- with readers working within the Media & Information industries

1. Introduction

In the vast world of asset management, trust structures stand tall, with the Cyprus International Trust (CIT) leading the charge. Recognized as a top-tier financial hub, Cyprus guarantees CITs a seamless blend of business affairs coordination and generous tax benefits.

Rooted in the profound English principles of equity and trust, Cypriot Trust Law offers a harmonious blend: it caters to both complex business needs and delicate family matters. This article, which is not an exhaustive analysis of the CIT regime, navigates through the ins and outs of the Cyprus trust mechanism, highlighting its unparalleled asset protection and tax benefits.

2. Unwavering Cypriot Jurisdiction

Legal amendments in 2012 fortified the Cyprus Trust landscape. These provisions clarified that all matters concerning a CIT, from its validity to the trustee's fiduciary powers, are undeniably under Cyprus law.

More specifically, the powers and duties of protectors and trustees are exclusively interpreted with reference to Cyprus laws. Also, succession/heirship, tax laws, and judgments accorded by foreign courts cannot affect the validity of a CIT or the transfer of property (e.g., the sale of trust assets) of a CIT. Accordingly, the Cyprus Trust regime governing CITs is effectively injected with further stability, predictability, and protection, for example, from forced inheritance/succession or "claw-back" rules. For those mulling over trust jurisdictions, these are compelling points favoring Cyprus.

3. Defense Against External Threats

The beauty of a CIT? It stands firm against potential financial downturns of the Settlor. However, exceptions exist if there's undeniable evidence that the trust was a veil for fraudulent activities (namely, that the trust was used with the intent to defraud creditors at the time of creation and transfer of assets into the trust). But, there's a catch – claims must be lodged within a tight two-year window, further strengthening the trust's defensive posture.

4. A CIT In Action- working example

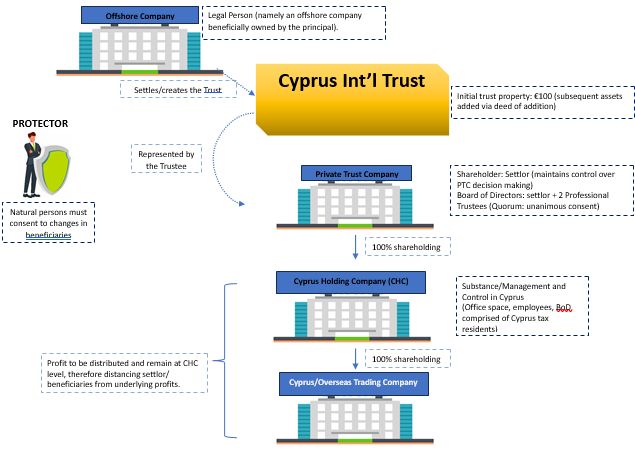

Structure:

- Settlor (being the person who creates a trust): An offshore company beneficially owned by a non-Cyprus individual.

- Beneficiary (being the person(s) who benefit from the trust, i.e., ultimately receive its assets and/or income): A legal person (i.e., offshore company), beneficially owned by one or more non-Cyprus individuals.

- Trust Vehicle: a Private Trust Company (PTC) incorporated in

Cyprus with the following structure:

- Board of Directors: Settlor + 2 Professional Trustees (quorum requiring unanimous consent).

- Shareholder: Settlor (in essence, exerts control over the PTC's decision-making process via designated shareholder powers).

- Trust Assets: 100% of the shares in a Cyprus Holding Company (CHC), which in turn owns 100% of the shares of a Cyprus Trading Company (CTC). The CTC carries out international trading activities.

Please see diagram below.

Benefits achieved by the example Cyprus International Trust structure:

- Asset Protection: The ownership of the Cyprus/overseas trading company is separated from the Principle and, in fact, no longer beneficially owned by the Principle but instead by the Beneficiaries of the newly formed Cyprus International Trust.

- Heightened Confidentiality: The Settlor no longer discloses ownership of the trust assets, despite the fact that the Settlor is the shareholder of the PTC and can retain indirect power over its Board of Directors.

- Tax: dividend income received by the CHC is exempt from Cypriot corporate income tax. This same profit is separated from the beneficiaries' taxable income (subject to taxation rules in the country where the beneficiaries are tax residents).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.