- within Employment and HR, Real Estate and Construction and Wealth Management topic(s)

- with readers working within the Retail & Leisure industries

This is a continuation of our previous Tech Deals series (Tech Deals Vol. 1, Vol. 2, Vol. 3, and Vol. 4), as we provide herein, the recent tech deals completed in the period between 1 April and 15 July 2022, and our brief commentary regarding the tech investment environment in Indonesia.

Generally, the trend of investment in Indonesian startups is still going up in spite of the looming "funding winter" and layoffs in startups and major technology companies in Indonesia. Despite the more careful approach of most investors including venture capital investors in allocating their investments, we see that most Indonesian-focused investors remain active in the Indonesian market. There are, however, several major effects on the flow of investments especially the ones made into earlier-stage start-ups, which experience what market observers call the "funding winter".

As a result, entering this second half of 2022, technology companies are more focused on saving money and maintaining their internal sustainability by taking measures such as conducting employee redundancy, having overall management, and restructuring their operations.

The recent spiking of new variant of COVID-19 has some effects on investment flow in the first semester of 2022, albeit life has generally returned to normal in Indonesia. Throughout this period, the media coverage of Indonesian start-ups and technology companies has been dominated by major layoffs.

In spite of the potential downsides of the current situation, we note that the trend is still positive and Indonesia remains an attractive market to most investors. The trend of technology mergers and acquisitions (M&A) is also going up. Therefore, it will be interesting to see how bigger techplayers acquire some of their competitors to be able to compete in the Indonesian market.

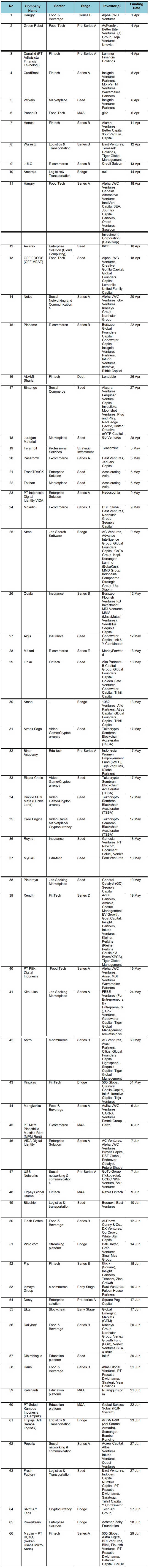

I. Start Up and Tech Investment Deals in the period between 1 April and 15 July 2022

Please refer to the table below on the list of Tech Deals that have been completed during the period from 1 April to 15 July 2022:

II. NLP Commentary on the Recent Tech Deals

With lessening fundings entering the second half of 2022, Indonesian startups begin to be cautious about their sustainability to survive business approaching the end of 2022. One of the significant factors of having such concern is the increase of COVID-19 cases in Indonesia, which hampers the business activities of many Indonesian startups. As a result, most startups tend to focus on maintaining their current financial positions, while directing their stances in the Indonesian market. Startups that focus on short-term goals are now in a vulnerable position because less investors opt to invest in this type of companies. Generally speaking, sustainability, as opposed to fast aggressive growth, has become the popular approach for investors and their target companies.

Based on the data that we compile in Section I, we note that there are increasing M&A activities of leading startups in Indonesia. Major startups such as the GoTo group, Bukalapak, Blibli, Sirclo, Carro, Yummy Corp, Emtek Group, and Mekari are merging and acquiring other Indonesian startups. We note that the M&A activities are focused on four main sectors, namely: (i) telecommunication and technology; (ii) business services; (iii) transportation; and (iv) energy mining and utilities. Such a high volume of M&A activities would be followed by efficiency adjustments during the expansion phase, which in turn, force key business players to take the redundancy approach. One of the major players that have resorted to employee redundancy is Shopee (i.e., notably on employees of ShopeeFood and ShopeePay), due to the company's plan to expand into other regional markets such as Europe and South America.

Notwithstanding the downsides of the current outlook, the Indonesian startup market is more stable compared to other markets in Southeast Asia neighbors. The issue on the decreasing funding for Indonesian startups is, in fact, not always the case. Although the investment number is decreasing, the record shows that local ventures have been active throughout the first semester of 2022 to promote their fundings into Indonesian startups such as East Ventures, AC Ventures, MDI Ventures, Trihill Capital, Alpha JWC, and others. This ecosystem can be beneficial in the coming second semester of 2022.

While the issue of layoffs may seem substantial and not at all pleasant, it is evident that Indonesian startups have maintained their ambition to grow their presence as major players, not only in Indonesia, but also in other attractive markets.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.