necessary procedures on its part.

The exemption from taxes, levies and customs duties may not be exercised until the necessary amendments are introduced to the Tax Code of Ukraine and the Customs Code of Ukraine. In September 2020, the relevant draft laws under numbers No. 3761 and 3762 respectively have voted for in the first reading. They now await the second reading to be adopted and enter into effect. Per those draft laws, the tax exemptions will consist in the following:

- until 01 January 2035, exemption from the value added tax for all goods imported for the Major Project, if they are new and were manufactured not earlier than 3 years before the Special Investment Agreement was executed. The list of the goods shall be an annex to the Special Investment Agreement;

- until 01 January 2035, exemption from import duty for the same goods as described above;

- exemption from the corporate profit tax for all income derived from the Major Project during any 5 consecutive years chosen by the Major Investor, yet only after the main investment item has been commissioned; and

- until 01 January 2035, local authorities are allowed to define any lower land tax for the land plots utilized in the Major Project.

- It shall be noted that the corporate profit tax exemption applies only after the investment item has been commissioned, which implies that it applies to the Major Projects that involve construction. In case the Major Project does not involve actual construction that shall be commissioned, that issue shall be clarified in the wording of the Special Investment Agreement to make sure that the exemption still applies.

In addition, within six months after the Draft Law is signed, there should be adopted several resolutions of the Cabinet of Ministers of Ukraine, regulating the process of reviewing the applications and the draft Special Investment Agreements, requirements to the feasibility study and the Major Project itself, procedure of calculating the value of the state support, etc. Commonly, stakeholders are invited to participate in working groups and round tables concerning drafting the resolutions thus the interested businesses may offer their proposals and insights.

Value of state support. Consequences of breach of the Special Investment Agreement

The Special Investment Agreement shall contain a detailed list of the types and extent of the support offered by the state, and the amount and description of the investment to be made by the Major Investor.

The state support is expressed in the monetary value and shall not exceed 30% of the amount of the investment made by the Major Investor. The value of the state support will include the amount of all taxes, levies and customs duties not paid by the Major Investor due to applying the exemptions, including the land tax, and the costs for construction of infrastructure.

If the Major Investor breaches the Special Investment Agreement terms as to making the investment in full or meeting the deadline for investing, the Special Investment Agreement may be terminated, and the value of the state support shall be refunded to the state. This also means that the Major Investor shall relinquish the titles to the land plot.

Termination of the Special Investment Agreement does not entail the Major Investor losing its investment or termination of the project; yet the project will not be considered the Major Project and will cease to receive the state support. This shall be clarified in the Special Investment Agreement together with the necessary liability limitation of the investor in case of such breach.

Key Provisions of the Special Investment Agreement

The Draft Law introduces the following rules applicable to the Special Investment Agreement, that may be even more beneficial to the investor than the proposed types of state support.

Stabilization of the Ukrainian Laws

The rights and duties of the Major Investor shall be governed by the Ukrainian laws in effect at the date the Special Investment Agreement was executed unless the new law improves the Major Investor's position.

This will serve as a good ground to secure the risk of unfavourable laws changes. As a matter of good practice, the Special Investment Agreement shall contain a procedure for the Major Investor, and not the state, to decide that the new law is beneficial and thus shall apply.

Arbitration and Foreign Law

The parties to the Special Investment Agreement may choose foreign law to govern the Special Investment Agreement.

For resolution of disputes, the Draft Law allows to refer to mediation and non-binding expert proceedings, and to refer the disputes either to the Ukrainian court or an international arbitration institution chosen by the parties. To be able to refer the dispute to international arbitration, the Major Investor shall have at least 10% of its shares owned by a foreign person or legal entity.

Single-window investment authority

The Draft Law introduces a new authorized institution (the "Authorized Institution"), that will be responsible for cooperation with the investors in terms of receiving the state support for their investments.

The Authorized Institution's functions will include aiding the investors in preparing their applications for entering into the Special Investment Agreements, arranging communication with the state authorities both during signing the Special Investment Agreement and performing it, as well as certain monitoring functions. This is the closest step so far to the "investment nanny" project announced by the government, which was supposed to provide the investors with a single window for communication with the authorities on all investment matters.

Prospects for realisation

Apart from the state support offered to the investor, having an option to utilize the stabilization clause in the Special Investment Agreement and refer the disputes to international arbitration may serve as additional incentives for the investors to initiate their projects in Ukraine, since they offer more security for the project and a more predictable business climate for it.

Although the Special Investment Agreement is meant to define the state's obligation to provide the state support, it may contain further provisions not concerning the duties of the state. For example, the Special Investment Agreement may define what is considered an investment and the investor's right to it, give definition of expropriation, that is not present in the Ukrainian laws, which may be referred to in case of investor-state disputes.

While considering the draft Special Investment Agreement, the state will regard it from a more formalistic point of view intending to draft its provisions as close as possible to the actual provisions of the laws. The state may be reluctant to introduce even best practice provisions and mechanisms to the Special Investment Agreement, if they are not explicitly described in the Ukrainian laws. Thus, while negotiating the draft Special Investment Agreement terms with the state, the investor shall be ready to justify and reason the investor's opinion on each provision with references to the good international investment practice, analogy of law or statute and recent tendencies in investment dispute resolution.

Therefore, the newly introduced Special Investment Agreement potentially is an effective instrument to secure the state's support, which will consist in granting tax and levies exemption, provision of lease title to the land plots, construction of infrastructure and offering a single-window authority to help carry out the project. The stabilization clause and reference of the disputes to the international arbitration shall contribute to the overall project security.

We may expect this new approach to attract investment to Ukraine since it will apply to many business areas, from manufacturing of goods to healthcare, education and recreation projects. Still, when drafting the Special Investment Agreement and negotiating it with the state, the investors shall pay attention to specifying the actual procedures for performing the state's duties since they are not provided by the laws and watch out for the legislative gaps in the Draft Law to cure them by the wording of the Special Investment Agreement.

Originally published 21 January 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.