Choosing the right location for the centralization and management of your IP is a very important strategic business decision. The ideal location to establish an IP structure is one that can serve the organization's business strategies/model, safeguard and protect its IP and more important to contribute to its tax optimization.

Cyprus – U.S. tax treaty: 0% withholding tax on Royalties

Under the Double tax treaty concluded between Cyprus and the U.S the royalties paid from U.S. to Cyprus or from Cyprus to U.S. are subject to 0% withholding tax.

Taxation of Intellectual property in Cyprus:

When a Cyprus company license a US company, the only taxation will be imposed is in Cyprus at the effective Cyprus tax rate of 2,5% or less on the net income.

IP Box regime Cyprus:

- 80% tax exemption on profits derived from the use or sale of IP

- Competitive amortization provision over a 5 year period

- Effective Tax rate of 2,50% or less

- Gross IP income reduced by expenses incurred for the production of IP Income

- All intangible assets are eligible under the law.

- Both internally developed or acquired assets are treated the same

- There is no limitation of the place of research and development

- Portfolio of IPs can be registered outside Cyprus

The Cyprus IP tax regime The IP tax regime covers a wide range of intangibles, including and not limited to copyrights, patents and trademarks. Also, there is no requirement to register your IP in Cyprus in order to benefit from Cyprus Tax regime.

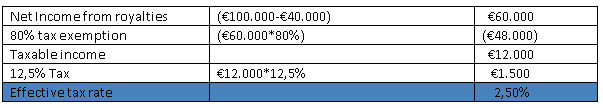

Taxation of Royalty Income – Practical example

A Cyprus tax resident company derives royalty income amounting to €100.000 and incurs directly related expenses of €40.000. Under the IP Regime the royalty income will be taxed as follows:

Cyprus offers a unique European base for international business companies.

Cyprus provides for numerous tax benefits and it is classed as a low tax jurisdiction. Its tax and legal systems are in full compliance with the EU and the OECD's requirements, thus resulting in Cyprus being included in the white list of international cooperative jurisdictions.

IP protection in Cyprus

The protection of IP rights is dealt extensively in Cyprus. There is a comprehensive system in place that guarantees that the results of innovation and creativity are protected at a European and an International level.

a. Patents

As far as patents are concerned, a new invention is protected in the following ways in Cyprus:

- A national patent certificate is granted by the Department of Registrar of Companies and Official Receiver.

- A European Patent issued by the European Patent Office.

- An International Patent under the provisions of the Patent Cooperation Treaty, administered by the World Intellectual Property Organization (WIPO).

b. Trademarks/Service Marks/ Designs

As far as Trademarks/Service Marks and Designs are concerned, protection is granted in the following ways:

- Registration under the provisions Capital 268 offering protection at a National level.

- EU Regulation 207/2009 of 26 February 2009 on the Community Trademark and EU Regulation 6/2002 of 12 December 2001 on the Community Design offer via Cyprus uniform protection throughout the territory of the European Union.

- Cyprus being a signatory to the Paris Treaty on the Protection of Industrial Property, as administered by the World Intellectual Property Organization (WIPO) and a party to the Madrid Protocol, offers global protection of trademarks, service marks and designs.

c. Copyrights

- Copyrights are protected under Law N.59/76 on the Protection of Intellectual Property which offers protection at a National level.

- Cyprus being a signatory to the Bern Convention for the Protection of Literary and Artistic Works which covers a broad range of rights, including software copyrights. This guarantees protection to all the Convention member states with no further process being required.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.