- within Finance and Banking topic(s)

- in Australia

- within Finance and Banking topic(s)

- within Media, Telecoms, IT, Entertainment, Strategy and Employment and HR topic(s)

In the fast-paced world of international business, companies often engage in high-value transactions that require robust security and reliability. Paymaster services have emerged as a vital tool for managing these complex financial dealings, ensuring that payments are processed smoothly, securely, and in compliance with all relevant laws.

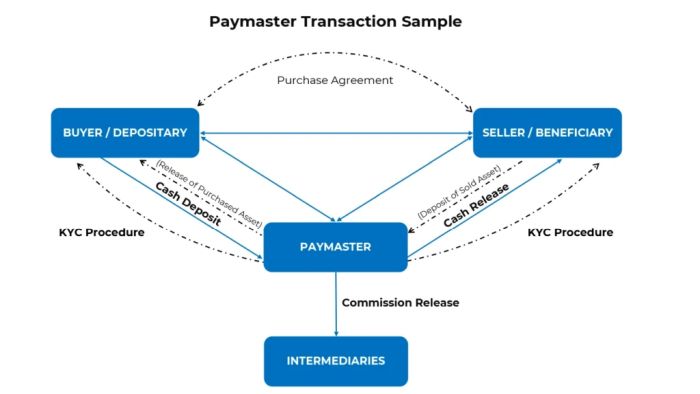

A paymaster acts as a neutral third party, receiving funds into an intermediated account and disbursing them according to the pre-agreed terms once all conditions are met. This process ensures that all parties involved fulfill their obligations before the funds are released. For example, in a transaction involving a buyer, a seller, and multiple intermediaries, the paymaster ensures that each intermediary receives their commission only after the main transaction is completed. This structured approach helps mitigate risks, reduce the potential for disputes, and maintain transparency and accountability throughout the transaction process.

Paymaster services are highly effective in managing complex transactions involving multiple stakeholders, such as joint ventures, mergers and acquisitions, and large-scale international trade agreements. This insight highlights the most common concerns related to this type of transactions.

How do paymasters handle currency conversion and exchange rate fluctuations?

Handling currency conversion and managing exchange rate fluctuations are critical components of international transactions. Paymasters are equipped to manage these complexities through multi-currency accounts that can hold and convert various currencies as needed.

When funds are received in one currency and need to be disbursed in another, the paymaster coordinates with banks and financial institutions to convert the funds at the most favorable exchange rates available. Paymasters often have access to real-time currency exchange data and use this information to execute conversions efficiently. They also monitor exchange rate fluctuations to ensure that the value of the funds is preserved as much as possible during the conversion process.

For businesses, this service is essential as it not only ensures that the correct amount is disbursed but also minimizes the financial impact of exchange rate volatility. This capability is crucial for global operations where transactions often involve multiple currencies and the risk of significant fluctuations in exchange rates.

What are the tax implications of using paymaster services?

Using paymaster services can have various tax implications that businesses need to consider. By understanding them, you can better navigate the complexities of transactions and ensure full compliance with all relevant tax laws and regulations.

✓ Jurisdiction and Transaction Specifics

The tax implications of using paymaster services vary based on the jurisdiction and the specifics of each transaction. Different countries have different tax laws and regulations that can impact how transactions are taxed.

✓ Meticulous Documentation

One of the primary benefits of using a paymaster is the meticulous documentation of all transactions. Paymasters maintain detailed records of the amounts, recipients, and purposes of payments.

✓ Compliance with Tax Regulations

Detailed transaction records help businesses comply with tax regulations. These records provide a clear audit trail for tax authorities, ensuring that all financial activities are transparent and traceable.

✓ Tax Withholding

While paymasters typically do not withhold taxes, they provide the necessary documentation for businesses to report their income and expenses accurately. This helps businesses fulfill their tax obligations without directly involving the paymaster in tax withholding.

✓ Consulting Tax Professionals

When using paymaster services, it is important that companies consult with tax professionals to understand their specific tax obligations. This includes understanding how different types of transactions are taxed, whether any withholding taxes apply, and how to take advantage of any applicable tax treaties or incentives.

How does a paymaster ensure compliance with anti-money laundering laws?

Compliance with anti-money laundering (AML) laws is a critical function of paymaster services. Paymasters conduct rigorous due diligence and "Know Your Client" (KYC) procedures to verify the identities of all parties involved in a transaction. This includes collecting and verifying documentation such as passports, business licenses, and other identification documents.

The KYC process helps ensure that the parties involved in the transaction are legitimate and that the funds being transferred are not associated with illegal activities. Paymasters also monitor transactions for any unusual or suspicious activity, such as large or frequent transfers that do not match the client's profile.

In addition to internal controls, paymasters comply with international AML regulations, which often require them to report any suspicious activities to the relevant authorities. This dual layer of scrutiny helps prevent money laundering, fraud, and other financial crimes, providing businesses with an added layer of security.

How can you ensure the credibility and reliability of a paymaster?

Clients should start by verifying the paymaster's credentials, including their professional affiliations, licenses, and certifications.

Engaging a paymaster who is a licensed attorney can offer additional peace of mind, as they are subject to stringent professional regulations and oversight by legal authorities. You should also look for paymasters who have a proven track record in handling similar transactions and can provide references or testimonials from previous clients.

Additionally, it is advisable to conduct an online search for any reviews or complaints about the paymaster to ensure they have a solid reputation. Transparency in communication and a clear explanation of their processes and fees are also indicators of a trustworthy paymaster.

What unexpected delays can occur during transaction and how can Paymasters manage them?

Paymaster services include comprehensive contingency plans to address challenges such as unforeseen delays effectively. However, they cannot eliminate delays entirely, but significantly reduce the impact on the transaction timeline.

✗ Banking Holidays and Opening Hours

Paymasters can mitigate the impact of banking holidays by scheduling transactions around known holiday dates and opening hours. They should maintain close communication with banks to understand their schedules and plan accordingly. Additionally, paymasters can build buffer periods into the transaction timeline to accommodate these potential delays. Utilizing multiple banking channels can also provide alternative options for processing funds if one bank is unavailable.

✗ Verification Delays

To handle verification delays, paymasters should conduct pre-verification checks to ensure that all necessary documentation is complete and accurate before initiating the transaction. Establishing clear timelines for each step of the verification process and maintaining regular follow-ups with verification agencies can expedite the process. In case of delays, having expedited verification services available can help speed up the KYC and AML checks.

✗ Unforeseen Regulatory Checks

Paymasters need to stay updated with the latest regulatory changes and requirements to handle unforeseen regulatory checks. Building good relationships with regulatory bodies can facilitate quicker resolution of any issues. Having legal experts on hand to address regulatory concerns promptly is also crucial. If a regulatory check is imposed, the paymaster should communicate transparently with all parties involved about the situation and the steps being taken to resolve it.

Successfully handling the complexities of large-scale business transactions requires expertise and reliable services. Paymaster services provided by experienced professionals can offer the security, efficiency, and compliance needed to manage large-scale transactions effectively.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.