- within Employment and HR topic(s)

- with readers working within the Technology and Pharmaceuticals & BioTech industries

For the German version, please read here >>

In an increasingly globalized world of work, companies are no longer limited to local talent pools. Through targeted "remote work" and "workation" models, they can address highly qualified specialists worldwide and integrate them flexibly into their organization. Despite the similar terminology, however, the two concepts differ considerably - both in terms of their practical implementation and their implications under labor law, income taxes and social security.

It is, therefore, essential for HR managers not only to be aware of these differences, but also to integrate them into their talent strategy in a legally compliant and routine manner. The detailed legal expertise does not have to be held internally - it can be purchased externally in a selective manner. However, it is crucial that HR managers are aware of the differences and legal risks and have a solid basic understanding of the associated challenges in the areas of income taxes, social security, and work permits.

In the following, we highlight these differences, explain their strategic importance for recruitment as well employer positioning and highlight the associated challenges.

1. Remote Work vs. Workation: differences and legal implications

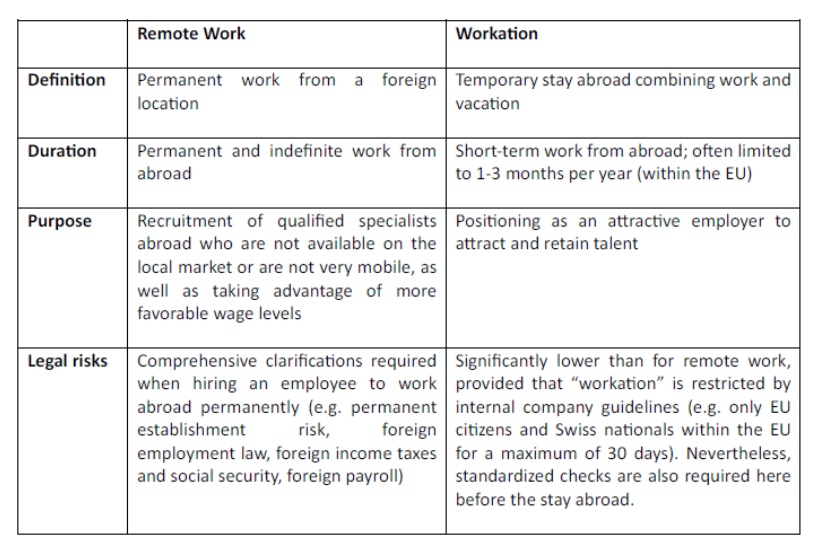

Although remote work and workation are quite often used interchangeably, they differ in key aspects. It is particularly important for HR managers to understand the respective framework conditions and legal risks in order to make informed decisions. The following overview shows the key differences between the two models:

2. Remote Work: Opportunities and Challenges for Employers

Remote work opens up new opportunities for companies in global talent acquisition, but poses significant legal and administrative challenges. In the next section, we look at a specific case study on the implementation of remote work and explain the strategic considerations involved.

2.1 Example: Remote work - Recruitment from the United Kingdom (UK)

A Swiss company hires a software developer from the United Kingdom (UK). The employee lives and works permanently in the UK, but occasionally travels to Switzerland for quarterly meetings.

2.2 Strategic Benefits of Remote Work for Attracting Employees Based Abroad

The strategic benefit of remote work lies primarily in tapping into a global talent pool. Companies can access highly qualified specialists who are not available on the local Swiss labor market and, thus, strengthen their overall competitiveness.

In addition, the remote work model can offer certain cost benefits, as there are no relocation or international assignment costs and the employee remains in their current place of residence in the UK. At the same time, remuneration levels in the UK are often lower than in Switzerland, creating additional economic incentives for the Swiss employer in relation to remote work.

Especially for specialized positions that do not require a physical presence in the office, remote work is an attractive alternative to traditional on-site employment. Companies benefit not only from a larger selection of talent, but also from greater flexibility in their HR strategy.

2.3 Legal Aspects and Challenges of Remote Work

However, remote work across national borders not only offers strategic advantages, but also poses a number of challenges in terms of payroll, employment law, and work permits. Key aspects are social security and income taxes, as the employee tends to remain subject to income tax and social security at their place of residence and work. This inevitably means that the company has to deal with the foreign payroll.

In addition, the employment law framework must be clearly defined. As the employee's usual place of work is in the UK, British employment law primarily applies. Nevertheless, the employment contract should include provisions on travel and possible legal interfaces with Switzerland in order to avoid any subsequent ambiguities.

The example above shows that while remote work across national borders can offer considerable advantages, it also requires careful legal and tax assessment in order to minimize the risks for the company and its employees.

3. Workation: A Means of Employee Retention and Positioning as an Attractive Employer

Workation is an increasingly popular model that enables companies to allow their employees to work from abroad on a temporary basis. This can increase employer attractiveness, but also poses legal and administrative challenges. In the next section, we look at a specific case study on the implementation of workation and explain the strategic considerations involved.

3.1 Example: Workation - Temporary work from Spain

A Swiss company allows a Swiss employee (without a management function) to work from Spain for three months per year while working in Switzerland for the rest of the year. The employee is free to choose when to work in Spain during the year. The three months can be "in one go" or split up into several periods.

3.2 Strategic benefits of Workation for increasing employer attractiveness

Workation offers companies a relatively inexpensive way to increase their attractiveness as a modern employer and, thus, strengthen employee loyalty. Workation's offering, therefore, represents a clear competitive advantage.

While remote work is often a long-term strategic decision, workation offers a short-term opportunity to attract and retain talent without having to make permanent changes to the organizational structure.

3.3 Legal Aspects and Challenges of Workation

Although workation may seem less complicated than remote work at first glance, there are various legal and administrative factors to consider. In order to minimize the effort required for workation from an HR perspective, many companies have restricted the duration and choice of location (e.g. up to 30 days within the EU for EU nationals and/or Swiss nationals).

The advantage of this is that the legal aspects are relatively straightforward and only a few administrative steps are required (e.g. A1 certificates or PWD – posted worker notifications).

In the above example of the employee who is allowed to work up to 90 days from Spain, neither tax nor social security obligations are likely to be triggered. The permanent establishment risk and other legal aspects are also minimal. Nevertheless, certain key points such as obtaining an A1 certificate and the basic requirement to register in Spain must be observed.

Workation is, therefore, an attractive, flexible way for companies to benefit from the advantages of international working models without having to take on the more complex legal and administrative requirements of permanent remote working.

4. Conclusion & Outlook: Remote Work vs. Workation - Flexible Working Models as the Key to Employee Recruitment and Retention

In an increasingly globalized world of work, companies are no longer limited to local talent pools. Remote work and workation models open up new opportunities to attract highly qualified specialists worldwide and integrate them flexibly into the organization. Both concepts offer strategic advantages, but differ in terms of practical implementation and legal aspects. It is crucial for HR managers to understand these differences in order to make informed decisions and minimize legal risks.

Choosing the right model depends on the company's strategy and specific needs. While remote work offers long-term solutions, workation is ideal for short-term, flexible working models that can increase employer attractiveness and contribute to employee retention. However, both models require careful legal consideration to avoid risks in the areas of income taxes, social security, and work permits.

Next week, we will be looking at the topics of "Recruiting foreign employees and relocating them to Switzerland" as part of the talent strategy. We will highlight the legal and strategic aspects that companies should consider when recruiting international talent and integrating them into the Swiss labor market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.